|

Burn injuries in the United States lead to over 400,000 people needing care each year. Yet, with simple lifestyle changes and safety measures most home burns can be prevented. Below are a few tips to help you and your family avoid burn injuries.

Monitor the condition of electrical cords Electrical fires are a common cause of injuries resulting from burns. Be sure that the quality of your cords is being maintained and always throw away electrical cords that are damaged or broken. Make sure to check for damage frequently and never overload your outlets, power strips, or electrical circuits. For increased safety, experts advise installing safety caps on electrical cords and storing them out of reach. Use space heaters carefully Make sure to have enough fixed space around your heaters. When you leave the room or turn in for the night, always switch off heating devices. Experts recommend keeping all flammable materials, like curtains, blankets or towels at least three feet away from your heaters. Practice burn safety in your kitchen Burn accidents happen frequently in the kitchen. While cooking, never leave your food unattended and keep the stove area clear of all flammable materials. Make sure to keep your cooking area clean - grease and debris can quickly cause a fire emergency. Never use an oven to heat your home and always turn off cooking appliances when you are finished using them. Check your fire alarms frequently The US Fire Administration recommends checking your smoke detector as often as once a month, changing batteries every 6 months and replacing the alarm itself every 10 years. If the batteries are not working, make sure to change them immediately. Test the temperature of your water and hot liquids Not all burns are caused by fire.Extremely hot liquids could seriously harm you and your family members. Make sure to set your water thermostat to a maximum of 120 degrees and always check the temperature of hot liquids you consume or touch. Never leave candles unattended Candles can quickly become a fire and burn hazard. Always put them out before leaving your home or if they are in reach of your kids or pets, and make sure there are no flammable materials around. What to do if you get a burn Although by following fire and burn safety guidelines most home burns can be avoided, accidents do happen. Here are a few tips on what to do if you or your family member gets a burn: Run the burn under cool or lukewarm water To prevent the burn from spreading and gaining severity, run the affected spot under cool or lukewarm water for at least 20 minutes. Remove any wet clothing or jewelry from the site of the burn to avoid irritation. Avoid using home remedies Using home remedies, such as putting ice or using non-prescribed ointments on your wound can actually make the duration and intensity of the burn worse. Avoid self-treatment and stick to the guidance offered by medical professionals. Call 911 or your medical provider No matter the severity of the burn, it's always best if it can get checked out by a medical professional. Experts recommend calling your medical provider (or 911 in the case of potentially severe injuries) immediately after the accident so you can get the right treatment and avoid the burn from getting worse. Call us (508) 540-2601 for more advise and best insurance covers to protect you and your family.

0 Comments

As your home begins defrosting from winter’s chill, it’s a good time to get everything ready for spring.

Take advantage of the burst of energy you get from spotting that first flower or songbird to deep clean and maintain your property, from the bedrooms to the backyard. Does your home need some upkeep? Continue reading for five tasks that should be on every homeowner’s seasonal to-do list. HVAC Readiness Whether you have central air or use window units, you should:

Consider scheduling a professional tuneup visit if you’re unsure what shape your system is in. Tree Trimming Prune and trim shrubbery and trees as needed. This will boost the appearance of your landscaping and protect your home by keeping overgrowth away from doors, windows and HVAC units. Look for trees that have been damaged or died over the winter. You may need to have them taken down to prevent risks to your property (or a neighbor’s). Cleaning and Decluttering Now is the time to donate or sell unwanted items, dust and mop your whole home, wash your porch or deck and finish other seasonal or annual cleaning tasks. Roof and Gutters Check for buildup in your gutters, make sure downspouts are pointing away from your home, and look for holes or cracks. If you don’t feel comfortable cleaning your gutters, you can hire a professional. You should also survey your roof to see if there are any damaged or missing shingles, and contact a roofing expert if there are repairs to be made. Drain Your Water Heater Sediment can build up in your water heater, which reduces efficiency. Draining and flushing it once a year can help the unit last longer, and it may also reduce your utility costs. If you’ve got questions about home upkeep or your homeowners insurance policy, get in touch today. Most homeowners would probably love to reduce their utility bills while making a positive impact on the environment. Does that sound like you?

Good news: Installing a renewable energy system in your home can provide clean electricity and heat while lowering or eliminating your energy bills. However, there are upfront costs and other considerations involved. Want to learn about your options for renewable energy systems? What are the options for renewable energy?

What to Consider Before Installing a Renewable Energy System Check with local and state governments for any regulations you need to follow. The company you choose for installation should also be able to help you research and understand:

How to Determine Your Electricity Needs Be sure you know how much electricity you’ll need your system to generate by calculating your current consumption. You may be able to get this information from your utility company or renewable energy company. You can also get a close estimate by multiplying the wattage of each appliance in your home by the approximate number of hours it’s used per day. Reach out if you have questions about how your homeowners insurance policy may be affected by the installation of a renewable energy system. Are you deciding between renovating your current house and finding a new one?

Rising interest rates have made some would-be buyers and sellers reconsider — and if you decide to stay put, you may want to modify your home to better fit your lifestyle. You should base your renovation decisions on what will most enhance your comfort and enjoyment of the home, especially if you’re not planning to sell anytime soon. But it doesn’t hurt to also consider the potential return on investment (ROI) of your project. Here are six home updates that could also boost your home’s value. Updated Flooring You may just want to refinish hardwood floors, or you could swap one flooring material for another. Outdoor Space A new deck, patio or porch can add new living space to your house — especially if it’s enclosed or covered. It also enhances your backyard, offering a place to relax, enjoy a meal or entertain guests. Kitchen Improvements You don’t have to do a complete kitchen remodel to see a positive ROI. Smaller improvements such as cabinet refacing, new cabinet hardware, a granite countertop or new appliances can also boost the aesthetic of your kitchen and your home’s value. Finished Basement Do you need more space? You might be able to add living space to your home if you have a basement to finish. You could make it a bedroom, home office, playroom or gym — the options are nearly endless. Energy-Efficient Upgrades Installing solar panels, switching to an electric heat pump and replacing older windows can all save you money on utility costs while increasing your home’s value to future buyers. Neutral Paint Colors A fresh coat of paint gives the interior of your home an instant lift. A light, neutral color palette is the best choice for ROI because it appeals to the largest number of people. Are you curious about how home improvements could impact your insurance policy? Get in touch today. While renters insurance offers broad protection for tenants, it's important for consumers to choose the policy that best suits their individual needs.

A renters policy can cover your personal belongings and help cover legal costs in the event you are sued for accidental bodily injury or property damage of others. But not all policies are the same. Here are five questions to ask your insurance representative to help you make the right choice. 1. What's Covered and What's Not? A renters policy generally covers your stuff against events like theft, lightning, fire, smoke, vandalism, explosions and windstorms.1 There's also liability protection against claims and lawsuits alleging that you caused bodily injuries or property damage. There may be coverage for certain kinds of water damage, such as leaks from damaged pipes. Your insurance rep can tell you if the policy includes additional living expenses if you're forced to move due to a covered loss. A typical renters insurance policy does not generally provide coverage for damage from floods and earthquakes. Also, there will be limits on how much coverage is provided for your things. There could also be lower limits in the policy for different categories of your possessions. If you own expensive collectibles, such as jewelry or art, ask your insurance representative about buying additional coverage for these valuables. 2. Will a Renters Policy Cover my Roommate? Renters insurance typically covers family members, but may not cover roommates. Calfee Insurance recommends that each occupant obtains his/her own policy to cover their individual stuff. Some insurers allow roommates to be insured under a single policy. In these instances, roommates must agree to the level of coverage, based on the combined value of their stuff. If one roommate moves away, the remaining renter typically will need to obtain a new policy. 3. What's the Difference Between Cash Value and Replacement Coverage? There are two types of renters coverage, one that pays based on your property’s actual cash value and one that pays based on you property’s replacement cost. For example, a computer you bought for $1,000 eight years ago has significantly depreciated in value, let’s say to $200. If you have a cash value policy, the maximum amount you would be paid would be the lesser of the cost to repair it, or $200. If you have a replacement cost policy, the amount you would be paid would be the lesser of the cost to repair or replace the item with a similar new computer. 4. Will Owning a Dog Affect my Renters Coverage? Some policies provide coverage if your dog injures someone, and some insurers exclude or limit coverage for customers who own a dog. It’s best to discuss this with your insurance representative when purchasing your policy. 5. Am I Covered if my Laptop Computer is Stolen from my Car Parked Outside my Home? Renters policies generally include coverage for items stolen off-premises. That means belongings outside your home have insurance protection similar to the things inside your home. However, off premises coverage may be limited to a percentage of your total coverage for personal items. For example, if you have $50,000 in personal items coverage, the amount available for off-premises losses may be 10 percent of that figure, or $5,000. Also, keep in mind, there is generally a deductible that applies. There are many common myths about potential dangers in and around the home that can keep some homeowners up at night. However, the gap between myth and fact can make all the difference when it comes to reducing risk in your house. So what does the data tell us are the biggest risks to your home?

From leaking valves to house fires, a look at Calfee Insurance Claim data reveals the facts about the most frequent causes of homeowners’ claims, as well as the costliest. The answers may surprise you. While some risks are common nuisances we are all too aware of, others can be catastrophic. To help keep your home, your valuables and your family safe, you will want to take steps to protect them. Danger #1: Water Damage Many people think of damage from hurricanes and heavy rains when they think of water damage. But according to Travelers Claim data from 2013-2020, more property losses resulted from non-weather water claims (23%) than weather-related water claims (15%)*. Non-weather water claims can involve plumbing-related losses, such as pipes, drains and valves, as well as appliance issues. Learn more about common causes of water damage and the steps that you can take to help prevent it. Danger #2: Weather-Related Roof/Flashing Damage Wind, hail and weather-related water damage accounted for more than half, or 53%, of all Travelers property loss claims between 2013-2020. Falling limbs and branches weighed down by snow and freezing rain can cause roof/flashing damage. It is a good idea to inspect trees on your property to help prevent damage caused by falling tree limbs. Learning how to identify and remove ice dams can also help you avoid costly damage in the winter months. Danger #3: Frozen Pipe Damage Frozen water pipes are considered a potential source for catastrophic property damage, and make the list of Travelers’ five costliest sources of homeowner claims. While a sub-item of weather-related water loss, it is so significant, it deserves special mention. The good news is you can take steps to help prevent your pipes from freezing by identifying pipes that are most at risk and taking steps before winter arrives to help insulate them. During the winter, you may consider using a smart thermostat to manage and monitor that your heat is set at a safe level to help avoid freezing, and to receive notifications if the temperature in your home drops unexpectedly. Danger #4: Theft Theft from the premises makes the list of top causes of property loss claims, accounting for 4% of losses. There are many steps that you can take to help make your home less attractive to thieves, including landscaping with theft prevention in mind, adding outdoor lighting and creating a plan to make your home appear occupied while you are away. There are a number of methods to monitor your home to help minimize the theft potential, including smart home alarm systems. Danger #5: Fire Although fires do not occur as often as other incidents around the home, the damage that they can cause puts fire at the top of the costliest types of claims, according to Travelers Claim data from 2013-2020. Fire and related damages accounted for 27% of claims as measured by costs paid out. Fires can start from cooking, overloading circuits, and improperly using a wood stove, among other causes. Learn more about the potential wood stove safety tips, and how to help protect your home. Is Your Home Insured to Its Replacement Cost?

If you lost your home in a fire, how much would it cost to rebuild it? The answer may be different than you think. And if your home isn’t insured to its full replacement cost, your homeowners policy may not cover the full cost for you to rebuild it in the event of a covered loss. Rebuilding costs could differ from what you paid for your home and be more than its current market value what it would sell for today – especially in areas where the value of real estate has changed. A replacement estimate includes costs to rebuild your home component by component. Current costs for labor, materials and contractor fees may influence the replacement cost of your house. Some key factors that affect the cost of rebuilding a home:

We are an insurance company that cares. We help you get the coverage that meets your needs to help protect the things that are important to you, so you don’t have to worry. It’s important to have a current estimate for your home’s replacement cost, one that reflects any significant improvements that you have made to the house. For example, if you installed a central air conditioner or finished your basement after you took out your insurance policy and never updated the replacement cost, your home might not be fully covered in the event that you need to completely rebuild following a covered loss. Here are some steps that you can take:

Making sure that your home is insured to its full estimated replacement cost is another way to help protect your home and the things you’ve worked hard to build. Learn more about our homeowners insurance products, or if you’re ready to take the next step, click here to get a quote or find an agent. If you're working on your home or putting on a new roof, consider renovating to FORTIFIED standards.

Developed by the Insurance Institute for Business & Home Safety (IBHS), FORTIFIED Home™ construction practices are designed to help homeowners and communities better weather future storms, including hurricanes, high winds, hail and severe thunderstorms. Building codes set a minimum standard for construction techniques and materials. Building FORTIFIED means exceeding those requirements. The goal of building FORTIFIED is to take action today to make homes and communities more resilient to natural disasters tomorrow. Using data from more than 20 years of storm damage, IBHS created a set of standards for new and existing construction that can be affordable and can be incorporated into your home’s building design. Travelers Insurance allows you to customize your coverage to fit your unique needs. We focus on understanding you, so you'll feel right at home working with us. Three Levels of FORTIFIED Home Designations

Adding Value and Safety After a certified, third-party evaluator verifies that the home meets FORTIFIED standards, you receive a certificate and a unique ID number valid for five years. The FORTIFIED designation helps show you have made consistent and defined structural updates to your home. To learn more, visit the IBHS website. Learn more about Calfee homeowners insurance products, or if you’re ready to take the next step, click here to get a quote. As a homeowner, you have a lot to think about when it comes to taking care of your home. But one thing you may not have considered is how water-connected appliances and systems can lead to water damage. Learn how to proactively defend against potential water issues. Just a few simple tasks can help you come home happy.

9 Home Areas to Keep an Eye on for Water Issues: 1. Refrigerator Water Supply Line Look for kinks, cracks, and other signs of wear and tear in the water supply line. If you move your refrigerator to inspect the supply line, be careful not to damage or kink the line when you put it back into place. 2. Water Heater Corrosion on the external pipe on the tank could be a sign of internal problems. Look for crystal-like deposits that may be white, blue, or green. And remember, water heaters don’t last forever. Check the manufacturer’s warranty for guidance about the lifespan of your water heater. 3. Main Water Shut-off Valve In the event of a sudden water leak, the main shut-off valve can stop the flow of water to your home and help mitigate resulting damage. Take a minute to locate your main water valve before there’s an issue, and flag it with tape or a tag to help people spot it. 4. Sink Fittings and Connections If you notice a drip or signs of a leak or other potential plumbing problems, immediately call a professional. To be alerted early to signs of a leak, install a smart water sensor under your sink. 5. Caulking Around Your Tub/Shower Caulking used to seal the perimeter of a tub or shower can fail over time. Look for cracks, missing caulking or other signs of wear and tear. Regularly check sealants to ensure they are properly sealing against unwanted water intrusion. 6. Inside Your Toilet Tank Look for corrosion, degradation or discoloration. Some cleaning products that can be added to the tank can prematurely degrade the components. Regularly check the components in your toilet tank. If they show signs of wear and tear, replace them. 7. Washing Machine Supply Lines Supply lines are made of rubber or braided stainless steel. A cracked line could not just lead to damage to the room where the leak occurred, but also to the floor below. Turn off water supply, whether your washer is on an upper floor or in the basement, when you’re not running the machine. 8. Sump Pump To test your sump pump to see if it’s functioning properly, pour water into the sump (pit) to make sure the pump kicks on. The float inside the sump will begin to rise with the water and activate the pump, an indication that it’s working. 9. Central Air Conditioning Unit Drain Pan Extreme temperatures in an attic can cause plastic drain pans to crack and leak. An overflow sensor switch in the pan will shut off the air conditioning system if the pan is full. A leaking pan or malfunctioning sensor can lead to a bigger issue. Check the drain pan and test the overflow sensor switch regularly. While you’re taking steps to help protect your home from a non-weather water disaster, it’s also a good time to make sure you’ve got the appropriate insurance coverage. Contact your local agent to review and update your homeowners insurance coverage. If you’re a homeowner, you may be surprised to learn that the bulk of water damage to a home isn’t due to natural disasters or flooding. It’s actually due to unchecked plumbing issues that lurk on the property — things like slow leaks, corroded pipes, and degraded valves and supply lines. Even your water make-up can be a culprit.

Fortunately, many of these issues are preventable with some basic, proactive home maintenance. Do you want to reduce the chances of water damage in your house? Here are some home maintenance tips that risk control specialists recommend: 1. Locate your main water shutoff valve and learn how to turn it on and off Knowing how to turn off your main water valve is critical in the event of a burst pipe or other water emergency. In many homes, the valve is located on an exterior wall of the home, in the garage, or in the basement. If you have a public water supply, the main water valve is typically on the street-side of your home. For homeowners who have wells, the main water valve will most likely be located on the same side of the house as your well. Typically, to turn off the main water valve, you simply turn the valve handle clockwise until it stops. Closing the valve should shut off all water supply into your home in the event of a leak, or if a repair is needed. 2. Have your plumbing systems professionally inspected If you’re unfamiliar with your plumbing system or have concerns about it, have a licensed plumber inspect it for any issues (or signs of impending ones). One good tip is to ask the plumber to tag your main water valve — as well as any other important plumbing valves — for example, with a red flag or piece of tape. This can help you locate them more quickly in an emergency. 3. Visually inspect your pipes regularly You don’t have to be a professional plumber to recognize potential problems with your pipes. It’s a good idea to regularly walk through your home to take a closer look at any exposed pipes, fittings, valves and supply lines you can see. You’ll want to look for signs of damage. These can include things like:

4. Watch for evidence of slow or weeping leaks Not all leaks are obvious. In fact, slow leaks can be some of the most insidious, as they’re often very difficult to spot before a larger problem occurs. Routinely check your appliances, such as your washing machine, dishwasher, or even fixtures, and the area around your appliances for signs of leaks. Look in cabinets and areas that have pipes connecting to appliances or fixtures (under the kitchen sink, for example) for telltale signs. Is there discoloration or damage on the wood below a pipe or fitting? Is the paint peeling? These environmental signs could point to a slow leak. 5. Tag or label any items you replace or repair If you do end up having a licensed plumber replace a part or make a repair, be sure to label the item with the date it was replaced or repaired and keep records of the work done. Plumbing fixtures have a set lifespan and knowing when you last replaced or repaired a part can help you plan ahead for a maintenance check of that fixture. 6. Have your water tested The chemical make-up of your water can lead to corrosion. Mineral content, pH, and chlorides are examples of water characteristics that should be measured and controlled to prevent issues with your plumbing system. This is especially important if you own a well. Consider having your water tested and treated, if necessary, by a certified professional to help guard against an often-overlooked threat to your home’s plumbing. 7. Inspect and replace toilet supply lines and valves proactively Just as you inspect your exposed pipes, you should also check your toilet supply lines and valves regularly. Make sure the supply hoses going to and from your toilets are in good condition and consider replacing them if they have signs of wear and tear or are more than a few years old. Read the installation instructions carefully and do not overtighten connections. Many of these products are installed hand-tight only, which means don’t use a wrench. You should also open your toilet tank and evaluate the flushing valve for signs of degradation, including crazing, cracking, or discoloration of plastic components. More Ways to Protect Your Home Technology has made water loss prevention easier than ever. There are now “smart” water leak detectors and sensors you can install near or around your appliances and connection points that can alert users of leaks in their earliest stages. These water leak detectors come in both DIY and professionally installed options, so there’s likely something for every budget and capability. Finally, having the right amount of homeowners insurance coverage is also an important step toward protecting yourself from the potentially devastating costs of water damage. If you are not sure if your home and belongings are covered in the event of non-weather water damage, reach out to your agent or representative today. Calfee Insurance is here to help. |

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

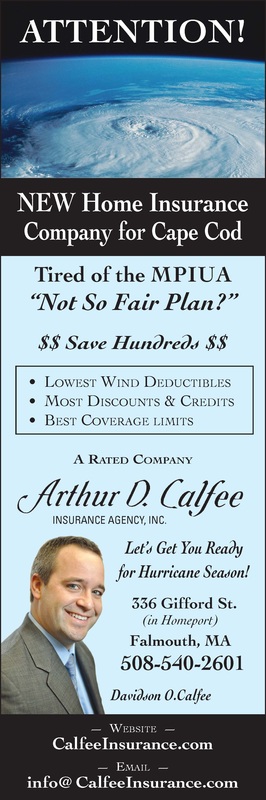

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2023 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed