|

Are you deciding between renovating your current house and finding a new one?

Rising interest rates have made some would-be buyers and sellers reconsider — and if you decide to stay put, you may want to modify your home to better fit your lifestyle. You should base your renovation decisions on what will most enhance your comfort and enjoyment of the home, especially if you’re not planning to sell anytime soon. But it doesn’t hurt to also consider the potential return on investment (ROI) of your project. Here are six home updates that could also boost your home’s value. Updated Flooring You may just want to refinish hardwood floors, or you could swap one flooring material for another. Outdoor Space A new deck, patio or porch can add new living space to your house — especially if it’s enclosed or covered. It also enhances your backyard, offering a place to relax, enjoy a meal or entertain guests. Kitchen Improvements You don’t have to do a complete kitchen remodel to see a positive ROI. Smaller improvements such as cabinet refacing, new cabinet hardware, a granite countertop or new appliances can also boost the aesthetic of your kitchen and your home’s value. Finished Basement Do you need more space? You might be able to add living space to your home if you have a basement to finish. You could make it a bedroom, home office, playroom or gym — the options are nearly endless. Energy-Efficient Upgrades Installing solar panels, switching to an electric heat pump and replacing older windows can all save you money on utility costs while increasing your home’s value to future buyers. Neutral Paint Colors A fresh coat of paint gives the interior of your home an instant lift. A light, neutral color palette is the best choice for ROI because it appeals to the largest number of people. Are you curious about how home improvements could impact your insurance policy? Get in touch today.

0 Comments

When an unexpected natural disaster or state or local emergency interrupts your plans to start house hunting, all is not lost. While opportunities to get preapproved for a mortgage, meet with a real estate agent or tour homes for sale may be on the back burner, there are still ways you can work toward buying your dream home.

Why Making the Move Now May Be Right for You House hunting during a time when your area or region is shut down can have its benefits. There may be less competition for the houses in the areas where you might be planning to move, and sellers may be more motivated to sell or more flexible on price. Starting your hunt virtually while sheltering in place can be beneficial if you find you have the time to shop online more thoroughly; that extra effort may give you an advantage in finding a home you love within your price range. Once the crisis passes, there may be more house hunters back on the market and prices may escalate due to a more competitive market that benefits sellers rather than buyers, so taking a few steps forward now could be the right move for you. Get Preapproved for a Mortgage When you eventually find the home of your dreams, you will want the seller to see you as a serious buyer. To do that, get a mortgage preapproval before you begin house hunting. It may be possible to get preapproved online, so consider looking into that option. Mortgage preapproval is a letter from a lender that indicates how much you are qualified to borrow from the lender, at a specific interest rate. While it may not be possible to meet with a lender when an emergency situation exists, such as the coronavirus pandemic, you can get your information organized that will help your lender prepare your mortgage preapproval.

Use This Time to Research the Market If you are just beginning to look for a home, take time to research the areas where you want to move, the area’s home values and the average selling prices for the type of home you are interested in purchasing. Familiarize yourself with real estate terms and listing abbreviations so you can easily browse listings and focus on the features that most interest you. Finally, ask friends and family for realtor recommendations and check out their credentials and online reviews. Make a short list of real estate agent candidates to interview once you are able to set up interview times. Virtual Home Viewing If you were all set to start house hunting only to be disrupted by a natural disaster, state or regional mandates, or even the COVID-19 pandemic, take heart: You can still view houses on the market right from your own home, whenever it is convenient for you. Many real estate agents post virtual tours of properties for sale on their websites and YouTube. When you take a virtual tour or attend a virtual open house, you can get a realistic view of the property. Then, with a click of the mouse, you can see all the details that are important to you. In addition, by touring homes virtually, you can see many more than would be possible in a single day with your real estate agent. Find a Representative Even during these challenging times, there is still much you can accomplish in your quest to find your dream home. If you’re planning to buy a house, you’ll need home insurance. Call Calfee Insurance today for a free quote at 508-540-2601.

We offer a wide range of coverage, including auto, home, renters and life insurance. It doesn't stop there - we also provide motorcycle and small business insurance. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! We'll help you understand and customize the right home insurance coverage for you. Get started today with a free homeowner's quote — it only takes a few minutes. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you. Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote. Get your free home insurance quote online today. Get a quote online and work with an insurance agent to find the right Home Insurance coverage for your property and unique needs. Understanding the four essential protections provided by your homeowners policyHomeowners coverage provides financial protection against loss due to disasters, theft and accidents. Most standard policies include four essential types of coverage: Coverage for the structure of your home; Coverage for your personal belongings; Liability protection; Coverage for Additional Living Expenses Coverage for the structure of your homeYour homeowners policy pays to repair or rebuild your home if it is damaged or destroyed by fire, hurricane, hail, lightning or other disasters listed in your policy. Most policies also cover detached structures such as a garage, tool shed or gazebo—generally for about 10 percent of the amount of insurance you have on the structure of the house. A standard policy will not pay for damage caused by a flood, earthquake or routine wear and tear. When purchasing coverage for the structure of your home, remember this simple guideline: Purchase enough coverage to rebuild your home. Coverage for your personal belongingsYour furniture, clothes, sports equipment and other personal items are covered if they are stolen or destroyed by fire, hurricane or other insured disasters. The coverage is generally 50 to 70 percent of the insurance you have on the structure of the house. Liability protectionLiability covers you against lawsuits for bodily injury or property damage that you or family members cause to other people. It also pays for damage caused by your pets. So, if your son, daughter (or even your dog) accidentally ruins a neighbor’s expensive rug, you are covered. (However, if they destroy your rug, you’re out of luck.) The liability portion of your policy pays for both the cost of defending you in court and any court awards—up to the limit stated in your policy documents. Liability limits generally start at about $100,000, however, it’s a good idea to discuss whether you should purchase a higher level of protection with your insurance professional. If you have significant assets and want more coverage than is available under your homeowners policy, consider purchasing an umbrella policy, which provides broader coverage and higher liability limits. Your policy also provides no-fault medical coverage, so if a friend or neighbor is injured in your home, he or she can simply submit medical bills to your insurance company. This way, expenses can be paid without a liability claim being filed against you. It does not, however, pay the medical bills for your own family or your pet. Additional living expensesALE pays the additional costs of living away from home if you cannot live there due to damage from a an insured disaster. It covers hotel bills, restaurant meals and other costs, over and above your usual living expenses, incurred while your home is being rebuilt.

Keep in mind that the ALE coverage in your homeowners policy has limits—and some policies include a time limitation. However, these limits are separate from the amount available to rebuild or repair your home. Even if you use up your ALE your insurance company will still pay the full cost of rebuilding your home up to the policy limit. If you rent out part of your house, ALE also covers you for the rent that you would have collected from your tenant if your home had not been destroyed. When it comes down to getting good home insurance the best way to make sure that you not only get the least expensive deal but also the most comprehensive, is to let us quote multiple companies for you. Insurance is a complicated matter and getting the best cover can be an absolute nightmare and for this reason you should consider going with an independent and specialist broker. Good deals in home insurance can be found, but you have to know what to look for, what you need and also what is involved in a policy. All polices have exclusions within them and it is important to know what you are covered for and what you are not covered for. Never just take it for granted that because its in your home and you have insurance, then it will be covered. This applies in particular to any usual or very expensive items which you have in your home, if you have items such as these then you might have to take out extra cover. Again this is where the expertise of a specialist broker can come in handy; by talking over your requirements they can look around and make suggestions that can in the long run save you money while making sure you have adequate cover. While it is important that you get cheap home insurance you don’t want a poor quality policy, a poor quality policy will have many exclusions within it, which means that if you haven’t read it thoroughly you could find if it comes to claiming you are turned down, which could be very costly. Before taking out insurance you should have made an inventory of all your belongings and will have an overall value should they need to be totally replaced if the worst came to the worst. Of course, while none of us likes to think of losing our belongings and home completely it could happen. Along with the inventory of your belongings you will also have to come to a price when it comes to the actual building itself if it should be destroyed. Only then can a broker get you comprehensive and fully covered cheap home insurance. Call us for more information at 508-540-2601. www.CalfeeInsurance.com Cheap cape cod Home Insurance Can Be Bought From the Specialist Online Broker at calfee insurance3/14/2017 If you have built up your home and have pride in it then you will of course want to do everything possible to insure it against all possibilities. Home insurance comes in many different forms including taking out insurance to guard against fire and theft, and protection of all your contents and possessions along with the structure of the building and outer buildings and garden equipment. You can safeguard against all types of possibilities but home insurance can work out expensive unless you go to a specialist online broker to find cheap home insurance on your behalf. When it comes to safeguarding your possessions then you can take out home contents insurance. This type of insurance is taken to protect your belongings against such as fire and theft and all possessions can be taken into account in the home. When deciding how much cover you need then go around and make an inventory of all the items you have, it can be surprising how much they add up to. If you have any expensive items such as jewellery then you might have to insure these separately so don’t just assume that a policy covers everything and you should always ask your broker for advice. The outside of your home is at risk too and as such should be insured against natural disasters which could cause structural damage caused by storm, fire, flood, subsidence etc. You should also take into account any patio furniture, garden furniture, shed and contents and insure these against damage or theft. There are many different types of home insurance and a specialist broker will be able to give you the details to make sure that you get what you need along with securing you cheap home insurance quickly and easily. A specialist broker will know where to look to find the best deals when it comes to cheap home insurance and buying online is quick and easy not only when it comes to getting the lowest premiums, but also when it comes to applying for the cover itself.  Changes That Mother Nature Brings Means You Should Have Home Insurance Changes That Mother Nature Brings Means You Should Have Home Insurance We have all heard about the impact that we are having on the world and the changes that are set to happen and indeed are happening, including changes to the weather. With more claims on home insurance policies being related to weather, it is now more than ever imperative to have home insurance in order to protect yourself from whatever Mother Nature throws our way. While there is nothing we can do to prevent Mother Nature from doing her worse there are many things which homeowners can do to prepare for what she offers and the damage it can do to the home. Making sure that your roof tiles are in good order, the chimney and roofing is in good order and cutting back any large and overhanging trees can all go towards getting cheaper home insurance cover and reducing the risk if making a claim. Even if you have adequate insurance to cover damage done to your home, in the majority of cases claims take time to pay out. Therefore it is essential that you have savings in order to pay for any major repairs that cannot wait until the insurance pays out. Of course you will eventually be able to reclaim any money you pay out for repairs providing the insurance company agrees to the work and damage and that it is covered under the policy. It is also essential that you keep any receipts for any work done. Another factor to take into account is if you have had major home improvements made to your home, this can add value to your property so should be included in your policy when you renew it. By shopping online or using a specialist independent broker to find your home insurance are the easiest and cheapest ways to protect yourself against what Mother Nature has to bring your way. When getting home insurance quotes, always compare policy terms and conditions and not just the premiums. And when comparing policies make sure that you check out at least four or five different companies and compare not only the cost of the premium but also what the policy entails. Some will ask that you pay up front for repairs and then reclaim, while others will provide you with a 24 hour emergency number and certain companies to complete the work needed in the quickest time possible. In 2004, the insurance industry estimated that about 45% of their settled claims were for damages caused by weather. This past January, that percentage climbed as high as 60%, with a possible £300 million worth of damages being claimed by homeowners for weather related incidents. Is your home covered against damage from high winds? Will your insurance company pay out to repair damage caused when your plumbing freezes? How much will you have to pay out of pocket for repairs if heavy snow takes out your rain gutters or damages your roof? If you’re not sure of the answers to those questions, it might prove enlightening to pull out your home insurance policy and have a read. According to an industry spokesman, too many homeowners find out what their buildings insurance does and doesn’t cover after they have incurred a loss and submitted a claim. That’s the case for many homeowners who suffered damage to their homes during the high winds of the past January who found, to their shock, that they’d be bearing the brunt of the repair bills from their own pockets. In fact, the most recent figures suggest that over one third of homeowners have no home insurance at all, and many more are paying out for policies that don’t adequately cover the damages that they might face from adverse weather. Home insurance policies vary widely on precisely what weather damage they cover, and how much you’re expected to pay out before the insurance company will pay its share. That’s why it’s important to sit down with your policy or your broker – or both – to discuss precisely how much coverage you have for weather-related damages, and if there are limits and exclusions to that cover. Some of the most common exclusions and limits include: Damage from floods If you live in an area with a high possibility of flooding, you may need to purchase separate cover to deal with damage from flooding. It’s vital that you not neglect this, say insurance spokesmen. The cost of repairing damage after a flood can easily run to £30,000 or more. Compare that to the average weather related claim of about £500. Water damage from burst pipes Watch for limits on the amount of damages you can claim if your pipes freeze and burst. A burst pipe in your loft can quickly damage walls and ceilings, and result in unhealthy growth of mold and mildew if not cleaned properly. The cost of all those repairs can easily and quickly mount above typical limits on damages. Contents cover If you only have buildings insurance, you may find yourself out of luck when damage to your roof results in the destruction of your expensive draperies, carpets and furnishings. Even if you carry cover for your home contents, you may want to carry extra insurance if you own expensive items like Oriental rugs or fine artwork. Outdoor and garden items Many policies only cover items inside your home from weather damage, while other policies will even pay to replace plants damaged by storms in severe weather. If you’re an avid gardener, or have outdoor patio and yard equipment, consider a policy that includes garden cover. Be sure to review your policy periodically to be certain that you’ve kept it up to date, especially when you make new purchases or add an extension to your home. You may think that buying Florida home owner insurance is an easy task, but if you really get down to the details you may find out that this is not true.

The fact of the matter is that there are many details that go into Florida home owner insurance that you may not even be aware of. You want to make sure that you do not make the mistake of buying Florida home owner insurance before you know what it is all about. If you do make a quick purchase you could end up regretting it in the end. This should not scare you away from buying Florida home owner insurance; it should instead make you want to get the best possible policy. The biggest misconception about Florida home owner insurance is that it covers every natural disaster known to man. If you live in Florida you are probably aware of the fact that hurricanes are going to hit your area sooner or later. Of course you hope that you are spared time and time again, but you cannot always be so lucky. So knowing that these hurricanes are coming is a good thing. But what are you going to do if your home is damaged in the process? You need to know what your Florida home owner insurance policy is going to cover. For instance, in most cases you will need to buy flood insurance in addition to your home owner insurance policy. There is a very good chance that a hurricane will cause your home to flood, and if it does you will definitely want to have insurance that you can rely on. In order to get details on all coverage levels make sure that you speak with a Florida home owner insurance company in depth before you make a purchase. Tell them what you are concerned about, as well as what you are looking to receive. They should then be able to tell you about every policy that you could possibly buy. Remember, you are not the only one who knows about the hurricane season in Florida. The companies that sell Florida home owner insurance know this as well. Overall, buying Florida home owner insurance can be a difficult process if you do not take the time to look into all of the details. It is very important that you know what is available, as well as what you should buy.  Call (508)540-2601 for your Affordable Alternative to MPIUA 'Fair Plan' Home Insurance - Save More It doesn't matter how many times you crawl the Internet for information. When looking for tips on taking out a mortgage, you will always be given this advice: compare mortgage quotes. This is the first and most important rule for would-be homeowners. Always compare mortgage quotes. Unless you do, you cannot distinguish the good offer from the bad. Only when you compare mortgage quotes can you assure yourself that you are getting the best possible deal there is. You need to make plans for deductibles. Yes, they are usually different from state to state. And the rule of thumb is that the more predominant a peril is in a state, the higher the deductibles such a peril will attract in that state. To give you an example, earthquakes are common perils in California and the deductibles for earthquakes are far higher in California than Florida which is more prone to wind and water damages. Well again it depends on the lawyer's experience and specialty. My recommendation would be to find a lawyer who focuses and specializes in personal injury law. Get the lawyers personal track record for success in dealing with insurance companies and has experience and success in the courtroom. Inquire about the law firm's ability to cover the costs of the case as they arise. And, from a personal point of view make sure that your lawyer is approachable and communicates well and regularly with you. Life insurance is no doubt the most important insurance policy that you need to take care of. On the other hand there are many other Factors such as Home Insurance card insurance and insurance on other assets. When you were married you probably didn't even think twice about who would make these insurance payments month after month. But when you are separated you need to be aware of where you have taken the responsibility to make the payments. You need to stop payments on assets that have not come you're away after the divorce and realize where you do have to make payments. Take a day off to work this one out. Get on the internet and use an auto insurance quote comparison website. It is literally a 1-2 minute process and then you can get insurance quotes from a lot of companies. After you found some that are in your price range, just call them and see what's the deal. Is it that hard? Does it seem hard? It takes you 2 damn minutes. To do this, you need to install a lightning detector and protector. Use surge protectors in all your appliances. Don't plug too many gadget in one socket, and when leaving home unplug appliances and put off switches and sockets. I hope that this step by step guide has helped you a little bit, but like I said at the beginning of this article I am no professional expert on this. I know from my own personal experience what my husband and I had to go through and that is what I wrote on. Nothing more, nothing less. Please always get a second opinion and research this topic more because this is one of the most biggest purchases you will ever have to go through in your entire life! Good Luck! |

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

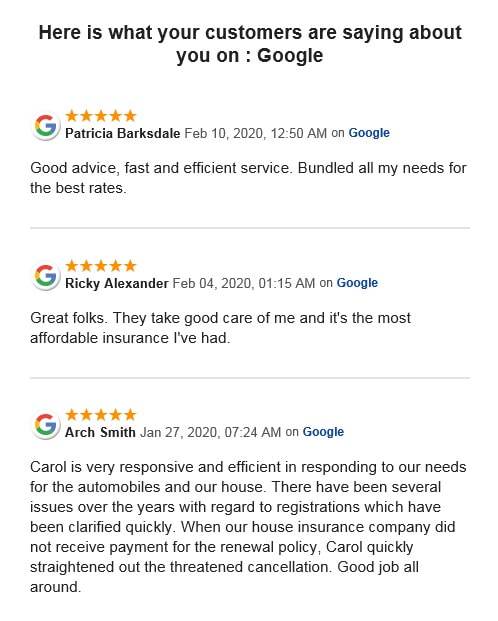

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2024 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed