We offer a wide range of coverage, including auto, home, renters and life insurance. It doesn't stop there - we also provide motorcycle and small business insurance. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! We'll help you understand and customize the right home insurance coverage for you. Get started today with a free homeowner's quote — it only takes a few minutes. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you. Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote. Get your free home insurance quote online today. Get a quote online and work with an insurance agent to find the right Home Insurance coverage for your property and unique needs.

0 Comments

'Best Home & Auto Insurance' Package Deal in Massachusetts

Click here - Testimonials & Reviews: "Trustworthy, Knowledgeable, Qualified, Skillful, Talented, Accomplished" FAST HOME INSURANCE QUOTES (508)540-2601 Posted on 21. Nov, 2013 by Leonard Baron in PropertyManager.com

When you own real estate – whether an investment or a personal residence – you should procure the proper type and dollar value of insurance needed for your property. Unfortunately, many people don’t understand the basics of how insurance coverage works, and many individuals just want to spend “as little as possible” on insurance. The trouble comes about when there is an problem, like a fire, slip-n-fall, or lawsuit. If you don’t have the right type of insurance, nor enough coverage, it could end up costing you a lot of money. So let’s go over the basics herein, plus we’ll discuss renter’s insurance basics and tenant liability insurance basics too. A standard dwelling insurance policy will cover losses on the building, separate structures, personal property, loss of use, liability, and a few other optional coverages. The one’s that are more important to focus upon are: 1. Coverage for your physical assets – building, separate structures, and personal property 2. Liability and lawsuit coverage. Physical Assets Each year when you renew your policy it comes with limits on how much coverage you have in case your physical assets are destroyed. These are listed on your policy declarations page. For example you might have a 4,000 square foot structure – like a five unit building – and if it costs $100 per square foot to rebuild that structure, you should have $400,000 in dwelling coverage. Note that only the structure is covered by insurance, not the land because typically land isn’t destroyed. If you also have separate structures like pools, unattached garages, or significant personal property like appliances, you need to have your insurance agent add up the total value and procure enough coverage for all of your assets. What happens if there is a fire and you only have $250,000 worth of coverage but it will cost $400,000 to rebuild and replace assets? You’ll get a check from the insurance company for the $250,000 dollars, and that’s all. You’ll have to spend your own money to rebuild it. So pull out your declarations page and make sure you’ve got enough coverage based on what it costs to rebuild. Liability Protection Insurance also provide liability coverage in case there is a lawsuit related to your property. If a tenant’s dog bites a neighbor, you’re going to get sued too. If you do get sued, your insurance company will step in and provide a lawyer to negotiate, defend, settle, or pay a judgment – up to your policy coverage limits. So if you have $300,000 in liability coverage, that is the maximum they will pay out – you’re on the hook for the rest. You can up that coverage amount with a Personal Umbrella Policy, and you should consider doing this. You can increase your liability coverage in increments of $1,000,000 for between $300-$600 per year. So estimate your net worth and your earning potential, and make sure you’ve got enough on this issue too in case the worst occurs. Other types of coverage that are typically not included in your regular policy are earthquake coverage, flood coverage, and others depending on the state within which you live. And, of course, discuss all insurance issues with your insurance agent, plus do your own research on the Internet and talk to other property owners. Also shop around every few years to make sure you are still getting a fair deal. Renter’s Insurance As a landlord you should also work towards moving all your tenants to having Renter’s Insurance when they renew their leases. This insurance protects the tenants from theft, water and fire damage, and liability issues. And it also protects you as claims should first go against your tenant’s policy, not your master policy. A typical renter’s policy runs about $125-$175 per year. Tenant Liability Insurance You should also consider Tenant Liability Insurance. This type of insurance protects you, the landlord, in many instances including if a tenant lets their renter’s insurance lapse or they didn’t procure the right type or enough insurance. You pay for it, or assess it to your tenants, and it protect you against lawsuits filed against your tenants, against property damages caused by your tenants, it may protect your from frivolous lawsuits from your tenants, or insurance deductibles you might otherwise have to pay when your property is damaged. This coverage costs around $120-$150 per year per unit. Make sure to fully understand the policy and what is and what isn’t covered, because coverages can vary by carrier and policy. Conclusion Having the proper type and amount of insurance in place isn’t needed, if nothing bad ever happens. Unfortunately, we all know, things happen! So take a day each year, meet with your insurance agent, do some research, look at your current policies and limits, to make sure you are property covered. Because, when something does occur, you’ll breathe easier knowing you’ve got the appropriate insurance policies in place. With meteorologists forecasting a very active hurricane season, you may want to learn how to best prepare for an oncoming storm.

Here are tips from Geico, the National Hurricane Center and the Insurance Information Institute: Hurricane Preparedness • Determine escape routes and places where your family can meet. • Know your home's vulnerability to storm surge, flooding and wind. • Locate a safe room in your home or the safest area in your community. • Have an out-of-state friend as a family contact. • Plan what to do with your pets if you need to evacuate. • Post emergency telephone numbers by your phones. Teach your children how to call 911. • Check your insurance coverage; flood damage is not usually covered by homeowners insurance. • Trim trees to remove un-healthy or dead limbs or branches. Emergency Supplies • water-one gallon daily per person for three to seven days • food-enough for three to seven days • nonperishable packaged or canned food/juices-foods for infants or the elderly • nonelectric can opener • cooking tools/fuel • paper plates/plastic utensils • blankets/pillows, etc. • clothing-seasonal/rain gear/ sturdy shoes • first-aid kit/medicines/prescription drugs • special items for babies and the elderly • toiletries/hygiene items/moisture wipes • flashlight/batteries • radio-battery-operated radio and National Oceanic & Atmospheric Administration (NOAA) weather radio. Replace the batteries every six months. • cash-banks and ATMs may not be open for extended periods. • keys • photographs • computer hard drive or laptop • toys, books and games • important documents-in a waterproof container including insurance, medical records, bank account numbers, etc. • tools-keep a set with you during the storm • vehicle fuel tanks filled • pet care items • proper identification/immunization records/medications • food and water • a carrier or cage • muzzle and leash Added Preparedness • Take first-aid, CPR and disaster preparedness classes. http://www.cnn.com/2015/10/23/americas/hurricane-patricia/ |

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

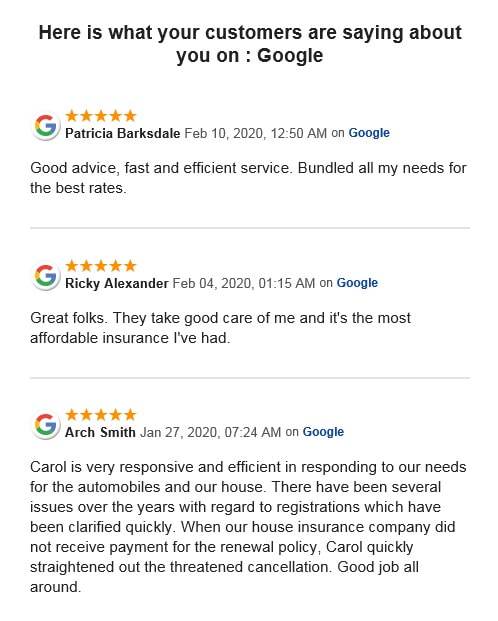

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2024 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed