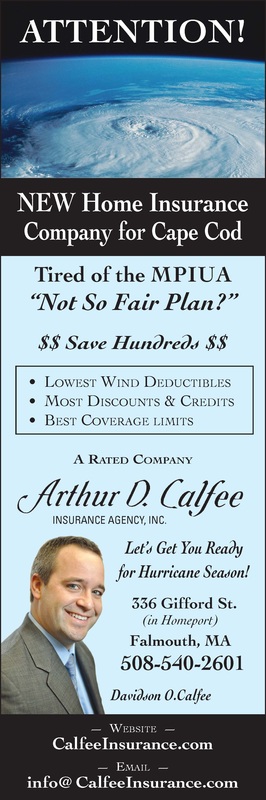

Best Cape Cod Home Insurance - A Few Tips To Save Money Best Cape Cod Home Insurance - A Few Tips To Save Money Call (508)540-2601 for the best alternative to the Massachusetts Property Insurance Underwriting Association, better known as the 'Fair Plan.' The Massachusetts Property Insurance Underwriting Association (MPIUA) is a residual market insurance association in which all companies writing basic property insurance in the Commonwealth are required to participate with losses shared among the member companies on a premium volume basis. Responding to Federal Legislation, the Massachusetts Legislature in 1968 called for an urban area insurance placement facility and thereby gave rise to MPIUA. MPIUA is also known as FAIR Plan (Fair Access to Insurance Requirements). The FAIR Plan operates similar to that of a normal insurance company in that it underwrites and inspects risks, accepts premium, issues policies and adjusts claims. It has a seasoned professional staff, which provides exceptional service to its clientele. FAIR Plans are the outgrowth of the national emergency created by three years of rioting in American cities, beginning with the Watts outbreak in 1965. When the rioting of the 1960s suddenly mushroomed to disastrous proportions, the companies found themselves in the position of having to pay losses in excess of $100 million, on which they had collected no specific premium. Although the companies paid these losses, their capacity was severely taxed and their normal riot reinsurance market had dried up. It became obvious that emergency revisions of underwriting and reinsurance procedures were necessary for the future protection of urban property and urban existence. Is there such a thing as best home insurance? There may be a better question. Is home insurance really that expensive? Homeowner’s insurance may very well be the consumer’s best buy when it comes to insurance. There are multiple benefits and features that make the home policy unique. Most everything that the homeowner owns including the dwelling can be covered in some way by homeowner’s insurance. When you think of the magnitude of the coverage afforded by homeowner’s insurance versus the premium paid then you would have to agree that homeowner’s insurance is a very good buy. The rates on property insurance in general, have increased over the last ten years. Much of that has to with increased catastrophes like the hurricanes in Florida. The toxic mold problem that originated out west has also caused premiums to increase on a national basis. The home insurance buyer really needs to focus on a few areas to get the most for the premium dollars paid. Accurate Dwelling Amount – This is the first most critical decision that you will make. The square footage of your dwelling has to be correct in establishing the replacement value of your home. The market value is of little use to you when you purchase insurance to rebuild the structure. Replacement cost is better for homes that have been built within the last 40 years. Check with your insurance company underwriting guidelines. Replacement Cost or Actual Cash Value – This facet of your home insurance policy should be clearly understood. Replacement cost insurance on both your dwelling and its contents means that the insurance company will rebuild or replace your loss with like kind and quality. Actual Cash Value will calculate the replacement cost and then subtract for depreciation. The actual cash value policy is cheaper but you will have to come up with the depreciate amount out of your own pocket. Deductible – Higher deductibles bring your premium down substantially. $500 to $1000 deductibles are common. This is a huge savings to you over the years and is your most valuable tool in lowering the cost.

0 Comments

Best Cape Cod Home Owner Insurance - What Is The Best? Best Cape Cod Home Owner Insurance - What Is The Best? The best homeowner insurance is the insurance that best meets your needs. The insurance shopper that takes the time to understand the basic elements of home insurance will have much more confidence and sense of satisfaction when making an insurance purchase. The homeowner policy has been around for a long time and so most of us have a general concept on how the policy works. The more you know about the market value of your home and the approximate cost to rebuild it the better off you will be when shopping for the homeowner policy. This kind of knowledge is the foundation for determining what kind of policy to purchase. The age of your home has a direct bearing on the market value. The older homes built in the 1900’s have much lower market values today because most of them have depreciated. The market value for an older Victorian style home may be $50,000 but the actual cost to rebuild that home may be $200,000. The older homes that depreciate in market value are insured with actual cash value policies. They are often called market value policies. These policies will reimburse you for the market value of your home when there is a total loss. The market value policy is the best homeowner policy for the older home that has depreciated. The replacement cost policy is better designed for newer homes or homes under construction. The replacement cost of a home and the market value are almost the same. Replacement cost is applied to the dwelling and most often to the contents of the dwelling. Replacement cost will repair or replace any loss with like kind and quality of materials without depreciation. The best homeowner insurance for you will be determined by the age and market value of your home. The discounts for older and newer homes are the same. The protective device discount for deadbolt locks, smoke detectors, and fire extinguisher apply to both types of policies. Fire and burglar alarm systems are additional discounts that could be applied to both older and newer homes. Check our recommended insurers for more details.  Buying Your Dream Cape Cod Home Buying Your Dream Cape Cod Home Even though it’s not easy for everyone to buy a home, it is in fact easier than ever to get a home these days with most lending agencies and banks being more liberal than ever with providing home loans and mortgages. Even if you don’t have a lot of capital or a lot of money to put down, you can still get the home of your dreams at a very affordable price. A lot of us think that buying a home is a tough process, needing a large down payment, although this isn’t always the case. Buying a home largely depends on your budget. If you put a down payment on your home purchase, it will go towards your overall purchase. The more money you put down on a home when you purchase, the lower your monthly payments will be. Those of us who don’t own a home live in rental houses and apartments. This can be a worthwhile solution, although your still paying money towards your housing that you could instead be putting towards a home of your own. Owning a home is a dream for many of us, especially when it comes to that dream home that we all hope to own one day. Apartments and homes are great to rent - although most these days will cost you just as much as a mortgage payment - which doesn’t make any sense at all. Instead, you can easily convert your rental payments into monthly installments towards your own home. All across the United States, you can find of lot of banks and lenders that offer easy to get loans for purchasing your own home or real estate property at low interest rates. With a lot interest rate, you can get the home of your dreams and enjoy low monthly payments. Keep in mind, you need to choose a loan plan that’s best for you. You can go through bank, through a lender, or use a service online. There are many different ways that you can go, although real estate agents seem to be the most common now days. Good real estate agents will be more than willing to help you get a great deal on the home, at prices that are right for you. Anytime you buy a house, you should always plan ahead, get yourself a real estate agent, and then pursue your dream home. If you plan your budget and take things one step at a time, you’ll be closer than you think to the home of your dreams. If you choose to keep renting and pay money toward something you don’t own - the home of your dreams will continue to slip away. Take action now and stop renting - find the home of your dreams and put your money towards owning it instead. With all the rising costs in the world consumers are looking for ways to cut costs and save money. Americans spend billions of dollars every year on their home insurance policies. It does not take a genius to figure out that every homeowner needs insurance, most people consider their home to be their greatest asset.

Thousands of homeowners are reaping the rewards that comes from filling out a FREE home insurance quote. Many are receiving 25-30% discounts on their policies while becoming more educated about the home insurance that is right for them. Here are a few tips that might help you when you are shopping for that "Perfect" insurance policy. Increase Your Deductible Just like auto insurance, policies have deductibles, and the same rule of thumb applies--carry the highest deductible you can afford. The higher your deductible, the more premium credit you can expect to receive from your insurance company. Your savings could reach 25% by increasing the deductible from $100 to $1000. Improve Your Home Security Most insurance companies offer discounts for smoke detectors, burglar alarms, dead bolts, fire extinguishers, and Neighborhood Watch Areas. Homes with a fire and burglar alarm system hooked up to a third-party monitoring company receive higher discounts than homes with local bell alarms. Consolidate Policies Insuring two or more vehicles with the same insurance company can save you 10 - 15% on your premiums. If you cover your homeowners insurance and auto insurance together, you can reduce your premiums by another 10 - 15%. Construction Type Before buying a home, consider its construction type, such as frame or concrete block and steel (CBS). A wood frame house typically costs more to insure than one built mostly of concrete. Verify Distance To Fire Stations And Windstorm Areas If you live in the country, you'll probably pay higher rates for your insurance than if you lived in town. Why? It’s because of the longer distance to your local fire station. If you live more than 5 miles from the nearest fire station, and more than 1,000 feet from a fire hydrant, you will most likely pay a higher premium. Before purchasing your home, you may want to get a quote for both and flood insurance. Insurance companies may not offer you windstorm or flood coverage, depending upon the area in which you live. If your home is in a hurricane prone area and your insurance company offers windstorm coverage, then installing approved hurricane shutters should result in a premium discount. Claims Free Record And Renewal Discounts If you have not had a claim under your policy during the past 3 - 5 consecutive years, you could receive up to a 15% discount, depending on the insurance company. Plus, most companies will discount your premium if your policy has been in force for 3 straight years. Mortgage Free Discounts Some insurance companies target who have paid off their mortgage and offer them premium discounts of up to 5%. New And Renovated Home Discounts A majority of insurance companies offer a discount for new homes, and you may qualify if your home was built in the last 10 - 15 years. Also, a recently renovated home costs less to insure, so find out when the last major electrical, heating and plumbing update was completed on the home. Live-In House Keeper Some insurers offer up to a 2% premium credit if you have a live-in employee as they feel it could reduce the likelihood of burglary. Conclusion After reviewing the foregoing savings tips, you may think that if you added up all your credits you could receive a 70 – 90% reduction in your premiums. Unfortunately, it doesn’t work that way. Certain safety or other measures you take may qualify you for being placed with the "preferred" company of a particular insurance group. This "preferred" company will be able to give you more premium credits than a standard company is able to. When you first buy a home, you may become overwhelmed by all of the extra costs you never thought about having. One of those costs may be home insurance coverage. Young homebuyers may not see the need for such costly insurance, but anyone who has used their home insurance knows exactly how important it is. Many mortgage companies require specific coverage plans. Even if you choose to buy your home, without financing it, you will need home insurance coverage. Take a look at this information to learn more about home insurance plans.

When You Need It You may think home insurance is only good in natural disasters. When a tornado, hurricane, or earthquake damages your home, your plan should cover the damage. However, there are many times you can use your home insurance coverage regardless if there is a natural disaster or not. Consider this scenario: Your hot water heater bursts and no one is home. There is so much water on your floor that your expensive hard wood flooring is completely ruined. With home owner insurance, you would simply be responsible for your deductible. The coverage would pay for the flooring to be replaced and often will even pay for a new hot water heater. Of course, these terms all depend on the type of plan you have, but for the most part, home insurance is beneficially for large as well as small disasters. How To Pay For It Choosing how you pay for your home insurance coverage can be important. Some owners would rather add their insurance right into their mortgage payment. Many banks prefer you to do it this way and are happy to accommodate. Other insurance companies will allow you to pay the premium monthly, every six months, or yearly. Select companies will even offer additional discounts for those who make one yearly payment. Consider these things when setting up your home insurance. You may get a great deal when you choose the right payment arrangement.  Home Insurance Needs Careful Consideration Home Insurance Needs Careful Consideration When thinking of taking out home insurance you have to give it some very careful consideration especially when it comes to determining how much cover you actually need. If you do not take out enough cover then you are leaving yourself open to problems if the worse comes to the worse and you have to replace everything in your home due to fire, for example. Take out too much and you will be paying for cover that you do not need. Not only is the amount of home contents insurance confusing but also where you have to buy the cover. Many individuals believe that they have to take the cover out that is offered by when you take out your mortgage. In fact 2.9 million of the policies that are sold are bought from the high street lender which means they are probably paying way over the odds for their cover. High street lenders jump onto all types of insurance and try pushing it alongside offering a cheap mortgage or loan and home insurance is no exception and is just one more way of boosting profits. Home insurance has to be shopped around for just the same as with any type of insurance, the premiums do vary depending on the provider and if you go with an independent broker then they will be able to shop around on your behalf and can often get special internet or broker deals, which will save you even more money. By doing so they will be able to gather together the cheapest premiums and along with this will make sure that you have access to the key facts which will explain clearly how much the cover will cost. A good indication as to how much you need to insure your home contents for is to go around and jot down all the contents of your home including clothing, electrical equipment, accessories in your kitchen and any other items that you would have to replace in the event that you lost everything. Even the cost of CDs, DVDs and expensive cosmetics can all add up, you’d be really surprised. And if you lost everything, you’d have to replace it all, right from the carpets upwards. That is why getting the right amount of insurance cover is so important. However you do have to take into account that certain items in your home might not be covered under a standard policy. For example if you have an extensive collection or jewelery collection then you might have to take out extra cover. Even your bicycle may need to be insured separately. It is also essential that just because you got the cheapest premiums for home contents insurance one year it does not necessarily mean that you will get the cheapest premiums again by just renewing it. Loyalty is not often rewarded by brokers. Premiums can vary greatly from year to year and you can get a better deal by going back to a broker and allowing them to search on your behalf.

Ordinance & Law Home Insurance for Cape Cod Home Buyers  Ordinance & Law coverage for Cape Cod home buyers and residents Ordinance & Law coverage for Cape Cod home buyers and residents Ordinance & Law coverage is available on both Commercial Property policies as well as via endorsement on Homeowners policies. For the purpose of this discussion I’ll focus on the Commercial form. Briefly, Ordinance & Law coverage is available via endorsement from most carriers and is broken down into three coverage segments: Coverage A- Undamaged Portion- Should your building be partially damaged by a covered cause of loss (i.e. Fire or Tornado), the local Building Department or Fire Marshal might require that you demolish the undamaged portion of the structure and reconstruct an entire new building. Without Ordinance & Law coverage on your policy, the insurance company may not pay for the part of the building that wasn’t originally damaged. Coverage A closes that gap. Coverage B- Demolition- Continuing from the loss scenario above, Coverage B pays for the cost to actually demolish the remaining portion of the building left standing after the original cause of loss. Again, without Ordinance & Law on your policy, you’d likely be left “self insuring” this expense. Coverage C- Increased Cost of Construction- If the building code has changed since the time your building was originally constructed, Coverage C pays for these mandatory building enhancements. Without this coverage, the insurance company would only pay to rebuild what was originally there. Common examples which might apply include hurricane strapping, fire sprinkler systems, ADA-compliant hardware or elevators. Because Ordinance & Law coverage can prove so valuable, it isn’t always cheap. Coverage A is usually written up to the building limit on the policy. Shared or separate sub-limits are typically chosen for Coverages B&C (i.e. $50,000 combined or $50,000 for B and $50,000 for C). All that being said, every client’s exposure is different so be sure to ask your agent to discuss your specific exposure and the cost associated with closing this gap. Part A provides this protection based on the coverage limit you select. Demolition costs. While property insurance covers debris removal for a portion of property damaged by a covered peril, it doesn't cover demolition expenses for an undamaged portion of a building that has to be removed. Coverage for loss caused by enforcement of ordinances or laws regulating construction and repair of damaged buildings. Older structures that are damaged may need upgraded electrical; heating, ventilating, and air-conditioning (HVAC); and plumbing units based on city codes. Many communities have a building ordinance(s) requiring that a building that has been damaged to a specified extent (typically 50 percent) must be demolished and rebuilt in accordance with current building codes rather than simply repaired. Unendorsed, standard commercial property insurance forms do not cover the loss of the undamaged portion of the building, the cost of demolishing that undamaged portion of the building, or the increased cost of rebuilding the entire structure in accordance with current building codes. However, coverage for these loss exposures is widely available by endorsement. Standard homeowners policies include a provision granting a limited amount of building ordinance coverage; this amount can be increased by endorsement. Also referred to as building ordinance coverage. Photo provided by: https://www.linkedin.com/nhome/influencer-entitlement via a Creative Commons license requiring attribution |

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2023 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed