|

Burn injuries in the United States lead to over 400,000 people needing care each year. Yet, with simple lifestyle changes and safety measures most home burns can be prevented. Below are a few tips to help you and your family avoid burn injuries.

Monitor the condition of electrical cords Electrical fires are a common cause of injuries resulting from burns. Be sure that the quality of your cords is being maintained and always throw away electrical cords that are damaged or broken. Make sure to check for damage frequently and never overload your outlets, power strips, or electrical circuits. For increased safety, experts advise installing safety caps on electrical cords and storing them out of reach. Use space heaters carefully Make sure to have enough fixed space around your heaters. When you leave the room or turn in for the night, always switch off heating devices. Experts recommend keeping all flammable materials, like curtains, blankets or towels at least three feet away from your heaters. Practice burn safety in your kitchen Burn accidents happen frequently in the kitchen. While cooking, never leave your food unattended and keep the stove area clear of all flammable materials. Make sure to keep your cooking area clean - grease and debris can quickly cause a fire emergency. Never use an oven to heat your home and always turn off cooking appliances when you are finished using them. Check your fire alarms frequently The US Fire Administration recommends checking your smoke detector as often as once a month, changing batteries every 6 months and replacing the alarm itself every 10 years. If the batteries are not working, make sure to change them immediately. Test the temperature of your water and hot liquids Not all burns are caused by fire.Extremely hot liquids could seriously harm you and your family members. Make sure to set your water thermostat to a maximum of 120 degrees and always check the temperature of hot liquids you consume or touch. Never leave candles unattended Candles can quickly become a fire and burn hazard. Always put them out before leaving your home or if they are in reach of your kids or pets, and make sure there are no flammable materials around. What to do if you get a burn Although by following fire and burn safety guidelines most home burns can be avoided, accidents do happen. Here are a few tips on what to do if you or your family member gets a burn: Run the burn under cool or lukewarm water To prevent the burn from spreading and gaining severity, run the affected spot under cool or lukewarm water for at least 20 minutes. Remove any wet clothing or jewelry from the site of the burn to avoid irritation. Avoid using home remedies Using home remedies, such as putting ice or using non-prescribed ointments on your wound can actually make the duration and intensity of the burn worse. Avoid self-treatment and stick to the guidance offered by medical professionals. Call 911 or your medical provider No matter the severity of the burn, it's always best if it can get checked out by a medical professional. Experts recommend calling your medical provider (or 911 in the case of potentially severe injuries) immediately after the accident so you can get the right treatment and avoid the burn from getting worse. Call us (508) 540-2601 for more advise and best insurance covers to protect you and your family.

0 Comments

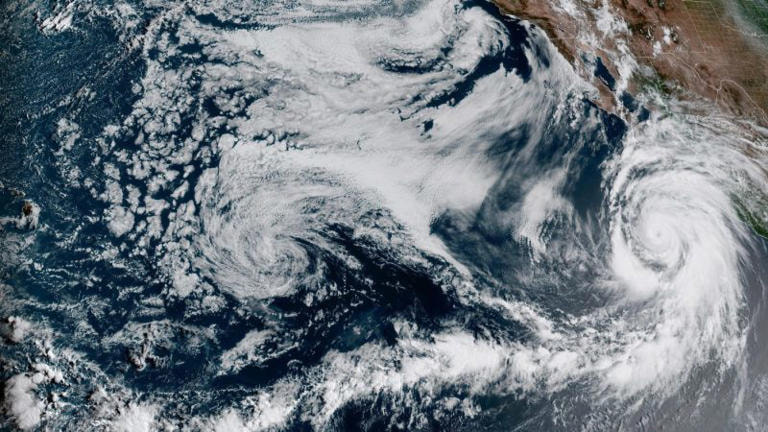

A pair of climate scientists are proposing a sixth category for hurricanes as climate change increasingly intensifies these storms, according to a new research study. In a study, published Monday in the Proceedings of the National Academy of Sciences, the two scientists argued the “open-ended” Saffir Simpson hurricane wind scale is becoming increasingly “inadequate” as the globe continues to warm. The scale, developed in the early 1970s, may not reflect the true intensity of some storms, argued study co-authors Michael F. Wehner — a climate scientist at the Lawrence Berkeley National Lab — and James P. Kossin — a former NOAA climate and hurricane researcher. A Category 6 designation would apply to storms with winds that exceed 192 miles per hour under their proposal. Storms with winds of 157 mph or higher are currently ranked Category 5, an open-ended approach that fails to adequately warn people of the dangers of higher wind speeds, the study contended. The study’s co-authors believe the open-ended nature of the current scale will prompt people to underestimate the risk of some hurricanes, which will become “increasingly problematic in a warming world.” “We find that a number of recent storms have already achieved this hypothetical category 6 intensity and based on multiple independent lines of evidence examining the highest simulated and potential peak wind speeds, more such storms are projected as the climate continues to warm,” the study stated. Does the hurricane intensity scale need a new 'category 6'?Since 2013, five — all in the Pacific — reached wind speeds of 192 mph or higher, with warming conditions expected to bring even stronger weather, The Associated Press reported. “Climate change is making the worst storms worse,” Wehner told the news wire. Some experts told The AP they do not believe another category is needed, and could give people the wrong impression as it’s based on wind speed, rather than water — the deadliest element of hurricanes. University of Miami hurricane researcher Brian McNoldy reportedly noted climate change is not causing more storms, but rather intensifying storms and increasing the proportion that qualify as major hurricanes. This is driven by warmer oceans, McNoldy said. Kossin told The AP pacific storms are stronger as there is less land to weaken them, in contrast to the Gulf of Mexico and Caribbean. While no Atlantic storm has reached the 192 mph threshold, Kossin and Wehner told the news wire the world warming will create a greater chance in the future. Jamie Rhome, deputy director of the National Hurricane Center, noted to the news wire that his office attempts “to steer the focus toward the individual hazards, which include storm surge, wind, rainfall, tornadoes and rip currents, instead of the particular category of the storm, which only provides information about the hazard from wind.” Rhome added a Category 5 already suggests “catastrophic damage” from wind so adding a higher category would not be necessary even in the case storms get stronger, the AP noted. No one wants to be in the position of filing a car or home insurance claim, but it may be necessary from time to time. Whether your home sustained damage or you were in an accident involving another vehicle, filing a claim starts the process of getting reimbursed. This may include repair costs, the value of lost or stolen property, or associated expenses (such as a rental car or hotel stay). Keep reading to learn when you should or shouldn’t file a claim and how the process works. When should you file a claim? Generally, it can be a good idea to file a claim on your homeowners or car insurance if:

When is it not necessarily worth it to make a claim? There are times when you may not benefit from filing an insurance claim; for example, if the damage to your car or home isn’t covered by your policy. Additionally, if the damage is so minimal that it doesn’t meet your deductible or isn’t worth potentially higher premiums, you may not want to make a claim. Filing several claims in a short time frame could result in higher rates. How to File a Claim If you do decide to file a claim, it’s important to do so as soon as possible. You should provide photos and relevant details and respond to requests for additional information. Call the police if you’ve been in a car accident or if your home has been burglarized. Obtain a copy of the police report to submit with your claim. Stop using the damaged vehicle (or part of your home) until it can be inspected. You don’t want to cause further damage while your claim is active. Reach out if you have questions about your insurance coverage. No matter what else winter may bring, you’re probably experiencing lower temperatures this time of year.

That’s why this season can bring a specific set of challenges for your home and car. Snow and ice, heating systems, fire safety, pipes and tires should all be top of mind during the colder months. Keep reading for 12 tips on staying safe at home and on the road when the thermostat is at its lowest. Stay Safe and Warm at Home

Drive Safely This Winter

If you have questions about winter safety or your insurance policies, reach out today. What’s one of a homeowner’s greatest enemies? Water (where it shouldn’t be).

When water enters your home, it can quickly cause a lot of damage. So, it’s important to understand which types of plumbing issues and water damage are covered by your home insurance policy. Learn about the types of insurance for water damage as well as what is and isn’t covered: Likely Covered When it comes to coverage of water damage, the key indicators that an issue is likely covered are sudden and accidental. Coverage of water damage would fall under dwelling coverage (the structure of your home) or personal property coverage (your belongings). A deductible and coverage limits may apply to personal property coverage — review your policy or contact us with questions. Examples of water damage that are likely covered include:

Not Covered On the other hand, water damage caused by issues that are not sudden or accidental, such as delayed maintenance and neglect, will not be covered. And homeowners insurance only covers the damage caused, not the source of it. You’ll have to replace or repair pipes and appliances yourself. Examples of water damage that isn’t covered include:

“Act of God” is a commonly used insurance term, but you may not know exactly what it means. When it comes to weather and other unpreventable events, it’s important to understand acts of God so you can protect your property by making sure you have the right insurance coverage.

Keep reading to learn what an act of God is, the types of events that qualify and how it all factors into home and auto insurance policies. What does “act of God” mean? Simply put, an act of God (in property and car insurance policy terms) refers to events, such as extreme weather, that are out of your control. If it’s something you can’t prevent, it’s likely an act of God. What types of events qualify as an act of God? Examples of acts of God include windstorms, lightning strikes, hail storms, wildfires, hurricanes, tornadoes, floods and earthquakes. However, not every act of God is included in a standard insurance policy. You may need additional coverage. Does auto insurance cover acts of God? Car insurance will cover acts of God if you sign up for comprehensive coverage. This type of auto insurance covers natural disasters as well as other types of damage not caused by a collision. For example, if your car is vandalized or an animal runs out in front of you, comprehensive coverage can help you pay for repairs or a total loss. What about home insurance? A standard homeowners policy usually covers some acts of God. Flooding and earthquakes are two common exceptions. If you live in a flood zone or an area prone to earthquakes, you’ll need separate coverage for those natural disasters. Is an act of God the same as a force majeure? The two terms are similar; however, the term force majeure is more commonly used in business and construction contracts. It refers to unforeseeable circumstances that prevent a contract from being fulfilled. Have questions about your insurance coverage for acts of God? Just reach out, and we’ll be happy to help. Are you a home insurance expert or does the industry’s jargon leave you scratching your head?

Unfortunately, if you don’t understand everything that’s in your homeowners insurance policy, you could be vulnerable to expensive mistakes or unpleasant surprises later on. We’re here to help. Keep reading for our list of 10 important, uncommon and often misunderstood home insurance terms to know about. 1. Adjuster: The claims adjuster investigates your claim, collects evidence and determines how much to pay for the property damage or total loss. 2. Declarations Page: This is the front page of your homeowner’s insurance policy. A declarations page summarizes basic information about your policy such as the policyholder, the home covered, and your coverage and premium amounts. 3. Indemnification: The compensation for your homeowners insurance claim. 4. Loss of Use: Coverage that pays additional expenses when a policyholder has to move out of their residence while repairs are made as a result of damage caused by a covered loss. 5. Negligence: A failure to take reasonable care or otherwise prevent damage to your home and property. For example, you neglect to shovel the snow from your sidewalk and a neighbor injures themselves. Or, you don’t take a dead tree down and it falls on your property or your neighbor’s. 6. Occurrence: A single event or series of exposures that cause an injury or damage to your property. Examples include break-ins, fires, burst pipes and more. 7. Personal Umbrella Policy: An optional, additional liability coverage for your personal assets in the event of an accident on your property that exceeds the limits of your current homeowners coverage. 8. Replacement Cost: The actual cost of replacing your home and property in the event of damage or complete destruction. Replacement cost is different from the current market value of your home. 9. Scheduled Personal Property: If you have high-value personal property such as jewelry, artwork, antiques and more, this type of coverage can be added to your homeowners policy. 10. Subrogation: When someone else’s negligence leads to damage to your property (such as a neighbor’s tree falling on your roof), you can ask your insurer to settle the claim for you. Subrogation is the process of seeking payment recovery for you. Have questions about your homeowners insurance? Just reach out, and we’ll be happy to help. Does your homeowner’s insurance protect against all the possible threats to your property? If you’re worried about something that isn’t covered, you may be able to add it on. An insurance add-on, also known as a rider or endorsement, is an optional addition to your policy.

It’s a good idea to review your current policy to get clear on the types of damage you’re insured against. Learn about a few popular insurance add-ons to see if any of them make sense for you: 1. Sewer Backup Having your sewer back up into your sink, toilet or drain is no fun. In addition to the ickiness factor, the repair bill can be expensive. You need a plumber to unblock the sewer, and you’ll probably have a mess to clean up. Adding a sewer backup rider to your homeowner’s coverage will cover the costs associated with repairing the problem, replacing damaged belongings and removing wastewater from your home. 2. Home-Based Business Do you run a small business out of your personal residence? Instead of purchasing a commercial insurance policy, you can add a home-based business rider to your policy. This will protect the personal belongings in your office space and cover any medical bills for business visitors who are injured on your property. 3. Swimming Pool When it comes to home pools, you should check your existing coverage to see if damage to the structure of your pool is covered. If guests injure themselves in or around your pool, it’s likely not covered by your standard homeowner’s policy. You’ll have to add injury coverage as a rider. 4. Earthquake As with hurricanes and floods, earthquakes are a type of natural disaster that require additional coverage. An earthquake rider will cover the costs of repairs and debris removal in the wake of an earthquake. In addition to your home, earthquake coverage protects other structures on your property such as a garage, shed, deck, etc. 5. Umbrella Coverage This is a type of personal liability insurance that protects you and your family from major claims and lawsuits. Umbrella coverage may extend to other homes you own, as well as your vehicles and any watercraft. Have questions about insurance add-ons? Just reach out, and we’ll be happy to help. Moving to a new place is certainly exciting, but it can also be stressful — and expensive. Once you factor in things like movers, packing materials, truck rentals, gas and more, the costs can creep into the hundreds, maybe even thousands of dollars, for just a single move.

Are you planning a move soon? Don't want to break the bank in the process? Fortunately, a little forethought and creativity can help in that department. Here are five ways to help reduce your costs and keep a tight rein on your moving budget: 1. Shop Around for a Moving Company Moving companies typically charge hundreds of dollars for their services, plus extra for things like gas, mileage and larger items like pianos and furniture. If you're going to hire a professional mover, shop around first. Get quotes from at least three different moving companies, and double-check the line-item charges. Does the quote include the truck, all protective materials, gas, mileage and larger furniture items? Does it provide insurance coverage in case of damage to any items you’ll be moving? If not, learn what adding these will cost you if they become necessary. You can also consider local “mom and pop” moving teams or using an online service that matches freelance labor with local demand to help with everyday tasks. These come at a cost, of course, but are typically more affordable than a large moving company that has less flexible pricing. Another great way to reduce your cost is to schedule your move for the winter or fall, if that is an option for you, as that’s when demand for professional movers is typically low. Weekdays are also a good choice, as most people move on the weekends. A moving company may be willing to give you a better deal if you move during these low-demand times, as they may be less busy and looking to fill their schedule. It may be worth exploring these options. Pro tip: Consider doing a little research by checking out organizations online that provide consumer reviews of businesses. Before booking your movers, look at their reviews to get a sense of a company’s track record with other customers and try to verify that the company is legitimate. Note that none of these websites is a guarantee of a perfect experience, but they may help you with your decision. 2. Consider a DIY Move Depending on how much you have to move and how heavy or cumbersome the items are, you may want to consider forgoing professional movers altogether if it looks as if your belongings can be managed without hiring help. If you have dependable family and friends that are willing and able to help with the packing, loading and transport, you might consider offering pizza or a free meal as a token of your appreciation in exchange for their help. If you have larger items, consider renting a small rental truck for a few hours. Get the smallest size possible and be sure to fill up the fuel tank before you return the vehicle. (It may cost you more if you leave the rental truck in need of gas that the moving company must take care of itself. Pro tip: Plan so that you're not moving during rush hour. Heavy stop-and-go traffic can drive up your fuel costs as well as delay your move. 3. Only Move What You Need It's important to pare down your belongings before a move. That means donating, selling or throwing away any items you no longer use, need or plan to use in the future. For one, this reduces your load and, subsequently, your costs to move it. Additionally, if you’re motivated to sell some of your unwanted items, you can put those extra funds toward your moving costs — or use it toward the cost of furniture or decor for your new place. Here are some options for downsizing your household before you move:

Offloading some belongings will also make unpacking easier (not to mention faster). Pro tip: Measure your furniture and make sure it will fit in your new home, as well as through necessary access points. If it won't fit, sell it and consider using the funds for replacement furniture once you're in your new place. 4. Get Creative with Your Packing Buying boxes, bubble wrap, tape and packing peanuts can get expensive. Instead of purchasing these items, take a more creative approach and use things you already have. Sheets, towels, blankets and cloth napkins all work great as packing materials, and they all need to be packed up anyway, so why not use them? You can also use your own duffel bags, luggage, purses and backpacks rather than cardboard boxes. Once you run out of these items, try one of these resources for free or low-cost boxes:

Pro tip: Start saving the plastic and paper bags from your shopping trips. These make good packing materials and can even be used to help protect fragile items. 5. Track and Deduct Your Expenses If you're a member of the military (or someone in your household is) you may be able to deduct your moving expenses1 on your annual tax returns. To qualify, you'll need to be moving due to a permanent change of station. If you're eligible, you'll be able to deduct the costs of moving, storage, travel, lodging and other expenses you incur due to the move. Pro tip: Keep a detailed record of your moving costs if you qualify for this deduction. Save all your receipts and invoices and keep them somewhere safe until tax season rolls around. Don't Forget Are you moving to a new place? Don't forget to update your homeowners insurance policy. Use your move as an opportunity to ensure all your belongings, valuables and new property are protected. Contact your insurance agent to learn more about home insurance coverage and how it can safeguard your new home and family. Did you ever leave for work without turning down the heat on a blustery winter day? Or head out for a day trip in the middle of summer without dialing down the air conditioning for your dog? A smart thermostat can help you heat and cool your home more efficiently, monitor your energy consumption and let you control your home’s heating and AC systems from your smartphone, wherever you may be. These devices can help protect your home from damage caused by frozen pipes by alerting you if your home is getting dangerously cold. But there are also some important safety considerations.

How Smart Thermostats Work Unlike traditional and programmable thermostats, many smart thermostats learn and adapt based on temperature, humidity and your family’s behavior, including when you and your family are likely to be home, awake and asleep. Your smartphone acts as a remote control for your heating, ventilation and air conditioning systems, allowing you to change the temperature from wherever you have a signal. Another benefit includes automated notifications if the temperature in your home rises or falls above or below a set threshold. For homeowners who travel frequently or who own a second home, these devices offer the ability to remotely monitor their property. Key Considerations for Using Your Smart Thermostat During cold temperatures, with a more traditional thermostat, you turn down the temperature when you leave your home and dial it back up when you return. With a smart thermostat app controlled by your phone, you are able, and might be more motivated, to turn down your system to a low temperature to conserve energy from wherever you may be. But be wary as turning the thermostat down too low could result in frozen pipes, Travelers Risk Control professionals warn. Be sure to keep the temperature at 55°F or higher to help keep the interior of the floor and wall cavities, where water piping can be located, above freezing temperatures. As part of the Internet of Things, smart thermostats are also subject to hacking and privacy concerns. You may think there is less of a safety concern than with smart locks or other security-related smart devices, as there is less incentive for hackers to target these devices. However, smart thermostats can provide details about your daily comings and goings, which a thief could find insightful. A prudent step would be for homeowners to make sure their devices are hard-wired to the Internet, rather than relying on a Wi-Fi connection. Choose a strong password and evaluate any specific safety concerns before you decide to buy a smart thermostat. As with any smart device, make sure it is compatible with your other devices or hub because not all devices communicate well with each other. The packaging for these smart devices may not offer detailed installation instructions, so you may want to consult a professional to help install them properly. |

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2024 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed