|

A heavy rainstorm has finally stopped. Or maybe a long winter has finally ended, and the deep snows have begun to melt.

While good weather may seem like a relief, the potential for water damage may just be beginning. Storm water runoff can quickly overwhelm natural and manmade systems, leading to flooding and property damage. The steps you take today to prepare your home and yard for proper drainage can help avoid time-consuming and costly repairs when the bad weather does blow through. In a natural environment, storm water runoff is absorbed by soil, evaporates into the atmosphere or flows into bodies of water, such as streams, lakes or rivers. Homeowners may need to recreate the natural environment on their property to address storm water runoff. This includes planting trees and other vegetation, building rain gardens and installing rain barrels or cisterns to collect roof water. How Can You Protect Your Home from Storm Water? The key to developing a yard drainage plan is to understand the specific characteristics of your property and implement the system that works best for you. During a storm, you can go outside and observe how the water flows. Take note of the different grades and slopes and whether they divert the flowing water away from your home. Look for any low spots that collect or pool water and for any steep slopes that have indications of surface erosion. Consider the steps needed to protect your property from water runoff. Rain that falls on roofs, driveways, patios, roads and other impervious areas moves across the ground surface at greater speeds. The property adjacent to these areas could be more susceptible to damage. Frozen soil can also increase risk of damage by preventing water from being absorbed by the soil. Replacing impervious areas with pervious surfaces, such as permeable paving stones or pavers, can also help. Other questions you might consider: Is storm water that falls on impervious surfaces diverted away from your house? This is the work of things like roof gutter downspouts, driveways, walkways and patios. Runoff from these surfaces should be directed to an area that has the ability to absorb or slow the surface flow, such as landscaped areas, and away from your house. Does your house have a stream, pond or lake close by? Consider the flood potential and how it may impact your property. You can research local flood maps that will detail flood water levels for various storm events and their flood potential. Does your driveway or other impervious surface have a negative pitch back toward the house? Consider installing trench drains or area drains to help prevent pooling and divert water away from the house. Do you have retaining walls on your property? If so, it is important that the walls have a drainage system in place to alleviate pressure behind the wall. Periodically clean weep holes to ensure they are not clogged. Surface water should not be allowed to cascade over the top of the wall and instead should be diverted to the end of the wall or around it. Is a portion of your house below ground level, such as a basement? Make sure any sewer and water lines, or any other pipes or lines that penetrate subsurface walls, and foundation cracks are properly sealed. Basements that are prone to water intrusion should have a water collection system in place, such as a sump pump system. This system should be maintained with a battery backup for continued operation in the event of a power failure. Consider elevating mechanical systems or installing curbs around areas that need protecting but cannot be elevated, such as finished areas and storage areas. Exterior basement window wells should have covers and the ground surface of the well should be below the well rim. Do you have a sewer or septic system and property with known high water tables? Have the system checked by a professional. If the groundwater rises too high, it can affect the efficiency and operation of the system. In some cases, this may lead to sewer back up or waste leaching above the ground or back into the house. Surface storm water is not the only consideration for protecting your home. It is also important to assess the functionality of your whole home envelope system. Make sure that your house exterior is maintained, including roofing, flashings, weather barriers, windows, doors and sealants. While you cannot prevent against all damage from storm water runoff during large acts of nature, these steps can help protect your home when storms do hit.

0 Comments

As you plan your next home renovation project, choosing the right contractor for the job is a critical first step in your planning process. You want to make sure you vet the quality of their work in advance, spell out in writing what work you want performed and agree upon the scope of the project, and inquire whether the contractor is properly licensed and insured in case something goes wrong.

This checklist compiles the top 10 tips to consider when selecting a contractor: 1. Get Multiple Estimates Talk to several contractors and get written estimates from at least three. Make sure you’re comparing apples to apples when you get multiple estimates. Look at building materials, work methods, timelines and other factors that may vary by contractor. Be cautious of estimates that are too high or too low. 2. Hire Local, Licensed Contractors Whenever Possible Local contractors are easier to contact if problems develop with the work in the future, and they are more likely to be familiar with building codes in your area. Ask the contractor for their local, physical address. Be suspicious of anyone who goes door-to-door or refuses to leave a contract overnight. 3. Check Their Past Work How has their worked turned out in the past? Do they specialize in the kind of work you want done? Check references about the quality of their products, their workmanship and their customer service. Inquire about their professional reputation and years in business with the Better Business Bureau. A contractor with more than five years of experience is preferable. 4. Take Your Time Making a Sound Decision Get multiple bids before making a decision. Don’t be pressured into making an immediate decision, particularly with regard to signing a contract. Be cautious when asked to pay a large deposit up front. Make sure to read the fine print on all estimates and contracts. If you’re having emergency repairs done and don’t have time to thoroughly research a contractor, ask neighbors, family or friends to see if they have had a good experience with an emergency services contractor. 5. Check Their Insurance and Bonding Make sure the contractor is properly insured and bonded. Ask the contractor for a certificate of insurance (COI), which should provide the name of the insurance company, policy number and policy limits the contractor carries. You can contact the insurance company directly to verify the coverage and make sure the policy is still in effect. Do not do business with a contractor who does not carry the appropriate insurance coverage. If the contractor is not insured, you may be liable for accidents that occur on your property. Travelers Insurance allows you to customize your coverage to fit your unique needs. We focus on understanding you, so you'll feel right at home working with us. 6. Get Everything in Writing Secure a comprehensive contract before work begins. Get everything in writing, and make sure the contract is clear and well written. Consider having a lawyer review the proposed contract for your protection before you sign it if the project involves substantial costs. The contract should include:

Changes to the contract should be acknowledged by all parties in writing. Ask the contractor for confirmation that he or she has obtained all applicable building permits. If you decide to cancel a signed contract, you should follow the contract’s cancellation clause. Written notification of the cancellation should be sent by registered mail to ensure you have proof of the cancellation. 7. Understand Your Right to Cancel Federal law may require a “cooling off” period, in which you can cancel the contract without penalty. Check with the Federal Trade Commission and the laws of your state to understand your rights. Be sure to follow applicable rules during the cooling off period. If you do cancel, consider sending the notice of cancellation by registered mail to ensure you have proof of the cancellation. 8. Don’t Pay Up-Front Don’t pay for the entire project before it is completed. Make sure you make checks payable to a company, not an individual, and do not pay in cash. For larger projects, it is standard practice to pay one-third of the estimated costs as an initial payment. That way, you can retain your cashed check as a receipt. 9. Anticipate Delays Delays happen, and may not be the fault of your contractor. In spite of the timeline outlined in your contract, circumstances such as weather may prevent the work from remaining on schedule. Be realistic and prepare to adjust your plans accordingly. 10. Keep a Job File Keep your contract and all the supporting documents in one folder. Your file should also contain any change orders, plans and specifications, bills and invoices, canceled checks, and certificates of insurance and any letters, notes, or correspondence with the contractor. Going online has become part of everyday life, whether it is for everyday activities such as shopping, sending email or paying bills, and managing your accounts. But data breaches, in all their forms, can potentially expose the personal information that we share online, putting consumers at risk of identity theft.

According to the 2017 report Consumer Risk Index, 57% of Americans worry about online identity theft. Fortunately, there are steps that consumers can take, including not opening unsolicited emails and avoiding unsecure websites, to protect their personal information while online. The following tips can help you learn how to help stay safe online: Online Shopping

Emails and Attachments

General Online Safety

For many, the winter holidays are a time of joy, celebration and tradition. Decorating your home, yard or office is a fun, festive way to celebrate the season. A little planning can help you enjoy your display all season long. Following are some tips ask Calfee Insurance to help keep your family and friends safe around your decorative displays.

Planning your Holiday Display

Decorating Safely

During the Holidays

Packing and Storage

If the water supply lines on your washing machine fail, it can cause significant damage to your home. If that leak goes undetected because you are away from home, the accumulated water can cause potentially catastrophic damage.

From moldy walls, to damaged, unreplaceable personal belongings to warped floorboards, virtually every surface in your home is exposed to potential water damage. The smart technology in water-sensor systems can help quickly alert homeowners of potential leaks and prevent the need for costly and time-consuming repairs. Water damage is a common and costly cause of loss in the home. Today, smart home technology is helping consumers manage their personal risks. In addition to potentially mitigating serious damage, water sensors can also help a homeowner avoid the loss of personal possessions and the hassle of coordinating disruptive repairs to their home. How Do Water Sensors Work? Water sensors detect the presence of water and, when placed in locations where water should not be present, a leak. When Wi-Fi is enabled, the sensor can send out a notification to the homeowner through a smartphone app. If the homeowner will be out of town, family members, friends or other caretakers can be designated to receive notification of a leak, so they can act quickly to help prevent further damage. Some water-sensor systems can be programmed to shut off the water to the house to help prevent a small leak from becoming a large one. If your home is heated by an older steam-heating system, or if it’s protected by an automatic fire sprinkler system, check with a qualified professional before installing sensor-activated water shut-off devices. Where Should Water Sensors Be Placed? It’s a good idea to place water sensors in areas where water damage inside the home can occur, often without warning. Those areas include: washing machines, hot water heaters (they may fail), dishwashers (they may leak), supply lines to automatic ice makers (they may be damaged) and toilets (they may overflow). Performing regular maintenance and visually checking for rusty, corroded, worn or damaged water supply lines and valves and other potential problems before you have a leak is one of the best ways to help prevent water damage. You might want to install water sensors in areas near:

After a fire, burglary or another event in which you lost possessions from your home, it may be difficult to remember the details of every one of the belongings that you have accumulated over the years. In this situation, having a current inventory of your possessions, including make and model numbers, may help you with any potential insurance claims. Taking the time to document your belongings now can help you recover faster after a loss.

Here are some steps you can use to help build your home inventory checklist. Step 1: Take the time to walk through your property. Compiling a comprehensive home inventory takes time and effort. The more detailed your inventory, the more useful it will be if you have to make a claim. Document possessions inside your home and on your property that may be of value. Step 2: Keep your inventory in a safe place. Creating a digital home inventory and storing it off-site will help ensure that it won’t be lost, stolen or damaged during any disaster at your home. You can also create a photo or video inventory and upload it to a cloud-based service.

Step 3: Update your inventory often. When you make a significant purchase, add the information to the inventory while the details are fresh in your mind. This is also a good time to delete items that you have replaced or no longer own. Step 4: Remember your business assets. While most people think of their home when making an inventory, it is important to document the contents of your business, if applicable, as well. Step 5: Consider valuable items. Valuable items like jewelry, art, and collectibles may have increased in value since you brought them into your home. Check with your agent, if you have one, to make sure that you have adequate insurance coverage for these items as they may need to be insured separately. Consider putting jewelry or other valuables that you don’t often wear or use in a safe deposit box. To learn more about ways to protect your home and belongings, check out our homeowners insurance products. Buying renters insurance to protect your stuff may seem like an unnecessary expense, until you experience a theft or fire in your rented home or apartment and lose some of your most treasured possessions forever.

Whether you're a longtime renter or starting out in your first place, renters insurance policies provide important benefits and coverage. If a fire or similar incident destroyed your home and you didn't have renters coverage, it would be up to you to replace everything you own. Plus, if someone claimed you caused an injury or property damage, without adequate insurance protection, you could be at risk for an expensive lawsuit and paying that person for his or her damages. As you consider whether to buy renters insurance, here are four things you need to know: 1. Renters Insurance Provides Off-Premises Coverage Renters insurance does more than cover the cost of lost or damaged possessions in your home. There is coverage if your bicycle is stolen from a bike rack at the park, or if your laptop is taken from your car while you're at the supermarket. 2. You Can Be Compensated if You're Forced to Relocate Most renters policies provide additional living expenses coverage if your home becomes uninhabitable due to an event such as vandalism, theft, fire or water damage from home utilities.1 This benefit usually includes the cost of living expenses, up to your policy limits. This coverage typically is limited to 30 to 50 percent of your insured personal property. For example, if your belongings were insured for $100,000, the limit on additional living expenses would be $30,000 to $50,000, as outlined in your policy. 3. A Home Inventory Can Determine How Much Coverage You Need Before you decide how much coverage you need, it's important to know how much it would cost to replace your possessions. You can calculate replacement costs by conducting a home inventory and checking with your insurance representative to make certain you're fully covered.2 4. You Can Reduce Your Renters Insurance Costs There are a variety of ways to reduce the cost of renters insurance. An option is to select a higher policy deductible, the amount you must pay before your insurance coverage takes effect. Increasing a deductible from $250 to $500 could create an annual savings of up to 15 percent. You also may want to consider buying all your insurance policies from one carrier. For example, when you bundle your auto and renters policies , you receive additional savings. As a seasoned homeowner, you’ve been paying off your mortgage and are now considering buying a second home – a place you can retreat to on vacation, an investment property, or maybe even a combination of the two. You’ve been through the home-buying process before so you know what to expect, but there are certain factors unique to buying a second home that you'll want to consider. These factors will vary depending on how you intend to use the property, so it's a good idea to determine if the home will be for mostly personal use or if it will be occupied by tenants.

Here are six essential things you should consider before buying a second home: 1. Can I Afford It? It may seem like an obvious question, but can you afford a second home? If you choose to take out a mortgage on a new property, take some time to carefully understand the requirements so you’ll be better prepared for the process when submitting your mortgage application. As a homeowner, you're probably well aware of the strict credit requirements for taking out a mortgage, and things get even more serious when it comes to buying a second home. Your debt-to-income ratio will, of course, be a significant factor, and when it comes to holding two mortgages, you may find it a bit more challenging to balance this ratio. Also, be prepared to shell out a hefty amount for a down payment, since you'll be required to put at least 10 percent down on a vacation home and perhaps an even higher amount if it will be used as an investment property. And don’t forget that a second home will need to be protected, so you’ll want to talk to your homeowners insurance agent about getting a quote, once you’ve got your sights set on a second property to call your own. 2. How Will It Affect My Taxes? Understanding the tax implications of your new property will be another challenge. If you intend to rent your place to tenants, that means you'll earn rental income throughout the year, and that income will be taxable. As the owner of the home, you also may be able to take deductions in the form of mortgage interest, property taxes, repairs, depreciation, and operating expenses. One of the most important things to do as the landlord is to maintain accurate records of your income and expenses throughout the year in order to properly report the information on your tax return. 3. What Home Expenses Should I Expect? Just like your primary residence, your second home will also require you to shell out cash for expenses – both expected and unplanned. It’s helpful to have a budget set up for home needs, and with two homes, this may be an even more critical step, since your expenses will be elevated. In addition to the maintenance costs, remember you'll have property taxes, insurance, potential homeowners' association dues and more. If the property is at the beach or in a flood zone, you'll also need to consider things like flood insurance in addition to your regular homeowners policy. And finally, if you plan to rent the property, you'll also need to look into insurance that specifically protects you as a landlord. Travelers wants to help you protect the things that matter to you. We offer a wide breadth of products so you can be covered at home and on the road. 4. How Will I Use the Property? If the property will solely be used for personal vacations, this question isn't as critical. However, if you intend to rent the home occasionally or full time, you'll want to consider your strategy ahead of time. Keep in mind that for mortgage purposes, your lender doesn't consider the income generated from renting the home. Whether you can afford the second property is determined solely based on your credit and debt-to-income ratio. If you plan to rent the home, it's important to build your rental strategy as early in the process as possible to ensure you'll have rental income that can help offset the home's monthly expenses from the start. That will translate to less cash out of your pocket, as long as the tenants are diligent in paying the rent on time. 5. Who Will Maintain the Property? You’ll want to plan for who will maintain the property to protect your investment. If the investment property is located near your primary home, it may be easy for you to provide the regular maintenance and upkeep of the home, if you’re handy and have the time – and the will – to do those tasks. However, if the property is far from your primary home, you'll need to think about how it will be cared for when you're not staying there. This is especially important if the property is located in an area that’s susceptible to strong storms and hurricanes. Severe weather events can pop up at a moment's notice, and your second home will need to be properly prepared to withstand such weather. If the home will be for your personal use, perhaps you can find a neighbor to keep an eye on the house when you're not there. If you plan to rent the home, consider hiring a rental management company to take care of the general upkeep so you won't have to worry about every little detail from afar. 6. Is the Property in an Ideal Location? Whether buying a second home for your personal enjoyment or as an investment property, make sure you choose the right location for your needs. You may not get as much use as you’d like from a vacation home that requires extensive travel to get there. And, a rental home in an unpopular locale may lead to months of being unoccupied – which means you’re paying the second mortgage yourself rather than with income from renting it out. In either scenario, ensuring the home is in an ideal area can help provide you with a positive return on investment. If you do intend to rent the property, take some time to research the rental climate in the area before moving forward. The best places to own investment property are often popular vacation destinations and cities with an abundance of career options. Buying a second home doesn't have to be daunting. In fact, with careful research and planning, it can be a smart investment for your future. What’s your biggest challenge at home? For many of us, it’s a lack of space.

So how can you carve out an extra bedroom, a home office or a study nook for a school-age child? The answer may not be as out-of-reach as you think. Here are four solutions for a range of spaces and budgets. 1. Transform the Garage Are you wishing for a home gym, an artist’s cottage, an office, a family room, an in-law suite or a rental apartment? Your garage may be the answer. Both attached and unattached garages can be converted into an extra room. To get started, research local building codes and zoning ordinances. If you belong to an HOA, you’ll need to check their rules, too. If you’re doing more than small cosmetic changes, it’s also a good idea to consult with a professional architect, engineer and contractor. 2. Consider a Prefab Shed Modern and inviting, a prefab shed is an easy way to add a room if you don’t have a garage to work with. And unlike with a garage remodel, you may not need a permit for installation. 3. Convert the Attic or Basement As with a garage, an attic or basement could be remodeled into an inviting living space for a variety of uses. Consider adding a half-bath and/or kitchenette if you have the budget and want to create an in-law suite or apartment. 4. The “No-Remodel” Option Finally, there are less expensive and invasive ways to create more space in your home. With more people working remotely, closet offices have become popular. Scan your space for any closets and corners where clutter has accumulated. How could these nooks be put to better use? Have questions about your insurance coverage? Is there anything else we can help with? Reach out anytime. Renovating your property has some serious perks, such as creating more space or updating your amenities.

Some upgrades, such as a new roof or security system, can even reduce home insurance costs. While others — like a pool — can have the opposite effect. Before you take on your next home improvement project, here’s what you should know about how renovations might change your premiums.

|

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

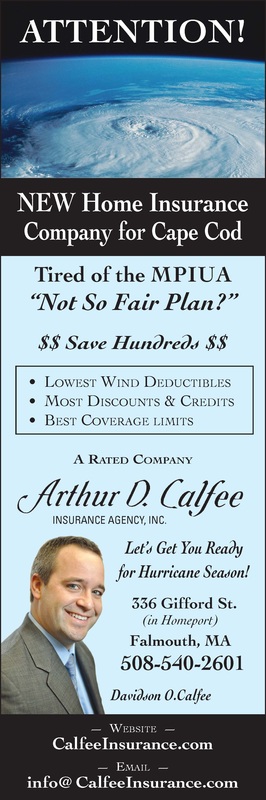

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2023 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed