Check your Cape Cod Flood Map changes with Calfee Insurance Check your Cape Cod Flood Map changes with Calfee Insurance Just a few inches of water from a flood can cause tens of thousands of dollars in damage. From 2008 to 2012, the average residential flood claim amounted to more than $38,000. Flood insurance is the best way to protect yourself from devastating financial loss. Flood insurance is available to homeowners, renters, condo owners/renters, and commercial owners/renters. Costs vary depending on how much insurance is purchased, what it covers and the property's flood risk. All policy forms provide coverage for buildings and contents. However, you might want to discuss insuring personal property with your agent, since contents coverage is optional. Typically, there's a 30-day waiting period from date of purchase before your policy goes into effect. That means now is the best time to buy flood insurance.

0 Comments

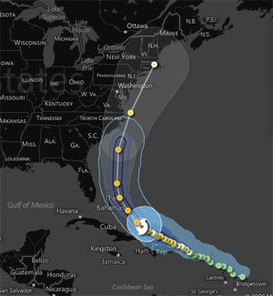

With a combination of soaking rain, flying debris, high winds, and tidal surges, hurricanes and tropical storms can pack a powerful punch. Besides causing extensive damage in coastal areas, hurricanes and tropical storms often bring flooding hundreds of miles inland, placing communities that normally would not be affected by the strongest hurricane winds in great danger. Just a few inches of water from a flood can cause tens of thousands of dollars in damage. Get Personalized Flood Analysis Everyone needs to be financially protected from the dangers of hurricanes. Because most policies take 30 days to go into effect, the time to act is now. Click HERE for more information. NHC Hurricane Specialist John Cangialosi discusses the deadly danger of inland flooding caused by tropical cyclones.

As hurricane season approaches we want to remind you that hurricane preparedness is of the utmost importance. Hurricane Sandy, the second costliest storm in U.S. history causing an estimated $50 billion in damage certainly show how devastating a storm can be and reminds us that we should not be complacent, but be prepared for severe weather events. We urge you to take the time to put together your personal hurricane kit to protect your family and property in the event that a storm impacts us this year. In addition to preparing for the safety of your family, it is a good time to review your homeowners policy with us to make absolutely certain that you have the coverages you need to protect your property. Replacement Cost - the differences between the replacement cost of your home and its market value in today's economy is a prevalent topic of discussion. With today's depressed market values, it i even more important that your Homeowners Coverage A limit is insured for 100% of the replacement value of your home. Deductibles - your homeowners policy has two deductibles, one for 'all other perils' (AP) and one for 'hurricanes' or it may be for all 'wind damage.' Your MPIUA policy will have a higher deductible for any 'wind' damage. But your UPC Insurance policy would have a 'Hurricane' deductible that applies only during a 'named hurricane.' Otherwise, your lower 'all other perils' deductible would be applied. Flood - we want to remind your that your homeowner's policy does not cover flood. Should a storm occur and your property becomes flooded, in order for you to have coverage you must have a separate flood policy.  By Todd Wallack | BOSTON GLOBE STAFF JANUARY 28, 2013 Competition in the state’s car insurance market has yielded an unexpected benefit: Thousands of residents who once had to buy expensive home coverage from the Massachusetts FAIR Plan are increasingly able to find policies through other insurers, saving them hundreds of dollars a year on premiums. The FAIR Plan, known as the insurer of last resort, provides home insurance in high-risk areas, including neighborhoods that have high crime rates or sit perilously close to the ocean. Home insurance companies have traditionally been reluctant to do business in such locations. But since the state gave insurers more freedom to set their own auto insurance rates, starting in 2008 — something it calls “managed competition” — 13 more auto insurance companies have set up shop in Massachusetts, with most also selling homeowners policies or partnering with firms that do. Over that time, the FAIR Plan lost nearly 27,000 homeowners insurance customers, or 16 percent of its base, an exodus few in the industry predicted. “It is all driven by this shift in the competitive marketplace,” said Robert Tommasino, general counsel for the Massachusetts Property Insurance Underwriting Association, better known as the FAIR Plan.

Some insurers, including Narragansett Bay Insurance Co., also decided the escalating prices of premiums for coastal properties made it worth their while to start selling policies in those locations. Their strategy has been to undercut the FAIR Plan rates while still charging enough to turn a profit. Bob Inello, whose waterfront home in Nahant is exposed to the wrath of storms, said he was forced to buy Fair Plan coverage for more than a decade. But three years ago, Inello said, his agent said he could switch to Narragansett, cutting his bill by $570 a year — more than 20 percent. “I don’t feel like I am being held hostage anymore,” Inello said. “It’s very liberating.”

By Randy Troutman On October 10, 2012 When discussing insured value and how a boat insurance policy will pay, most people think about a total loss. This is important but the majority of claims are partial losses. Depending on how your policy responds, you could pay several thousand dollars above your deductible. A boat insurance policy has two different ways to pay in the event of a partial loss. One is to replace the damaged items without deducting for depreciation. The second is to depreciate the damaged items. Depreciated Value is defined as Replacement Cost less depreciation. Most boat insurance companies use a non-published depreciation schedule that applies to partial losses. For example, the depreciation on a stern drive might be 7% per year, whereas the annual depreciation on canvas might be 15%. Each insurance company will apply Replacement Cost and Depreciated Value differently. Some boat insurance companies do not provide replacement cost coverage for partial losses. If the boat is insured on this policy form, then no matter the type of loss, the replacement parts are subject to depreciation. If the part costs $2,000 and is subject to 20% depreciation, you would be paid $2,000, less $400 depreciation, less your deductible. Most boat insurance companies provide replacement cost for partial losses until the boat (or items) reaches a certain age. The age will vary with each insurance company. Once a boat or item reaches that age, all partial losses are settled on an actual cash value basis. The boat insurance companies that provide replacement cost for partial losses usually name specific items that are subject to depreciation regardless of the age. Canvas, sails, cloth, trailers and plastics are examples of specifically named items. These items generally have a limited life span. They also name specific items that are subject to depreciation based on the item’s age. Outboards, stern drives and internal machinery are examples of items that change from replacement cost to depreciated value when they reach a certain age. Most insurance companies go by the age of the item to deduct depreciation. However, each insurance company has different specifically-named items and different ages which determine whether those items will be on replacement cost or depreciated value. It’s helpful to know that most companies will apply a reduced depreciation if you agree to replace with a remanufactured unit. A stern drive is a good example of an item that can be replaced with a remanufactured unit. This can save thousands of dollars in depreciation. Replacement Cost for a partial loss is what you want when available. A depreciated value can cost you several thousand dollars. United Marine Underwriters represents several boat insurance companies and we will be glad to discuss how they apply depreciation. Below are two examples to help explain how replacement cost vs. depreciated value work. Example 1 is an 8 year old stern drive boat with a $500 hull deductible that hits a submerged object. The replacement cost to the stern drive is $8000. Insurance company A provides replacement cost coverage until the stern drive is six years old. They will apply 60% depreciation (7.5% per year) to the $8000 replacement drive and then apply the $500 deductible. Insurance company A will pay $2700 ($8,000 less $4,800 depreciation, less $500 hull deductible). Insurance company B provides replacement cost coverage until the stern drive is 10 years of age. They will pay $7500 ($8000 less the $500 hull deductible). Example 2 is a boat with a $500 hull deductible that suffers wind damage to the fly bridge enclosure. The fly bridge enclosure is 2 years old and the replacement cost is $5000. Insurance company A provides replacement cost until the fly bridge enclosure is three years old. They will pay $4,500 ($5,000 less the $500 hull deductible). Insurance company B provides replacement cost but specifically names canvas as a depreciated item. Insurance company B will apply 20 percent depreciation to the replacement cost. They will pay $3,500 ($5000 replacement cost, less $1,000 depreciation, less the $500 hull deductible). |

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2024 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed