|

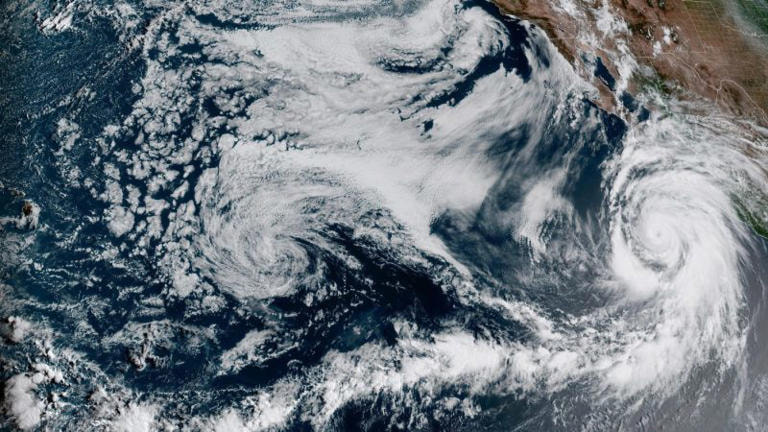

A pair of climate scientists are proposing a sixth category for hurricanes as climate change increasingly intensifies these storms, according to a new research study. In a study, published Monday in the Proceedings of the National Academy of Sciences, the two scientists argued the “open-ended” Saffir Simpson hurricane wind scale is becoming increasingly “inadequate” as the globe continues to warm. The scale, developed in the early 1970s, may not reflect the true intensity of some storms, argued study co-authors Michael F. Wehner — a climate scientist at the Lawrence Berkeley National Lab — and James P. Kossin — a former NOAA climate and hurricane researcher. A Category 6 designation would apply to storms with winds that exceed 192 miles per hour under their proposal. Storms with winds of 157 mph or higher are currently ranked Category 5, an open-ended approach that fails to adequately warn people of the dangers of higher wind speeds, the study contended. The study’s co-authors believe the open-ended nature of the current scale will prompt people to underestimate the risk of some hurricanes, which will become “increasingly problematic in a warming world.” “We find that a number of recent storms have already achieved this hypothetical category 6 intensity and based on multiple independent lines of evidence examining the highest simulated and potential peak wind speeds, more such storms are projected as the climate continues to warm,” the study stated. Does the hurricane intensity scale need a new 'category 6'?Since 2013, five — all in the Pacific — reached wind speeds of 192 mph or higher, with warming conditions expected to bring even stronger weather, The Associated Press reported. “Climate change is making the worst storms worse,” Wehner told the news wire. Some experts told The AP they do not believe another category is needed, and could give people the wrong impression as it’s based on wind speed, rather than water — the deadliest element of hurricanes. University of Miami hurricane researcher Brian McNoldy reportedly noted climate change is not causing more storms, but rather intensifying storms and increasing the proportion that qualify as major hurricanes. This is driven by warmer oceans, McNoldy said. Kossin told The AP pacific storms are stronger as there is less land to weaken them, in contrast to the Gulf of Mexico and Caribbean. While no Atlantic storm has reached the 192 mph threshold, Kossin and Wehner told the news wire the world warming will create a greater chance in the future. Jamie Rhome, deputy director of the National Hurricane Center, noted to the news wire that his office attempts “to steer the focus toward the individual hazards, which include storm surge, wind, rainfall, tornadoes and rip currents, instead of the particular category of the storm, which only provides information about the hazard from wind.” Rhome added a Category 5 already suggests “catastrophic damage” from wind so adding a higher category would not be necessary even in the case storms get stronger, the AP noted.

0 Comments

Going online has become part of everyday life, whether it is for everyday activities such as shopping, sending email or paying bills, and managing your accounts. But data breaches, in all their forms, can potentially expose the personal information that we share online, putting consumers at risk of identity theft. According to the Consumer Risk Index, 57% of Americans worry about online identity theft. Fortunately, there are steps that consumers can take, including not opening unsolicited emails and avoiding unsecure websites, to protect their personal information while online. The following tips can help you learn how to help stay safe online: Online Shopping

Emails and Attachments

General Online Safety

If the water supply lines on your washing machine fail, it can cause significant damage to your home. If that leak goes undetected because you are away from home, the accumulated water can cause potentially catastrophic damage.

From moldy walls, to damaged, unreplaceable personal belongings to warped floorboards, virtually every surface in your home is exposed to potential water damage. The smart technology in water-sensor systems can help quickly alert homeowners of potential leaks and prevent the need for costly and time-consuming repairs. Water damage is a common and costly cause of loss in the home. Today, smart home technology is helping consumers manage their personal risks. In addition to potentially mitigating serious damage, water sensors can also help a homeowner avoid the loss of personal possessions and the hassle of coordinating disruptive repairs to their home. How Do Water Sensors Work? Water sensors detect the presence of water and, when placed in locations where water should not be present, a leak. When Wi-Fi is enabled, the sensor can send out a notification to the homeowner through a smartphone app. If the homeowner will be out of town, family members, friends or other caretakers can be designated to receive notification of a leak, so they can act quickly to help prevent further damage. Some water-sensor systems can be programmed to shut off the water to the house to help prevent a small leak from becoming a large one. If your home is heated by an older steam-heating system, or if it’s protected by an automatic fire sprinkler system, check with a qualified professional before installing sensor-activated water shut-off devices. Where Should Water Sensors Be Placed? It’s a good idea to place water sensors in areas where water damage inside the home can occur, often without warning. Those areas include: washing machines, hot water heaters (they may fail), dishwashers (they may leak), supply lines to automatic ice makers (they may be damaged) and toilets (they may overflow). Performing regular maintenance and visually checking for rusty, corroded, worn or damaged water supply lines and valves and other potential problems before you have a leak is one of the best ways to help prevent water damage. You might want to install water sensors in areas near:

There are many common myths about potential dangers in and around the home that can keep some homeowners up at night. However, the gap between myth and fact can make all the difference when it comes to reducing risk in your house. So what does the data tell us are the biggest risks to your home?

From leaking valves to house fires, Claim data reveals the facts about the most frequent causes of homeowners’ claims, as well as the costliest. The answers may surprise you. While some risks are common nuisances we are all too aware of, others can be catastrophic. To help keep your home, your valuables and your family safe, you will want to take steps to protect them. Danger #1: Water Damage Many people think of damage from hurricanes and heavy rains when they think of water damage. But according to Travelers Claim data from 2009-2016, more property losses resulted from non-weather water claims (20%) than weather-related water claims (11%)*. Non-weather water claims can involve plumbing-related losses, such as pipes, drains and valves, as well as appliance issues. Learn more about common causes of water damage and the steps that you can take to help prevent it. Danger #2: Weather-Related Roof/Flashing Damage Wind, hail and weather-related water damage accounted for more than half, or 51%, of all Travelers property loss claims between 2009-2016. Falling limbs and branches weighed down by snow and freezing rain can cause roof/flashing damage. It is a good idea to inspect trees on your property to help prevent damage caused by falling tree limbs. Learning how to identify and remove ice dams can also help you avoid costly damage in the winter months. Danger #3: Frozen Pipe Damage Frozen water pipes are considered a potential source for catastrophic property damage, and make the list of Travelers’ five costliest sources of homeowner claims. While a sub-item of weather-related water loss, it is so significant, it deserves special mention. The good news is you can take steps to help prevent your pipes from freezing by identifying pipes that are most at risk and taking steps before winter arrives to help insulate them. During the winter, you may consider using a smart thermostat to manage and monitor that your heat is set at a safe level to help avoid freezing, and to receive notifications if the temperature in your home drops unexpectedly. Danger #4: Theft Theft from the premises makes the list of top causes of property loss claims, accounting for 6% of losses. There are many steps that you can take to help make your home less attractive to thieves, including landscaping with theft prevention in mind, adding outdoor lighting and creating a plan to make your home appear occupied while you are away. There are a number of methods to monitor your home to help minimize the theft potential, including smart home alarm systems. Danger #5: Fire Although fires do not occur as often as other incidents around the home, the damage that they can cause puts fire at the top of the costliest types of claims, according to Claim data from 2009-2016. Fire and related damages accounted for 25% of claims as measured by costs paid out. Fires can start from cooking, overloading circuits, and improperly using a wood stove, among other causes. Learn more about the potential wood stove safety tips, and how to help protect your home. Buying renters insurance to protect your stuff may seem like an unnecessary expense, until you experience a theft or fire in your rented home or apartment and lose some of your most treasured possessions forever.

Whether you're a longtime renter or starting out in your first place, renters insurance policies provide important benefits and coverage. If a fire or similar incident destroyed your home and you didn't have renters coverage, it would be up to you to replace everything you own. Plus, if someone claimed you caused an injury or property damage, without adequate insurance protection, you could be at risk for an expensive lawsuit and paying that person for his or her damages. As you consider whether to buy renters insurance, here are four things you need to know: 1. Renters Insurance Provides Off-Premises Coverage Renters insurance does more than cover the cost of lost or damaged possessions in your home. There is coverage if your bicycle is stolen from a bike rack at the park, or if your laptop is taken from your car while you're at the supermarket. 2. You Can Be Compensated if You're Forced to Relocate Most renters policies provide additional living expenses coverage if your home becomes uninhabitable due to an event such as vandalism, theft, fire or water damage from home utilities.1 This benefit usually includes the cost of living expenses, up to your policy limits. This coverage typically is limited to 30 to 50 percent of your insured personal property. For example, if your belongings were insured for $100,000, the limit on additional living expenses would be $30,000 to $50,000, as outlined in your policy. 3. A Home Inventory Can Determine How Much Coverage You Need Before you decide how much coverage you need, it's important to know how much it would cost to replace your possessions. You can calculate replacement costs by conducting a home inventory and checking with your insurance representative to make certain you're fully covered.2 4. You Can Reduce Your Renters Insurance Costs There are a variety of ways to reduce the cost of renters insurance. An option is to select a higher policy deductible, the amount you must pay before your insurance coverage takes effect. Increasing a deductible from $250 to $500 could create an annual savings of up to 15 percent. You also may want to consider buying all your insurance policies from one carrier. For example, when you bundle your auto and renters policies , you receive additional savings. What is the deductible for flood insurance?

A flood policy comes with separate deductibles for the building and its contents. You typically get to choose the deductible amount. Common flood deductibles range from $1,000 to $5,000. As with other types of insurance, a higher deductible on your flood policy will result in a lower premium; however, if you have a mortgage, your lender may not allow you to increase your deductible beyond specified limits. What does flood insurance cover? Flood insurance covers losses directly resulting from flooding or flood-related erosion caused by heavy or prolonged rain, snowmelt, coastal storm surges, blocked storm drainage systems, levee dam failure and similar events. Flood insurers reimburse policyholders for structural damage, including:

The FEMA flood insurance guide is also a helpful resource that provides details on claims, coverage and costs. Flood insurance coverage limits The NFIP lets you insure your house for up to $250,000 and your personal property (contents) for up to $100,000. If you rent, you can buy up to $100,000 in coverage for your belongings. For non-residential property, you can buy up to $500,000 of coverage for the building and contents. Tips for buying hurricane insurance Follow these tips to be sure you have adequate hurricane protection for your home.

What does hurricane insurance cover? There is not a type of insurance specifically called “hurricane insurance.” So, does homeowners insurance cover hurricane damage? Most standard homeowners policies will cover damage caused by hurricanes except for flood damage and, in some areas, wind damage. Those who live along the East Coast or Gulf Coast, which is where hurricanes most often occur in the U.S., may need to buy an additional windstorm coverage policy. You would also need to buy a separate flood insurance policy. A common misconception is that a homeowners policy covers flood damage. It doesn’t. What hurricane damage doesn’t cover Wind damage. Wait, what? Isn't wind practically the definition of a hurricane? And you're telling me that my insurance may not cover me if there's a hurricane? Well, yes, you may not be covered if there's a ton of wind - and you live in an area that gets a lot of hurricanes. Now, suppose you live off the beaten path of a hurricane, in, say, Ohio and Indiana, which, believe it or not, can occasionally get the remnants of a hurricane plowing through the neighborhood. In that case, you probably are covered for hurricane winds. But some insurance policies won't cover wind in a hurricane - again if you live in a hurricane zone. If you live in such a place, you may need to buy a separate windstorm insurance policy. Talk to your insurance agent, though. It's never good to assume anything with insurance. Flooding. Many insurance policies don't cover flooding unless you have purchased a separate flood insurance policy. If you live anywhere - hurricane zone or not - that sees a lot of flooding, you really should look into purchasing flood insurance. Mudslides. So, a hurricane created a mudslide, and your house is under that, and your insurance won't cover that? Yeah, you almost certainly aren't covered. Sorry. Insurers have this weird thing about "earth movement." They won't cover you for earthquakes or any time the ground shifts under your house for some reason, and a mudslide is considered, well, the earth moving. But you might be covered for a mudflow, where a flood brings mud into your home. Sure, it seems crazy, and you're probably now thinking that this is why some people drink heavily. But insurance companies become very exact when it comes to how they define coverage and natural disasters. Power failure. Insurers get very exact and weird here, too. Let's say that you have a freezer full of ribs and steak and seafood. You're about to throw a big party. Anyway, the power goes out, and you lose all of that food and are out a lot of money. If this is a one-off incident, where your house lost power, and nobody else did, your policy probably covers that. Homeowners insurance may provide limited coverage amounts for lost jewelry or valuable items based on the type of item and cause of loss. Valuable items coverage may provide the protection you need for your valuable possessions in the event of covered loss from, for example, theft or fire.

Does Homeowners Insurance Cover Engagement Rings and Wedding Rings? Homeowners insurance alone may not sufficiently cover your engagement rings and wedding rings. People who own valuable possessions may need broader coverage than a basic homeowners policy provides. The good news is that there is additional protection available that may help cover the cost of a lost or stolen engagement ring or wedding ring. How to Add Engagement Ring Insurance or Wedding Ring Insurance You can add engagement ring insurance or wedding ring insurance through two options that Travelers offers: You can purchase a “Valuable Items Plus endorsement” or a “Personal Articles Floater (PAF).” With a Valuable Items Plus endorsement, your homeowners insurance coverage is expanded to protect your valuables from loss caused by additional perils (subject to a few common exclusions). For jewelry, paintings and other fine art, you can purchase up to $50,000 of coverage; for silverware, you can purchase as much as $20,000 coverage. The maximum payment for any one item is either $10,000 or $20,000, depending on the state. You pay no deductible. If you own valuable, rare or irreplaceable items, such as collectibles or antiques, you may want to consider the comprehensive protection offered by a PAF. In case of a covered loss, this coverage allows you to recover the value of an item (based on a recent bill of sale or appraisal). This policy provides coverage for fine art and jewelry at an amount you and your agent agree upon. For other items, the policy provides either actual cash value, cost to repair, cost to replace or up to the insured amount, depending on the cause of loss and its current value. What Does Jewelry Insurance Cover? Jewelry insurance covers valuable items from jewelry to collectibles, if they are stolen or damaged in a covered event. A typical homeowners insurance policy may not cover, or provide enough coverage for, those valuable items. Jewelry and valuable items coverage can help give you peace of mind. How to Insure Jewelry and Other Valuable Items Step 1. Tell us what jewelry or valuable item you need to insure. Step 2. Fill out a brief form to tell us about yourself and your jewelry or valuable item and how much it is worth. Step 3. Once you’ve obtained the coverage you need, enjoy your jewelry or valuable item, knowing that you’ve protected these items with insurance coverage. 1. Personal Articles Endorsement or Floater This itemized coverage can give you some peace of mind knowing your belongings and jewelry may be covered at the time of a loss. Offered as protection for valuables, policies can be purchased separately. There is no deductible for most classes or types of property and the coverage insures against many risks. Consider a Personal Articles Floater policy for:

2. Adding Jewelry to Homeowners Insurance Available as an add-on coverage to homeowners insurance, a Valuable Items Plus endorsement can offer higher limits on certain types of valuables, and expanded protection. Unlike the PAF where items are individually listed, the Valuable Items Plus endorsement provides blanket coverage that affords protection for a class of property collectively, such as jewelry insurance coverage, up to a certain amount. This coverage insures against many risks, such as lost jewelry. Summary Protecting your valuables from loss may be an affordable option depending on your needs. Whether you just need coverage for your jewelry or want insurance for multiple valuables, Travelers offers multiple options. You can add on and choose the coverage that fits your needs. Find a Calfee Insurance agent near you to get an insurance quote for your diamond, wedding or engagement ring, or any other valuables you may want to protect. The trees in your yard can enhance your property, provide shade and offer abundant environmental benefits. However, trees can also pose a safety hazard to your family and your home if they are not properly inspected and maintained.

Trees can present a particularly significant danger during a storm. Wind, lightning, snow and ice can all transform a tranquil row of trees into an imminent threat to your property. Proper tree maintenance involves more than pruning and trimming overgrown branches. These are some of the key steps you can take to protect your trees and prevent them from becoming a safety hazard. Steps to Take Before a Storm

When performing maintenance on the trees in your yard, please make safety a priority. If you are unable to safely prune or remove trees and limbs, contact a professional tree-care service or arborist to help you do so. It may be a good idea to consult with a professional if the trees in your yard already display any of the following characteristics:

If you're planning a home renovation, you may want to call your insurance agent first because this decision can impact your homeowners insurance. Some home renovations will change the amount of coverage you need, while others could even help you qualify for a discount. We cover six common scenarios that could affect your insurance, so you can plan ahead. 1. Building a New Addition When you expand and improve your home, you could likely increase its replacement value. This is the cost to repair or rebuild your home. Some additions that could increase your replacement value include: adding a second-story bedroom, expanding the living room or building a new garage. After building a new addition, or making updates or other improvements, you may need to increase your coverage because the value of your home, and the cost to rebuild it will likely have increased. Most insurance companies require your Coverage A or dwelling coverage limit be at least 80 percent of the replacement value of your home. Your insurance agent can recalculate your home value to determine whether you'll need more coverage because of the addition or improvement. 2. Building a Pool If you're looking to add a pool, you will want to contact your insurance agent to review coverage for changes to your property's value, as well as any increase in risk. When people are swimming and running around the pool, there's the chance for an accident. If someone gets hurt, they could try to hold you responsible for damages. This can apply even if the accident isn't your fault. Check with your agent to see whether your existing policy covers a pool and if you need to increase your liability coverage. This coverage can help pay damages to injured persons and provide for a defense if you are sued as a result of their injuries. You should also ask your agent what steps you can take to keep your pool safe so you can avoid accidents. Adding a fence with a lock is a smart move. You could also add lights with motion sensors or a pool alarm to discourage trespassers. Consider skipping the diving board, because this increases the chance of an accident and your insurance cost. Calfee Insurance wants to help you protect the things that matter to you. We offer a wide breadth of products so you can be covered at home and on the road. 3. Adding a Deck A new deck is another improvement that can add value but also risk, especially if the deck is attached to a second story or higher. You should let your agent know that you've added a deck, so he or she can adjust your policy as necessary. 4. Renovating the Kitchen Upgrading the kitchen can significantly increase the value of your home, especially if you switch to higher-quality counter tops, appliances and new flooring. You should contact your agent to see if you need to increase your insurance coverage. If your contractor upgrades the plumbing or electrical wiring as part of the renovation, ask your homeowners insurance agent if you qualify for a discount or if your coverage needs to be adjusted. These upgrades can reduce the chance of flooding water damage and fire, so check if your insurance company has discounts that can help to reduce your premium. 5. Finishing the Basement Finishing your basement can also increase the value of your home. That means, yet again, you may need more homeowners coverage. Flooding can be a concern, especially for the lowest floor in your house. It is important to note that most homeowners insurance policies do not cover damage caused by floods. Ask your agent to review your coverage and look to see if there are steps you can take to help prevent future damage, like installing a sump pump. 6. Redoing the Roof Before you redo your roof, ask your insurance agent whether this could qualify for a discount. Some companies offer a discount when you reinforce the roof or use stronger roofing materials that are wind, hail and leak-resistant. Your agent can explain how to qualify. At the same time, redoing the roof could increase your property value, which means you might need more coverage. It is a good idea to contact your agent when you’re considering making home renovations. Their knowledge and expertise can help you get the most out of your discounts while making sure your home is adequately insured. Free Home Insurance Review with updated Pricing |

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2023 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed