|

When thinking of the cause of a kitchen fire, it is common to think of cooking. But not all kitchen fires start because of cooking hazards. Non-cooking related fires commonly involve refrigerators, freezers or dishwashers.

The following tips can help prevent non-cooking related fires from occurring in your kitchen.

What to Do If a Kitchen Fire Flares Up By exercising caution at all times in your kitchen, you can help reduce the risk of a kitchen fire. But if a fire does flare up, you need to be prepared.

0 Comments

Homeowners insurance may provide limited coverage amounts for lost jewelry or valuable items based on the type of item and cause of loss. Valuable items coverage may provide the protection you need for your valuable possessions in the event of covered loss from, for example, theft or fire.

Does Homeowners Insurance Cover Engagement Rings and Wedding Rings? Homeowners insurance alone may not sufficiently cover your engagement rings and wedding rings. People who own valuable possessions may need broader coverage than a basic homeowners policy provides. The good news is that there is additional protection available that may help cover the cost of a lost or stolen engagement ring or wedding ring. How to Add Engagement Ring Insurance or Wedding Ring Insurance You can add engagement ring insurance or wedding ring insurance through two options that Travelers offers: You can purchase a “Valuable Items Plus endorsement” or a “Personal Articles Floater (PAF).” With a Valuable Items Plus endorsement, your homeowners insurance coverage is expanded to protect your valuables from loss caused by additional perils (subject to a few common exclusions). For jewelry, paintings and other fine art, you can purchase up to $50,000 of coverage; for silverware, you can purchase as much as $20,000 coverage. The maximum payment for any one item is either $10,000 or $20,000, depending on the state. You pay no deductible. If you own valuable, rare or irreplaceable items, such as collectibles or antiques, you may want to consider the comprehensive protection offered by a PAF. In case of a covered loss, this coverage allows you to recover the value of an item (based on a recent bill of sale or appraisal). This policy provides coverage for fine art and jewelry at an amount you and the insurance agree upon. For other items, the policy provides either actual cash value, cost to repair, cost to replace or up to the insured amount, depending on the cause of loss and its current value. What Does Jewelry Insurance Cover? Jewelry insurance covers valuable items from jewelry to collectibles, if they are stolen or damaged in a covered event. A typical homeowners insurance policy may not cover, or provide enough coverage for, those valuable items. Jewelry and valuable items coverage can help give you peace of mind. 1. Personal Articles Endorsement or Floater This itemized coverage can give you some peace of mind knowing your belongings and jewelry may be covered at the time of a loss. Offered as protection for valuables, policies can be purchased separately. There is no deductible for most classes or types of property and the coverage insures against many risks. Consider a Personal Articles Floater policy for:

2. Adding Jewelry to Homeowners Insurance Available as an add-on coverage to homeowners insurance, a Valuable Items Plus endorsement can offer higher limits on certain types of valuables, and expanded protection. Unlike the PAF where items are individually listed, the Valuable Items Plus endorsement provides blanket coverage that affords protection for a class of property collectively, such as jewelry insurance coverage, up to a certain amount. This coverage insures against many risks, such as lost jewelry. Summary Protecting your valuables from loss may be an affordable option depending on your needs. Whether you just need coverage for your jewelry or want insurance for multiple valuables, Calfee Insurance offers multiple options. You can add on and choose the coverage that fits your needs. Find an agent near you to get an insurance quote for your diamond, wedding or engagement ring, or any other valuables you may want to protect.  Moving into a newly purchased home can be one of the most stressful and challenging life moments for any homeowner. An important part of the process of purchasing a home, aside from the financial considerations, is the required home inspection. Once you make an offer on a home, it is critical to have a licensed home inspector go over it with a fine-toothed comb before you finalize the purchase. As the home buyer, it is your responsibility to choose an inspector wisely and stay involved through the entire process. You might consider checking to see if there are any professional memberships or associations in your area that can recommend a licensed inspector. A helpful tool like the one available from the American Society of Home Inspectors might be a good place to start your search for a licensed home inspector in your area. Choosing an Inspector Finding a qualified, licensed and experienced home inspection professional is the first step. How and when the inspection and inspection report will be done is another important factor in choosing the right inspector for your needs and timeline. Here are some questions to ask potential candidates:

Calfee Insurance allows you to customize your coverage to fit your unique needs. We focus on understanding you, so you'll feel right at home working with us. During and After a Professional Inspection During and after the inspection, good home inspectors will expect you to ask them questions. Once you receive the report, carefully review any findings. Ask the inspector about anything you don’t already know yourself or fully understand (e.g., How old is the plumbing system? What are the parts that make up the heating and cooling system? What is that crack in the foundation?) Your home inspector should be willing to explain things more than once and in different ways until you feel confident you understand the issue and potential solutions. Take Notes of Your Own Observations, Too You should also do your own initial home inspection before making an offer. Evaluate the conditions of and be alert for obvious flaws/deficiencies. Highest Voted 5 Star Home Insurance Agency for MassachusettsIf you're planning a home renovation, you may want to call your insurance agent first because this decision can impact your homeowners insurance. Some home renovations will change the amount of coverage you need, while others could even help you qualify for a discount. We cover six common scenarios that could affect your insurance, so you can plan ahead. 1. Building a New Addition When you expand and improve your home, you could likely increase its replacement value. This is the cost to repair or rebuild your home. Some additions that could increase your replacement value include: adding a second-story bedroom, expanding the living room or building a new garage. After building a new addition, or making updates or other improvements, you may need to increase your coverage because the value of your home, and the cost to rebuild it will likely have increased. Most insurance companies require your Coverage A or dwelling coverage limit be at least 80 percent of the replacement value of your home. Your insurance agent can recalculate your home value to determine whether you'll need more coverage because of the addition or improvement. 2. Building a Pool If you're looking to add a pool, you will want to contact your insurance agent to review coverage for changes to your property's value, as well as any increase in risk. When people are swimming and running around the pool, there's the chance for an accident. If someone gets hurt, they could try to hold you responsible for damages. This can apply even if the accident isn't your fault. Check with your agent to see whether your existing policy covers a pool and if you need to increase your liability coverage. This coverage can help pay damages to injured persons and provide for a defense if you are sued as a result of their injuries. You should also ask your agent what steps you can take to keep your pool safe so you can avoid accidents. Adding a fence with a lock is a smart move. You could also add lights with motion sensors or a pool alarm to discourage trespassers. Consider skipping the diving board, because this increases the chance of an accident and your insurance cost. Calfee Insurance wants to help you protect the things that matter to you. We offer a wide breadth of products so you can be covered at home and on the road. 3. Adding a Deck A new deck is another improvement that can add value but also risk, especially if the deck is attached to a second story or higher. You should let your agent know that you've added a deck, so he or she can adjust your policy as necessary. 4. Renovating the Kitchen Upgrading the kitchen can significantly increase the value of your home, especially if you switch to higher-quality counter tops, appliances and new flooring. You should contact your agent to see if you need to increase your insurance coverage. If your contractor upgrades the plumbing or electrical wiring as part of the renovation, ask your homeowners insurance agent if you qualify for a discount or if your coverage needs to be adjusted. These upgrades can reduce the chance of flooding water damage and fire, so check if your insurance company has discounts that can help to reduce your premium. 5. Finishing the Basement Finishing your basement can also increase the value of your home. That means, yet again, you may need more homeowners coverage. Flooding can be a concern, especially for the lowest floor in your house. It is important to note that most homeowners insurance policies do not cover damage caused by floods. Ask your agent to review your coverage and look to see if there are steps you can take to help prevent future damage, like installing a sump pump. 6. Redoing the Roof Before you redo your roof, ask your insurance agent whether this could qualify for a discount. Some companies offer a discount when you reinforce the roof or use stronger roofing materials that are wind, hail and leak-resistant. Your agent can explain how to qualify. At the same time, redoing the roof could increase your property value, which means you might need more coverage. It is a good idea to contact your agent when you’re considering making home renovations. Their knowledge and expertise can help you get the most out of your discounts while making sure your home is adequately insured. Free Home Insurance Review with updated PricingAs a seasoned homeowner, you’ve been paying off your mortgage and are now considering buying a second home – a place you can retreat to on vacation, an investment property, or maybe even a combination of the two. You’ve been through the home-buying process before so you know what to expect, but there are certain factors unique to buying a second home that you'll want to consider. These factors will vary depending on how you intend to use the property, so it's a good idea to determine if the home will be for mostly personal use or if it will be occupied by tenants. Here are six essential things you should consider before buying a second home: 1. Can I Afford It? It may seem like an obvious question, but can you afford a second home? If you choose to take out a mortgage on a new property, take some time to carefully understand the requirements so you’ll be better prepared for the process when submitting your mortgage application. As a homeowner, you're probably well aware of the strict credit requirements for taking out a mortgage, and things get even more serious when it comes to buying a second home. Your debt-to-income ratio will, of course, be a significant factor, and when it comes to holding two mortgages, you may find it a bit more challenging to balance this ratio. Also, be prepared to shell out a hefty amount for a down payment, since you'll be required to put at least 10 percent down on a vacation home and perhaps an even higher amount if it will be used as an investment property. And don’t forget that a second home will need to be protected, so you’ll want to talk to your homeowners insurance agent about getting a quote, once you’ve got your sights set on a second property to call your own. 2. How Will It Affect My Taxes? Understanding the tax implications of your new property will be another challenge. If you intend to rent your place to tenants, that means you'll earn rental income throughout the year, and that income will be taxable. As the owner of the home, you also may be able to take deductions in the form of mortgage interest, property taxes, repairs, depreciation, and operating expenses.1 One of the most important things to do as the landlord is to maintain accurate records of your income and expenses throughout the year in order to properly report the information on your tax return. 3. What Home Expenses Should I Expect? Just like your primary residence, your second home will also require you to shell out cash for expenses – both expected and unplanned. It’s helpful to have a budget set up for home needs, and with two homes, this may be an even more critical step, since your expenses will be elevated. In addition to the maintenance costs, remember you'll have property taxes, insurance, potential homeowners' association dues and more. If the property is at the beach or in a flood zone, you'll also need to consider things like flood insurance in addition to your regular homeowners policy. And finally, if you plan to rent the property, you'll also need to look into insurance that specifically protects you as a landlord. Travelers wants to help you protect the things that matter to you. We offer a wide breadth of products so you can be covered at home and on the road. 4. How Will I Use the Property? If the property will solely be used for personal vacations, this question isn't as critical. However, if you intend to rent the home occasionally or full time, you'll want to consider your strategy ahead of time. Keep in mind that for mortgage purposes, your lender doesn't consider the income generated from renting the home. Whether you can afford the second property is determined solely based on your credit and debt-to-income ratio. If you plan to rent the home, it's important to build your rental strategy as early in the process as possible to ensure you'll have rental income that can help offset the home's monthly expenses from the start. That will translate to less cash out of your pocket, as long as the tenants are diligent in paying the rent on time. 5. Who Will Maintain the Property? You’ll want to plan for who will maintain the property to protect your investment. If the investment property is located near your primary home, it may be easy for you to provide the regular maintenance and upkeep of the home, if you’re handy and have the time – and the will – to do those tasks. However, if the property is far from your primary home, you'll need to think about how it will be cared for when you're not staying there. This is especially important if the property is located in an area that’s susceptible to strong storms and hurricanes. Severe weather events can pop up at a moment's notice, and your second home will need to be properly prepared to withstand such weather. If the home will be for your personal use, perhaps you can find a neighbor to keep an eye on the house when you're not there. If you plan to rent the home, consider hiring a rental management company to take care of the general upkeep so you won't have to worry about every little detail from afar. 6. Is the Property in an Ideal Location? Whether buying a second home for your personal enjoyment or as an investment property, make sure you choose the right location for your needs. You may not get as much use as you’d like from a vacation home that requires extensive travel to get there. And, a rental home in an unpopular locale may lead to months of being unoccupied – which means you’re paying the second mortgage yourself rather than with income from renting it out. In either scenario, ensuring the home is in an ideal area can help provide you with a positive return on investment. If you do intend to rent the property, take some time to research the rental climate in the area before moving forward. The best places to own investment property are often popular vacation destinations and cities with an abundance of career options. Buying a second home doesn't have to be daunting. In fact, with careful research and planning, it can be a smart investment for your future. Millions of students in the U.S. are learning from home because of the coronavirus pandemic, and many parents may be feeling the stress of juggling working from home and guiding their children’s educations.

As the weeks at home with your kids continue to add up, you may have come across some unique or especially difficult challenges with this new setup. Here are a few recommendations to help guide you through some of the challenges that parents are facing during this time: Maintaining Schedules You may have made a daily or weekly schedule when your child’s school first closed its doors due to COVID 19. Perhaps it worked well for the first week or two, but by now, that schedule may need adjusting as you and your family have settled into your temporary routine. The truth is, creating a schedule for the entire week may not be feasible. Instead, during breakfast each morning, take a few minutes to talk with your kids about the day ahead and what schoolwork they need to accomplish ‒ and when. Encourage stability and regularity as much as you can. Setting daily expectations for your kids and making sure they meet them by the day’s end will help them stay disciplined. Preventing Distractions In some schools, students aren’t allowed to use smartphones in classrooms. The same should be true at home, at least when they’re completing their schoolwork. Keep them focused on their education by limiting phone use to non-study time. This is likely to get harder as more weeks roll by without your kids having face-to-face interaction with their peers. Consider using screen time as a reward for an assignment well done or completed early. Tip: Stay aware while your children are studying at home by looking out for unusual phone, digital or social media activity. Equipping Kids for Success Your kids need certain equipment and internet access to learn online. It’s a big challenge for some families, but help is becoming more available. For example, Everyoneon.org maintains a list of sources where students can access affordable computers and broadband. Keeping Kids Connected You may be concerned about your children feeling isolated from the social connections they normally have at school. While you don’t want screen time merging with school time, easing up a bit on your screen time rules and limits (if you haven’t already) may be the best way to get through this time. Allow children to interact with friends via video to help them maintain the relationships they’ve built in the classroom. Partner with other parents to plan virtual play and activity dates. Supporting these connections can be vital to your children’s learning and will help to provide some balance in their lives. Networking With Parents Connecting with other parents has obvious social benefits. As the coronavirus pandemic wears on, networking can be a good way to learn about the approaches other parents are taking with at-home education and what successes they’ve had. Plan virtual events to talk with other families and share with each other how you are making it through this time. Checking In Education is important, but the mental and emotional health of your children is even more critical. Check in throughout the day to make sure they’re doing okay. If something’s wrong, take time to stop what you’re doing and work with them to deal with their fears and concerns. |

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

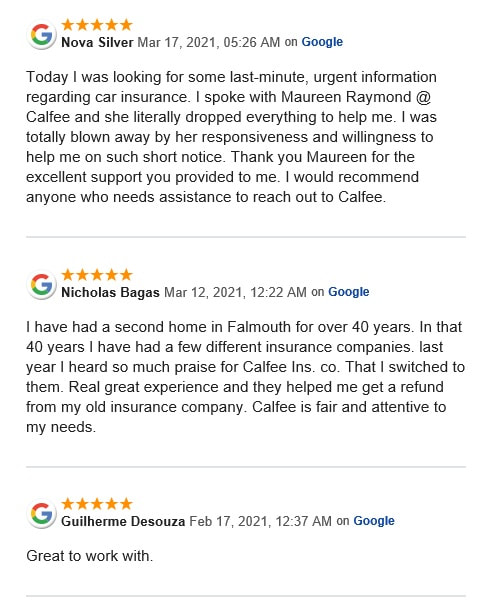

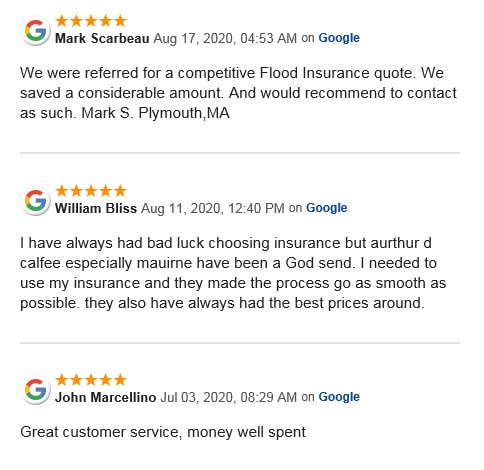

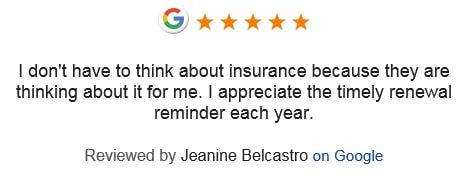

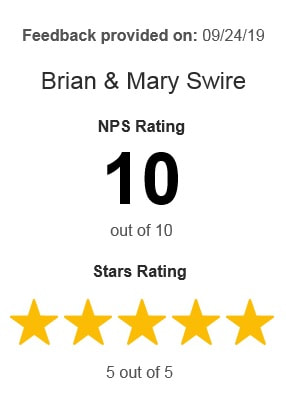

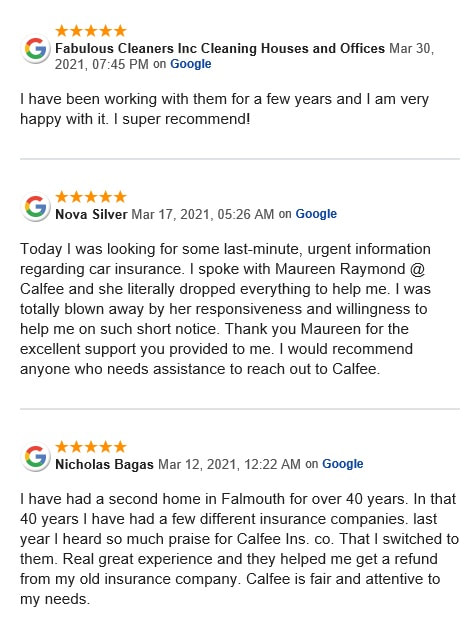

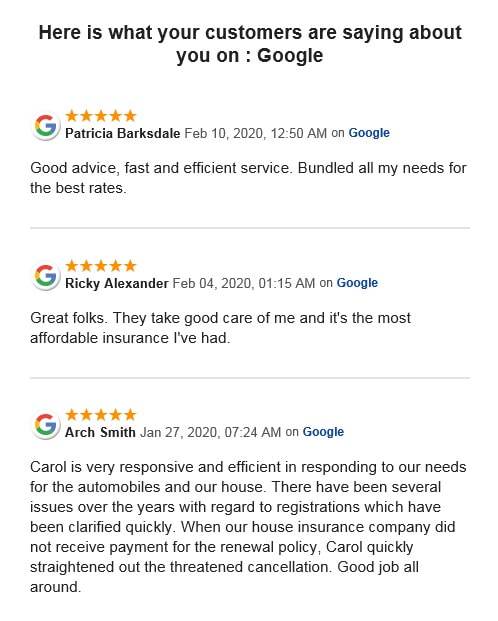

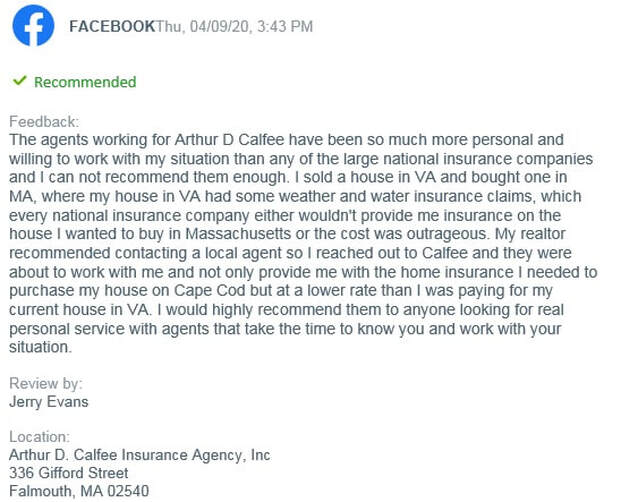

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2023 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed