|

Does your homeowner’s insurance protect against all the possible threats to your property? If you’re worried about something that isn’t covered, you may be able to add it on. An insurance add-on, also known as a rider or endorsement, is an optional addition to your policy.

It’s a good idea to review your current policy to get clear on the types of damage you’re insured against. Learn about a few popular insurance add-ons to see if any of them make sense for you: 1. Sewer Backup Having your sewer back up into your sink, toilet or drain is no fun. In addition to the ickiness factor, the repair bill can be expensive. You need a plumber to unblock the sewer, and you’ll probably have a mess to clean up. Adding a sewer backup rider to your homeowner’s coverage will cover the costs associated with repairing the problem, replacing damaged belongings and removing wastewater from your home. 2. Home-Based Business Do you run a small business out of your personal residence? Instead of purchasing a commercial insurance policy, you can add a home-based business rider to your policy. This will protect the personal belongings in your office space and cover any medical bills for business visitors who are injured on your property. 3. Swimming Pool When it comes to home pools, you should check your existing coverage to see if damage to the structure of your pool is covered. If guests injure themselves in or around your pool, it’s likely not covered by your standard homeowner’s policy. You’ll have to add injury coverage as a rider. 4. Earthquake As with hurricanes and floods, earthquakes are a type of natural disaster that require additional coverage. An earthquake rider will cover the costs of repairs and debris removal in the wake of an earthquake. In addition to your home, earthquake coverage protects other structures on your property such as a garage, shed, deck, etc. 5. Umbrella Coverage This is a type of personal liability insurance that protects you and your family from major claims and lawsuits. Umbrella coverage may extend to other homes you own, as well as your vehicles and any watercraft. Have questions about insurance add-ons? Just reach out, and we’ll be happy to help.

0 Comments

You’ve decided it's time to replace your outdoor deck and you’re ready to take it on as a DIY project, or you’ve decided to work with a licensed and bonded contractor for the heavy lifting. Before you start on such a critical project, it’s important to know that decking options have grown over the last several years, bringing new choices in composite plastic and wood products from which to construct your deck. While they often cost more than wood, composite materials offer the promise of greater durability and less maintenance. Wood is still the most common choice for deck material, but it doesn't last forever. Composites may be more durable, but they might lack the natural look and color you are looking for. In June 2016, CBS News reported that while wood products still have a command on the market, composites are growing in popularity. Synthetic wood commands about 16 percent of the $7 billion-per-year deck market and appear to be gaining some traction. From cost to maintenance and durability to look, there are many things to think about as you decide between composite or wood for your next deck. Here are some pros and cons to consider before you decide which product to buy. Calfee Insurance wants to help you protect the things that matter to you. We offer a wide breadth of products so you can be covered at home and on the road. Pros of Composite Decking

After a fire, burglary or another event in which you lost possessions from your home, it may be difficult to remember the details of every one of the belongings that you have accumulated over the years. In this situation, having a current inventory of your possessions, including make and model numbers, may help you with any potential insurance claims. Taking the time to document your belongings now can help you recover faster after a loss.

Here are some steps you can use to help build your home inventory checklist. Step 1: Take the time to walk through your property. Compiling a comprehensive home inventory takes time and effort. The more detailed your inventory, the more useful it will be if you have to make a claim. Document possessions inside your home and on your property that may be of value. Step 2: Keep your inventory in a safe place. Creating a digital home inventory and storing it off-site will help ensure that it won’t be lost, stolen or damaged during any disaster at your home. You can also create a photo or video inventory and upload it to a cloud-based service.

Step 3: Update your inventory often. When you make a significant purchase, add the information to the inventory while the details are fresh in your mind. This is also a good time to delete items that you have replaced or no longer own. Step 4: Remember your business assets. While most people think of their home when making an inventory, it is important to document the contents of your business, if applicable, as well. Step 5: Consider valuable items. Valuable items like jewelry, art, and collectibles may have increased in value since you brought them into your home. Check with your agent, if you have one, to make sure that you have adequate insurance coverage for these items as they may need to be insured separately. Consider putting jewelry or other valuables that you don’t often wear or use in a safe deposit box. To learn more about ways to protect your home and belongings, check out our homeowners insurance products. Here's a look at three recent innovations in home security.

A home security system could make you eligible for a property insurance discount, too. Get in touch today to discuss your policy or anything else Avoiding a Water Disaster from Your Second-Floor Washing Machine Having an upstairs laundry room can be convenient, as it may mean fewer trips downstairs to wash and fold clothes. But washing machines pose risks of leaks, and your upstairs washer could become a source of significant water damage to the floors below. A leak from a second-floor laundry room can lead to water seeping into the floors, walls and ceilings beneath.

As a homeowner, it’s critical that you know how to help prevent water damage to your home. It’s also a good idea to understand how to help prevent leaks in the first place. Preventing Water Damage from Second-Floor Washing Machines If your laundry room is on the second floor, there are ways to help prevent leaks and provide extra protection against water disasters in your home.

Typically, water sensors and their control modules are available online and at home improvement stores. There are numerous options available, so do your research to determine which options fit your needs and budget. If you’re not comfortable installing water sensors yourself, check out online resources, inquire at your local hardware or home improvement store or ask a plumber for guidance. Preventative Maintenance for Second-Floor Washing Machines Taking precautionary measures can help, but one of the most important ways to prevent washing machine water disasters is through proper maintenance. Keeping your washing machine in good working condition and checking hoses for leaks should be part of your regular home maintenance routine. No matter where in your house your laundry room is located, consider these tips:

While preventive measures can help, there are still risks to having a laundry room on the second floor of your home. Should a leak get out of control, it’s important to have the right insurance coverage for your home and belongings. Calfee Insurance can help. As a seasoned homeowner, you’ve been paying off your mortgage and are now considering buying a second home – a place you can retreat to on vacation, an investment property, or maybe even a combination of the two. You’ve been through the home-buying process before so you know what to expect, but there are certain factors unique to buying a second home that you'll want to consider. These factors will vary depending on how you intend to use the property, so it's a good idea to determine if the home will be for mostly personal use or if it will be occupied by tenants. Here are six essential things you should consider before buying a second home: 1. Can I Afford It? It may seem like an obvious question, but can you afford a second home? If you choose to take out a mortgage on a new property, take some time to carefully understand the requirements so you’ll be better prepared for the process when submitting your mortgage application. As a homeowner, you're probably well aware of the strict credit requirements for taking out a mortgage, and things get even more serious when it comes to buying a second home. Your debt-to-income ratio will, of course, be a significant factor, and when it comes to holding two mortgages, you may find it a bit more challenging to balance this ratio. Also, be prepared to shell out a hefty amount for a down payment, since you'll be required to put at least 10 percent down on a vacation home and perhaps an even higher amount if it will be used as an investment property. And don’t forget that a second home will need to be protected, so you’ll want to talk to your homeowners insurance agent about getting a quote, once you’ve got your sights set on a second property to call your own. 2. How Will It Affect My Taxes? Understanding the tax implications of your new property will be another challenge. If you intend to rent your place to tenants, that means you'll earn rental income throughout the year, and that income will be taxable. As the owner of the home, you also may be able to take deductions in the form of mortgage interest, property taxes, repairs, depreciation, and operating expenses.1 One of the most important things to do as the landlord is to maintain accurate records of your income and expenses throughout the year in order to properly report the information on your tax return. 3. What Home Expenses Should I Expect? Just like your primary residence, your second home will also require you to shell out cash for expenses – both expected and unplanned. It’s helpful to have a budget set up for home needs, and with two homes, this may be an even more critical step, since your expenses will be elevated. In addition to the maintenance costs, remember you'll have property taxes, insurance, potential homeowners' association dues and more. If the property is at the beach or in a flood zone, you'll also need to consider things like flood insurance in addition to your regular homeowners policy. And finally, if you plan to rent the property, you'll also need to look into insurance that specifically protects you as a landlord. Travelers wants to help you protect the things that matter to you. We offer a wide breadth of products so you can be covered at home and on the road. 4. How Will I Use the Property? If the property will solely be used for personal vacations, this question isn't as critical. However, if you intend to rent the home occasionally or full time, you'll want to consider your strategy ahead of time. Keep in mind that for mortgage purposes, your lender doesn't consider the income generated from renting the home. Whether you can afford the second property is determined solely based on your credit and debt-to-income ratio. If you plan to rent the home, it's important to build your rental strategy as early in the process as possible to ensure you'll have rental income that can help offset the home's monthly expenses from the start. That will translate to less cash out of your pocket, as long as the tenants are diligent in paying the rent on time. 5. Who Will Maintain the Property? You’ll want to plan for who will maintain the property to protect your investment. If the investment property is located near your primary home, it may be easy for you to provide the regular maintenance and upkeep of the home, if you’re handy and have the time – and the will – to do those tasks. However, if the property is far from your primary home, you'll need to think about how it will be cared for when you're not staying there. This is especially important if the property is located in an area that’s susceptible to strong storms and hurricanes. Severe weather events can pop up at a moment's notice, and your second home will need to be properly prepared to withstand such weather. If the home will be for your personal use, perhaps you can find a neighbor to keep an eye on the house when you're not there. If you plan to rent the home, consider hiring a rental management company to take care of the general upkeep so you won't have to worry about every little detail from afar. 6. Is the Property in an Ideal Location? Whether buying a second home for your personal enjoyment or as an investment property, make sure you choose the right location for your needs. You may not get as much use as you’d like from a vacation home that requires extensive travel to get there. And, a rental home in an unpopular locale may lead to months of being unoccupied – which means you’re paying the second mortgage yourself rather than with income from renting it out. In either scenario, ensuring the home is in an ideal area can help provide you with a positive return on investment. If you do intend to rent the property, take some time to research the rental climate in the area before moving forward. The best places to own investment property are often popular vacation destinations and cities with an abundance of career options. Buying a second home doesn't have to be daunting. In fact, with careful research and planning, it can be a smart investment for your future. How to Budget for Home Improvements

Your home has probably been through a lot this year. Between normal wear and tear and the extra hours spent at home these last few months, you may find yourself in need of an upgrade or repair sometime soon. Some projects can’t wait, but if you have time to save, here are a few strategies to help you manage that add-on, appliance replacement, or whatever else your property might need in 2021. 5 Tips for Managing Your Project 1. Compare Estimates Gather estimates from a few reputable contractors and compare them. Calculate the average cost of your project and plan your budget around that number. 2. Create a Sinking Fund Banks love to advertise home equity loans and lines of credit. However, financing your home improvement means paying interest, which raises the total cost of the project. If it can wait, try to save up first by creating a sinking fund: Set aside a certain amount each month so you know you’ll reach your goal within six months or a year. 3. If You Need to Finance, Do It Wisely Send me a Home Insurance Quote Cape Cod Massachusetts -Some projects, such as a leaky roof or broken furnace, can’t wait. If you need to finance, look for the lowest interest rate and don’t treat the loan like “free money.” Spend only what you have to and then make a plan to pay the loan back early if possible. 4. Prepare for Surprises Even when you do everything right, construction projects and remodels are notorious for going over budget. Leave a cushion in your budget for last-minute surprises so you won’t have to go into debt or pull from other areas. 5. Check Your Coverage Of course, preparing for surprises and avoiding unnecessary expenses also means having adequate homeowners insurance in place. If you're unsure about your coverage or want to review your current policy, reach out with your questions anytime. It’s a good idea to review your insurance coverage at least once a year to ensure that your family and belongings are appropriately protected. You’ll also want to review your coverage any time you’ve made a major purchase or experienced a significant life event, such as getting married, buying a house, sending your child off to college or receiving an inheritance. These life moments are considered insurance-qualifying events (also known as life-changing events for purposes of insurance), and it’s important to make sure your coverage is up to date to protect the people and things that matter most to you.

Have you had a life-changing event that might require an adjustment to your insurance coverage? Here’s some information to consider, which can help ensure that you’ve got the coverage you need to protect your loved ones and belongings. A good place to start is by doing an insurance review. What Is an Insurance Review? An insurance review is a thorough look at your insurance coverage – the policies protecting your vehicles, home, family members and other valuables. To review your insurance coverages, enlist the help of an experienced agent to tap into their expertise and knowledge. An agent will be knowledgeable about the available insurance products and can provide professional guidance on which coverages may be best for your unique situation. The Benefits of an Insurance Review An insurance review helps provide you the peace of mind that your most treasured belongings (and family members) are adequately protected in case something unexpected happens like a fire, theft or weather event. A review could also result in a potential reduction in your insurance costs if, for example, your agent discovers you are eligible for discounts, or that you require less coverage than you did previously. Why (and When) Should You Review Your Insurance Coverage?It is critical to review your insurance coverage regularly to help ensure that your property, your possessions and your loved ones are well protected. During an insurance review, you should evaluate your home insurance (or renters insurance), car insurance and any other policies you have in your name. When should you do a review? When your circumstances have changed, or you have what’s considered a “qualifying event” or a “life-changing event” in insurance terms, you may want to consider an insurance review. As mentioned earlier, these events include things like having a baby, getting married and other big milestones. You should also consider an insurance review any time your policies are up for renewal. This is typically once per year. What’s an Insurance-Qualifying Event? Insurance-qualifying events are those moments when life circumstances change. Since these events can occur throughout the period of an insurance policy, you’ll want to check with your agent when an insurance-qualifying event occurs outside of the typical policy renewal time frame. A qualifying or life-changing event, for insurance purposes, typically means:

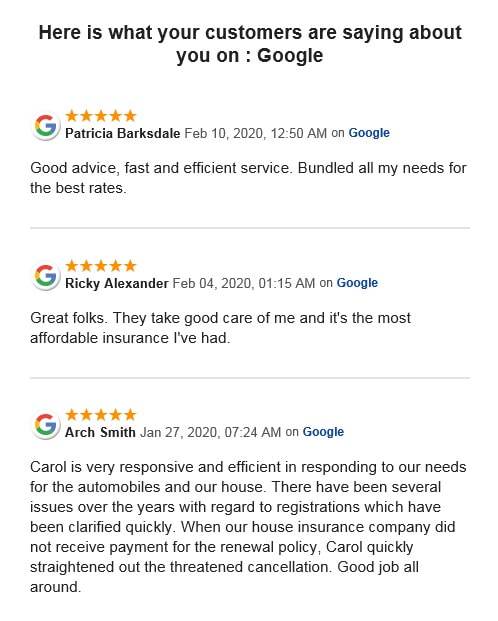

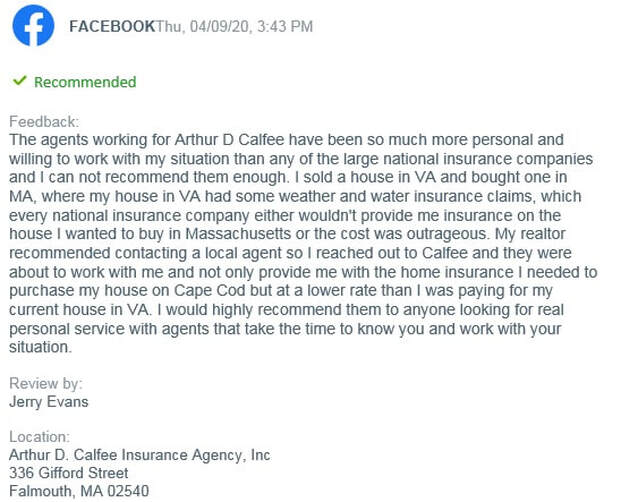

Other Times You May Want an Insurance Review In addition to those life events that might prompt an insurance review, there are other times that you may want to check with your insurance agent to review your coverage. For example, if you have expensive, high-value possessions on your property or are taking steps to increase the safety of your home, such as by adding an alarm system or upgrading your electrical system, those situations may warrant a fresh look at your insurance coverage. If natural disasters (for example, hurricanes) have increased in your area, you also may want to consider updating your policy to reflect these added risks. Check with your insurance agent for guidance. How Often Should You Change Your Coverage? Though you might review your policies annually, that doesn’t mean you’ll always need to make a change that often. In many cases, your current coverage may still be adequate. But generally, it’s a good idea to review all of your insurance needs at least once a year. If you have a major life change, contact your insurance agent or company representative, as the change in your life may have an impact on your insurance needs.1 How Current Is Your Household’s Insurance Coverage? If you haven’t conducted an insurance review recently (or you’ve experienced a major life event or acquired additional property of significant value since you last renewed your policy), it might be time to evaluate your coverage. Click Here - Fast Home Insurance QuoteWe run our insurance business with a value system of love (concern for others), trust, respect, a commitment to excellence and fun. And thanks, in part, to the customer service focus way we run our business, Arthur D. Calfee Insurance Agency, Inc., has consistently been rated 5-Stars (superior) on Google & other platforms by current clients for over 40 Years. We offer a wide range of insurance coverage, including auto insurance, home insurance, renters and life insurance. It doesn't stop there - we also provide motorcycle and small business insurance. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! We'll help you understand and customize the right home insurance coverage for you. Get started today with a free homeowner's quote — it only takes a few minutes. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings.

Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family. A-Excellent AM Best rating, A+ Excellent by the BBB Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you. Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote. Get your free home insurance quote online today. Get a quote online and work with an insurance agent to find the right Home Insurance coverage for your property and unique needs. Good customer service means helping customers efficiently, in a friendly manner. It's essential that we are able to handle issues for customers and to do our best to ensure you are satisfied.

Providing good service is one of the most important things that we can differentiate from our competitors. |

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2023 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed