Arbella car insurance provides:

Auto Loan/Lease Gap In the event of a covered total loss this coverage provides the difference between the actual cash value of an auto and the balance still owed on a qualifying loan or lease. If you purchased this additional coverage, we will pay off your bank’s auto loan or lease balance, if you have a covered total loss. Accident forgiveness* If you qualify, this endorsement waives the surcharge points that you would typically acquire for an accident, for as long as you have this coverage on your policy. Protection for your pet* Our unique pet lover’s endorsement provides up to $500 in veterinary fees in the event of an injury to your cat or dog while in your car during an accident. Customer Care Package* Available at no additional charge with qualifying Arbella car insurance policies, this package offers coverage enhancements such as New Vehicle Replacement Coverage, Enhanced Substitute Transportation Coverage, Enhanced Towing and Labor and more. Personal Property Package* This endorsement provides coverage for personal belongings that are in your car during an accident, such as PDAs (up to $200), laptops (up to $1,000) and $250 for child car seats. Snowplow Endorsement* Provides coverage subject to a $200 deductible for loss to a snowplow installed in or upon an insured vehicle. Multiple coverage options and limits available. Original Equipment Manufacturer Parts (OEM)** For qualifying vehicles, this endorsement offers coverage for damaged property from a covered claim to be replaced with original manufacturer parts when available.

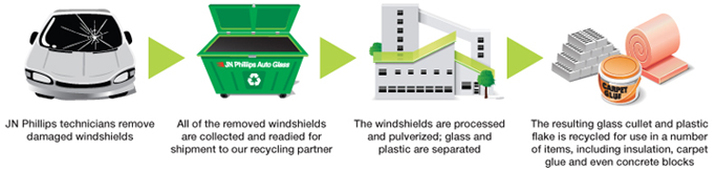

JN Phillips Auto Glass Windshield Recycling Guarantee

Only From New England's Largest and Most Respected Auto Glass Company GreenShield® is our commitment to responsibly recycle 100 percent of the windshields we replace. It is the first large-scale effort by any auto glass company to recycle and reduce the impact of consumer windshields at the end of their useful lives. Approximately 15 million windshields are replaced in the United States each year. The vast majority of these -- the equivalent of about 600 million pounds of glass and plastic -- end up in landfills. That's why JN Phillips created GreenShield®. Instead of sending the damaged windshields we remove to a landfill, we collect them and ship them to a special recycling plant where the glass and the plastic laminate layer that keeps your windshield from shattering are separated. Both the glass and the plastic are used in new products, such as concrete block, fiberglass insulation, and glues for carpet and roofing.  3x TIMES the MONEY that CALFEE raises will go to 'ONE FUND' So here's the scoop- The Arthur D. Calfee Insurance Agency, Inc. is proud to join the business community to support those most affected by the tragic events at the Boston Marathon. The Arthur D. Calfee Insurance Agency, with offices located in the Homeport Office Complex at 336 Gifford Street in Falmouth and across the street of the North Falmouth Ball Field at 121 County Road will be raising money for the Boston Strong - 'One Fund.' From now, April 29th to June 1st, 2013, the Arthur D. Calfee Insurance Agency will be raising 'One Fund' to turn in to 'One' large supporter who has agreed to match 3x TIMES the amount raised by Calfee Insurance, meaning they will match donations on a $3 to $1 basis up to $1,000 in total from the supporter. Massachusetts Governor Deval Patrick and Boston Mayor Tom Menino have announced the formation of 'The One Fund Boston, Inc.' to help the people most affected by the tragic events that occurred in Boston on April 15, 2013. AP | By LINDSEY TANNER Cost of amputating a leg? At least $20,000. Cost of an artificial leg? More than $50,000 for the most high-tech models. Cost of an amputee's rehab? Often tens of thousands of dollars more. These are just a fraction of the medical expenses victims of the Boston Marathon bombing will face. The mammoth price tag is probably not what patients are focusing on as they begin the long healing process. But friends and strangers are already setting up fundraisers and online crowd-funding sites, and a huge Boston city fund has already collected more than $23 million in individual and corporate donations. No one knows yet if those donations – plus health insurance, hospital charity funds and other sources – will be enough to cover the bills. Few will even hazard a guess as to what the total medical bill will be for a tragedy that killed three people and wounded more than 260. At least 15 people lost limbs, and other wounds include head injuries and tissue torn apart by shrapnel. Please visit www.CalfeeInsurance.com for more details.  Wind deductibles from $500 - $2,500 Special Tree Removal Protection Ultra Coverage Program Never get a late fee again! Sign up for Automatic Payments online through UPC Insurance.

Ways to Save on Personal Automobile Insurance

By Randy Troutman On October 10, 2012 When discussing insured value and how a boat insurance policy will pay, most people think about a total loss. This is important but the majority of claims are partial losses. Depending on how your policy responds, you could pay several thousand dollars above your deductible. A boat insurance policy has two different ways to pay in the event of a partial loss. One is to replace the damaged items without deducting for depreciation. The second is to depreciate the damaged items. Depreciated Value is defined as Replacement Cost less depreciation. Most boat insurance companies use a non-published depreciation schedule that applies to partial losses. For example, the depreciation on a stern drive might be 7% per year, whereas the annual depreciation on canvas might be 15%. Each insurance company will apply Replacement Cost and Depreciated Value differently. Some boat insurance companies do not provide replacement cost coverage for partial losses. If the boat is insured on this policy form, then no matter the type of loss, the replacement parts are subject to depreciation. If the part costs $2,000 and is subject to 20% depreciation, you would be paid $2,000, less $400 depreciation, less your deductible. Most boat insurance companies provide replacement cost for partial losses until the boat (or items) reaches a certain age. The age will vary with each insurance company. Once a boat or item reaches that age, all partial losses are settled on an actual cash value basis. The boat insurance companies that provide replacement cost for partial losses usually name specific items that are subject to depreciation regardless of the age. Canvas, sails, cloth, trailers and plastics are examples of specifically named items. These items generally have a limited life span. They also name specific items that are subject to depreciation based on the item’s age. Outboards, stern drives and internal machinery are examples of items that change from replacement cost to depreciated value when they reach a certain age. Most insurance companies go by the age of the item to deduct depreciation. However, each insurance company has different specifically-named items and different ages which determine whether those items will be on replacement cost or depreciated value. It’s helpful to know that most companies will apply a reduced depreciation if you agree to replace with a remanufactured unit. A stern drive is a good example of an item that can be replaced with a remanufactured unit. This can save thousands of dollars in depreciation. Replacement Cost for a partial loss is what you want when available. A depreciated value can cost you several thousand dollars. United Marine Underwriters represents several boat insurance companies and we will be glad to discuss how they apply depreciation. Below are two examples to help explain how replacement cost vs. depreciated value work. Example 1 is an 8 year old stern drive boat with a $500 hull deductible that hits a submerged object. The replacement cost to the stern drive is $8000. Insurance company A provides replacement cost coverage until the stern drive is six years old. They will apply 60% depreciation (7.5% per year) to the $8000 replacement drive and then apply the $500 deductible. Insurance company A will pay $2700 ($8,000 less $4,800 depreciation, less $500 hull deductible). Insurance company B provides replacement cost coverage until the stern drive is 10 years of age. They will pay $7500 ($8000 less the $500 hull deductible). Example 2 is a boat with a $500 hull deductible that suffers wind damage to the fly bridge enclosure. The fly bridge enclosure is 2 years old and the replacement cost is $5000. Insurance company A provides replacement cost until the fly bridge enclosure is three years old. They will pay $4,500 ($5,000 less the $500 hull deductible). Insurance company B provides replacement cost but specifically names canvas as a depreciated item. Insurance company B will apply 20 percent depreciation to the replacement cost. They will pay $3,500 ($5000 replacement cost, less $1,000 depreciation, less the $500 hull deductible). |

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2023 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed