|

You can get a for a renters insurance policy online in just a few minutes or consider making a quick call to your Travelers representative to get things started. Renters insurance can help cover the loss of or damage to your possessions, additional living expenses if you have to leave your home due to a covered event, and may protect you from personal liability claims, too. Renters insurance can help protect you from the potentially devastating costs of losing the things you own, from the home or apartment that you don’t.

Get answers to your frequently asked renters insurance questions like, "How much renters insurance do I need?" on our renters insurance FAQ page. What's Covered by a Renters Insurance Policy While your landlord’s insurance likely covers the physical dwelling where you live, it can be up to you to protect your personal property, such as your clothes, electronics and furniture. In addition, renters may spend considerable time and money on alterations or improving their rental unit. Under a renters policy, you may apply up to 10% of your personal property coverage to repair or replace improvements made by you or acquired at your expense if damaged by a covered loss. Higher amounts of coverage are available. Ways to Save on Your Renters Insurance When you purchase multiple policies or have a home security system, you may be able to save money on your renters insurance policy. You can also opt for a higher deductible policy. By doing so, you may have to pay more upfront before your insurance policy pays a claim if your covered possessions are lost, damaged or stolen. But typically, choosing a higher deductible means your monthly premiums will be lower. How to Shop for Renters Insurance

0 Comments

Power outages can be a major inconvenience. They can also create problems for you, your family and your home as you shift into "emergency mode" to prevent your food from spoiling, to safely navigate your home in the dark, or simply to keep the heat on. Investing in a home generator can help make being without power more bearable — and can even fuel some fun when not being used for an emergency. Home generators come in a variety of types and sizes, from portable versions to "standby" and inverter units. Portable generators typically run on gasoline and need to be operated at a safe distance from any structure. Standby generators start automatically when the power goes out, and are run on propane or natural gas. Inverter generators have a more complex engine than the other types, and are much quieter than their conventional counterparts. Regardless of which type of generator you choose, you will need to follow the manufacturer recommendations for safe operation of the unit. It's helpful to research this useful home device before you urgently need it, so here are 10 reasons to consider if you're thinking about purchasing a home generator of your own. 1. We can't control the weather. Most power outages are weather-related. As the number and severity of extreme weather events rises, so does the likelihood of a blackout lasting 24 hours or more. 2. You have well water. Without electricity, your well pump and filtration systems will quickly lose the ability to provide fresh, safe water for drinking, bathing, heating and more, to your house. 3. You have a sump pump. If you rely on a sump pump to keep your basement or crawlspace dry — including all the possessions you keep in those areas — losing power means you also lose protection against water damage in those areas. 4. You work from home. If you run a business or work out of your home, you know every minute counts. Going without power for even an hour can be a major inconvenience — if not a major risk — to you, your clients and customers. 5. Food spoils quickly. According to the FDA, perishable food items should be thrown out once your refrigerator has been without power for as little as four hours.1 Calfee Insurance wants to help you protect the things that matter to you. We offer a wide breadth of products so you can be covered at home and on the road. 6. You live in a high-risk or severe climate area. Some states are more vulnerable to weather-related outages. Others have such severe temperature extremes that power to control air conditioning and heating systems can be essential for comfort and safety. If you live in one of these areas, your risk to the potentially devastating effects of a power outage increase significantly. 7. Your property is vacant for extended periods of time. If you are a "snowbird," frequent traveler or own a seasonal home, having a generator can protect your property from outage-related emergencies — whether you're in or out of town. 8. Someone in your home relies on an electrically powered medical device. If you or a loved one requires the assistance of a home medical device that runs on electricity, a power outage can be deadly. A generator can help keep those devices running, but you also will want to check with a healthcare professional for suggestions on how to weather power outages with your particular medical device. 9. You have a hybrid or electric car. Make a portable generator go the extra mile! When not using it for your basic emergency power needs, keep it in your car to stay charged no matter where the road takes you. 10. Generators aren't just for emergencies. Portable generators can be put to use at work or play in, around and away from your home, too:

Whether it's due to storms, falling trees or some other challenge, power outages can bring an assortment of problems for home owners. A home generator can become one of your go-to remedies for those unexpected situations. Checking out the options before you lose electrical power is one smart way to beat the crowds who'll be racing to scoop up a home generator, for that "next time" outage scenario. Learn more about homeowners insurance products, or if you’re ready to take the next step, click here to get a quote. Renovating your property has some serious perks, such as creating more space or updating your amenities.

Some upgrades, such as a new roof or security system, can even reduce home insurance costs. While others — like a pool — can have the opposite effect. Before you take on your next home improvement project, here’s what you should know about how renovations might change your premiums.

If you're planning a home renovation, you may want to call your insurance agent first because this decision can impact your homeowners insurance. Some home renovations will change the amount of coverage you need, while others could even help you qualify for a discount. We cover six common scenarios that could affect your insurance, so you can plan ahead. 1. Building a New Addition When you expand and improve your home, you could likely increase its replacement value. This is the cost to repair or rebuild your home. Some additions that could increase your replacement value include: adding a second-story bedroom, expanding the living room or building a new garage. After building a new addition, or making updates or other improvements, you may need to increase your coverage because the value of your home, and the cost to rebuild it will likely have increased. Most insurance companies require your Coverage A or dwelling coverage limit be at least 80 percent of the replacement value of your home. Your insurance agent can recalculate your home value to determine whether you'll need more coverage because of the addition or improvement. 2. Building a Pool If you're looking to add a pool, you will want to contact your insurance agent to review coverage for changes to your property's value, as well as any increase in risk. When people are swimming and running around the pool, there's the chance for an accident. If someone gets hurt, they could try to hold you responsible for damages. This can apply even if the accident isn't your fault. Check with your agent to see whether your existing policy covers a pool and if you need to increase your liability coverage. This coverage can help pay damages to injured persons and provide for a defense if you are sued as a result of their injuries. You should also ask your agent what steps you can take to keep your pool safe so you can avoid accidents. Adding a fence with a lock is a smart move. You could also add lights with motion sensors or a pool alarm to discourage trespassers. Consider skipping the diving board, because this increases the chance of an accident and your insurance cost. Calfee Insurance wants to help you protect the things that matter to you. We offer a wide breadth of products so you can be covered at home and on the road. 3. Adding a Deck A new deck is another improvement that can add value but also risk, especially if the deck is attached to a second story or higher. You should let your agent know that you've added a deck, so he or she can adjust your policy as necessary. 4. Renovating the Kitchen Upgrading the kitchen can significantly increase the value of your home, especially if you switch to higher-quality counter tops, appliances and new flooring. You should contact your agent to see if you need to increase your insurance coverage. If your contractor upgrades the plumbing or electrical wiring as part of the renovation, ask your homeowners insurance agent if you qualify for a discount or if your coverage needs to be adjusted. These upgrades can reduce the chance of flooding water damage and fire, so check if your insurance company has discounts that can help to reduce your premium. 5. Finishing the Basement Finishing your basement can also increase the value of your home. That means, yet again, you may need more homeowners coverage. Flooding can be a concern, especially for the lowest floor in your house. It is important to note that most homeowners insurance policies do not cover damage caused by floods. Ask your agent to review your coverage and look to see if there are steps you can take to help prevent future damage, like installing a sump pump. 6. Redoing the Roof Before you redo your roof, ask your insurance agent whether this could qualify for a discount. Some companies offer a discount when you reinforce the roof or use stronger roofing materials that are wind, hail and leak-resistant. Your agent can explain how to qualify. At the same time, redoing the roof could increase your property value, which means you might need more coverage. It is a good idea to contact your agent when you’re considering making home renovations. Their knowledge and expertise can help you get the most out of your discounts while making sure your home is adequately insured. Free Home Insurance Review with updated PricingIf you've shopped for new kitchen cabinets recently, you know that it's often much more economical to refinish your old cabinets than to buy new ones. Here are 8 tips that will make your kitchen cabinet refinishing a huge success.

1. If your cabinets are painted, remove the paint with a chemical stripper. If your cabinets are stained or varnished, either clean the surface well or remove most of the stain or varnish with a chemical refinisher. 2. Take the doors off your cabinets and remove the handles and hardware. It will be much easier if you lay the doors flat to work on them. 3. Check to see how much damage there is to the cabinets. If there is only minor damage, such as dark stains around the door handles, just clean these areas. Use a synthetic steel wool pad because it won't hurt your fingers or get caught on the wood grain. 4. Dip the pad in paint thinner, mineral spirits, or turpentine, and scrub the stains. Then lightly scrub the whole surface, cleaning and dulling it so the new finish will stick. 5. Once you've cleaned the surface and removed the dark stains, wipe on an oil-based, clear finish such as Minwax. All clear finishes are low-odor and most are available in either glossy or satin finish. Apply several coats for a thicker finish. 6. If you find you need to redo more than just a few stained areas, use a chemical refinisher - a strong solvent cleaner that dissolves and removes part of the old varnish. Ask an expert at your local paint store to suggest a good quality refinisher. 7. When you're using the chemical refinisher, work in small areas, and scrub the finish with a synthetic steel wool pad. The chemical refinisher will remove the finish and even out the color of the wood and stain. Rinse the pad in more refinisher when it gets clogged with dirty finish. 8. The cabinet's surface should be smooth and evenly colored after you've scrubbed the whole surface. If you find it isn't, just wipe the entire cabinet in long, overlapping strokes with clean refinisher and clean steel wool in long, overlapping strokes. Most of the stain color will remain, and the wood will be very smooth. It's extremely important that you wear protective clothing and make sure that your work area is well-ventilated when you're refinishing your cabinets. And don't forget to follow all safety precautions on the refinishing product labels. By following the 8 tips above, you're sure to enjoy your newly-refinished, beautiful kitchen cabinets for many years.  Coastal Flood Area - Cape Cod, MA Coastal Flood Area - Cape Cod, MA BY ANGELA GREILING KEANE, BLOOMBERG May 6, 2014 (Bloomberg) -- More than half the U.S. population lives in coastal areas that are “increasingly vulnerable” to the effects of climate change, which will ripple throughout the U.S. economy, a White House advisory group’s report concluded. The report released today enumerates the impact across the U.S., including a 71% increase in heavy rain and snow in the Northeast during the past half-century and an increased risk from hurricanes linked to higher sea levels.

|

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

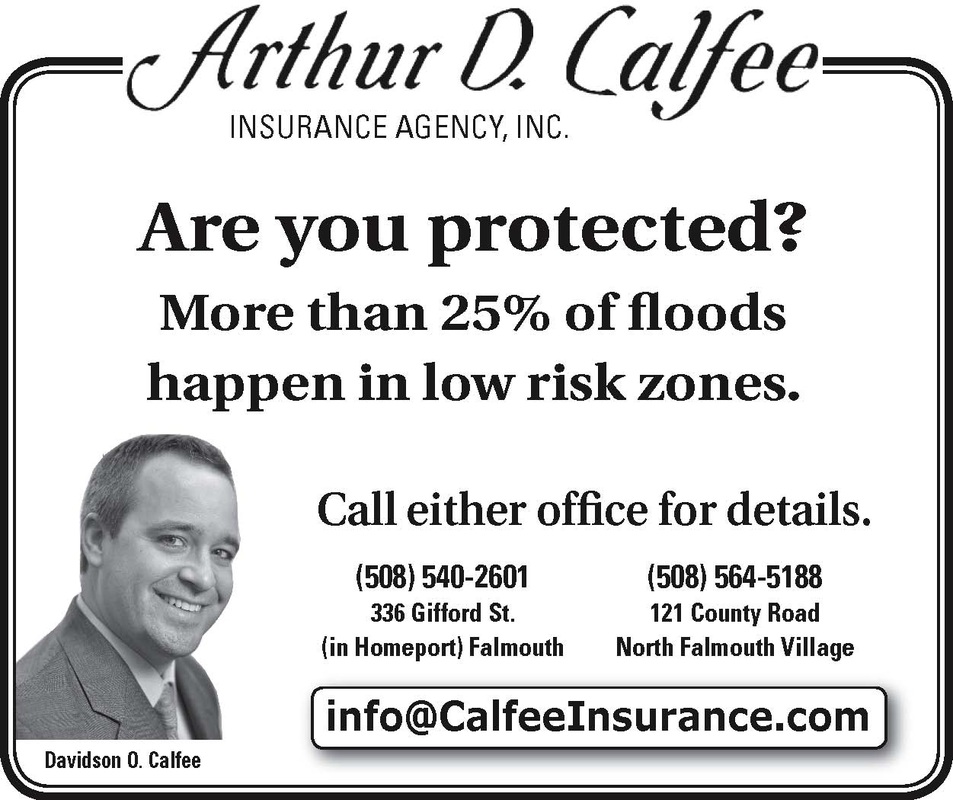

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

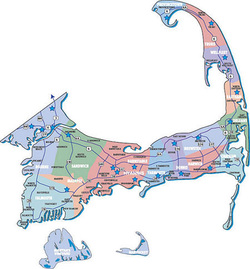

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

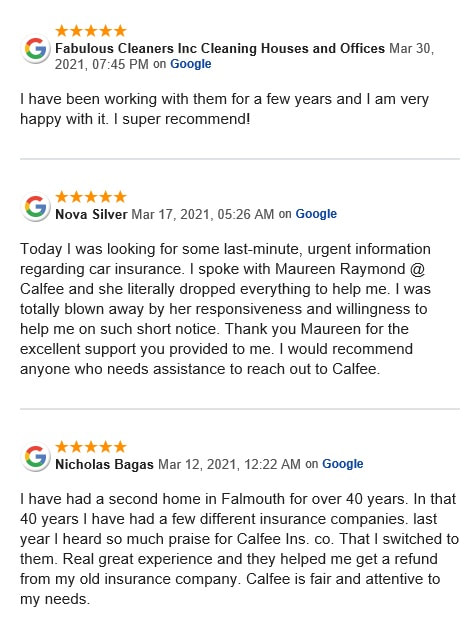

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2024 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed