|

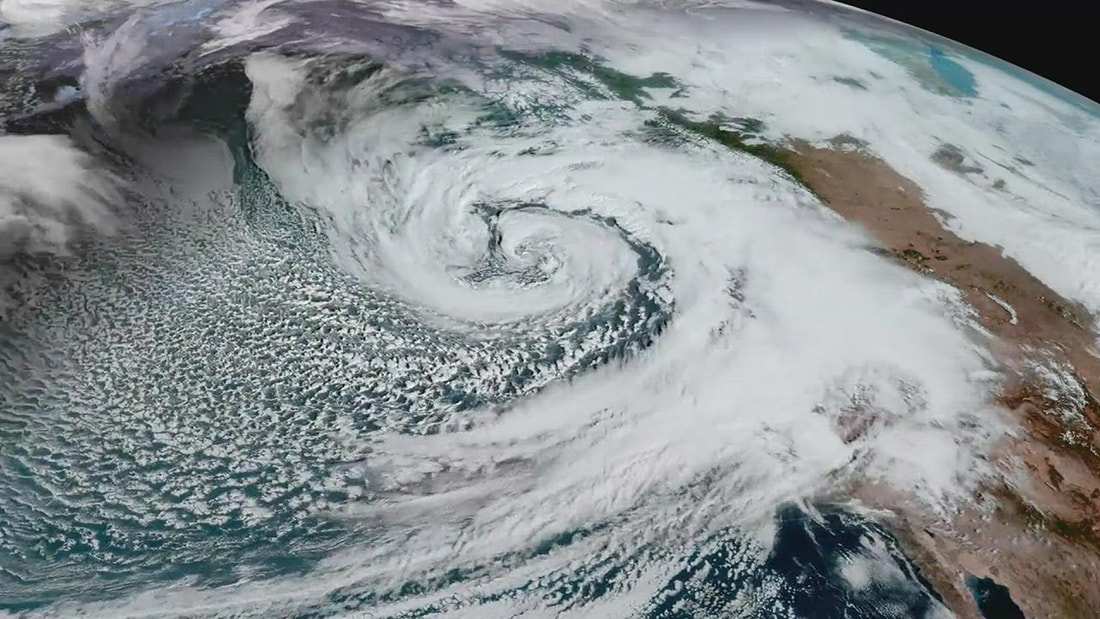

A bomb cyclone is defined as an area of low-pressure where the pressure in the storm rapidly decreases; losing 24 millibars in a 24-hour period.

This is closely associated with a rapidly strengthening system. Meteorologists term this as “bombing out,” hints the name. The general rule of thumb is the lower the pressure goes, the stronger the storm is. If a hurricane in the Atlantic were to rapidly lose pressure, we would be very concerned that we could see a major hurricane develop. Category four hurricanes generally have a pressure in the 930’s or low 940’s, very low considering the standard atmospheric pressure is around 1013 millibars. So to see a non-tropical area of low pressure deepen that quick and observe a pressure that low is definitely superlative. Thankfully, this storm is beginning to weaken as it pushes north towards Alaska. However, a piece of its energy will break off and become its own storm system Monday night into Tuesday and progress towards Texas. This will drag a front through here which will be accompanied by a strong line of showers and thunderstorms with hail and gusty winds being the primary threat.

0 Comments

There are many common myths about potential dangers in and around the home that can keep some homeowners up at night. However, the gap between myth and fact can make all the difference when it comes to reducing risk in your house. So what does the data tell us are the biggest risks to your home?

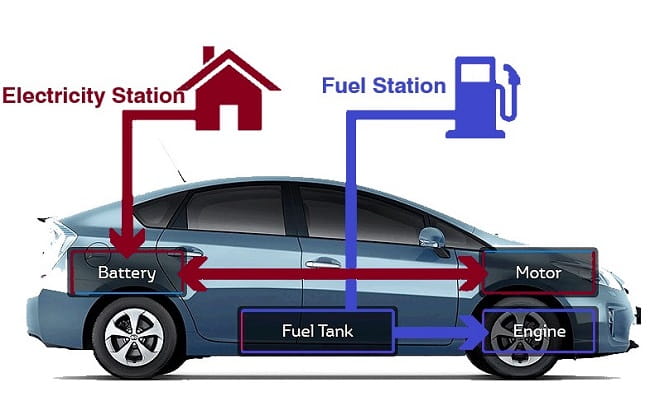

From leaking valves to house fires, Claim data reveals the facts about the most frequent causes of homeowners’ claims, as well as the costliest. The answers may surprise you. While some risks are common nuisances we are all too aware of, others can be catastrophic. To help keep your home, your valuables and your family safe, you will want to take steps to protect them. Danger #1: Water Damage Many people think of damage from hurricanes and heavy rains when they think of water damage. But according to Travelers Claim data from 2009-2016, more property losses resulted from non-weather water claims (20%) than weather-related water claims (11%)*. Non-weather water claims can involve plumbing-related losses, such as pipes, drains and valves, as well as appliance issues. Learn more about common causes of water damage and the steps that you can take to help prevent it. Danger #2: Weather-Related Roof/Flashing Damage Wind, hail and weather-related water damage accounted for more than half, or 51%, of all Travelers property loss claims between 2009-2016. Falling limbs and branches weighed down by snow and freezing rain can cause roof/flashing damage. It is a good idea to inspect trees on your property to help prevent damage caused by falling tree limbs. Learning how to identify and remove ice dams can also help you avoid costly damage in the winter months. Danger #3: Frozen Pipe Damage Frozen water pipes are considered a potential source for catastrophic property damage, and make the list of Travelers’ five costliest sources of homeowner claims. While a sub-item of weather-related water loss, it is so significant, it deserves special mention. The good news is you can take steps to help prevent your pipes from freezing by identifying pipes that are most at risk and taking steps before winter arrives to help insulate them. During the winter, you may consider using a smart thermostat to manage and monitor that your heat is set at a safe level to help avoid freezing, and to receive notifications if the temperature in your home drops unexpectedly. Danger #4: Theft Theft from the premises makes the list of top causes of property loss claims, accounting for 6% of losses. There are many steps that you can take to help make your home less attractive to thieves, including landscaping with theft prevention in mind, adding outdoor lighting and creating a plan to make your home appear occupied while you are away. There are a number of methods to monitor your home to help minimize the theft potential, including smart home alarm systems. Danger #5: Fire Although fires do not occur as often as other incidents around the home, the damage that they can cause puts fire at the top of the costliest types of claims, according to Claim data from 2009-2016. Fire and related damages accounted for 25% of claims as measured by costs paid out. Fires can start from cooking, overloading circuits, and improperly using a wood stove, among other causes. Learn more about the potential wood stove safety tips, and how to help protect your home. Hybrid gasoline-electric cars offer great fuel efficiency, but sales have suffered in recent years because of low gas prices.

Decreasing crude oil reserves and concern over air pollution from combustion engines are expected to increase the demand for hybrids in the near future.1 In the meantime, car manufacturers are looking for new ways to attract buyers. Some manufacturers are changing the hybrid's image. They want it to be known as a car that's fun to drive as well as practical. An example of this trend is the 2017 Chevrolet Malibu Hybrid. By combining a powerful engine with high fuel efficiency, the car won a first-place ranking among midsize hybrids from U.S. News & World Report. Here are four things to consider before buying a hybrid: 1. Used Cars Offer Better Values If you can't afford a new hybrid, consider buying a used one. Like all cars, hybrids begin losing value as soon as they're driven away from new car dealerships. Vehicle history reports offered from companies like Auto check and Carfax allow consumers to track service records and rule out vehicles that have performed poorly. 2. Fuel Efficiency Varies Among Drivers Autotrader points out that hybrids are at their most economical while driving at low speeds and in stop-and-go traffic. If you primarily drive on the freeway, your fuel savings may be reduced. 3. You May Get a Tax Break Newly purchased plug-in hybrids may be eligible for a federal income tax credit of up to $7,500.5 State and local tax incentives also may apply. 4. Insurers May Give You a Discount Buying a hybrid can lead to reduced car insurance costs. Some insurers have determined that hybrid drivers have a reduced risk of being involved in accidents. After a fire, burglary or another event in which you lost possessions from your home, it may be difficult to remember the details of every one of the belongings that you have accumulated over the years. In this situation, having a current inventory of your possessions, including make and model numbers, may help you with any potential insurance claims. Taking the time to document your belongings now can help you recover faster after a loss.

Here are some steps you can use to help build your home inventory checklist. Step 1: Take the time to walk through your property. Compiling a comprehensive home inventory takes time and effort. The more detailed your inventory, the more useful it will be if you have to make a claim. Document possessions inside your home and on your property that may be of value. Step 2: Keep your inventory in a safe place. Creating a digital home inventory and storing it off-site will help ensure that it won’t be lost, stolen or damaged during any disaster at your home. You can also create a photo or video inventory and upload it to a cloud-based service.

Step 3: Update your inventory often. When you make a significant purchase, add the information to the inventory while the details are fresh in your mind. This is also a good time to delete items that you have replaced or no longer own. Step 4: Remember your business assets. While most people think of their home when making an inventory, it is important to document the contents of your business, if applicable, as well. Step 5: Consider valuable items. Valuable items like jewelry, art, and collectibles may have increased in value since you brought them into your home. Check with your agent, if you have one, to make sure that you have adequate insurance coverage for these items as they may need to be insured separately. Consider putting jewelry or other valuables that you don’t often wear or use in a safe deposit box. To learn more about ways to protect your home and belongings, check out our homeowners insurance products. Buying renters insurance to protect your stuff may seem like an unnecessary expense, until you experience a theft or fire in your rented home or apartment and lose some of your most treasured possessions forever.

Whether you're a longtime renter or starting out in your first place, renters insurance policies provide important benefits and coverage. If a fire or similar incident destroyed your home and you didn't have renters coverage, it would be up to you to replace everything you own. Plus, if someone claimed you caused an injury or property damage, without adequate insurance protection, you could be at risk for an expensive lawsuit and paying that person for his or her damages. As you consider whether to buy renters insurance, here are four things you need to know: 1. Renters Insurance Provides Off-Premises Coverage Renters insurance does more than cover the cost of lost or damaged possessions in your home. There is coverage if your bicycle is stolen from a bike rack at the park, or if your laptop is taken from your car while you're at the supermarket. 2. You Can Be Compensated if You're Forced to Relocate Most renters policies provide additional living expenses coverage if your home becomes uninhabitable due to an event such as vandalism, theft, fire or water damage from home utilities.1 This benefit usually includes the cost of living expenses, up to your policy limits. This coverage typically is limited to 30 to 50 percent of your insured personal property. For example, if your belongings were insured for $100,000, the limit on additional living expenses would be $30,000 to $50,000, as outlined in your policy. 3. A Home Inventory Can Determine How Much Coverage You Need Before you decide how much coverage you need, it's important to know how much it would cost to replace your possessions. You can calculate replacement costs by conducting a home inventory and checking with your insurance representative to make certain you're fully covered.2 4. You Can Reduce Your Renters Insurance Costs There are a variety of ways to reduce the cost of renters insurance. An option is to select a higher policy deductible, the amount you must pay before your insurance coverage takes effect. Increasing a deductible from $250 to $500 could create an annual savings of up to 15 percent. You also may want to consider buying all your insurance policies from one carrier. For example, when you bundle your auto and renters policies , you receive additional savings. We never expect to get in a car accident. And even though accidents are common, they feel like a big deal when they happen to us.

It’s natural to experience shock, anger, fear and other emotions in the moment and after the fact. But, preparing in advance can help make a collision more manageable. If you're ever involved in a car accident, taking these six steps can help you better handle the experience. Step 1: Make sure no one is hurt. Call 911 if you, another driver, any passengers or any bystanders need immediate medical attention. Step 2: Keep everyone safe. The accident scene can be a hazard for other drivers. If the collision is minor, move the vehicles to the side of the road or the nearest parking lot. If the accident is major, carefully exit your car and walk to a safe place. Step 3: Call the police. Ideally, law enforcement will come to the scene quickly and take an official report. However, the local police department may not have the resources to respond to a minor accident, in which case you can file a police report yourself later. Step 4: Gather necessary information. Use your phone's camera or a pen and paper to note the other driver's name, address, phone number and insurance information. Record the other vehicle's license plate, vehicle identification number, make and model. Step 5: Document the accident. Take photos, videos and voice recordings to capture vehicle damage, road conditions and any details you remember about the events leading up to the crash. Step 6: File a claim. Get in touch as soon as possible to get your claim started. We can work to get your car repaired or replaced and minimize the disruption to your life. Reach out if you have questions about your accident coverage or anything else. Inclusive Basic Boat Insurance Coverage

Get basic boat insurance coverage with protection for which other carriers may require additional premiums such as mechanical breakdown, uninsured boater, personal property, medical payments, commercial towing reimbursement, fuel spills and dinghy coverage. Uninsured Boater Coverage This provides coverage for incidents when another boater may not have insurance coverage. As long as you've chosen sufficient limits on your policy, uninsured boater coverage can help cover your medical bills and bodily injury resulting from an accident with someone who does not have insurance. Coverage extends to you, your family and your passengers. The requirement for uninsured boater coverage varies by state. Flexible Coverage Options You choose between agreed value or actual cash value coverage. Agreed value provides “replacement value” on covered partial losses involving your vessel. Actual cash value earns you a premium discount. In the event of a loss, settlement is based upon a depreciated value. Towing and Assistance Reimbursement Get reimbursed for transportation of your boat to a repair facility when it’s inoperable, as well as for gas delivery and roadside assistance. Personal Property Coverage Protects personal property on the boat including but not limited to fishing equipment, clothing and boating-related equipment such as life vests. Physical Boat Damage Coverage This coverage provides protection in the event of a collision such as with a submerged object or another boat. Liability Coverage This helps cover costs of bodily injury or damage to the property of others. |

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2023 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed