|

We can help give exceptional peace of mind to a wide range of Home Insurance Companies to give you comparative & competitive rates for Massachusetts Home Owners and First Time Home Buyers.

We make it simple to find the best price on homeowners insurance from multiple companies. Specialty Rates · Top Coverages - First Time Home Buyers Affordable Home Insurance - Free Online Quote in Minutes Cover your biggest investment and build a custom home insurance policy & make the switch! Manage your policy online and enjoy multi-policy discounts. Switch & You Could Save We recommend coverage amounts for your personal situation and break down everything we offer with clear-cut explanations so you know exactly what you’re getting. When purchasing property insurance, doing your due diligence is more than a turn of phrase. The period when a house is under contract is an essential part of the home insurance buying process and requires careful attention to detail. Being thorough in the due diligence phase will help you uncover potential issues and make the right choices for you and your family by calling us at (508)540-2601. Simply having a roof over your head isn’t enough. As a homeowner you also need to take good care of this important part of the house, which means understanding what your homeowners policy includes (and what it doesn’t) in the event of damage or decay.

0 Comments

Insurance coverage designed for you. Call (508)540-2601 Our products are designed specifically to meet the needs of successful individuals and families. You have the flexibility to customize coverage to ensure your home and other significant assets are properly protected.

lService is our top priority and as such, you will have confirmation once this is completed TODAY. If you have any questions or should need anything further, please let me know. Call (508)540-2601

Watch Out for These Homeowner Mistakes Few things in life are as stressful as buying a home. That is, until something goes wrong with it. The real work of owning a house often begins after moving in, but you can start the journey well-prepared by being aware of these common pitfalls. Being Underinsured Many homeowners make the unfortunate error of underestimating how much their personal belongings are worth. Though it's important to have your property appraised, that alone isn't enough. To get the most suitable coverage, factor in the value of everything inside your dwelling, too -- not just what it would take to repair. From improvements you've made and appliances you've updated to furniture, clothing and electronics, you'll need to account for everything that would have to be replaced. Ignoring Routine Maintenance All homes require upkeep, and some tasks are more vital than others. Realistically, neglecting routine maintenance could even lead to a fire or flood. In fact, homeowners are more likely to file insurance claims for water and smoke damage than any other type. Since houses don't come with an owner's manual, it's a good idea to make and follow a home maintenance checklist that includes doors and windows, your washer and dryer, and fire prevention equipment. Making Assumptions About Your Policy Do you fully understand your homeowners insurance deductible? If not, it's important to get to know how it works and what out-of-pocket costs you'll be responsible for in the event of an incident. Generally, the higher the dollar amount or percentage deductible, the less you pay in premiums each month. But before you increase or decrease it, make sure you know how various claims would play out. All homes, even new ones, experience unexpected issues now and again. Fortunately, many are preventable with a bit of know-how. Life can naturally be unpredictable, and various events may cause your car insurance rates to fluctuate, too. If you'll be making a change in the future, be aware of which common milestones could affect your premium.

Can you reverse a rate increase? It may not be possible to reverse a rate increase, especially if it was due to an expansion of coverage; however, sharing updates about automatic security features in your car and doing a record review of other drivers on your policy may prevent outdated information from further raising your monthly rate. Keeping your insurance up to date starts with revising your policy to include major life changes. An annual review of your coverage will help make sure it still corresponds to your family's needs. Please reach out if you have questions or if you'd like to check in. Taynara (508)444-0509 Isabella (508)403-0300  Futuristic features aren’t just for luxury vehicles anymore. Many high-tech additions are now offered as standard options in all kinds of cars, which means it’s important to stay on top of these developments and their potential benefits. Want to know more? Here’s a look at a few top trends. Self-Driving Technology Though we’re inching toward full automation, for now even the most advanced vehicles still require a driver. Of the partial driving automation systems that do exist, they seem to perform best in bumper-to-bumper traffic where they excel at keeping a safe distance. A Paper-Free Approach Many manufacturers are embracing the digital approach and doing away with analog owner’s manuals. Instead of flipping through pages, drivers can check their screen display or the app they’ve downloaded when they have a question about their car’s features. Production Trends Nearly all major car manufacturers have announced the release of an alternative fuel vehicle. Some companies, like Volvo, have pledged that all new models will be either completely electric or hybrid. Luxurious Details In addition to being able to sync your vehicle with wearable technology, many of the luxury sedans of 2019 come standard with massaging seats. Many may also have features like aromatic, lighting and audio specifications that shift with your changing mood. Safety Innovations As part of their crash detection features, some cars will now emit a tone that helps cushion the ear canal in the seconds before an impact. Ideally, this will lead to less discomfort and hearing damage after an accident. Have questions about auto coverage for a new vehicle? Reach out anytime. Taynara (508)444-0509 Isabella (508)403-0300

Seguro para carros financiados

Seguro para carros financiados funciona da mesma forma que seguros para carros quitados. Só haverá diferença caso seja necessário receber a indenização em sinistros de perda total. Há duas maneiras de receber o pagamento integral da indenização quando você tem um seguro de veículo financiado. A primeira funciona assim: você quita o saldo devedor com a financeira ou com a montadora e conclui a dívida. A outra é forma é a seguradora quita o saldo devedor diretamente com a instituição que realizou o financiamento do carro e você recebe a diferença de valores |

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

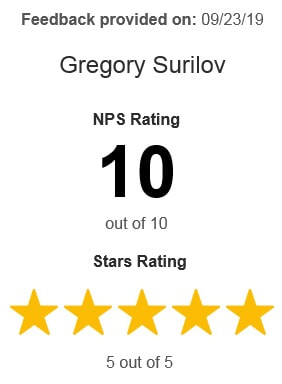

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2024 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed