|

According to a 2023 survey, 63% of workers said they would be unable to cover a $500 emergency expense.

This means a majority of Americans don’t have an emergency fund, which is a savings account with roughly three to six months of living expenses set aside for unexpected expenses. If you can, you should be working on building emergency savings. Even a small amount can add up over time. Learn about the most common reasons to tap your emergency fund. Job Loss Losing your job can be financially devastating, especially if you’re the primary earner in your household. Even if you qualify for unemployment benefits, emergency savings can help you keep up with bills. Emergency Home Repairs Homeowners can plan and budget for routine maintenance and repair tasks, but expensive repairs may arise suddenly. For example, a storm blows through and knocks a tree branch onto your roof or floods your basement. Whatever happens, it helps to have emergency savings to cover the cost without going into debt. Major Car Repair As with your house, your car doesn’t always give a warning before breaking down on the highway. Whether you have trouble with your brakes, engine or tires, having money saved up can get you back on the road. Medical Expenses Nearly half of American workers are enrolled in a high-deductible health plan, according to the most recent federal data. This can result in costly bills if you or one of your dependents has an injury or needs diagnostic testing. If you have access to a health savings account, you can save for medical expenses with pretax dollars. If not, your emergency fund will come in handy. Do you have questions about your insurance coverage and how it could help you save in case of property damage? Get in touch to talk about your policy.

0 Comments

With spring on the way, it’s time to think about protecting and maintaining your most valuable investment: your home. It’s a good idea to give your house a thorough cleaning and inspection inside and out, both to refresh your space and to spot any potential problems. Ready to get started? Be sure to add these five basic maintenance tasks to your spring checklist. Examine Your Roof Winter weather can take its toll on your roof. First, check for loose or damaged shingles, animal nests, loose metal strips, cracked caulking, signs of fungus or algae, and damage to the chimney exterior. Address smaller issues now before they turn into big problems later, and be sure to hire a professional if you’re not comfortable with ladders and heights. Clear Out the Gutters Again, this could be a DIY project depending on your skill level, or you could hire a professional cleaning service. Remove all debris from your gutters, then check for leaks. Finish by power-washing to clear out any remaining dirt. Check for Cracks in the Foundation Unfortunately, routine caulking isn’t always enough to prevent masonry cracks in your foundation. Hire a specialist for epoxy injection that will chemically bond the cracks. Reseal Windows as Needed A leaky window is bad for your energy bills. If the weatherstripping has been compromised or the caulk is cracked, make any needed repairs. Get an HVAC Inspection Along with changing the filters regularly, have a professional come out for a tuneup every year. Spring is also a good time to check your homeowners insurance to make sure you have enough coverage. Reach out today if you have questions about your policy. If you rent an apartment or home, you might not be thinking about insurance. After all, you don’t own the building and your landlord may have insurance in case something happens. But if your living room is damaged in a fire, your landlord’s policy likely won’t cover your brand new laptop or your vintage vinyl record collection.

Renters insurance helps protect your personal property inside your apartment — your electronics, furniture and clothing — unlike a homeowners policy that generally covers the building as well as what’s inside. In insurance speak, protection for your personal property is also known as “contents coverage.” And, as a renter, if you invest in updating items such as built-in appliances or bathroom fixtures, you may be able to apply a percentage of your contents coverage to repair or replace what has been damaged. Renters insurance can also protect your personal possessions from theft, fire, vandalism and other hazards, both at home and anywhere in the world. So if there’s a theft at the hotel you’re staying at while on vacation, your renters insurance may help you replace your stuff the same way it would if your things were stolen from your apartment. Protecting You, Along with What’s Inside Your Apartment It’s not just your possessions that renters insurance coverage can help protect. It can also help protect you. In case a claim is brought against you or you are sued by a third party, your renters personal liability coverage can help to cover the legal costs and related damages. Many renters policies provide a minimum of $100,000 of financial protection that may help if someone claims injuries or damages while in your apartment, or caused by your personal activities or those of your household members. For example, if you are found legally responsible for accidental fire damage to the building where you live, liability coverage in a renters insurance policy may provide financial protection. This liability protection may also extend to any vacation property that you rent. Like homeowners insurance, renters insurance can pay for necessary additional living expenses if you are unable to live in your apartment due to a fire or other loss that your insurance policy covers. You can also opt to purchase additional coverage for your valuable possessions that might have limited coverage in a typical policy, such as jewelry, fine art or silver. Things to Know About Renters and Landlord Insurance So, while your landlord’s insurance policy may protect the building itself in which you live, it likely doesn’t cover anything inside your apartment that belongs to you. A renters insurance policy can help give you peace of mind that you — and your stuff — have protection from unexpected events, both at home and wherever your travels take you. If damage to your home is covered by your policy, and you must leave it while it’s being repaired, where would you stay? Would the cost of a hotel or temporary apartment fit into your budget? Having loss of use coverage included in your homeowners insurance policy can help. If your home is damaged by a covered loss, loss of use coverage can help pay for your additional housing and living expenses while your home is being repaired or rebuilt.

What Is Loss of Use Coverage in Homeowners Insurance? Loss of use coverage, also known as additional living expenses (ALE) insurance, or Coverage D, can help pay for the additional costs you might incur for reasonable housing and living expenses if a covered event makes your house temporarily uninhabitable while it’s being repaired or rebuilt. What Is Additional Living Expenses (ALE) Insurance? ALE insurance reimburses homeowners for additional living expenses stemming from temporary relocation after a covered loss. For example, if your house is severely damaged by a fire, your loss of use coverage would reimburse you for the cost of a hotel up to your coverage limit. Many homeowners insurance companies include loss of use coverage in their policies and place a limit as a percentage of your dwelling coverage. For instance, if your limit is 30% and your dwelling coverage limit is $200,000, you would be covered for up to $60,000 under your loss of use coverage. Policy limits vary by insurance company and by policy, so if you have questions regarding your specific loss of use coverage limit, contact your insurance representative. Typically, you can increase your coverage limit for an additional cost. Loss of use coverage only applies to damage caused to your home by covered perils. For instance, if your home is flooded and you don’t have flood insurance, your loss of use claim would not be covered as a result of this type of loss. What Does Loss of Use Protection Cover? As previously mentioned, loss of use insurance typically provides coverage for additional living expenses resulting from a covered loss. In simpler terms, this means you would be covered for expenses you wouldn’t ordinarily have if you were living in your own home. For example, let’s assume you typically spend $100 on gas per month, but that amount has increased to $150 because you live in a hotel that is farther from work while your home is repaired. In this scenario, you would be reimbursed $50, which is the incremental cost. A list of common additional living expenses that are typically covered under loss of use insurance is provided below.

What Is Not Covered by Loss of Use Protection? Loss of use protection does not cover expenses that you were already responsible for before the loss. You will still be responsible for paying your mortgage, insurance, child care expenses and so on. The important thing to remember is that loss of use protection is for additional expenses you become responsible for because you can’t live in your home. For example, if your family normally spends around $200 a week for food, but now you are staying in a hotel without a kitchen, you may need to eat out for most of your meals. Eating out is costing you $300 a week. Under loss of use coverage, the $100 additional expense per week would be covered. Do I Have to Pay a Deductible on Loss of Use Insurance? You may be responsible for a deductible for other parts of your claim. Your homeowners insurance representative can explain your deductible further and help you explore other coverages you may want to add to your homeowners policy. The goal is to make sure you have coverage that fits your needs. How Much Loss of Use Coverage Do I Need? Everyone’s insurance needs are different. Loss of use coverage is typically based on your dwelling coverage and calculated at about 20% to 30% of the dwelling coverage limit. Consider whether this is enough to cover any necessary increases in your living expenses if your residence is not habitable while damage is being repaired or replaced. Consult your Calfee insurance agent about your individual policy to understand the amount of loss of use coverage you have; this is subject to coverage terms and limits. To insure your personal property, get a quote or find an agent. Do you know where most home fires start? If you guessed the kitchen, you’re right. One of the most popular rooms in the house also has the potential for danger. But a few simple habits can help prevent damaging fires from ever starting in the first place. To find a little more peace of mind this season, here are four ways to make your home safer. 1. Don’t walk away from an active stove. Unattended cooking is a leading cause of kitchen fires. If you need to leave while frying, grilling or broiling, make sure to turn your stove off first. It’s easy to lose track of time when you step away to answer the door or check on the kids, and it doesn’t take long for trouble to start. 2. Keep clutter under control. It’s not uncommon for kitchen counters to get loaded up with stuff. Make it a priority to clear your kitchen countertops of anything flammable, such as wooden utensils, papers and dish towels, especially around the stove. 3. Use space heaters, fireplaces and woodburning stoves safely. If you use a space heater during colder months, consider replacing older models with one designed to turn off if it tips over. Position space heaters with a 3-foot distance from everything else and always turn them off before you leave the house or go to sleep. If your home has a fireplace or wood-burning stove, have it inspected annually by a professional. Use a mesh screen to keep sparks inside the fireplace. 4. Practice candle safety. As with a stove, a lit candle is an active fire that you shouldn’t leave unattended. Blow out candles before leaving a room and keep burning candles on level surfaces and away from flammable objects, young children and pets. Have questions about your insurance coverage? Reach out and we’ll be happy to help. This may sound obvious, but selling a house sometimes comes down to just how appealing your home is to potential homebuyers. The attributes that make your house attractive to buyers can include price, the condition of your home and its curb appeal, as well as details like the number of bathrooms, bedrooms and whether the home appears dated. Discerning buyers typically want to walk into a house and immediately feel at home. How quickly you sell your home ‒ and at what price ‒ may depend on your ability to create that I’m-already-at-home feel.

Here are 10 easy home remodeling ideas that can help transform your home sweet home to the gotta-have-it house of your buyer’s dreams. 1. Replace the garage door. The surprise most home sellers discover ‒ often too late ‒ is that most sellers won’t fully recoup the cost of a renovation when they sell their home. When it comes to getting some bang for your renovating buck, however, the garage door is one suggestion to consider; it also can give a boost to your home’s curb appeal. 2. Upgrade the front door. A relatively inexpensive yet effective home improvement idea is a new front door ‒ one of the first things a home shopper will notice when they view online photos or arrive for a showing. For example, a new steel door can be both eye‒catching and energy efficient ‒ a boon for cost-conscious buyers-to-be. Or you could consider the pricier installation of a grand entrance ‒ perhaps a new front door with dual skylights ‒ which can help increase the attraction from upscale buyers. 3. Re-face the house. Another way to help increase your home value is by improving the exterior of your home. A good pressure washing may cost a few hundred dollars and can reduce or remove the unsightly dust, grime and mildew that often clings to exterior siding. For a house with more exterior wear, new siding is a pricey project but one that can help add a dramatic boost and take years off your home’s exterior appearance. 4. Maintain your lawn and refresh landscaping. You only have one chance to make a great first impression ‒ which is why renovations affecting curb appeal make our list. Home improvements that help add value and appeal to buyers include standard lawn care and landscape maintenance. Consider it a smart investment that can eventually turn out to be money well spent when you’re prepping your house for sale. 5. Refresh the kitchen. For many homeowners, the kitchen is where guests and family gather, making it one of the top house renovation ideas that come to mind when preparing a home for sale. Still, a major kitchen renovation may not be worth the cost when it comes time to sell; however, smaller, cost-effective upgrades can help make the kitchen more attractive. Consider replacing laminate countertops with granite and replacing a sink and faucet, for example. Leave cabinet boxes in place but replace out-of-date doors and hardware ‒ or hire a professional to give doors and drawers a fresh coat of paint. Finally, you can replace older appliances with slide-in, energy-efficient, stainless steel models. It’s your call as to whether spending money on these kitchen redo’s is feasible; think about your individual circumstances and what your goal is for selling your home. It also may be helpful to contact your homeowners insurance representative, to make sure that any renovations you’re considering will be covered. A savvy refresh doesn’t have to include all kitchen elements. Instead, to help save on cost, pick and choose the features that can make the greatest impression within your space. 6. Deep clean and declutter. When it comes to selling a home, you want to make a great first impression. Messy playrooms, cat or dog odors (even if Fido isn’t home), or an unmade bed can all be a turnoff to potential homebuyers. That may be why many real estate agents suggest their clients declutter and deep clean before listing their house for sale. While the main living spaces should take center stage, potential homebuyers may open your cabinets, drawers and refrigerator, so be sure to give them a good once-over, too. 7. Hire a professional home stager. When it comes down to it, the buyers who can envision themselves living in your home are the ones most likely to buy. That’s why staging your home to sell is such a popular tactic. A professional home stager will suggest removing personal items like photographs and excess furniture. Many professionals suggest storing or removing a quarter to half of your possessions, including sofas, bookcases, knickknacks, books and even clothes in your closet. Still, removing excess stuff is just the start. Stagers may rearrange furniture to highlight features like the fireplace, a view or unique architectural details. They may even suggest that you use a rental service to bring in items to dress up your home and will arrange for that service if you decide to take that advice. A professional home stager will often cost several hundred dollars, but the investment can help a home sell faster ‒ and often at a higher price than similar homes. To get the biggest bang for your staging buck, stagers recommend focusing on the living room, master bedroom and kitchen, in that order. 8. A fresh coat of interior paint. Paint has the power to entirely transform a home, particularly if it’s been a while since you upgraded your color scheme or if you happen to love eclectic colors. Neutrals are typically a safe bet ‒ they can create that clean slate feel that give home shoppers a greater ability to see their own belongings in your space. 9. Optimize lighting. High-quality lighting can help make a room feel larger, more modern and more inviting to potential homebuyers. For daytime showings, open curtains and blinds to bring in as much natural light as you can. Take advantage of accent lighting throughout the day and evening to emphasize art, a reading nook or any other interesting features in your home. If your home still feels dark, try strategically placing a mirror to reflect light and help make a room appear brighter. Alternatively, you can help brighten your space by bringing in a stylish floor or table lamp. If your fixtures are dated, new dining room and foyer chandeliers can bring a more modern vibe to your space. 10. Make small repairs. You may be accustomed to the inconvenience of that torn window screen or leaky showerhead but, to a new potential homebuyer, they may be red flags, prompting them to stay alert for any other necessary but unmade home repairs they’ll have to consider when it comes time to make an offer. Help get ahead of potential problems by doing a walkthrough, looking for any damage or necessary repairs. Then, consider hiring a handyman for the day. To really head off problems, consider hiring your own home inspector to help alert you to unexpected issues you can repair before homebuyers start walking through your home. Before You Move, Review Your Homeowner’s Insurance Coverage Selling your home is a good time to review your homeowners coverage. Learn more with us at: 508-540-2601 What is the deductible for flood insurance?

A flood policy comes with separate deductibles for the building and its contents. You typically get to choose the deductible amount. Common flood deductibles range from $1,000 to $5,000. As with other types of insurance, a higher deductible on your flood policy will result in a lower premium; however, if you have a mortgage, your lender may not allow you to increase your deductible beyond specified limits. What does flood insurance cover? Flood insurance covers losses directly resulting from flooding or flood-related erosion caused by heavy or prolonged rain, snowmelt, coastal storm surges, blocked storm drainage systems, levee dam failure and similar events. Flood insurers reimburse policyholders for structural damage, including:

The FEMA flood insurance guide is also a helpful resource that provides details on claims, coverage and costs. Flood insurance coverage limits The NFIP lets you insure your house for up to $250,000 and your personal property (contents) for up to $100,000. If you rent, you can buy up to $100,000 in coverage for your belongings. For non-residential property, you can buy up to $500,000 of coverage for the building and contents. Tips for buying hurricane insurance Follow these tips to be sure you have adequate hurricane protection for your home.

What does hurricane insurance cover? There is not a type of insurance specifically called “hurricane insurance.” So, does homeowners insurance cover hurricane damage? Most standard homeowners policies will cover damage caused by hurricanes except for flood damage and, in some areas, wind damage. Those who live along the East Coast or Gulf Coast, which is where hurricanes most often occur in the U.S., may need to buy an additional windstorm coverage policy. You would also need to buy a separate flood insurance policy. A common misconception is that a homeowners policy covers flood damage. It doesn’t. What hurricane damage doesn’t cover Wind damage. Wait, what? Isn't wind practically the definition of a hurricane? And you're telling me that my insurance may not cover me if there's a hurricane? Well, yes, you may not be covered if there's a ton of wind - and you live in an area that gets a lot of hurricanes. Now, suppose you live off the beaten path of a hurricane, in, say, Ohio and Indiana, which, believe it or not, can occasionally get the remnants of a hurricane plowing through the neighborhood. In that case, you probably are covered for hurricane winds. But some insurance policies won't cover wind in a hurricane - again if you live in a hurricane zone. If you live in such a place, you may need to buy a separate windstorm insurance policy. Talk to your insurance agent, though. It's never good to assume anything with insurance. Flooding. Many insurance policies don't cover flooding unless you have purchased a separate flood insurance policy. If you live anywhere - hurricane zone or not - that sees a lot of flooding, you really should look into purchasing flood insurance. Mudslides. So, a hurricane created a mudslide, and your house is under that, and your insurance won't cover that? Yeah, you almost certainly aren't covered. Sorry. Insurers have this weird thing about "earth movement." They won't cover you for earthquakes or any time the ground shifts under your house for some reason, and a mudslide is considered, well, the earth moving. But you might be covered for a mudflow, where a flood brings mud into your home. Sure, it seems crazy, and you're probably now thinking that this is why some people drink heavily. But insurance companies become very exact when it comes to how they define coverage and natural disasters. Power failure. Insurers get very exact and weird here, too. Let's say that you have a freezer full of ribs and steak and seafood. You're about to throw a big party. Anyway, the power goes out, and you lose all of that food and are out a lot of money. If this is a one-off incident, where your house lost power, and nobody else did, your policy probably covers that. Homeowners insurance may provide limited coverage amounts for lost jewelry or valuable items based on the type of item and cause of loss. Valuable items coverage may provide the protection you need for your valuable possessions in the event of covered loss from, for example, theft or fire.

Does Homeowners Insurance Cover Engagement Rings and Wedding Rings? Homeowners insurance alone may not sufficiently cover your engagement rings and wedding rings. People who own valuable possessions may need broader coverage than a basic homeowners policy provides. The good news is that there is additional protection available that may help cover the cost of a lost or stolen engagement ring or wedding ring. How to Add Engagement Ring Insurance or Wedding Ring Insurance You can add engagement ring insurance or wedding ring insurance through two options that Travelers offers: You can purchase a “Valuable Items Plus endorsement” or a “Personal Articles Floater (PAF).” With a Valuable Items Plus endorsement, your homeowners insurance coverage is expanded to protect your valuables from loss caused by additional perils (subject to a few common exclusions). For jewelry, paintings and other fine art, you can purchase up to $50,000 of coverage; for silverware, you can purchase as much as $20,000 coverage. The maximum payment for any one item is either $10,000 or $20,000, depending on the state. You pay no deductible. If you own valuable, rare or irreplaceable items, such as collectibles or antiques, you may want to consider the comprehensive protection offered by a PAF. In case of a covered loss, this coverage allows you to recover the value of an item (based on a recent bill of sale or appraisal). This policy provides coverage for fine art and jewelry at an amount you and your agent agree upon. For other items, the policy provides either actual cash value, cost to repair, cost to replace or up to the insured amount, depending on the cause of loss and its current value. What Does Jewelry Insurance Cover? Jewelry insurance covers valuable items from jewelry to collectibles, if they are stolen or damaged in a covered event. A typical homeowners insurance policy may not cover, or provide enough coverage for, those valuable items. Jewelry and valuable items coverage can help give you peace of mind. How to Insure Jewelry and Other Valuable Items Step 1. Tell us what jewelry or valuable item you need to insure. Step 2. Fill out a brief form to tell us about yourself and your jewelry or valuable item and how much it is worth. Step 3. Once you’ve obtained the coverage you need, enjoy your jewelry or valuable item, knowing that you’ve protected these items with insurance coverage. 1. Personal Articles Endorsement or Floater This itemized coverage can give you some peace of mind knowing your belongings and jewelry may be covered at the time of a loss. Offered as protection for valuables, policies can be purchased separately. There is no deductible for most classes or types of property and the coverage insures against many risks. Consider a Personal Articles Floater policy for:

2. Adding Jewelry to Homeowners Insurance Available as an add-on coverage to homeowners insurance, a Valuable Items Plus endorsement can offer higher limits on certain types of valuables, and expanded protection. Unlike the PAF where items are individually listed, the Valuable Items Plus endorsement provides blanket coverage that affords protection for a class of property collectively, such as jewelry insurance coverage, up to a certain amount. This coverage insures against many risks, such as lost jewelry. Summary Protecting your valuables from loss may be an affordable option depending on your needs. Whether you just need coverage for your jewelry or want insurance for multiple valuables, Travelers offers multiple options. You can add on and choose the coverage that fits your needs. Find a Calfee Insurance agent near you to get an insurance quote for your diamond, wedding or engagement ring, or any other valuables you may want to protect. If you're planning a home renovation, you may want to call your insurance agent first because this decision can impact your homeowners insurance. Some home renovations will change the amount of coverage you need, while others could even help you qualify for a discount. We cover six common scenarios that could affect your insurance, so you can plan ahead. 1. Building a New Addition When you expand and improve your home, you could likely increase its replacement value. This is the cost to repair or rebuild your home. Some additions that could increase your replacement value include: adding a second-story bedroom, expanding the living room or building a new garage. After building a new addition, or making updates or other improvements, you may need to increase your coverage because the value of your home, and the cost to rebuild it will likely have increased. Most insurance companies require your Coverage A or dwelling coverage limit be at least 80 percent of the replacement value of your home. Your insurance agent can recalculate your home value to determine whether you'll need more coverage because of the addition or improvement. 2. Building a Pool If you're looking to add a pool, you will want to contact your insurance agent to review coverage for changes to your property's value, as well as any increase in risk. When people are swimming and running around the pool, there's the chance for an accident. If someone gets hurt, they could try to hold you responsible for damages. This can apply even if the accident isn't your fault. Check with your agent to see whether your existing policy covers a pool and if you need to increase your liability coverage. This coverage can help pay damages to injured persons and provide for a defense if you are sued as a result of their injuries. You should also ask your agent what steps you can take to keep your pool safe so you can avoid accidents. Adding a fence with a lock is a smart move. You could also add lights with motion sensors or a pool alarm to discourage trespassers. Consider skipping the diving board, because this increases the chance of an accident and your insurance cost. Calfee Insurance wants to help you protect the things that matter to you. We offer a wide breadth of products so you can be covered at home and on the road. 3. Adding a Deck A new deck is another improvement that can add value but also risk, especially if the deck is attached to a second story or higher. You should let your agent know that you've added a deck, so he or she can adjust your policy as necessary. 4. Renovating the Kitchen Upgrading the kitchen can significantly increase the value of your home, especially if you switch to higher-quality counter tops, appliances and new flooring. You should contact your agent to see if you need to increase your insurance coverage. If your contractor upgrades the plumbing or electrical wiring as part of the renovation, ask your homeowners insurance agent if you qualify for a discount or if your coverage needs to be adjusted. These upgrades can reduce the chance of flooding water damage and fire, so check if your insurance company has discounts that can help to reduce your premium. 5. Finishing the Basement Finishing your basement can also increase the value of your home. That means, yet again, you may need more homeowners coverage. Flooding can be a concern, especially for the lowest floor in your house. It is important to note that most homeowners insurance policies do not cover damage caused by floods. Ask your agent to review your coverage and look to see if there are steps you can take to help prevent future damage, like installing a sump pump. 6. Redoing the Roof Before you redo your roof, ask your insurance agent whether this could qualify for a discount. Some companies offer a discount when you reinforce the roof or use stronger roofing materials that are wind, hail and leak-resistant. Your agent can explain how to qualify. At the same time, redoing the roof could increase your property value, which means you might need more coverage. It is a good idea to contact your agent when you’re considering making home renovations. Their knowledge and expertise can help you get the most out of your discounts while making sure your home is adequately insured. Free Home Insurance Review with updated Pricing |

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

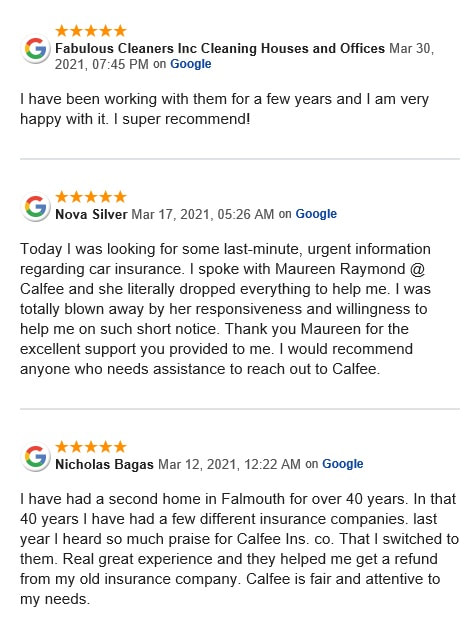

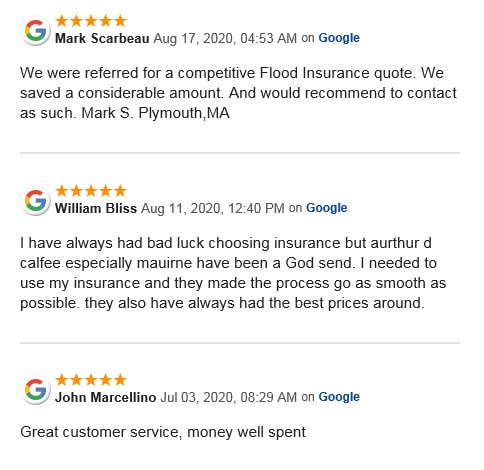

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2023 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed