Need Home Insurance?

Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now!

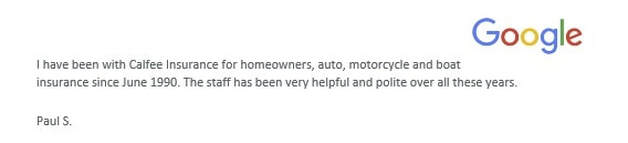

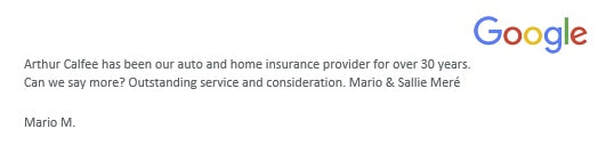

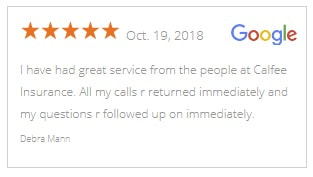

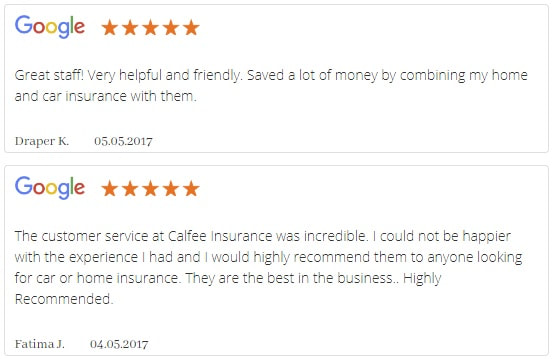

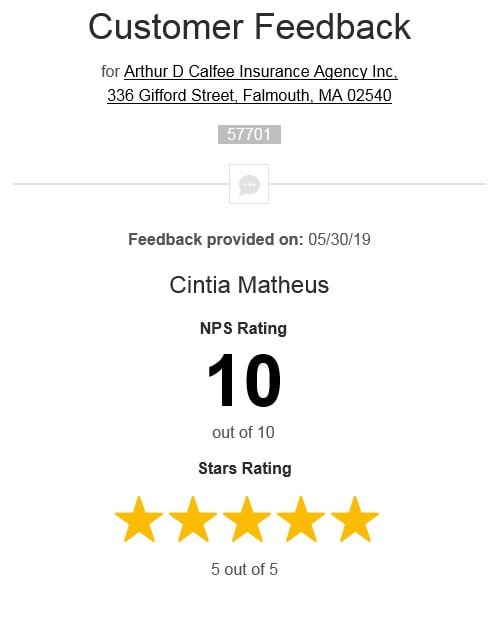

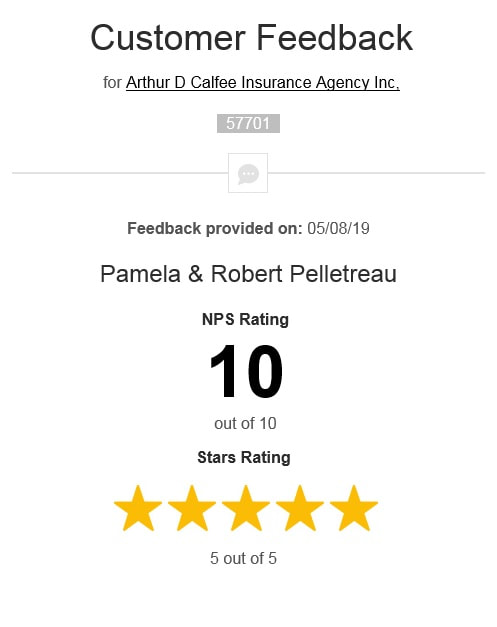

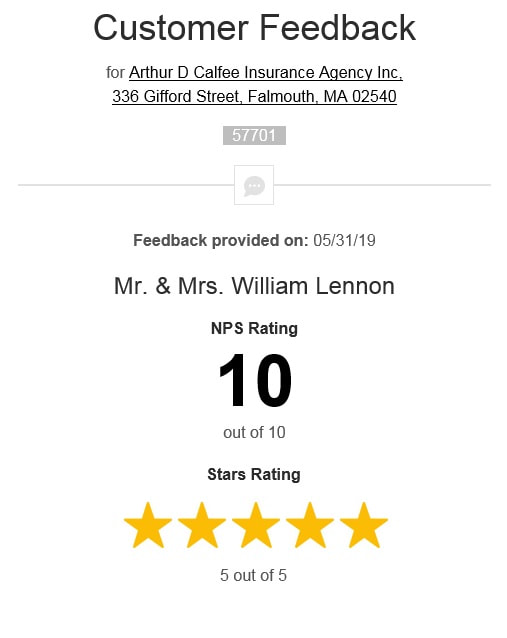

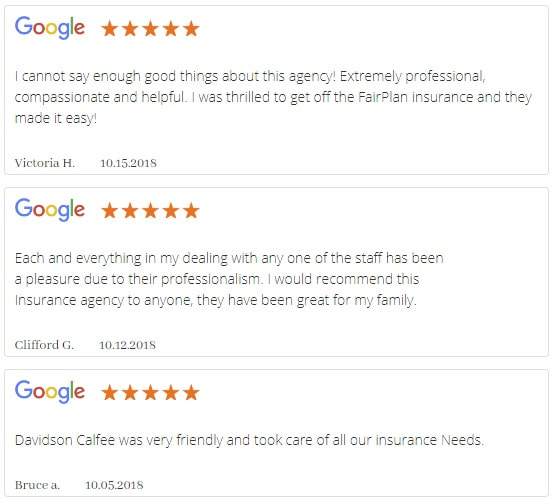

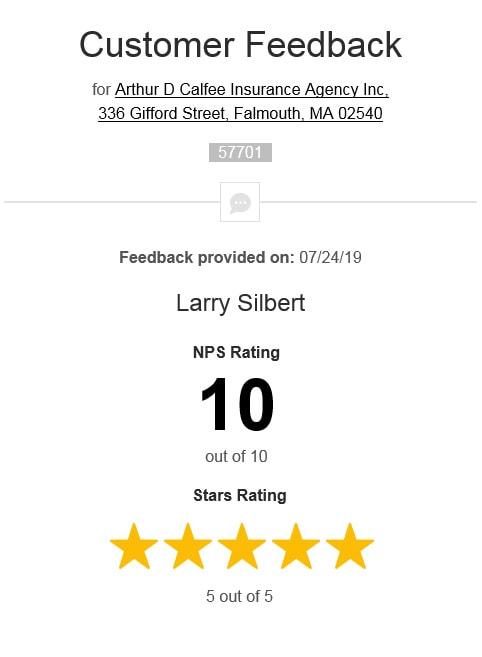

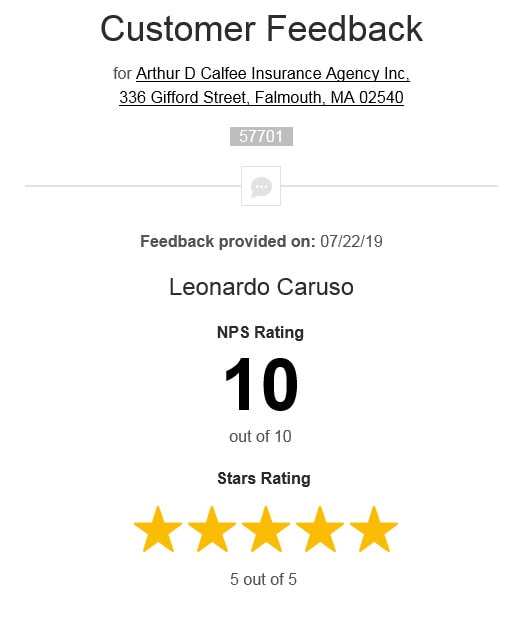

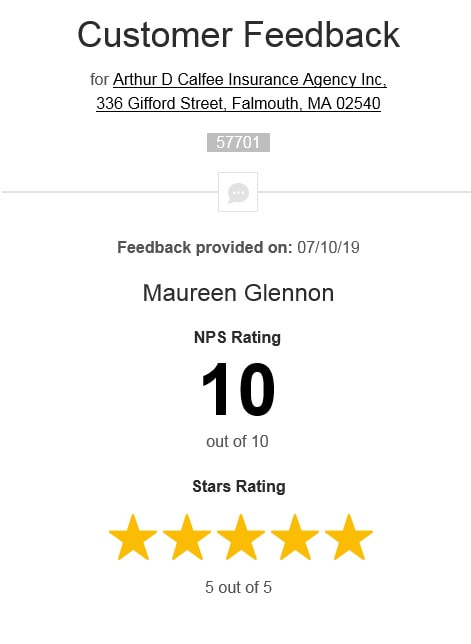

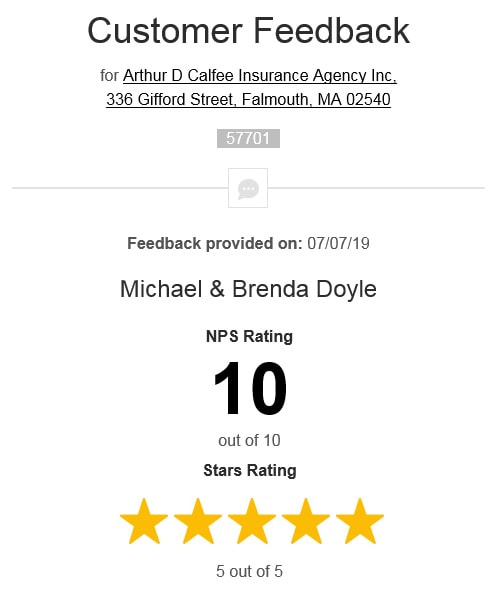

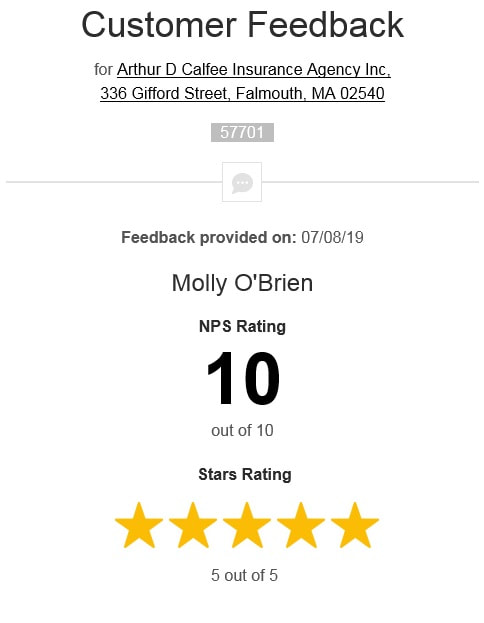

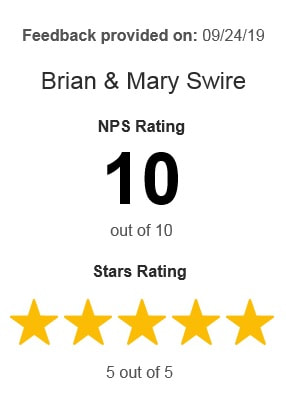

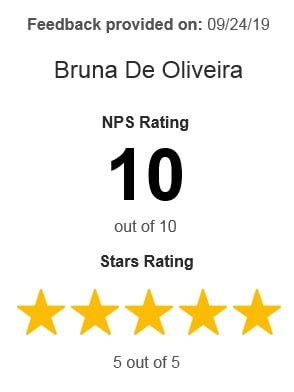

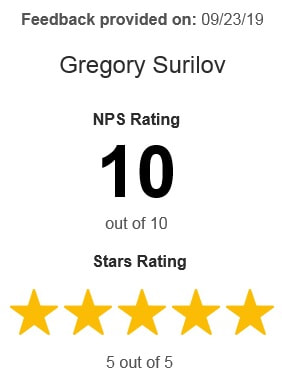

Click Here - What people have said about our insurance competence, knowledge & ability.

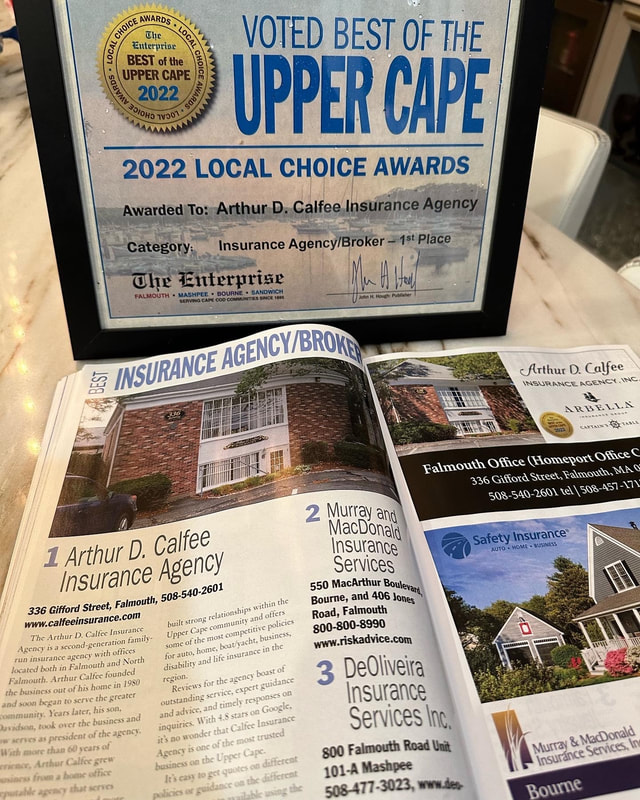

Arthur D. Calfee, Founder

Arthur D. Calfee has 60 years of experience in the insurance industry. Davidson O. Calfee, President & Owner

Cape & Plymouth Business, was proud to honor Davidson O. Calfee as one of the region's top young & most dynamic business leaders with a '40 Under 40 Award' on June 16, 2010! |

A-Excellent AM Best rating & reviews

|

|

Davidson O. Calfee is the Owner, President & CEO of Operations overseeing all agency & portfolio management, consumer relations and new business generation. He has a natural ability to manage complex situations to achieve outstanding results for his clients.

By constantly looking for ways to improve professionally, Davidson Calfee has worked diligently to revamp his team’s service of the needs and expectations of clients. Calfee specializes in developing, designing and implementing complex property catastrophe insurance programs for his clients. His market knowledge and client service skills have made Calfee’s Agency a sought-after home insurance resource for Massachusetts coastal residents. Calfee created a cohesive work environment by recruiting, retaining talent and developing successful home insurance products that has built a strong clientele over the years. Calfee has maintained a high customer retention rate by tirelessly searching for savings solutions and fostering community relationships to bring people closer to home insurance resources that can improve their situation. Currently, Calfee is leading and developing the execution of an upcoming home insurance package product launch. Always keeping the interest of the insured at the forefront, followed by the markets and associated parties, Calfee truly has the recipe for developing a great home insurance program. Calfee has an incredible ability to consistently build strong relationships to create win-win partnerships with clients, colleagues, and business partners. With a firm belief that effective client services is rooted in trusted relationships, Calfee approaches projects by ensuring all parties are on the same page in order to deliver effective results from start to finish. His team uncovers cost savings by navigating the complex world of home insurance to create specific insurance solutions that are unique to each home. Calfee also assists in producing presentations, submissions and documentation; interpreting analytical results to evaluate and compare different home insurance prices and strategies. By helping clients fully understand their actual and potential costs, Calfee provides actionable advice to support in minimizing the total cost of risk in protecting home assets. |

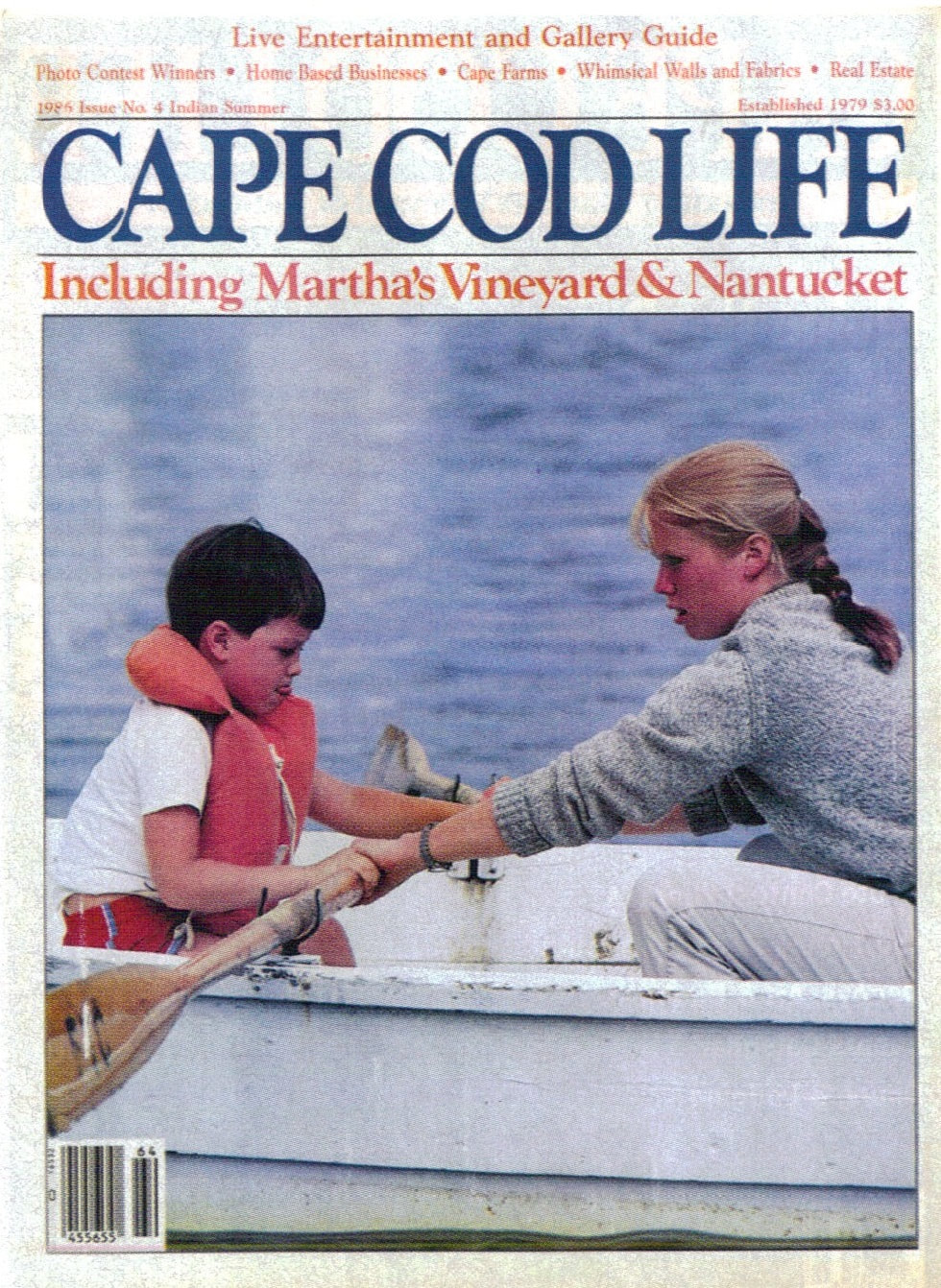

Davidson Calfee as a young boy learning to row a boat along the shores of Cape Cod as the Falmouth Yacht Club.

|

Cape & Plymouth Business, was proud to honor Davidson O. Calfee as one of the region's top young & most dynamic business leaders with a 40 under 40 award on June 16, 2010!

The following year, Bryan Braley, our Account Executive was honored with the prestigious 40 under 40 award. For more information on the prestigious award click here. |

Home insurance is often one of those necessary-yet-avoided topics of discussion. Its importance for family continuity and individual survival is paramount, but no one wants to voluntarily think of “the worst that can happen.” Sometimes it does happen and local communities can suffer incredible damage from natural and man-made disasters. It is for this reason you need representation that can build a connection, share this knowledge and offer resources in a way that dissolves doom and gloom scenarios and encourages you to see the positive benefits of insurance policies.

The Arthur Draper Calfee Insurance Agency, Inc. demonstrates this empathic capacity to connect with clients specifically in its community about policies and preparing for those surprise catastrophes. The Cape Cod agency offers home insurance, flood map info, flood insurance, boat/yacht, auto, disability and life insurance packages to meet the unique needs of the community. A 2nd generation company solely family-run, the agency originated with founder Arthur from his home in 1980. Arthur Draper Calfee comes from a long line of leaders; his middle name “Draper” originates from the Draper Family from Hopedale that was responsible for leading the industrial revolution in Massachusetts. The Draper brothers, General Draper and Massachusetts Governor, Eben Draper also manufactured Looms, which distributed fabric for people internationally. Art’s vision expanded beyond his Cape Cod home borders and he eventually began servicing over 3,000 clients in his immediate territory. It was this single-minded dedication to serving his community that endowed him with “Outstanding Citizen of Year” by the Falmouth Chamber of Commerce in 1997. The agency is now well positioned with developed relationships in the industry, enabling the family team to offer its clients more competitive policies. The list includes but not limited to: Kingstone, Swyfft, Clear Blue Insurance, Travelers, Pilgrim, Safety, Hanover, Progressive, ASI, MPIUA, Mass Property Insurance, Main Street America, Arbella, Encompass, Plymouth Rock, Universal Property, Narragansett, ASI, Lloyds of London, Preferred Mutual and others. Legacy is vital in a family-run business that serves its local region, and the insurance agency’s leadership principles have continued with Art’s son, Davidson O. Calfee, as President and a humble recipient of the “40 Under 40 Award" from the Cape & Plymouth Business Magazine. Contact Arthur D. Calfee Insurance Agency, Inc. to learn more about its services and how you may be assisted immediately. |

Homeport Plaza

|

Map of our Falmouth Office |

Family Business Association Awards for Massachusetts 2019

For more information on the award click here.

As you progress in your studies you will learn to refine this definition of insurance, but for now, think of insurance as a promise to pay for a financial loss that results from a specified cause.

No one knows the exact date when the idea of insurance came into being. We do know, however, that some forms of insurance existed at various places and periods in ancient history.

Some historians speculate that a kind of insurance existed in China as early as 4,000 B.C. The unofficial story is that the Chinese merchants pooled their rice cargoes by placing a fraction of each man’s cargo in several junks, instead of placing one owner’s entire cargo in one junk. This pooling arrangement reduced the chances of one man experiencing a huge financial setback because if a cargo was lost, all merchants experienced a minor loss, but none of them suffered a total loss. Today we would call this arrangement a form of insurance because the merchants acted to spread the risk of loss among themselves. The merchants substituted the undesirable risk of a total loss for a somewhat greater chance of suffering a smaller one.

The Code of Hammurabi, written around 2,000 B.C., tells us of another form of insurance. In that day and age a merchant would hire a salesman to sell his goods in foreign ports. When a salesman returned from a trip, the merchant received one-half of the profit that the salesman had made. But if the salesman did not return, or if he returned without the cargo or the profit, the merchant was entitled to the salesman’s property, wife, and children as compensation.

However, the Code did contain a provision that granted some financial protection to the salesman. It stated that if a cargo was lost by piracy, the salesman would be released from his debt to the merchant. Now, under our definition, the Code of Hammurabi represents insurance. A promise was present. The promise was to release the salesman from debt, the specified cause was piracy.

Imagine the year is 916 B.C. and you are a merchant bound for Rhodes from Athens with your cargo of wine. As the last cargo loaded in Athens, your wine is stored on the ship’s top deck. You look out worriedly over the Mediterranean, the sky growing black, the wind reaching a full gale. The ship is in danger. Your worst fears are realized as the captain orders your cargo to be jettisoned (tossed overboard) in an effort to save the ship. The captain’s strategy works. The ship weathers the storm. However, you finish the journey ruined, financially destitute. It just isn’t fair that your wine has been sacrificed to save the cargo of all the other merchants. You have lost everything, and they have lost nothing.

Upon landing in Rhodes, you discover that the Emperor has established a new law that saves your enterprise. He has ruled that any merchant who suffers a loss such as yours is to be reimbursed by those who benefited from the loss (such as the shipowner and the other merchants whose cargoes remained on board). A form of insurance? Yes – the promise in this instance is financial recovery, the specified cause of the loss was jettisoning a cargo to save an imperiled ship. Interestingly, this rule is still in force today. It is now called the rule of general average. Each shipper will participate in the loss of a cargo that is damaged or lost in an effort to save a vessel.

By 400 B.C., the Greeks were using a system of financial protection somewhat similar to that used 1,600 years before in the Code of Hammurabi. To finance the shipping of a cargo to some agreed-upon port, a shipowner borrowed money (at a high rate of interest). In return, he pledged his ship, sometimes his cargo, to the moneylender in order to secure the loan. If, after the trip, the merchant failed to make the principal and interest payment to his financier, the financier was free to take the ship. This arrangement is called a bottomry contract.

Not surprisingly, the bottomry contract of 400 B.C. had an insurance provision. The money tender agreed to release the shipowner from his loan obligation if the ship – or its cargo – were lost at sea. As in the other examples, there was a promise and a specified cause of loss.

In each of the above instances, ancient insurance amounted to a promise to help someone cope with severe financial loss. Those methods used to cope with the losses may be crude by modern standards, but they are nonetheless fundamental examples of the insurance concept.