|

When you first buy a home, you may become overwhelmed by all of the extra costs you never thought about having. One of those costs may be home insurance coverage. Young homebuyers may not see the need for such costly insurance, but anyone who has used their home insurance knows exactly how important it is. Many mortgage companies require specific coverage plans. Even if you choose to buy your home, without financing it, you will need home insurance coverage. Take a look at this information to learn more about home insurance plans.

When You Need It You may think home insurance is only good in natural disasters. When a tornado, hurricane, or earthquake damages your home, your plan should cover the damage. However, there are many times you can use your home insurance coverage regardless if there is a natural disaster or not. Consider this scenario: Your hot water heater bursts and no one is home. There is so much water on your floor that your expensive hard wood flooring is completely ruined. With home owner insurance, you would simply be responsible for your deductible. The coverage would pay for the flooring to be replaced and often will even pay for a new hot water heater. Of course, these terms all depend on the type of plan you have, but for the most part, home insurance is beneficially for large as well as small disasters. How To Pay For It Choosing how you pay for your home insurance coverage can be important. Some owners would rather add their insurance right into their mortgage payment. Many banks prefer you to do it this way and are happy to accommodate. Other insurance companies will allow you to pay the premium monthly, every six months, or yearly. Select companies will even offer additional discounts for those who make one yearly payment. Consider these things when setting up your home insurance. You may get a great deal when you choose the right payment arrangement.

0 Comments

The winter months can be a dangerous time for drivers, with icy surfaces, inclement weather, and reduced visibility making roads more difficult to navigate. Here are some tips for reaching your destination safely while driving in winter conditions:

How to drive safely in winter conditions. (2015, January 1). Retrieved January 1, 2015, from http://www.theonion.com/articles/how-to-drive-safely-in-winter-conditions,37691/ Don't own your own home yet? You should know that you can, and should, be properly insured for your personal property even though you're renting. One of our leading competitive insurance providers, Arbella, just announced that they're offering a new insurance package plan that's aimed at saving you even more money. With the clever name "carpartment", this package plan combines both your renters insurance as well as your auto. It’s a match made in savings heaven. First and foremost, you’ll get dynamic Massachusetts car insurance. Arbella knows the New England roads better than anybody, and they pride themselves on responding faster to your needs if you have to report an accident. For more details on car insurance and additional discounts on insurance, click here.

The other half of this package is just as important. When you sign up for car insurance with Arbella, they'll throw in a side of renters insurance for as low as $3 a week. That’s less than a latte at starbucks! Your policy covers what your landlord won’t in case of things like fire, bursting pipes or break-ins. They'll protect your electronics, your furniture, your retro sneaker collection, even your identity. And They'll do it with the same commitment to service that’s been Arbella’s calling card from day one. For more details on renters insurance or home insurance, click here. Are you planning a major project, such as remodeling, rebuilding or building new? Do you know if your insurance will adequately cover it? These questions are important to answer anytime you hire a contractor to work on your home or property. Make sure you take time to verify that they and any subcontractors are appropriately insured, as well as licensed and bonded. While it’s always a good idea to ask for a contractor’s certificates of insurance, an even better practice is to contact the insurers to confirm coverage. Some experts recommend that contractors carry at least $1 Million in coverage for each insurance type.

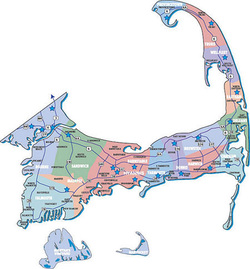

Meanwhile, highly-rated insurance providers tell us that you should consider an extra step: get yourself named as an “additional insured” on the contract of general liability policy. This ensures that you are fully covered against liability for damage that can occur during your project, such as workers breaking a water line that causes a neighbor’s property to flood. Getting yourself added to the policy may cost you little or nothing at all. Also, it means that the insurer will alert you if the contractor’s policy lapses. It’s important to realize that some home improvements can affect your homeowners insurance premium or coverage. For example, a major kitchen remodel could mean that your home would cost more to replace in the event of a disaster than it was at the time your policy was written. Many policies include a replacement cost endorsement that guarantees sufficient coverage to rebuild your home. Be sure that you have replacement coverage and that the amount is in line with the current costs. Another renovation-related insurance consideration arises if you transform an unused room into a home office. Standard policies rarely extend coverage for accidents, theft, or other hazards that can happen on property used for business. Talk to your insurance agent about extending coverage or buying a separate policy. It’s important to inform your agent or insurer when you make significant changes to your home. Some upgrades, like a replaced roof or updated furnace, can actually significantly reduce your premium! The typical homeowners insurance policy is not sufficient to cover risks associated with building or rebuilding a home. You may want to take out a builder’s-risk policy to insure your property and on-site building materials during construction. If you’re in the market for home-related insurance, we can provide you quotes from several different insurance companies that have good ratings from both consumers and from independent rating organizations. Hicks, A. (2014, December 1). Are you properly insured for remodeling? Vitality, p. 22.  Coastal Flood Area - Cape Cod, MA Coastal Flood Area - Cape Cod, MA BY ANGELA GREILING KEANE, BLOOMBERG May 6, 2014 (Bloomberg) -- More than half the U.S. population lives in coastal areas that are “increasingly vulnerable” to the effects of climate change, which will ripple throughout the U.S. economy, a White House advisory group’s report concluded. The report released today enumerates the impact across the U.S., including a 71% increase in heavy rain and snow in the Northeast during the past half-century and an increased risk from hurricanes linked to higher sea levels.

Flooding is nature's most common natural disaster. The average homeowner is five times more likely to incur flood damage than fire damage. If you live in a high-risk zone, you have a one-in-four chance of experiencing flood damage. Almost 25% of all flood claims come from low- to moderate-risk areas and 90% of all presidential-declared disasters involved flooding. Homeowner's policies may not cover the flood damage, and the out-of-pocket costs can be burdensome.

Flood insurance is designed to provide an alternative to disaster assistance to reduce the escalating costs of repairing damage to buildings and their contents caused by floods. While your homeowner's policy may cover fire, tornado, or even earthquake damage, most EXCLUDE damage caused by flooding. Those that cover SOME flood damage do so by specific endorsement and only for a certain dollar amount. Check with your insurance agent to see what coverage is available. To learn more about flooding, flood risks, residential coverage, commercial coverage, preparation, recovery, etc., visit our Flood Insurance page.  Earthquakes, floods, and other disasters can seriously disrupt normal life. Services may not be available, transportation may be cut off and roads may be blocked. In some cases, you may be forced to evacuate. Be ready to respond to any situation by assembling and maintaining a Disaster Supplies Kit. Click 'Read More' below for the Disaster Supplies Plan. |

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2024 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed