|

Don't own your own home yet? You should know that you can, and should, be properly insured for your personal property even though you're renting. One of our leading competitive insurance providers, Arbella, just announced that they're offering a new insurance package plan that's aimed at saving you even more money. With the clever name "carpartment", this package plan combines both your renters insurance as well as your auto. It’s a match made in savings heaven. First and foremost, you’ll get dynamic Massachusetts car insurance. Arbella knows the New England roads better than anybody, and they pride themselves on responding faster to your needs if you have to report an accident. For more details on car insurance and additional discounts on insurance, click here.

The other half of this package is just as important. When you sign up for car insurance with Arbella, they'll throw in a side of renters insurance for as low as $3 a week. That’s less than a latte at starbucks! Your policy covers what your landlord won’t in case of things like fire, bursting pipes or break-ins. They'll protect your electronics, your furniture, your retro sneaker collection, even your identity. And They'll do it with the same commitment to service that’s been Arbella’s calling card from day one. For more details on renters insurance or home insurance, click here.

0 Comments

CLICK HERE - for a quote on your Home & Auto Package policies! Save The MOST on Your Insurance Policies!  Published: Monday, 2 Dec 2013 | 10:09 AM ET By: Andrew Osterland, Special to CNBC.com All three financial advisors interviewed say the wild card—and potential budget killer—is health care. According to Ward, a couple over age 65 can expect to spend $600 per month each between contributions to Medicare, any Medicare supplemental plan and out-of-pocket medical costs. "It's the biggest expense for retirees," he said. If a health crisis necessitates long-term care, the expenses can be crippling. Long-term care insurance costs approximately $200 per month per person; people should determine whether they want coverage now or will pay for potential costs out of their own pockets should the time come. Wealthy, poor and single people may choose the latter option, but insurance is probably a good idea for the bulk of middle-class married couples. "We generally recommend long-term care insurance for most people," Edelman said. "It's usually health care that causes a crisis for people in retirement." —By Andrew Osterland, Special to CNBC.com  By Todd Wallack | BOSTON GLOBE STAFF JANUARY 28, 2013 Competition in the state’s car insurance market has yielded an unexpected benefit: Thousands of residents who once had to buy expensive home coverage from the Massachusetts FAIR Plan are increasingly able to find policies through other insurers, saving them hundreds of dollars a year on premiums. The FAIR Plan, known as the insurer of last resort, provides home insurance in high-risk areas, including neighborhoods that have high crime rates or sit perilously close to the ocean. Home insurance companies have traditionally been reluctant to do business in such locations. But since the state gave insurers more freedom to set their own auto insurance rates, starting in 2008 — something it calls “managed competition” — 13 more auto insurance companies have set up shop in Massachusetts, with most also selling homeowners policies or partnering with firms that do. Over that time, the FAIR Plan lost nearly 27,000 homeowners insurance customers, or 16 percent of its base, an exodus few in the industry predicted. “It is all driven by this shift in the competitive marketplace,” said Robert Tommasino, general counsel for the Massachusetts Property Insurance Underwriting Association, better known as the FAIR Plan.

Some insurers, including Narragansett Bay Insurance Co., also decided the escalating prices of premiums for coastal properties made it worth their while to start selling policies in those locations. Their strategy has been to undercut the FAIR Plan rates while still charging enough to turn a profit. Bob Inello, whose waterfront home in Nahant is exposed to the wrath of storms, said he was forced to buy Fair Plan coverage for more than a decade. But three years ago, Inello said, his agent said he could switch to Narragansett, cutting his bill by $570 a year — more than 20 percent. “I don’t feel like I am being held hostage anymore,” Inello said. “It’s very liberating.”

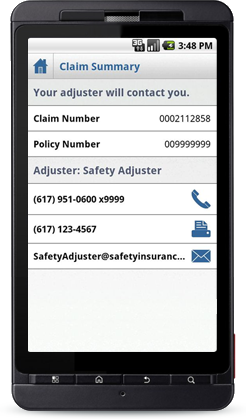

Safety Insurance has partnered with Safe Roads Alliance and Travelers Marketing to develop the first "The Parent's Supervised Driving Guide". The guide provides detailed instruction for parents in helping them teach their teens how to drive. This guide will be provided to all operators at the time they receive their learners permit. It is distributed at all Massachusetts Registry of Motor Vehicle locations. Safety Insurance is proud to sponsor this official Guide, and hopes that it will make the driving experience a safer one for both you and your teen driver.

Hello Friends!

I wanted to write with an update after yesterday's email (click here if you missed it). From what we can tell, more than 500 of you emailed the Governor over the last 24 hours. Beyond that, hundreds have called. We are grateful for your support and absolutely floored with such a large response. We are also tremendously proud of the dozens of emails we were cc'd on including stories of crashes avoided thanks to our program. As of late afternoon today, we have yet to hear from the Governor or a member of his immediate staff. We have spoken to a few people at his switchboard and have been promised that someone would be getting back to us by now. Not having lead one of these "movements" before, we have no idea how many calls or emails it takes to make an impression.....sooooo please feel free to continue to encourage others to call or write per the instructions below. If you are a facebook user, you can click here and show your support there. Meanwhile, we have received a few inquiries from Boston media and will start to reach out to them tonight. If you have a particular radio program, news channel or newspaper that you want to make aware of our situation, please feel free to forward our email to them. We've helped nearly all of them with some type of news feature in the past, so hopefully they will be interested in helping us too. Please encourage them to follow up with me personally: Dan Strollo Dan@DriveInControl.com (617) 306-6264 mobile We did receive one call last night concerned with our request to get the government involved in an issue between two private companies. As the president of a small business, this is definitely something I am sensitive about. I placed hundreds of calls or emails in October believing that a change in a Mass DOT contract would result in our ability to remain in S. Weymouth a few more months and that the developer of the former naval base was supportive of this effort. When we moved that mountain and learned that our landlord was still not interested in extending our lease, we felt mislead. They did not break any laws and we had nothing in writing from them, but efforts were made based on emails and conversations held with the parties involved. In my response to their eviction notice I promised not to let up on my efforts and have not heard from them since. We do not believe that government can force our landlord to do anything, but we do feel that the Governor's Office has the ability to call a meeting and educate them on the importance of what we do; a meeting we requested weeks ago, when we were told via email that their hands were tied. I will try not to abuse this distribution list, but tomorrow morning we start to dismantle our classroom. By Thursday it will be on a truck and by Friday it will be moved from the airbase. While it is possible for us to find a replacement classroom in the coming weeks, the expense may not be justified as our potential class days fall from the calendar. To the dozens of you who have offered to write letters, make additional calls, etc. We thank you and will write back as soon as time permits. To the nearly 1,000 of you who have contacted the governor - "THANK YOU!!!" Our commitment to everyone remains the same and we hope to be around a long time regardless of how this is resolved. If you additional suggestions, ideas for corporate sponsors or simply want to put on a holiday party for your employees next month...just let me know and we'll make it happen! Questions? |

better Insurance

|

||||||||||||

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2023 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed