|

Flooding is nature's most common natural disaster. The average homeowner is five times more likely to incur flood damage than fire damage. If you live in a high-risk zone, you have a one-in-four chance of experiencing flood damage. Almost 25% of all flood claims come from low- to moderate-risk areas and 90% of all presidential-declared disasters involved flooding. Homeowner's policies may not cover the flood damage, and the out-of-pocket costs can be burdensome.

Flood insurance is designed to provide an alternative to disaster assistance to reduce the escalating costs of repairing damage to buildings and their contents caused by floods. While your homeowner's policy may cover fire, tornado, or even earthquake damage, most EXCLUDE damage caused by flooding. Those that cover SOME flood damage do so by specific endorsement and only for a certain dollar amount. Check with your insurance agent to see what coverage is available. To learn more about flooding, flood risks, residential coverage, commercial coverage, preparation, recovery, etc., visit our Flood Insurance page.

0 Comments

Earthquakes, floods, and other disasters can seriously disrupt normal life. Services may not be available, transportation may be cut off and roads may be blocked. In some cases, you may be forced to evacuate. Be ready to respond to any situation by assembling and maintaining a Disaster Supplies Kit. Click 'Read More' below for the Disaster Supplies Plan.  Published: Monday, 2 Dec 2013 | 10:09 AM ET By: Andrew Osterland, Special to CNBC.com All three financial advisors interviewed say the wild card—and potential budget killer—is health care. According to Ward, a couple over age 65 can expect to spend $600 per month each between contributions to Medicare, any Medicare supplemental plan and out-of-pocket medical costs. "It's the biggest expense for retirees," he said. If a health crisis necessitates long-term care, the expenses can be crippling. Long-term care insurance costs approximately $200 per month per person; people should determine whether they want coverage now or will pay for potential costs out of their own pockets should the time come. Wealthy, poor and single people may choose the latter option, but insurance is probably a good idea for the bulk of middle-class married couples. "We generally recommend long-term care insurance for most people," Edelman said. "It's usually health care that causes a crisis for people in retirement." —By Andrew Osterland, Special to CNBC.com  There are so many things that should be considered before you purchased insurance. For example; you already know that every community has building ordinances or zoning laws that affect how houses are built or updated. But did you know that there are also laws and ordinances that govern how or whether a house can be repaired after a loss? When you have a loss that damages part of your house, the repairs, in many situations, must be made to the specifications of any regulations that are in effect at the time of the loss. It doesn’t really matter if everything met code when your house was built. What matters now is the new building code. Even more important than that, there are regulations that may compel you to tear down the house if the damage is more than 40–50 percent of its value. You’re probably thinking: “So how does that affect me? Isn’t that what insurance pays for?" Well…the answer is yes and no at the same time! Insurance pays for the cost to repair or replace the damaged part of the building. Think of it this way: if the value of your house is $200,000 and you have $100,000 in damage, insurance pays for the damage (minus your deductible, of course). But now that your house has sustained damage equal to 50 percent of its value, the law kicks in and requires you to tear it down—damaged and undamaged parts—and rebuild the whole thing! Now, since insurance pays for the damaged part of the building, but even the undamaged part has to be torn down, where does the other $100,000 come from? Well, that’s where Ordinance or Law coverage comes in. There are very few total losses; partial losses are far more likely. But a partial loss could trigger the enforcement of an ordinance or law that could cause you to have to pay more than the amount of loss covered by your policy. Additional coverage may be purchased that would help pay for the value of the undamaged part of the house and the increased cost to rebuild according to the new code. Replacement value doesn’t mean upgrade cost what if this happened to you…A fire causes major destruction to your building. Because more than 50% was damaged, a local by-law requires the building to be torn down and rebuilt to current building codes. You’re a responsible person and take the necessary steps to maintain your property. You have replacement cost value on your policy, so you’d be fully covered…right? Not necessarily. Property insurance policies generally have an “Ordinance or Law” exclusion, which means that the policy covers the building as it exists, but it does not cover the cost to upgrade the building to current building codes and ordinances after a loss. Therefore, having “replacement cost” coverage for your building does not mean that you have “upgrade cost” coverage, unless you purchase an “Ordinance or Law endorsement” for your property. Even if a property policy offers some built-in Ordinance or Law protection, often the amount of coverage isn’t sufficient in a major loss. Building codes and zoning laws affect every piece of property no matter how big or small. These laws are continually changing…requiring new or improved features such as better wiring, handicap access, sprinkler systems and more. If a loss situation triggers code upgrades, it could be financially devastating unless you have Ordinance or Law coverage. While some regard this coverage to be important only for older buildings, laws are always changing, and newer buildings can be affected. This is an area of concern for all building owners. How ordinance and law coverage protects you:

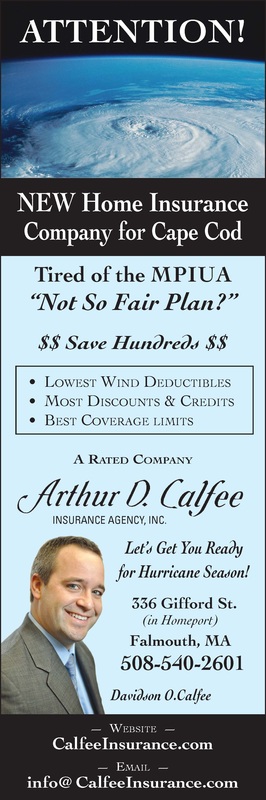

3x TIMES the MONEY that CALFEE raises will go to 'ONE FUND' So here's the scoop- The Arthur D. Calfee Insurance Agency, Inc. is proud to join the business community to support those most affected by the tragic events at the Boston Marathon. The Arthur D. Calfee Insurance Agency, with offices located in the Homeport Office Complex at 336 Gifford Street in Falmouth and across the street of the North Falmouth Ball Field at 121 County Road will be raising money for the Boston Strong - 'One Fund.' From now, April 29th to June 1st, 2013, the Arthur D. Calfee Insurance Agency will be raising 'One Fund' to turn in to 'One' large supporter who has agreed to match 3x TIMES the amount raised by Calfee Insurance, meaning they will match donations on a $3 to $1 basis up to $1,000 in total from the supporter. Massachusetts Governor Deval Patrick and Boston Mayor Tom Menino have announced the formation of 'The One Fund Boston, Inc.' to help the people most affected by the tragic events that occurred in Boston on April 15, 2013. AP | By LINDSEY TANNER Cost of amputating a leg? At least $20,000. Cost of an artificial leg? More than $50,000 for the most high-tech models. Cost of an amputee's rehab? Often tens of thousands of dollars more. These are just a fraction of the medical expenses victims of the Boston Marathon bombing will face. The mammoth price tag is probably not what patients are focusing on as they begin the long healing process. But friends and strangers are already setting up fundraisers and online crowd-funding sites, and a huge Boston city fund has already collected more than $23 million in individual and corporate donations. No one knows yet if those donations – plus health insurance, hospital charity funds and other sources – will be enough to cover the bills. Few will even hazard a guess as to what the total medical bill will be for a tragedy that killed three people and wounded more than 260. At least 15 people lost limbs, and other wounds include head injuries and tissue torn apart by shrapnel. Please visit www.CalfeeInsurance.com for more details.  By Todd Wallack | BOSTON GLOBE STAFF JANUARY 28, 2013 Competition in the state’s car insurance market has yielded an unexpected benefit: Thousands of residents who once had to buy expensive home coverage from the Massachusetts FAIR Plan are increasingly able to find policies through other insurers, saving them hundreds of dollars a year on premiums. The FAIR Plan, known as the insurer of last resort, provides home insurance in high-risk areas, including neighborhoods that have high crime rates or sit perilously close to the ocean. Home insurance companies have traditionally been reluctant to do business in such locations. But since the state gave insurers more freedom to set their own auto insurance rates, starting in 2008 — something it calls “managed competition” — 13 more auto insurance companies have set up shop in Massachusetts, with most also selling homeowners policies or partnering with firms that do. Over that time, the FAIR Plan lost nearly 27,000 homeowners insurance customers, or 16 percent of its base, an exodus few in the industry predicted. “It is all driven by this shift in the competitive marketplace,” said Robert Tommasino, general counsel for the Massachusetts Property Insurance Underwriting Association, better known as the FAIR Plan.

Some insurers, including Narragansett Bay Insurance Co., also decided the escalating prices of premiums for coastal properties made it worth their while to start selling policies in those locations. Their strategy has been to undercut the FAIR Plan rates while still charging enough to turn a profit. Bob Inello, whose waterfront home in Nahant is exposed to the wrath of storms, said he was forced to buy Fair Plan coverage for more than a decade. But three years ago, Inello said, his agent said he could switch to Narragansett, cutting his bill by $570 a year — more than 20 percent. “I don’t feel like I am being held hostage anymore,” Inello said. “It’s very liberating.”

The risk of catastrophic loss during hurricane season requires an innovative approach to property coverage—and a rapid response when losses occur. For over 40 years, Lexington Insurance Company has helped our brokers and clients prepare for, protect against, and recover from catastrophic losses. We are the leading U.S.-based surplus lines insurer, and a property and casualty market leader. Make sure you’re a step ahead of risk this hurricane season. Watch LexTV for the latest on hurricane risk and coverage solutions. Hurricane 2012 Update Dr. Phil Klotzbach updates his 2012 seasonal hurricane forecast and shares his outlook for the remainder of the season. This episode also introduces Lexington's new Hurricane Infographic which will help streamline the understanding of a hurricane event.  Before a Flood What would you do if your property were flooded? Are you prepared? Even if you feel you live in a community with a low risk of flooding, remember that anywhere it rains, it can flood. Just because you haven't experienced a flood in the past, doesn't mean you won't in the future. Flood risk isn't just based on history; it's also based on a number of factors including rainfall , topography, flood-control measures, river-flow and tidal-surge data, and changes due to new construction and development. Flood-hazard maps have been created to show the flood risk for your community, which helps determine the type offlood insurance coverage you will need since standard homeowners insurance doesn't cover flooding. The lower the degree of risk, the lower the flood insurance premium. In addition to having flood insurance, knowing following flood hazard terms will help you recognize and prepare for a flood. To prepare for a flood, you should:

|

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2024 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed