|

Credit is an important financial factor in modern life, necessary for making large purchases and borrowing money.

What many people don’t realize, though, is that your credit score can also affect things unrelated to loans, like your insurance coverage and rates. That’s why it’s essential to know what impacts your credit history and score (and what doesn’t). Read this to learn the truth behind four common credit myths. Myth #1: Carrying a credit card balance will improve your score. While debt utilization (the percentage of your total available credit in use at any given time) matters, carrying a balance won’t necessarily help your score — and could hurt it. Carrying a balance also means having to pay interest on it, which is why paying off your card’s balance in full each month is best, if you can manage it. Myth #2: Checking your credit history will lower your score. When you apply for a loan and the lender checks your credit, that’s a hard inquiry, which can affect your score (especially if multiple credit checks happen within a short period). But you can make a soft inquiry to check your own credit report and score without penalty. Myth #3: Closing a credit account will improve your score. The age of your credit accounts and your credit utilization ratio are both factors in calculating your score. Closing a credit card, especially a longtime account, can actually hurt your score temporarily. It’s generally better to leave a credit card open and unused than to close it. Myth #4: You can quickly improve your credit. Unfortunately, there’s no quick fix for your credit history. Certain events, like bankruptcy or foreclosure, may stay on your credit report for years. Other factors, like high credit utilization, simply take time to improve. But the upside is that you can rebuild your credit over time with sustained effort and good habits. Get in touch if you have questions about your insurance policy or need to make changes to your coverage.

0 Comments

Burn injuries in the United States lead to over 400,000 people needing care each year. Yet, with simple lifestyle changes and safety measures most home burns can be prevented. Below are a few tips to help you and your family avoid burn injuries.

Monitor the condition of electrical cords Electrical fires are a common cause of injuries resulting from burns. Be sure that the quality of your cords is being maintained and always throw away electrical cords that are damaged or broken. Make sure to check for damage frequently and never overload your outlets, power strips, or electrical circuits. For increased safety, experts advise installing safety caps on electrical cords and storing them out of reach. Use space heaters carefully Make sure to have enough fixed space around your heaters. When you leave the room or turn in for the night, always switch off heating devices. Experts recommend keeping all flammable materials, like curtains, blankets or towels at least three feet away from your heaters. Practice burn safety in your kitchen Burn accidents happen frequently in the kitchen. While cooking, never leave your food unattended and keep the stove area clear of all flammable materials. Make sure to keep your cooking area clean - grease and debris can quickly cause a fire emergency. Never use an oven to heat your home and always turn off cooking appliances when you are finished using them. Check your fire alarms frequently The US Fire Administration recommends checking your smoke detector as often as once a month, changing batteries every 6 months and replacing the alarm itself every 10 years. If the batteries are not working, make sure to change them immediately. Test the temperature of your water and hot liquids Not all burns are caused by fire.Extremely hot liquids could seriously harm you and your family members. Make sure to set your water thermostat to a maximum of 120 degrees and always check the temperature of hot liquids you consume or touch. Never leave candles unattended Candles can quickly become a fire and burn hazard. Always put them out before leaving your home or if they are in reach of your kids or pets, and make sure there are no flammable materials around. What to do if you get a burn Although by following fire and burn safety guidelines most home burns can be avoided, accidents do happen. Here are a few tips on what to do if you or your family member gets a burn: Run the burn under cool or lukewarm water To prevent the burn from spreading and gaining severity, run the affected spot under cool or lukewarm water for at least 20 minutes. Remove any wet clothing or jewelry from the site of the burn to avoid irritation. Avoid using home remedies Using home remedies, such as putting ice or using non-prescribed ointments on your wound can actually make the duration and intensity of the burn worse. Avoid self-treatment and stick to the guidance offered by medical professionals. Call 911 or your medical provider No matter the severity of the burn, it's always best if it can get checked out by a medical professional. Experts recommend calling your medical provider (or 911 in the case of potentially severe injuries) immediately after the accident so you can get the right treatment and avoid the burn from getting worse. Call us (508) 540-2601 for more advise and best insurance covers to protect you and your family. What Does Home Insurance Cover?Typical home insurance coverage (level HO-3) protects the buildings on your property against certain types of damage and affords you personal liability coverage.

Enhanced Coverage for Massachusetts Homeowners Insurance

According to a 2023 survey, 63% of workers said they would be unable to cover a $500 emergency expense.

This means a majority of Americans don’t have an emergency fund, which is a savings account with roughly three to six months of living expenses set aside for unexpected expenses. If you can, you should be working on building emergency savings. Even a small amount can add up over time. Learn about the most common reasons to tap your emergency fund. Job Loss Losing your job can be financially devastating, especially if you’re the primary earner in your household. Even if you qualify for unemployment benefits, emergency savings can help you keep up with bills. Emergency Home Repairs Homeowners can plan and budget for routine maintenance and repair tasks, but expensive repairs may arise suddenly. For example, a storm blows through and knocks a tree branch onto your roof or floods your basement. Whatever happens, it helps to have emergency savings to cover the cost without going into debt. Major Car Repair As with your house, your car doesn’t always give a warning before breaking down on the highway. Whether you have trouble with your brakes, engine or tires, having money saved up can get you back on the road. Medical Expenses Nearly half of American workers are enrolled in a high-deductible health plan, according to the most recent federal data. This can result in costly bills if you or one of your dependents has an injury or needs diagnostic testing. If you have access to a health savings account, you can save for medical expenses with pretax dollars. If not, your emergency fund will come in handy. Do you have questions about your insurance coverage and how it could help you save in case of property damage? Get in touch to talk about your policy. As your home begins defrosting from winter’s chill, it’s a good time to get everything ready for spring.

Take advantage of the burst of energy you get from spotting that first flower or songbird to deep clean and maintain your property, from the bedrooms to the backyard. Does your home need some upkeep? Continue reading for five tasks that should be on every homeowner’s seasonal to-do list. HVAC Readiness Whether you have central air or use window units, you should:

Consider scheduling a professional tuneup visit if you’re unsure what shape your system is in. Tree Trimming Prune and trim shrubbery and trees as needed. This will boost the appearance of your landscaping and protect your home by keeping overgrowth away from doors, windows and HVAC units. Look for trees that have been damaged or died over the winter. You may need to have them taken down to prevent risks to your property (or a neighbor’s). Cleaning and Decluttering Now is the time to donate or sell unwanted items, dust and mop your whole home, wash your porch or deck and finish other seasonal or annual cleaning tasks. Roof and Gutters Check for buildup in your gutters, make sure downspouts are pointing away from your home, and look for holes or cracks. If you don’t feel comfortable cleaning your gutters, you can hire a professional. You should also survey your roof to see if there are any damaged or missing shingles, and contact a roofing expert if there are repairs to be made. Drain Your Water Heater Sediment can build up in your water heater, which reduces efficiency. Draining and flushing it once a year can help the unit last longer, and it may also reduce your utility costs. If you’ve got questions about home upkeep or your homeowners insurance policy, get in touch today. Most homeowners would probably love to reduce their utility bills while making a positive impact on the environment. Does that sound like you?

Good news: Installing a renewable energy system in your home can provide clean electricity and heat while lowering or eliminating your energy bills. However, there are upfront costs and other considerations involved. Want to learn about your options for renewable energy systems? What are the options for renewable energy?

What to Consider Before Installing a Renewable Energy System Check with local and state governments for any regulations you need to follow. The company you choose for installation should also be able to help you research and understand:

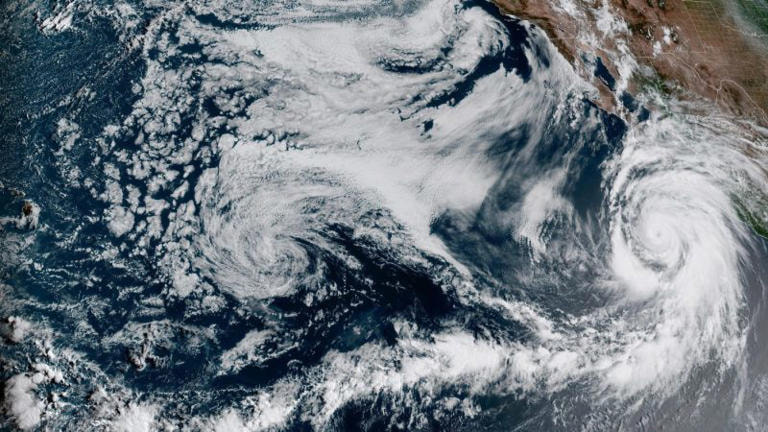

How to Determine Your Electricity Needs Be sure you know how much electricity you’ll need your system to generate by calculating your current consumption. You may be able to get this information from your utility company or renewable energy company. You can also get a close estimate by multiplying the wattage of each appliance in your home by the approximate number of hours it’s used per day. Reach out if you have questions about how your homeowners insurance policy may be affected by the installation of a renewable energy system. A pair of climate scientists are proposing a sixth category for hurricanes as climate change increasingly intensifies these storms, according to a new research study. In a study, published Monday in the Proceedings of the National Academy of Sciences, the two scientists argued the “open-ended” Saffir Simpson hurricane wind scale is becoming increasingly “inadequate” as the globe continues to warm. The scale, developed in the early 1970s, may not reflect the true intensity of some storms, argued study co-authors Michael F. Wehner — a climate scientist at the Lawrence Berkeley National Lab — and James P. Kossin — a former NOAA climate and hurricane researcher. A Category 6 designation would apply to storms with winds that exceed 192 miles per hour under their proposal. Storms with winds of 157 mph or higher are currently ranked Category 5, an open-ended approach that fails to adequately warn people of the dangers of higher wind speeds, the study contended. The study’s co-authors believe the open-ended nature of the current scale will prompt people to underestimate the risk of some hurricanes, which will become “increasingly problematic in a warming world.” “We find that a number of recent storms have already achieved this hypothetical category 6 intensity and based on multiple independent lines of evidence examining the highest simulated and potential peak wind speeds, more such storms are projected as the climate continues to warm,” the study stated. Does the hurricane intensity scale need a new 'category 6'?Since 2013, five — all in the Pacific — reached wind speeds of 192 mph or higher, with warming conditions expected to bring even stronger weather, The Associated Press reported. “Climate change is making the worst storms worse,” Wehner told the news wire. Some experts told The AP they do not believe another category is needed, and could give people the wrong impression as it’s based on wind speed, rather than water — the deadliest element of hurricanes. University of Miami hurricane researcher Brian McNoldy reportedly noted climate change is not causing more storms, but rather intensifying storms and increasing the proportion that qualify as major hurricanes. This is driven by warmer oceans, McNoldy said. Kossin told The AP pacific storms are stronger as there is less land to weaken them, in contrast to the Gulf of Mexico and Caribbean. While no Atlantic storm has reached the 192 mph threshold, Kossin and Wehner told the news wire the world warming will create a greater chance in the future. Jamie Rhome, deputy director of the National Hurricane Center, noted to the news wire that his office attempts “to steer the focus toward the individual hazards, which include storm surge, wind, rainfall, tornadoes and rip currents, instead of the particular category of the storm, which only provides information about the hazard from wind.” Rhome added a Category 5 already suggests “catastrophic damage” from wind so adding a higher category would not be necessary even in the case storms get stronger, the AP noted. No matter what else winter may bring, you’re probably experiencing lower temperatures this time of year.

That’s why this season can bring a specific set of challenges for your home and car. Snow and ice, heating systems, fire safety, pipes and tires should all be top of mind during the colder months. Keep reading for 12 tips on staying safe at home and on the road when the thermostat is at its lowest. Stay Safe and Warm at Home

Drive Safely This Winter

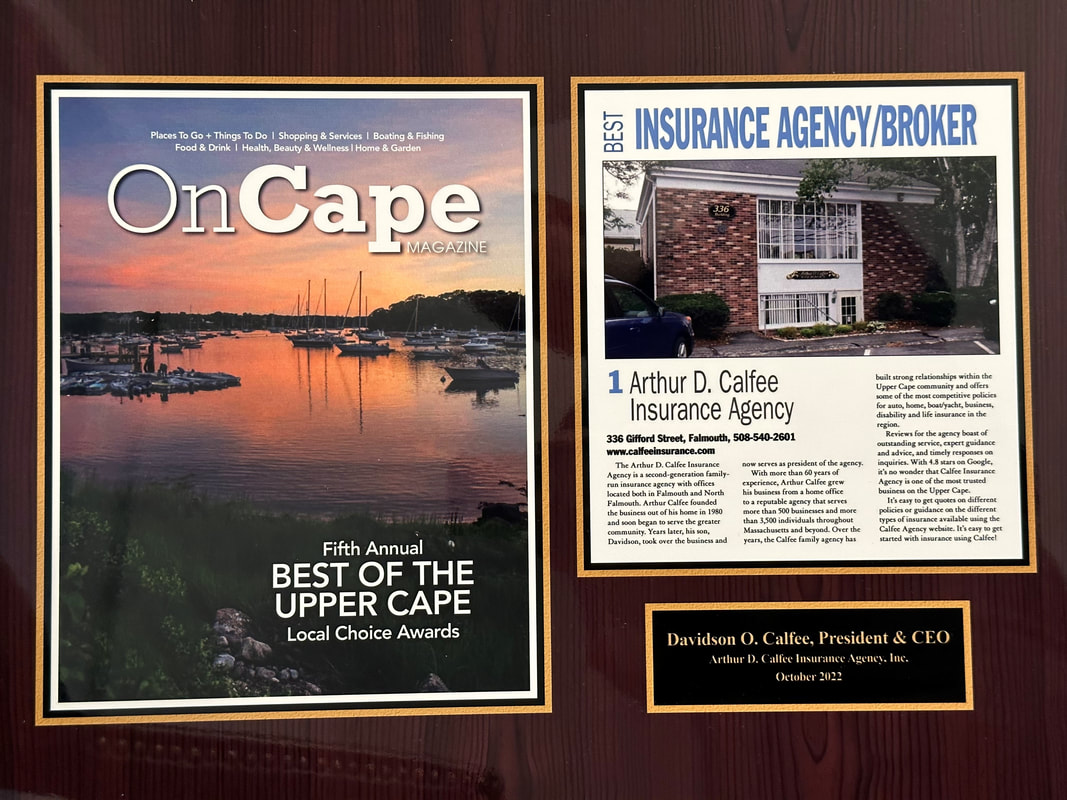

If you have questions about winter safety or your insurance policies, reach out today.  2022 Local Choice Award Insurance Agency - Serving Massachusetts Since 1980 We Shop Leading Insurance Carriers To Save You Money! Click Here - FAST Home & Auto Insurance Quote We Create the 'Best Home & Auto Insurance' Package Deals in Massachusetts  We Create the 'Best Home & Auto Insurance' Package Deals in Massachusetts We run our business with a value system of love (concern for others), trust, respect, a commitment to excellence and fun. And thanks, in part, to the customer service focus way we run our business, Calfee Insurance, has consistently been rated 5-Stars (superior) on Google & other platforms by current clients for more than 40 Years. We were voted the Best in the Local Choice Awards in 2022. Click here - Testimonials & Reviews: "Trustworthy, Knowledgeable, Qualified, Skillful, Talented, Accomplished" We offer a wide range of coverage, including umbrella, auto, home, renters and life insurance. It doesn't stop there - we also provide motorcycle and small business insurance.  "Good customer service means helping customers efficiently, in a friendly manner. It's essential that we are able to handle issues for customers and to do our best to ensure you are satisfied." "Providing fast, educated, quality service is one of the most important things that we can differentiate from our competitors." FAST HOME INSURANCE QUOTES (508)540-2601 We recommend coverage amounts for your personal situation and break down everything we offer with clear-cut explanations so you know exactly what you’re getting. Easy, Fast, & Secure Homeowners Insurance & Car Insurance. Get a Free Quote 100% Online Now! Real-Time Pricing. Affordable Rates. Available 24/7. Insurance coverage: Wind Damage, Fire Loss, Water Damage. "Providing fast, educated, quality service is one of the most important things that we can differentiate from our competitors." FAST HOME INSURANCE QUOTES (508)540-2601 By answering some simple questions about your home, we’ll get you the protection that you deserve, all through our secure network. We offer a comprehensive set of home insurance coverages to protect your property and your family. Once you start a quote, we’ll recommend to you the appropriate amount of insurance needed for your home by calculating property and building construction information from multiple databases.  Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! When purchasing property insurance, doing your due diligence is more than a turn of phrase. The period when a house is under contract is an essential part of the home insurance buying process and requires careful attention to detail. Being thorough in the due diligence phase will help you uncover potential issues and make the right choices for you and your family by calling us at (508)540-2601. Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Our local underwriting insurance professionals focus exclusively on finding the best home insurance products for our Massachusetts residents. Protect yourself on the road with auto insurance. Find out about coverage options, discounts and get a free online car insurance quote. Car Insurance shopping has become something of a science. If you time your insurance purchase right, you could save hundreds off the sticker price, while buying insurance during certain times of the month or on the wrong day can cost you. Here's a look at when you might find the best deals on a new set of wheels by calling us at (508)540-2601. Arthur D. Calfee has 60 years of experience in the insurance industry. He worked in the Boston claims office of the Boston Old Colony Insurance Company from 1960 to 1966, when he moved to Falmouth. After 14 years working for a local agency, Art opened his own agency in 1980. In 1988 he purchased the Everitt W. Noyes Insurance Agency in North Falmouth. In 1990 he purchased the Gordon W. Bryden Insurance Agency and merged it into the North Falmouth office. Today the agency's Falmouth office serve the insurance needs of more than 500 businesses and more than 4,000 individuals throughout Massachusetts and beyond. Arthur was named the town's "Outstanding Citizen of the Year" by the Falmouth Chamber of Commerce" for many years of dedicated service, leadership and achievements that have made Falmouth and Cape Cod a very special place to live," an honor recognized by citations from the State Senate and House of Representatives. Arthur has also received similar community awards such as the Falmouth Heritage Award. In the past, Arthur has held several positions such as President to the Falmouth Beautification Council and President of the Design Review Committee to the Town of Falmouth. Cape & Plymouth Business, was proud to honor Davidson O. Calfee as one of the region's top young & most dynamic business leaders with a '40 Under 40 Award' on June 16, 2010! Born & raised on Cape Cod, Eagle Scout, Davidson studied platinum customer service techniques and obtained his bachelor of science hotel & restaurant management degree. Soon after they asked him to become the 2002 Alumni Class Director to the Conrad N. Hilton College of Hotel & Restaurant Management at the University of Houston, TX. Davidson learned quickly about home insurance & flood insurance during the 2001 Tropical Storm Allison in Houston when the entire city of Houston, Texas was under water. Davidson studied more about the insurance industry when Hurricane Katrina destroyed his coastal home & property along the Mississippi Gulf Coast in September, 2005 with heavy winds, storm surges & tidal waves. Learning from his past experiences with natural catastrophes & hurricanes, Davidson grew a natural passion to assist his hometown residents on Cape Cod, Massachusetts understand their home insurance policies and their complexities surrounding coverage amounts, causes of damage and relief. Quickly settling on Cape Cod, Massachusetts after losing his home to Hurricane Katrina, Davidson became the Founding President & Chairman of the Falmouth Young Professionals, President of Business Networking International - Cape Cod Team Advantage, Treasurer of the Falmouth Education Foundation and the Director of Automation with the Cape Cod Insurance Agent's Association. In the past, Davidson has held positions such as a Loaned Executive, personally raising over $800,000 for the United Way of South Mississippi, the Ambassador to the Conrad N. Hilton College in Houston, TX, the Falmouth Chamber of Commerce and the Canal Region Chamber of Commerce in Massachusetts. In 2012, the Falmouth Chamber of Commerce voted him on to their Board of Directors. The Falmouth Community Television Station awarded Davidson with their prestigious 2012 "Volunteer of the Year" Award during their Annual Dinner for many events & special productions including The Village Green, Live Election Coverage, Young Professional Television and special government meetings, to name a few. Davidson O. Calfee is the Owner, President & CEO of Operations overseeing all agency & portfolio management, consumer relations and new business generation. He has a natural ability to manage complex situations to achieve outstanding results for his clients. By constantly looking for ways to improve professionally, Davidson Calfee has worked diligently to revamp his team’s service of the needs and expectations of clients. Calfee specializes in developing, designing and implementing complex property catastrophe insurance programs for his clients. His market knowledge and client service skills have made Calfee’s Agency a sought-after home insurance resource for Massachusetts coastal residents. Calfee created a cohesive work environment by recruiting, retaining talent and developing successful home insurance products that has built a strong clientele over the years. Calfee has maintained a high customer retention rate by tirelessly searching for savings solutions and fostering community relationships to bring people closer to home insurance resources that can improve their situation. Currently, Calfee is leading and developing the execution of an upcoming home insurance package product launch. Always keeping the interest of the insured at the forefront, followed by the markets and associated parties, Calfee truly has the recipe for developing a great home insurance program. Calfee has an incredible ability to consistently build strong relationships to create win-win partnerships with clients, colleagues, and business partners. With a firm belief that effective client services is rooted in trusted relationships, Calfee approaches projects by ensuring all parties are on the same page in order to deliver effective results from start to finish. His team uncovers cost savings by navigating the complex world of home insurance to create specific insurance solutions that are unique to each home. Calfee also assists in producing presentations, submissions and documentation; interpreting analytical results to evaluate and compare different home insurance prices and strategies. By helping clients fully understand their actual and potential costs, Calfee provides actionable advice to support in minimizing the total cost of risk in protecting home assets. Home insurance is often one of those necessary-yet-avoided topics of discussion. Its importance for family continuity and individual survival is paramount, but no one wants to voluntarily think of “the worst that can happen.” Sometimes it does happen and local communities can suffer incredible damage from natural and man-made disasters. It is for this reason you need representation that can build a connection, share this knowledge and offer resources in a way that dissolves doom and gloom scenarios and encourages you to see the positive benefits of insurance policies.

The Arthur Draper Calfee Insurance Agency, Inc. demonstrates this empathic capacity to connect with clients specifically in its community about policies and preparing for those surprise catastrophes. The Cape Cod agency offers home insurance, flood map info, flood insurance, boat/yacht, auto, disability and life insurance packages to meet the unique needs of the community. A 2nd generation company solely family-run, the agency originated with founder Arthur from his home in 1980. Arthur Draper Calfee comes from a long line of leaders; his middle name “Draper” originates from the Draper Family from Hopedale that was responsible for leading the industrial revolution in Massachusetts. The Draper brothers, General Draper and Massachusetts Governor, Eben Draper also manufactured Looms, which distributed fabric for people internationally. Art’s vision expanded beyond his Cape Cod home borders and he eventually began servicing over 3,000 clients in his immediate territory. It was this single-minded dedication to serving his community that endowed him with “Outstanding Citizen of Year” by the Falmouth Chamber of Commerce in 1997. The agency is now well positioned with developed relationships in the industry, enabling the family team to offer its clients more competitive policies. The list includes but not limited to: Kingstone, Swyfft, Clear Blue Insurance, Travelers, Pilgrim, Safety, Hanover, Progressive, ASI, MPIUA, Mass Property Insurance, Main Street America, Arbella, Encompass, Plymouth Rock, Universal Property, Narragansett, ASI, Lloyds of London, Preferred Mutual and others. Legacy is vital in a family-run business that serves its local region, and the insurance agency’s leadership principles have continued with Art’s son, Davidson O. Calfee, as President and a humble recipient of the “40 Under 40 Award" from the Cape & Plymouth Business Magazine. Contact Arthur D. Calfee Insurance Agency, Inc. to learn more about its services and how you may be assisted immediately. What’s one of a homeowner’s greatest enemies? Water (where it shouldn’t be).

When water enters your home, it can quickly cause a lot of damage. So, it’s important to understand which types of plumbing issues and water damage are covered by your home insurance policy. Learn about the types of insurance for water damage as well as what is and isn’t covered: Likely Covered When it comes to coverage of water damage, the key indicators that an issue is likely covered are sudden and accidental. Coverage of water damage would fall under dwelling coverage (the structure of your home) or personal property coverage (your belongings). A deductible and coverage limits may apply to personal property coverage — review your policy or contact us with questions. Examples of water damage that are likely covered include:

Not Covered On the other hand, water damage caused by issues that are not sudden or accidental, such as delayed maintenance and neglect, will not be covered. And homeowners insurance only covers the damage caused, not the source of it. You’ll have to replace or repair pipes and appliances yourself. Examples of water damage that isn’t covered include:

|

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2024 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed