The largest purchase most people make is a home. Surprisingly, given the importance of this purchase, and the impact that losing it could have on their lives, many persons not only carry inadequate insurance but rarely, if ever, review their insurance policies. Worse is the fact that many agents feel that homeowners insurance is a “no brainer” and deserves short shrift in the agency. Get the business on the books, and let it take care of itself.

That philosophy works fine until there is a loss. To paraphrase a well-known saying, a good agent knows the client; a great agent knows the coverages. When the agent is not knowledgeable, the insured is left to deal with the claims adjuster. If the claims adjuster is new to the business, or is uncertain, then it becomes all too easy to err on the side of caution and deny a claim. This is not to say that the adjuster is to blame; unfortunately, insurers often put pressure on the adjuster to close claims quickly. Of course, the adjuster can simply decide it is easier to pay a claim and close it rather than research the reasons why it is not covered.

Further, in event of a catastrophe, many homeowners insureds find that their insurance is inadequate. Either replacement costs have been woefully miscalculated, or, in the case of an older home that must be rebuilt, there is either none or insufficient ordinance and law coverage so that rebuilding to code must come from the insured’s pocket. The lessons from Northridge, Andrew, and Katrina have not yet been learned. Agents and insurers have not yet begun to educate the public in the importance of adequate insurance, let alone the advantages of earthquake, flood, or ordinance and law coverage.

Equally important as the property exposure, and frequently overlooked, is the liability exposure. The homeowners forms provide comprehensive personal liability, but frequently common exposures are overlooked. Watercraft, a home business, and volunteer work — the agent must make sure the client is not left unprotected.

The current Insurance Services Office (ISO) HO 00 03 is the basis for much of the following. Although convention generally refers to “all risks” policies, we will use “open perils” since the homeowners forms now refer to “risk” of direct physical loss unless excluded.

One final note — the many cases used in this training are by way of example. Interpretation varies, so if alluding to any of the court cases, please check to make sure that they are valid in your jurisdiction.

That philosophy works fine until there is a loss. To paraphrase a well-known saying, a good agent knows the client; a great agent knows the coverages. When the agent is not knowledgeable, the insured is left to deal with the claims adjuster. If the claims adjuster is new to the business, or is uncertain, then it becomes all too easy to err on the side of caution and deny a claim. This is not to say that the adjuster is to blame; unfortunately, insurers often put pressure on the adjuster to close claims quickly. Of course, the adjuster can simply decide it is easier to pay a claim and close it rather than research the reasons why it is not covered.

Further, in event of a catastrophe, many homeowners insureds find that their insurance is inadequate. Either replacement costs have been woefully miscalculated, or, in the case of an older home that must be rebuilt, there is either none or insufficient ordinance and law coverage so that rebuilding to code must come from the insured’s pocket. The lessons from Northridge, Andrew, and Katrina have not yet been learned. Agents and insurers have not yet begun to educate the public in the importance of adequate insurance, let alone the advantages of earthquake, flood, or ordinance and law coverage.

Equally important as the property exposure, and frequently overlooked, is the liability exposure. The homeowners forms provide comprehensive personal liability, but frequently common exposures are overlooked. Watercraft, a home business, and volunteer work — the agent must make sure the client is not left unprotected.

The current Insurance Services Office (ISO) HO 00 03 is the basis for much of the following. Although convention generally refers to “all risks” policies, we will use “open perils” since the homeowners forms now refer to “risk” of direct physical loss unless excluded.

One final note — the many cases used in this training are by way of example. Interpretation varies, so if alluding to any of the court cases, please check to make sure that they are valid in your jurisdiction.

Tips for Homeowners

- Top 7 Things You Can Do to Make Your Home More Efficient

- Preventing & Addressing Water Damage Due to the Spring Thaw

- 10 Tips On How To Manage Insurance Costs

- Avoid Dreaded Surprises: What Is Really Covered Under My Homeowner's Policy?

- What Causes Flooding and Will my Homeowners Insurance Cover Flood Damage

Brochures

20 Tips for Home Safety and SecurityIn addition to your a monitored home security system, there are steps you can take to protect your home and family from burglary, fire and intrusion. Below are some basic tips to keep yourself and your loved ones safe.

General Home Safety and Security

|

|

|

|

Home Fire Safety

- Never leave candles or other open flames burning unattended.

- Douse cigarette and cigar butts with water before dumping them in the trash.

- Don't leave hot irons, or burning stovetops and outdoor grills unattended while in use. Double-check that you've turned them off after use.

- Regularly clear and dispose of dry or dead vegetation in your yard or areas near your home.

- Make sure the lid stays on your trash can, and store firewood and other combustibles away from your home.

- Install smoke alarms on every level of your home. For the best detection and notification protection, install both ionization and photoelectric-type smoke alarms. Put them inside or near every bedroom. Test them monthly to make sure they work. Put in new batteries once a year.

- Don't have deadbolts that lock with an inside key. You need to get out fast if a fire starts. A missing key could trap you inside. Also, don't nail windows shut. Make sure they open easily.

- Make a fire escape plan for your family. Find two exits out of every room. Pick a meeting place outside. Practice makes perfect – hold a family fire drill at least twice each year.

- Be sure your street address is visibly posted so that firefighters can identify your home in the event of an emergency.

|

|

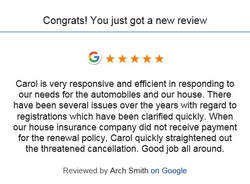

Arthur D. Calfee Insurance Agency, Inc. is proudly serving primary home, vacation home, auto, collector car, business, general liability, property, professional liability, contractor's liability, worker's comp, key man, whole life, term life, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, Eastham, Falmouth, Hatchville, Harwich, Hyannis, Hyannisport, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Truro, Wellfleet, Woods Hole, Yarmouth, and Yarmouthport.