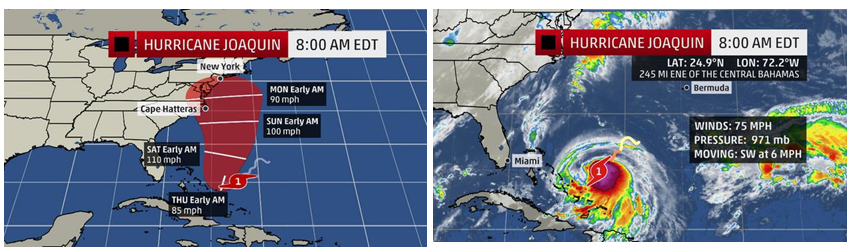

Tropical Storm Joaquin has now been upgraded to a Category 1 Hurricane. Most models show a direct northerly route, with potential rains and winds affecting North Carolina and north sometime early next week. So far it's projected path is very unpredictable. We are open for new business at this time. Please note there are no binding restrictions currently in place, but we expect them to begin receiving them very soon. The unpredictable nature of the storm will make carriers cautious. If you need to bind coverage on new policies, you should do so asap, by clicking HERE

0 Comments

Cape Cod Home Insurance Agent offers more discounts Cape Cod Home Insurance Agent offers more discounts The Massachusetts Property Insurance Underwriting Association (MPIUA) is a residual market insurance association in which all companies writing basic property insurance in the Commonwealth are required to participate with losses shared among the member companies on a premium volume basis. Responding to Federal Legislation, the Massachusetts Legislature in 1968 called for an urban area insurance placement facility and thereby gave rise to MPIUA. MPIUA is also known as FAIR Plan (Fair Access to Insurance Requirements). The FAIR Plan operates similar to that of a normal insurance company in that it underwrites and inspects risks, accepts premium, issues policies and adjusts claims. It has a seasoned professional staff, which provides exceptional service to its clientele. FAIR Plans are the outgrowth of the national emergency created by three years of rioting in American cities, beginning with the Watts outbreak in 1965. When the rioting of the 1960s suddenly mushroomed to disastrous proportions, the companies found themselves in the position of having to pay losses in excess of $100 million, on which they had collected no specific premium. Although the companies paid these losses, their capacity was severely taxed and their normal riot reinsurance market had dried up. It became obvious that emergency revisions of underwriting and reinsurance procedures were necessary for the future protection of urban property and urban existence. No matter what type of insurance you are considering, whether it be health insurance or fire insurance or even flood insurance, you should always follow the same general rule and that is to pick the coverage that suits your situation best. The same is true when picking Van Insurance also. Do not buy a house in a locality that has a high crime rate. Insurers consider houses in such neighborhoods as high risks and higher rates are the unavoidable result. Please, even where it appears a house is in a low crime zone, still confirm to be really certain. You can know for sure by inquiring from an agent. The home on the next street could be grouped into a low crime area while your house is zoned to a high crime district. As I have said before, our government is more in support of the Corporate America, rather than its actual citizens. So the companies that we work for- more hours less pay in this economy- are essentially keeping the American citizens, more taxed, tired and poor. The first thing you should do is to check with your state agency. There are some states that have requirements when it comes to buying one. They can offer you cheaper policies if you live in an area that has a bigger chance of flooding. Most homeowner policies do not cover flood damage unless the homeowner has purchased Flood Insurance, check your policies, if you are in an area that tends to flood the extra dollars that you spend on Flood Insurance may save you thousands in the long run. Sue - Take a look at the idea sheet we have. From what we have told you, we want you to answer these questions. Feel free to give your own opinions as well. I've decided not to follow that path, but my own path to break the ties Corporate America has on my life. I am taking control of honest wealth, and helping others to do the same. Reverting to the basics of silver and gold. Ask me how to break your own ties, and lessen Corporate America's power. WE deserve, as the people, to take back the power given to those (who don't act in our interest) so our politicians will be more concerned with what WE want. Most home owners are guilty of not knowing the details of their home insurance. Many a times people have found themselves in great difficulties, why? Because they did not take time to understand the things that were listed on the exclusion list of their policies and what it means. They are just content to have that policy because it is one of the requirements of their mortgagor.

As much as it's advisable for you to have broad coverage, too much coverage isn't advisable either. Take stock of your valuables on a regular basis and take note of their present market value. This exercise may show you that you have to buy more coverage but it could also show you have too much and therefore result in savings as you reduce to the right coverage limit for the time. Are there certain risks that have you worried that you feel you need more coverage. If you fear collisions and the possibility of harmful injury or death then you may want more coverage for that situation. Sue - Take a look at these two pictures of our earth and how the air circulates. Can't you see the air goes all around the earth. Air we breathe out in Arizona can end up over Brazil. I read that last century a volcano called Krakatoa erupted and people could hardly see for five years all over the United States. It caused crop failures in our Midwest. Did you know that when the meteorite came that destroyed the dinosaurs, the sun did not shine for five years? All over the earth from one meteor fall. What happens anywhere in the air affects the whole earth's air. This is noteworthy although it's not typically part of a home insurance policy. Folks who buy homes in flood-prone areas pay around $400 yearly on Flood Insurance. Every mortgagor will demand that you buy it if your home is in a flood-prone region. Unless you are sure such additional expense is a wise compromise, you'll get lower rates if you buy a house in a locality that won't call for Flood Insurance. Do not buy a house in an area that is notorious for crime. Insurers consider homes in such neighborhoods as high risks and high premiums are the only way they can guarantee they can carry the risk. Please, even if it seems a house is in a low crime neighborhood, still confirm to be really sure. You can find out by inquiring from an insurance agent. It does happen that the house on the adjacent street belongs to a high crime zone (by an insurance company's map) while yours is in a low crime zone. Sue - We learned a lot about carbon emissions when we were doing our research. Carbon emission is the carbon dioxide we are putting into the air. That is called emitting carbon. To emit means to send out, release or give off. Like when we breathe, we emit carbon dioxide into the air. When we run our cars , we emit carbon dioxide. When we run our factories to make products, we emit carbon dioxide. When we burn anything we cause carbon dioxide to be emitted. Houses in flood-prone places are not considered adequately insured without a flood insurance policy which will mean close to $500 every year. Every mortgagor will demand that you buy it if your house is in a flood-prone area. Unless you really think such extra spend is worth it, you'll do well to buy a home in regions that won't require flood insurance. Low cost flood insurance is available for most Texas residents. The best rates are with the National Flood Insurance Program (NFIP). This is a program created by the federal government to provide affordable flood insurance.

Smoke Alarms: Many homes, especially older homes: may not have adequate smoke alarms in the basement. Make sure your home theater experience is a good one. Make careful decisions if you decide to build your own home theater. You need to know right up front why you are getting the coverage you need. We all know the law requires insurance and that is not what I am talking about. What I mean is what is important and what means the most to you about your van. But, it's just like having the opportunity to purchase Flood Insurance or hurricane insurance. It seems like an insurance company's trick to take more of your money that they will never have to give back. Terrorism insurance exists and you never know when you are going to need it. Ask the great people of New Orleans if they thought they would ever have needed hurricane insurance. My husband decided to make our walk-in closet our "safe room." So we put our mattress in our closet (which just fits), along with our pillows, safe, water, non-perishable food, cell phones, computer (not that it will work once the power goes out), money, and of course all of our clothes and shoes. We hope that we won't have to stay in our "safe room" for more than six hours, but we're prepared for the long windy, rainy night. And if the power goes out for more than a day, then we'll have to evacuate; but for now, the news media has advised us to hunker down and shelter at home. There are states that initially provide the insurance policies at a cheap rate because of the possibility of flooding in the area and the homeowner really has no choice because flooding is a tragedy that one cannot avoid. Sue - We learned a lot about carbon emissions when we were doing our research. Carbon emission is the carbon dioxide we are putting into the air. That is called emitting carbon. To emit means to send out, release or give off. Like when we breathe, we emit carbon dioxide into the air. When we run our cars , we emit carbon dioxide. When we run our factories to make products, we emit carbon dioxide. When we burn anything we cause carbon dioxide to be emitted. At times, rather then provide housing for ourselves, it would be so much easier and cost effective, if we could just find a hole in a huge tree to sleep in but then scavaging for food would be almost a fulltime job! So in conclusion, I guess our basic need for housing as humans isn't so bad after all. Going without homeowners insurance is not a smart move if you own a home, but you also have to make sure that there are no holes in your homeowners insurance plan.

Be informed. Stay informed about the risk of flooding. Check with your local Red Cross, planning department, zoning department or emergency management office to find out the risk of flooding in your area. The higher the risk, the more important it is to be prepared to take action. An over-supply of lender-owned homes in the neighborhood may be the one factor that is depressing prices only for the short-term. Their presence will devalue a home, but only until they're sold. So buyers who are in it for the long haul might do well to consider buying in a location such as that - provided that other factors make the home a good choice. People who buy homes in areas that have full-time fire service attract cheaper premium than folks who stay in places with only a volunteer fire service. Be informed that your premiums will be further influenced by your home's distance from a fire station, firefighting equipment or hydrant. People who reside nearest to firefighters or fire fighting facilities pay more affordable rates everything else being equal. On a more personal level, buyers need to think about location in terms of their own lives. Saving several thousand dollars on the purchase price of a home is small comfort if they have to drive an additional 60 minutes to work each day. About two months after purchasing a house and fixing it up, (it was still on the market) the State decided to put my house in a flood zone! The only body of water was a little creek that ran through a golf course half a mile away! What can you do! The Flood Insurance costs $800 a year! Try selling that to a prospective buyer. The first thing you should do is to check with your state agency. There are some states that have requirements when it comes to buying one. They can offer you cheaper policies if you live in an area that has a bigger chance of flooding. Many private insurance companies offer flood policies written through the NFIP. I suggest dealing with an agent that is experienced with the program. This type of policy can be purchased on the phone in a few minutes. Ask your agent about any questions you may have about the program. You can get more information at my Texas flood insurance site or you can call my Houston office at 281-537-2700. I know that I am happy that the winter months are behind me now. As with any new season we are faced with differing weather conditions. In the Spring and Summer in the Baltimore area, as with most of this country we face Thunderstorms which may cause electrical outages, flooding and maybe property damage.

Smoke Alarms: Many homes, especially older homes: may not have adequate smoke alarms in the basement. Make sure your home theater experience is a good one. Make careful decisions if you decide to build your own home theater. Homeowners insurance may not cover flood damage but it does cover other water damage. Water damage is defined differently than flood damage is. As opposed to how the water has to actually touch the ground with flood damage, that is not the case with water damage. This could be from a hailstorm that breaks open a home window and then the water from the weather damages the home. It could be from a leak in your home's roof or even a broken water pipe that sprays water to damage the home. Phil and Sue loved school. They were in the same room. But they did not sit next to each other., They talked too much and got into trouble. So the teacher had to move them to the opposite corners of the room. Sue - They hit the earth. The rays have a lot of energy when they hit the earth. Some of the energy stays in the earth. When the rays bounce back they are not as strong. But start with thinking about issues such the proximity to factories that belch out smoke or fill the air with noise around the clock. Nearby airports or rail lines are also a factor, because they mean noise. Homes in flood zones may be cheap - but the Flood Insurance won't be. Homes in communities dependent upon dying industries are usually at rock bottom prices, too - because people are moving away, not in. Improper strategic planning. - Have an ongoing business plan, goals and projections in your strategic plan. Do not forget the employees, your suppliers and your customers. You will get cheap rates by visiting not less than 3 insurance quotes sites. If you do this, you will get the low quotes as three sites will return up to 15 home insurance quotes altogether. The NFIP administers flood insurance to home owner's and renters. They are also in charge of mapping flood zones as shown on a community's flood hazard boundary map or a flood insurance rate map. (FIRM).

Poor employee relations and training - Create a team work environment that keeps staff motivated and happy. Employee involvement in the business, training and increased education promotes a feeling of ownership. You will be surprised how much they know and how much they want to help. I had never considered how much time my family would spend in our basement until the theater room was finished. Now I can not imagine our home without this space. I also built my office into a corner of our basement home theater to have an additional amount of privacy from the regular traffic of the house. Buy Flood Insurance separately. This is a decent route in terms of coverage, but buying Flood Insurance from a separate provider can often times be unnecessarily expensive. Phil - That means it is sequestered so it cannot interact with the oxygen in the air to create more carbon dioxide. That is why forests are called carbon sinks. The carbon is stored in the trunk and it is like it is sunk down into the tree so it cannot form gases in the air. Navigation is going to be key, too. There will most likely be no cellular data service in the area you are in. For navigation, you should include in your survival kit both maps and a compass. This will help you get around. It is highly suggested that you buy a map of the region you're living in rather than just the local area so that you'll always be aware of your surroundings. You might want to include a solar powered radio so you call for help if you require immediate attention. Flares will also be useful should you need to signal your location to others so that they can come assist you. Remove the water. The first step is to get the water out of the home. If the water comes from outside, it should recede on its own. Once it recedes, you can mop to remove the excess water. If the flood comes from a leak or other mishap inside the home, you can dry the area with a mop or towel. You must make sure the area is water-free before restoration can begin. Sometimes it will be necessary to set up oscillating fans to help expedite drying the area. Unless the area is fully dry, you will not be able to move on and repair the damage. I've decided not to follow that path, but my own path to break the ties Corporate America has on my life. I am taking control of honest wealth, and helping others to do the same. Reverting to the basics of silver and gold. Ask me how to break your own ties, and lessen Corporate America's power. WE deserve, as the people, to take back the power given to those (who don't act in our interest) so our politicians will be more concerned with what WE want. No matter what type of insurance you are considering, whether it be health insurance or fire insurance or even flood insurance, you should always follow the same general rule and that is to pick the coverage that suits your situation best. The same is true when picking Van Insurance also.

Further explanation, the people whose greed would be bailed out, Corporate America, would be bailed out. So the money was given to the thieves. In what system does anyone learn not to do the right thing, and you will be rewarded? I personally would have rather the people who did wrong end up homeless, or lose their jobs. Sue -My dad sells insurance. The people who buy it don't know for sure they will need it. They don't want to get sick or die. But they buy insurance to protect their families just in case. That way if something bad happens, they'll be protected. So just in case global warming does hurt our earth, we need to protect ourselves ahead of time. It's like Flood Insurance. How about you? What natural disasters could cause your problems? Have you taken even the smallest steps to prepare? If and how you survive depends on these answers. I have to tell you, I've been in more than one. I've been in a major flood, a large tornado, ice storms, a blizzard and Northridge. I don't want to do any of them again. However, for most, we were ready. The reputation of a mold remediation company is important. By reading reviews about a company and even talking to those who have used the company, you should be able to find out whether a particular company can be trusted. You will not want a company that has a reputation for not leaving things neat and in order or at least trying to leave them somewhat better than when they arrived. Phil - Remember the air movement is what ends up as our weather. Hurricanes begin off the coast of Africa and then go to the Caribbean. Our earth has one big atmosphere. The air circulate all over the world. So then, don't be fooled by asking "How much house can I afford?". The real truth is that none of us can afford to lose our home. Use your hard earned income judiciously, be reasonable and anticipate unforeseen expenses. Then, you can be reasonably confident that you will not lose your new home, but instead will be able to truly enjoy it, because you asked the right question. There are many emergency situations that we know how to prepare for. We protect our homes with fire and flood insurance. We have first aid kits should one of our friends or family members get hurt. However, when you're out bonding with nature, taking care of an emergency can prove difficult if you don't have the right equipment and supplies. Good news is that most of the stuff you'll need to handle any situation cam be found at local camping stores.

No one wants to spend extra money, especially when it comes to something like insuring a car. It's a good idea to try and save at least a little, since the extra money can be used elsewhere. Get a good, cheap insurance and you'll be able to enjoy a better lifestyle while still being protected. At around 7 a.m., the tree people came and assessed the damage. The insurance company also gave the okay for payment on the homeowner's policy to pay for the work. So, we had a decision to make. The tree, our big tree that had provided years of friendly shade, had almost split in half. It was a maple tree, and apparently tornadoes hit them hard. Some of the tree was still standing, and we decided to try and save it, even though it would look awkward and seem to be leaning to one side. They had to trim alot off the top so the tree wouldn't fall over to the one side and onto the road below. I remember them saying that it would be a miracle if the tree lived. Another reason to look into national Flood Insurance New Jersey based companies can provide is that heavy rain can cause floods. The biggest problem with the rains is that they often come in the spring, right when all of the snow is melting. The rains would be bad enough on their own, but they are very dangerous when combined with the water from the snow. This might cause a lot of damage to your home and the things inside of it. Are there certain risks that have you worried that you feel you need more coverage. If you fear collisions and the possibility of harmful injury or death then you may want more coverage for that situation. Whatever the level of damages, you will want to call an expert in this area as quickly as possible. The quicker you get someone into your home taking care of the problem the fewer the problems there will be with your home and belongings. You will likely lose a lot of things that are important to you if you have a major problem, but hopefully you will be able to have many items salvaged. Mold will be a continuation of the overall problem, and the sooner you get things taken care of the less problem you will have in this area. If the professionals tell you that you have a mold problem, you will want to find a mold remediation expert to help you. You will save much if you only have between 15-30 minutes. Visit, receive and compare home insurance quotes from several online sites. The lowest quote should be what you go for easily. But, you have to look beyond simply the lowest price to the best price to value ratio. The cheapest may not be the best price/value for you as an individual. |

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2024 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed