For most of us, our house is our biggest and most valuable asset. It’s our shelter – our place to be safe and to call home. And for that reason, we want to keep it protected when disaster strikes. Homeowners insurance is a necessary way for us to keep our homes safe from the unpredictable. A few things might cause you to change your homeowners insurance company. First, you might switch homeowners insurance companies to save money. Shopping with us for better policies is an important part of the process, and we will look for the best possible option. Click here to learn more. The other common reason is that you want to increase or reduce your coverage in a way that cannot be done by your current homeowners insurance company. So, we begin the search for a company that can better meet your custom insurance needs. Making the Switch Whatever your reason is for switching, you’ll want to make this transition in the right way. Let’s take a moment to go through the steps of changing your insurance carrier. Step 1: Break Up with Your Carrier When you decide to change insurance companies, we just need a signature to make the move nice and easy for you. Step 2: Refund the Refund If your old policy hasn’t ended when you cancel, you may receive a refund check from your now-previous carrier. Before you run to the mall and splurge on your wish list, take a few deep breaths and send that fully endorsed check to your mortgage company. Whoa, whoa, whoa! But that’s your refund! At a first glance, this can seem confusing. Let’s take a second to break down what’s really happening with this refund and how your mortgage company is involved in the process. An escrow account that’s set up by your mortgage lender as a service to you, will pay your yearly homeowners insurance policy upfront. You’ll pay it back on a monthly basis as part of your regular mortgage payment. This way, your payments are more manageable. But what does this have to do with your refund? Let’s say your yearly policy costs $1200. Your mortgage company pays that upfront, and you’ll pay in monthly increments of $100 as part of your escrow account. After three months (during which you paid $300 for homeowners insurance), you decide to change insurance companies, meaning you receive a refund from your previous carrier. Since you’ve only had the policy for three months, you will receive a refund for nine months of insurance payments ($900). Step 3: Beware the Escrow Shortage If you change homeowners insurance companies, your mortgage company will again pay for your policy upfront. But if you didn’t send your mortgage company the refunded check from your previous policy, you’ll need to pay for both the old policy and the new policy as part of your monthly mortgage payment. This basically means you don’t have enough money in your escrow account to pay for all of your insurance. This causes your monthly mortgage payment to increase the next time your annual escrow analysis is performed. This is why sending your fully endorsed refund check to your mortgage company, is usually easier. If you prefer, you can send a personal check for the amount of the refund you received instead. Where Do I Send My Refund? Once you’ve received your refund and your new policy, you should send those documents along with your loan number and property address to your mortgage co. By doing this, you’ll be taking full advantage of your new policy and keeping your escrow account in check. We're committed to offering you the best products available, that's why we'll create a custom auto quote from Hagerty® for you. Call us at 508-540-2601. We're convinced Hagerty is the only choice for classic car insurance. Their program is designed with you in mind and includes benefits like:

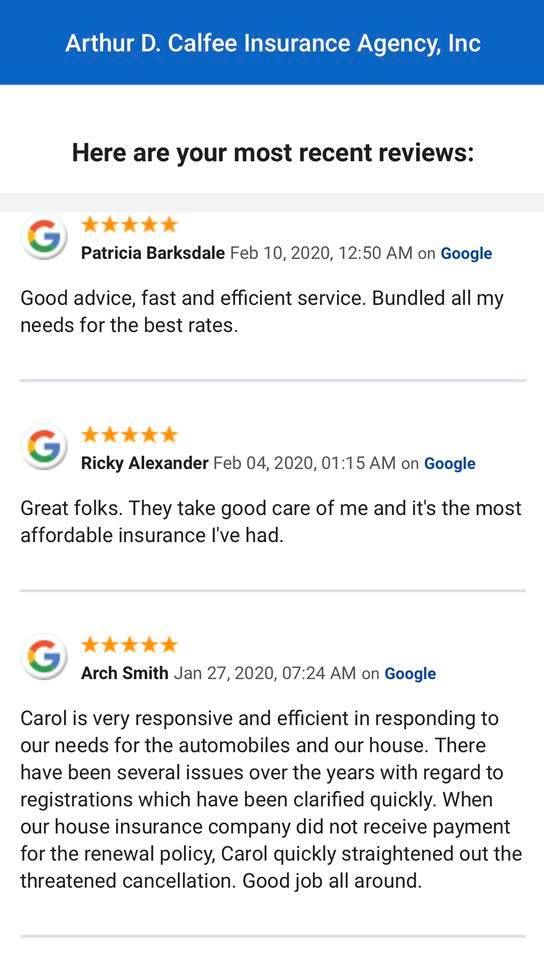

Hagerty goes beyond insurance with Hagerty Drivers Club®. Member benefits include unlimited emergency roadside service, valuable automotive discounts, 6 issues of the award-winning Hagerty magazine, access to members-only events, and more. We‘ve offered the 1st Gear membership level with your quote and encourage you to visit hagerty.com to learn more and choose the plan that fits your needs. We're excited to present this one and look forward to getting you covered with Hagerty. Please contact us if you have questions or there is anything we can do to help you along the way. Sincerely, Arthur D. Calfee Insurance Agency, Inc. *Less any deductible and/or salvage value, if retained by you. “Please remember Hagerty does not monitor your specific vehicle values. You are solely responsible for requesting any future increase or decrease in your vehicle‘s Guaranteed Value coverage, Which is displayed on your policy declaration‘s page.  We run our business with a value system of love (concern for others), trust, respect, a commitment to excellence and fun. And thanks, in part, to the customer service focus way we run our business, Calfee Insurance, has consistently been rated 5-Stars (superior) on Google & other platforms by current clients for more than 40 Years. We offer a wide range of coverage, including auto, home, renters and life insurance. It doesn't stop there - we also provide motorcycle and small business insurance. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch!  The COVID-19 pandemic has presented all of us with a unique set of challenges and our hearts go out to everyone who have been affected by this life altering event. Our insurance agency is currently taking several precautions and preventative steps to maintain a healthy and safe work environment. While we are continuously monitoring this evolving situation and are taking appropriate actions based on the guidance from our public health officials, we want to assure you that we are here for you. As we continue to monitor the impact of COVID-19, the health and wellness of our clients, employees and communities remain our top priority. Like many others, we are closely following guidelines from the Centers of Disease Control and Prevention (CDC), the World Health Organization (WHO), and national health organizations and will continue to seek guidance from these agencies and public health officials. Our leadership team has increased the frequency of cleaning and sanitization of all office areas, added five air purification machines, and encouraged all employees to sanitize their work areas throughout the day. With the forward thinking of our leadership team and with the advancement of technology, our insurance services will continue uninterrupted as we can make all insurance policy changes and updates through online web tools & portals. We have built a STAY HOME area of self-service online tools and applications on our agency website to make it easy – and safe – for you & your family. We have business continuity plans in place that we have used previously to ensure that we can continue to deliver our services without having to meet face to face. If you have questions, comments or concerns, you may reach out to us at (508)540-2601 or email me at Davidson@CalfeeInsurance.com. Davidson O. Calfee, President Arthur D. Calfee Insurance Agency, Inc. Homeport Office 336 Gifford Street - Falmouth, MA 02540 508-540-2601 x 1008 direct 508-371-9221 fax You know that sinking feeling you get when something goes wrong with your house? Whether it’s a stolen bike or a burst pipe, your first reaction may be to call us to file a claim. In reality, filing a claim “just to be on the safe side” could cost you -- in more ways than one. But won’t your insurance just deny claims that are too small? Not necessarily. Find out how to decide which claims to file and which to pay for out of pocket: Should you file a claim? It depends. Some types of events, think fire or theft, are too serious and expensive to tackle on your own. Anything causing significant damage that would be impossible to pay for, even with your emergency fund, is probably a good claim candidate. What if...? Here are a few common scenarios and how you might want to deal with them: You recently filed a claim. Think long and hard before submitting another. Most underwriters assume one claim every 10 years is average. Filing more could be cause for a rate increase. The claim is related to home maintenance. Nope -- upkeep falls squarely on you. If it’s revealed that you’ve let your maintenance schedule lapse on things like plumbing or HVAC systems, your homeowners policy could even be canceled. The cost to repair the damage is well over your deductible. Yes, report away. Say a tornado takes out the whole back half of your house. In this case, filing a claim is the only way to make your home liveable again. When it comes down to it, you have homeowners insurance for a reason. If you need it, use it. Just be smart about when you do and you could save yourself a lot of stress and a good chunk of money. Have questions about whether or not to file a claim? Reach out anytime. You’re driving to work when your favorite podcast suddenly stops playing. You know you shouldn’t look at your phone, but you hate sitting in silence during your commute. What do you do?

Do you glance around for cops, then tap around on your phone until the story starts up again? A lot of us do this — but it isn’t the safest choice. Beyond breaking the bad habit of distracted driving, here are four more behind-the-wheel behaviors to leave behind. 1. Don’t rely too much on fancy technology. If we let ourselves become less engaged drivers because we’re expecting blind-spot notifications and attention assist to save us when we’re tired or preoccupied, we aren’t really any safer. Continue your same careful driving habits and let these innovations give you an extra boost. 2. Don’t assume other drivers are paying attention, well rested or sober. Learn to spot the signs of impairment: wandering out of their lane, swerving, erratic braking, inconsistent speed and getting too close to other cars or objects. Keep a safe distance from these potentially dangerous drivers. 3. Don’t let your insurance make you complacent. Even if your collision deductible is low, don’t let your guard down. Dealing with car repairs and the other driver after an accident — not to mention the injury risk — probably isn’t worth it. 4. Don’t neglect routine maintenance. Overheating, breaking down or blowing a tire can be terrifying and dangerous. Fortunately, these problems can often be prevented with regular maintenance. Check your tire pressure and fluids monthly and have a trusted mechanic inspect your car thoroughly once or twice a year. Have questions about your auto coverage? Reach out today to discuss your policy. Water damage doesn’t always reveal itself right away. But over time, a small hole in your roof or a slowly leaking pipe can easily lead to big problems and expensive repairs.

With smart habits and a few check-ins a year, however, you can limit the chances of costly damage and annoying cleanup. Want to keep your home in good shape? Here are five simple steps to minimize the risk of water damage. 1. Care for Your Roof and Gutters An annual roof inspection is a must. It’s also important to patch holes, replace missing shingles and keep gutters debris-free to direct rain and ice away from your home. Keep downspouts far enough away from the house to ensure good drainage. 2. Keep Your Pipes in Good Shape Insulate your pipes and check on them regularly to keep tabs on signs of weakness or leaks. Have a plumber inspect your water lines every few years. Also avoid using hard drain cleaners, which damage pipe interiors and make them more susceptible to cracks and breaks. 3. Watch Those Windowsills Is the caulk around your windows discolored? Is condensation appearing on the inside of the windows or along the frames? Maintaining these areas helps keep moisture out and can also boost your home’s energy efficiency. 4. Install Flood and Moisture Sensors Smart homes can include simple sensors that alert you to moisture buildup and flooding in high-risk areas like the basement, laundry area and kitchen. 5. Test the Sump Pump If you have a sump pump that pushes water away from your home, inspect it annually to make sure it’s working properly. Follow the manufacturer’s recommendations. Have questions about water damage or anything else? Reach out to discuss your policy. |

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2023 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed