|

There are many common myths about potential dangers in and around the home that can keep some homeowners up at night. However, the gap between myth and fact can make all the difference when it comes to reducing risk in your house. So what does the data tell us are the biggest risks to your home?

From leaking valves to house fires, a look at Calfee Insurance Claim data reveals the facts about the most frequent causes of homeowners’ claims, as well as the costliest. The answers may surprise you. While some risks are common nuisances we are all too aware of, others can be catastrophic. To help keep your home, your valuables and your family safe, you will want to take steps to protect them. Danger #1: Water Damage Many people think of damage from hurricanes and heavy rains when they think of water damage. But according to Travelers Claim data from 2013-2020, more property losses resulted from non-weather water claims (23%) than weather-related water claims (15%)*. Non-weather water claims can involve plumbing-related losses, such as pipes, drains and valves, as well as appliance issues. Learn more about common causes of water damage and the steps that you can take to help prevent it. Danger #2: Weather-Related Roof/Flashing Damage Wind, hail and weather-related water damage accounted for more than half, or 53%, of all Travelers property loss claims between 2013-2020. Falling limbs and branches weighed down by snow and freezing rain can cause roof/flashing damage. It is a good idea to inspect trees on your property to help prevent damage caused by falling tree limbs. Learning how to identify and remove ice dams can also help you avoid costly damage in the winter months. Danger #3: Frozen Pipe Damage Frozen water pipes are considered a potential source for catastrophic property damage, and make the list of Travelers’ five costliest sources of homeowner claims. While a sub-item of weather-related water loss, it is so significant, it deserves special mention. The good news is you can take steps to help prevent your pipes from freezing by identifying pipes that are most at risk and taking steps before winter arrives to help insulate them. During the winter, you may consider using a smart thermostat to manage and monitor that your heat is set at a safe level to help avoid freezing, and to receive notifications if the temperature in your home drops unexpectedly. Danger #4: Theft Theft from the premises makes the list of top causes of property loss claims, accounting for 4% of losses. There are many steps that you can take to help make your home less attractive to thieves, including landscaping with theft prevention in mind, adding outdoor lighting and creating a plan to make your home appear occupied while you are away. There are a number of methods to monitor your home to help minimize the theft potential, including smart home alarm systems. Danger #5: Fire Although fires do not occur as often as other incidents around the home, the damage that they can cause puts fire at the top of the costliest types of claims, according to Travelers Claim data from 2013-2020. Fire and related damages accounted for 27% of claims as measured by costs paid out. Fires can start from cooking, overloading circuits, and improperly using a wood stove, among other causes. Learn more about the potential wood stove safety tips, and how to help protect your home.

1 Comment

What is the deductible for flood insurance?

A flood policy comes with separate deductibles for the building and its contents. You typically get to choose the deductible amount. Common flood deductibles range from $1,000 to $5,000. As with other types of insurance, a higher deductible on your flood policy will result in a lower premium; however, if you have a mortgage, your lender may not allow you to increase your deductible beyond specified limits. What does flood insurance cover? Flood insurance covers losses directly resulting from flooding or flood-related erosion caused by heavy or prolonged rain, snowmelt, coastal storm surges, blocked storm drainage systems, levee dam failure and similar events. Flood insurers reimburse policyholders for structural damage, including:

The FEMA flood insurance guide is also a helpful resource that provides details on claims, coverage and costs. Flood insurance coverage limits The NFIP lets you insure your house for up to $250,000 and your personal property (contents) for up to $100,000. If you rent, you can buy up to $100,000 in coverage for your belongings. For non-residential property, you can buy up to $500,000 of coverage for the building and contents. Renovating your property has some serious perks, such as creating more space or updating your amenities.

Some upgrades, such as a new roof or security system, can even reduce home insurance costs. While others — like a pool — can have the opposite effect. Before you take on your next home improvement project, here’s what you should know about how renovations might change your premiums.

If you're planning a home renovation, you may want to call your insurance agent first because this decision can impact your homeowners insurance. Some home renovations will change the amount of coverage you need, while others could even help you qualify for a discount. We cover six common scenarios that could affect your insurance, so you can plan ahead. 1. Building a New Addition When you expand and improve your home, you could likely increase its replacement value. This is the cost to repair or rebuild your home. Some additions that could increase your replacement value include: adding a second-story bedroom, expanding the living room or building a new garage. After building a new addition, or making updates or other improvements, you may need to increase your coverage because the value of your home, and the cost to rebuild it will likely have increased. Most insurance companies require your Coverage A or dwelling coverage limit be at least 80 percent of the replacement value of your home. Your insurance agent can recalculate your home value to determine whether you'll need more coverage because of the addition or improvement. 2. Building a Pool If you're looking to add a pool, you will want to contact your insurance agent to review coverage for changes to your property's value, as well as any increase in risk. When people are swimming and running around the pool, there's the chance for an accident. If someone gets hurt, they could try to hold you responsible for damages. This can apply even if the accident isn't your fault. Check with your agent to see whether your existing policy covers a pool and if you need to increase your liability coverage. This coverage can help pay damages to injured persons and provide for a defense if you are sued as a result of their injuries. You should also ask your agent what steps you can take to keep your pool safe so you can avoid accidents. Adding a fence with a lock is a smart move. You could also add lights with motion sensors or a pool alarm to discourage trespassers. Consider skipping the diving board, because this increases the chance of an accident and your insurance cost. Calfee Insurance wants to help you protect the things that matter to you. We offer a wide breadth of products so you can be covered at home and on the road. 3. Adding a Deck A new deck is another improvement that can add value but also risk, especially if the deck is attached to a second story or higher. You should let your agent know that you've added a deck, so he or she can adjust your policy as necessary. 4. Renovating the Kitchen Upgrading the kitchen can significantly increase the value of your home, especially if you switch to higher-quality counter tops, appliances and new flooring. You should contact your agent to see if you need to increase your insurance coverage. If your contractor upgrades the plumbing or electrical wiring as part of the renovation, ask your homeowners insurance agent if you qualify for a discount or if your coverage needs to be adjusted. These upgrades can reduce the chance of flooding water damage and fire, so check if your insurance company has discounts that can help to reduce your premium. 5. Finishing the Basement Finishing your basement can also increase the value of your home. That means, yet again, you may need more homeowners coverage. Flooding can be a concern, especially for the lowest floor in your house. It is important to note that most homeowners insurance policies do not cover damage caused by floods. Ask your agent to review your coverage and look to see if there are steps you can take to help prevent future damage, like installing a sump pump. 6. Redoing the Roof Before you redo your roof, ask your insurance agent whether this could qualify for a discount. Some companies offer a discount when you reinforce the roof or use stronger roofing materials that are wind, hail and leak-resistant. Your agent can explain how to qualify. At the same time, redoing the roof could increase your property value, which means you might need more coverage. It is a good idea to contact your agent when you’re considering making home renovations. Their knowledge and expertise can help you get the most out of your discounts while making sure your home is adequately insured. Free Home Insurance Review with updated PricingWhen was the last time you considered the air quality in your home? It’s easy to forget about something invisible, but like many around-the-house tasks, clearing the air is well worth your effort. In the interest of health, safety and keeping your home in good shape, here are a few steps you can take to help your family breathe a little easier. 1. Test for radon gas and install carbon monoxide detectors. You can’t see, taste or smell radon and carbon monoxide, but these indoor gases can be dangerous to your health and safety if left undetected.

2. Run an air purifier to clear allergens and pollutants. Improve your indoor air quality by filtering out pollen, dust, pet hair and other irritants. If anyone in your household becomes sick with COVID-19, running an air purifier in their quarantine room may provide some protection from floating virus particles. HEPA air purifiers can also help remove smoke particulates during wildfires. 3. Use a dehumidifier. Is your home prone to dampness? Keep your humidity level under 50% to prevent mold growth. Run a dehumidifier (and clean it regularly) as well as the exhaust fan in your bathroom(s) after every shower. 4. Follow these daily best practices. In addition to testing and equipment purchases, these simple habits can help maintain your indoor air quality:

Power outages can be a major inconvenience. They can also create problems for you, your family and your home as you shift into "emergency mode" to prevent your food from spoiling, to safely navigate your home in the dark, or simply to keep the heat on. Investing in a home generator can help make being without power more bearable — and can even fuel some fun when not being used for an emergency.

Home generators come in a variety of types and sizes, from portable versions to "standby" and inverter units. Portable generators typically run on gasoline and need to be operated at a safe distance from any structure. Standby generators start automatically when the power goes out, and are run on propane or natural gas. Inverter generators have a more complex engine than the other types, and are much quieter than their conventional counterparts. Regardless of which type of generator you choose, you will need to follow the manufacturer recommendations for safe operation of the unit. It's helpful to research this useful home device before you urgently need it, so here are 10 reasons to consider if you're thinking about purchasing a home generator of your own. 1. We can't control the weather. Most power outages are weather-related. As the number and severity of extreme weather events rises, so does the likelihood of a blackout lasting 24 hours or more. 2. You have well water. Without electricity, your well pump and filtration systems will quickly lose the ability to provide fresh, safe water for drinking, bathing, heating and more, to your house. 3. You have a sump pump. If you rely on a sump pump to keep your basement or crawlspace dry — including all the possessions you keep in those areas — losing power means you also lose protection against water damage in those areas. 4. You work from home. If you run a business or work out of your home, you know every minute counts. Going without power for even an hour can be a major inconvenience — if not a major risk — to you, your clients and customers. 5. Food spoils quickly. According to the FDA, perishable food items should be thrown out once your refrigerator has been without power for as little as four hours.1 Travelers wants to help you protect the things that matter to you. We offer a wide breadth of products so you can be covered at home and on the road. 6. You live in a high-risk or severe climate area. Some states are more vulnerable to weather-related outages. Others have such severe temperature extremes that power to control air conditioning and heating systems can be essential for comfort and safety. If you live in one of these areas, your risk to the potentially devastating effects of a power outage increase significantly. 7. Your property is vacant for extended periods of time. If you are a "snowbird," frequent traveler or own a seasonal home, having a generator can protect your property from outage-related emergencies — whether you're in or out of town. 8. Someone in your home relies on an electrically powered medical device. If you or a loved one requires the assistance of a home medical device that runs on electricity, a power outage can be deadly. A generator can help keep those devices running, but you also will want to check with a healthcare professional for suggestions on how to weather power outages with your particular medical device.2 9. You have a hybrid or electric car. Make a portable generator go the extra mile! When not using it for your basic emergency power needs, keep it in your car to stay charged no matter where the road takes you. . Generators aren't just for emergencies. Portable generators can be put to use at work or play in, around and away from your home, too:

Whether it's due to storms, falling trees or some other challenge, power outages can bring an assortment of problems for home owners. A home generator can become one of your go-to remedies for those unexpected situations. Checking out the options before you lose electrical power is one smart way to beat the crowds who'll be racing to scoop up a home generator, for that "next time" outage scenario. Task Force Members Working In Unison to Prepare for Summer 2020 as Memorial Day Weekend Approaches5/26/2020 The Cape Cod Reopening Task Force released a statement regarding the outlook for Summer 2020 today, after Governor Charlie Baker announced the reopening plan for the Commonwealth on Monday. “We are cautiously optimistic that our friends, relatives and guests will return to the Cape this summer for respite and a return to a traditional vacation,” said Wendy Northcross, CEO of the Cape Cod Chamber of Commerce and Facilitator for the Cape Cod Reopening Task Force. “This optimism is supported by our recent traveler sentiment survey. The volume and pace of this summer is expected to differ from prior summers, but 67% of our opt-in visitor database is reporting they are likely to visit the Cape this year.”The Chamber is the region’s tourism council, which promotes Cape Cod and the Islands to visitors from around the world. While beaches officially open statewide May 25th, most town-owned and Cape Cod National Seashore beaches on Cape Cod have remained open and will be open this Memorial Day weekend. There is hope that restaurants will begin to serve dine-in customers and expand to outdoor dining where able, beginning at some point in June. Many restaurants are open for take-out service with new safety and ordering protocols including dozens of the region’s famous take-out seafood establishments, clam shacks, and ice cream parlors. Accommodations of all types are clean, stocked with supplies and are scheduled by the state guidance to reopen in early June as well. Governor Baker’s reopening plan lists a return to dine-in for restaurants (with a possible restriction to outdoor only seating) and allowance of leisure accommodations in phase 2 of his reopening plan, which would begin no earlier than June 8th. The Governor has made clear that decisions on moving to phases 2, 3 and 4 of the Commonwealth’s reopening plan will be dictated by public health surveillance data including rates of hospitalization, positive tests, and morbidity. While Memorial Day has traditionally been the unofficial start to summer, this year’s calendar is creating an ironic opportunity, with 14 more days of summer in 2020, Northcross reported. Memorial Day falls this year as early as possible on May 25th, and Labor Day falls as late as it can, on September 7th; the additional 14 days of summer provide a cushion to summer business cycles that may be muted by stay at home orders just now lifting. “Over the past several weeks as we have planned for reopening on Cape Cod our aim has been to save lives and livelihoods,” State Senator Julian Cyr (D- Truro) Member and Public Information Officer for the Cape Cod Reopening Task Force. “We all know that the 2020 summer season will be different than what we are used to; indeed we expect a muted season. But opportunities to enjoy this special place will still be plentiful this summer with all Cape Cod has to offer.”“Moving out of the ‘stay at home’ phase into the ‘start’ phase of reopening, allows everyone to plan, knowing there are at least three weeks between phases,” said Wendy Northcross. “Currently, accommodations and restaurants are serving guests under restrictions in Phase 1. Phase 2 plans for restaurants and accommodations and some attractions to reopen with guidelines.” Those guidelines include social distancing, hygiene protocols, staffing and operations training and cleaning rules, which apply to all business and social organizations. Northcross is participating in a working group organized by the Governor’s office on restaurants, accommodations, and tourism to advise on safe reopening prior to Phase 2, when these sectors are expected to begin reopening. Given the highly seasonal nature of many businesses on Cape Cod, which serve their guests on a leisure travel experience during the warm weather months, the Cape Cod Reopening Task Force has been instrumental in pushing for advancement of the reopening date and guidance for the region and state’s many tourism amenities,” said State Representative Sarah Peake (D-Provincetown) Member of the Cape Cod Reopening Task Force. “If we do this right, giving confidence to the consumer and ensuring the health and safety of our workforce and residents, we expect to have the reawakening of our tourism businesses in just a few weeks’ time.” In order to help businesses follow best guidelines for mandatory safety practices, Sean O’Brien, Director of Barnstable Health & Environment and Member of the Cape Cod reopening Task Force has marshalled county resources to prepare information for businesses to access for best practices on cleaning and operations. “We will be publishing FAQs on topics like testing, best practices for entities ranging from boating to farmer’s markets and everything in between,” said Sean O’Brien. The County’s Department of Human Services will compile health metrics, and the Cape Cod Commission will publish a new economic data dashboard and track business impact through a new survey tool. All will be on one central Cape Cod website which will launch in the coming days. “Guidance to towns on how to quickly ramp up outdoor dining, accommodate more pedestrian flow and town-regulated activities that may need adjusting at this time is being vetted and shared with the 15 towns,” said Kristy Senatori, Executive Director of the Cape Cod Commission and Member of the Cape Cod Reopening Task Force. “The single biggest determinative factor for what’s possible this summer season depends on the personal responsibility of residents and visitors alike,” said State Senator Julian Cyr. “That means everyone covering their nose and mouth with a face covering when unable to keep distance between others, washing hands and surfaces, maintaining distance from others, and watching out for symptoms. Adherence to these health precautions will both prevent spread of coronavirus and allow us to safely reopen.”“While we expect this summer to be different from any we’ve experienced in our lifetime, we do believe the lure of Cape Cod’s plentiful and beautiful beaches, miles of hiking and biking trails, 47 golf courses, boating and outdoor recreation are the right prescription at the right time. We will be here to safely and warmly welcome our guests,” said Wendy Northcross.

You spend time shopping for lots of things because you are a smart consumer who wants quality at a good price. But if you are a person who is going to take the time to shop for a new smart phone or shoes, doesn't it make sense to take time to shop for car insurance? Homeowners insurance discounts. Don't be afraid to ask your agents if there are any available discounts that you can avail. Know the requirements and see if you are qualify for that discounts. Although nothing can be guaranteed, having good alarm systems can really offer you peace of mind when you're at home or while you're away. For instance, when you travel for long periods of time, you may have someone stop by and get your mail and check on your house. However, he or she cannot prevent a fire and that's where your fire alert comes into action. No matter where you are, if your home begins to burn, the fire department will arrive at your house in no time. Make the exterior of your home fire-safe and you will reduce your Home Insurance rate. Having things that are quite inflammable or that aid combustion around your dwelling will make you pay more expensive premiums. Bushes near your house should be cut and maintained at not less than ten feet from your structure. This is because how fire-safe a house is goes a long way in affecting what it will cost to insure it. You are done and now ready to move into your new home. Usually you will have about 30 days or until the end of the month to switch over water and electric in your names and out of the sellers name. If you have a a good length of time before that happens, please take your time. Get all your stuff in your new home, and everything up and running the way you want it before you switch over names. Heath Insurance- Right now, our Government is trying to pass bills that provide medical care to many of our fellow Americans that do not have appropriate coverage for their needs. This is not a political website, so we will not take a side as to if these new policies are right or wrong. We do however; want to stress that without good Health Insurance. Most of us could not afford to even get the medical care we need, much less purchase the thousands of overpriced prescriptions needed on a daily basis. To get rid of pot holes, tree limbs, icy side walks etc, do landscaping. Discussing with your agents would help you know how to make your landscaping effort more effective and profitable for you. Even though I've spent a lot of time researching online insurance I don't want you to simply take my word for anything. Instead I want YOU to get online and check out the savings you find yourself. The one thing I can promise you is that you will be amazed by how much you can save simply by buying your nursing home policy online. |

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

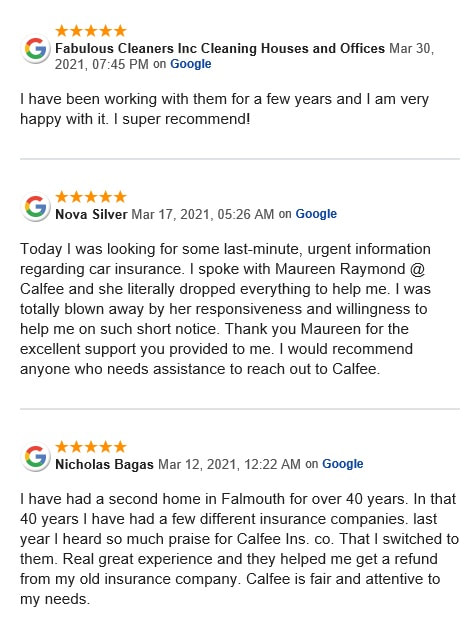

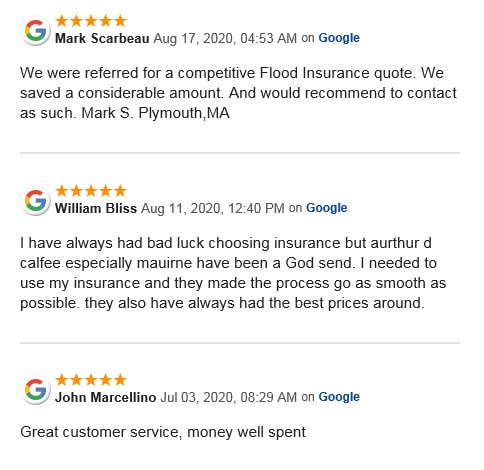

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2023 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed