|

The best homeowner insurance is the insurance that best meets your needs. The insurance shopper that takes the time to understand the basic elements of home insurance will have much more confidence and sense of satisfaction when making an insurance purchase. The homeowner policy has been around for a long time and so most of us have a general concept on how the policy works. The more you know about the market value of your home and the approximate cost to rebuild it the better off you will be when shopping for the homeowner policy. This kind of knowledge is the foundation for determining what kind of policy to purchase. The age of your home has a direct bearing on the market value. The older homes built in the 1900’s have much lower market values today because most of them have depreciated. The market value for an older Victorian style home may be $50,000 but the actual cost to rebuild that home may be $200,000. The older homes that depreciate in market value are insured with actual cash value policies. They are often called market value policies. These policies will reimburse you for the market value of your home when there is a total loss. The market value policy is the best homeowner policy for the older home that has depreciated. The replacement cost policy is better designed for newer homes or homes under construction. The replacement cost of a home and the market value are almost the same. Replacement cost is applied to the dwelling and most often to the contents of the dwelling. Replacement cost will repair or replace any loss with like kind and quality of materials without depreciation. The best homeowner insurance for you will be determined by the age and market value of your home. The discounts for older and newer homes are the same. The protective device discount for deadbolt locks, smoke detectors, and fire extinguisher apply to both types of policies. Fire and burglar alarm systems are additional discounts that could be applied to both older and newer homes. Check our recommended insurers for more details.

0 Comments

Making a purchase as big and important as a home owner insurance policy should be taken seriously. Undoubtedly, you want to purchase your policy from the best company, as well as get the best home owner insurance quote. How can you do that? When it comes to home owner insurance quotes, what sets the insurance companies apart? Home owner insurance companies are set apart in many ways. Look at the rating of the home owner insurance companies in question, as well as whether or not they are licensed to do business in your state. Home owner insurance companies also differ in the level of coverage they offer and the kinds of coverage you can add on to your home owner insurance policy. While you’re shopping for the best home owner insurance quote, find the company’s rating. This will let you know how financially stable the insurance company is. Talk to family members, friends, and neighbors about the home owner insurance companies with which they do business. Unless they are employees of the company, they’ll be more than willing to dish the dirt – both good and bad. What really makes the best home owner insurance quote? The best home owner insurance quote varies from person to person. You want to get a quote for a home owner insurance policy that offers the exact coverage you want at a rate that will not completely drain your bank account. Therefore, you need to check out several different home owner insurance companies. Ask about coverage, price, additional coverage, and discounts. Where can I find everything I need to know about home owner insurance in my state? Your state’s department of insurance has all the information you need to know about home owner insurance coverage in your state. The insurance department will also be able to provide you with a list of home owner insurance companies and agents licensed to do business in your state.  We are SAVING MONEY $$ for LOTS of PEOPLE. No Seriously. Take a PHOTO of your Current AUTO INSURANCE Policy with your phone (front & back) and email it to: [email protected] We almost Guarantee that we will save you $ HUNDREDS or GIVE YOU better coverage or both! http://www.CalfeeInsurance.com/ We are a full-service insurance agency, locally owned and operated since 1980 on Cape Cod. "We offer innovative coverage in step with the times, coupled with good, old-fashioned personal service."  Buying Your Dream Cape Cod Home Buying Your Dream Cape Cod Home Even though it’s not easy for everyone to buy a home, it is in fact easier than ever to get a home these days with most lending agencies and banks being more liberal than ever with providing home loans and mortgages. Even if you don’t have a lot of capital or a lot of money to put down, you can still get the home of your dreams at a very affordable price. A lot of us think that buying a home is a tough process, needing a large down payment, although this isn’t always the case. Buying a home largely depends on your budget. If you put a down payment on your home purchase, it will go towards your overall purchase. The more money you put down on a home when you purchase, the lower your monthly payments will be. Those of us who don’t own a home live in rental houses and apartments. This can be a worthwhile solution, although your still paying money towards your housing that you could instead be putting towards a home of your own. Owning a home is a dream for many of us, especially when it comes to that dream home that we all hope to own one day. Apartments and homes are great to rent - although most these days will cost you just as much as a mortgage payment - which doesn’t make any sense at all. Instead, you can easily convert your rental payments into monthly installments towards your own home. All across the United States, you can find of lot of banks and lenders that offer easy to get loans for purchasing your own home or real estate property at low interest rates. With a lot interest rate, you can get the home of your dreams and enjoy low monthly payments. Keep in mind, you need to choose a loan plan that’s best for you. You can go through bank, through a lender, or use a service online. There are many different ways that you can go, although real estate agents seem to be the most common now days. Good real estate agents will be more than willing to help you get a great deal on the home, at prices that are right for you. Anytime you buy a house, you should always plan ahead, get yourself a real estate agent, and then pursue your dream home. If you plan your budget and take things one step at a time, you’ll be closer than you think to the home of your dreams. If you choose to keep renting and pay money toward something you don’t own - the home of your dreams will continue to slip away. Take action now and stop renting - find the home of your dreams and put your money towards owning it instead. Life Insurance – a Small Price to Pay for Peace of Mind

We all reach the stage in life when we wonder whether we need life insurance or not. This isn’t a great decision for any of us – nobody likes to be reminded of their own mortality, after all! But, it’s a decision that comes to us all at some time or other – especially if we have a family to consider. To be honest it’s worth while looking at taking out life insurance at virtually any stage of your life – especially as we reach adulthood and start to amass mortgages and other financial commitments. The fact is that it doesn’t really matter if we have a family to care for or not – if we have any kind of current financial commitments then we need to think about what would happen to them if we were to die out of the blue. And, you have to remember that it doesn’t matter how healthy you think you are – you could die in a car accident or get run over by a bus tomorrow! The thing you have to consider here is what would happen to your financial commitments if you were to die unexpectedly. A lot of people don’t realise that the money they owe on stuff like loans and mortgages doesn’t necessarily pay for itself after their death – somebody will have to take responsibility for its repayment. And, in the simplest of terms you have to think about who would pay for your funeral at the end of the day. Life insurance may be worth thinking about at this stage – it is essential, however, if you have a family to add to the equation. If you have a partner and/or kids then think about how they would cope financially if you did die and your salary died with you. This isn’t just about managing stuff like the mortgage – it’s also all about working out how they would pay for life’s necessities never mind life’s luxuries. If you protect them with a life insurance policy then they could at least cope financially during what would be a very difficult time for them. The key thing to remember with life insurance is that it doesn’t have to cost the earth.Life insurance policies nowadays can be taken out at minimal cost – you really could be paying just a couple of pounds a week to get the right levels of protection. To make things easier most industry experts recommend that you shop around for the best quote as the sector is extremely competitive at the moment. This is easily done – there are loads of web sites out there that can help you sift through competitive quotes so you can find the cheapest policies in just a matter of minutes, for example. This is a great way of getting the life insurance cover you need without spending too much time or money in the process. Life settlements can be a viable option for seniors willing to exchange their life insurance policy for immediate cash. A life settlement is the sale of an existing life insurance policy for a lump sum of money. It allows policyholders to access the fair market value of their life insurance by selling their policies and receiving payments greater than the cash surrender value.

Technically, a life settlement contract allows you to sell your insurance policy to a third party in exchange for a reduced amount of the face value. This is possible because a life insurance policy is actually property, like a car, house, stocks and bonds that can be legally sold. A life settlement essentially lets you extract value today from an asset that is generally thought to only have a benefit when you die. Typically, life settlement transactions involve life insurance policies of a large face amount; “key-person” coverage or corporate-owned life insurance; or policies representing excess coverage that is no longer needed. Here’s how a life settlement works: When a life settlement company buys your life insurance policy, it pays you a percentage of the policy's face value. Then the life settlement company becomes the new beneficiary of the policy at maturation. As such, it is responsible for all paying all future premiums and collects the entire death benefit when the insured dies. A Growing Industry With a life settlement, you can receive a large sum of cash in exchange for your insurance policy while you’re still alive. This eliminates premium payments, accommodates the changing needs of your dependents and provides greater financial flexibility. Life settlements can also be used for charitable giving. Complex estate and tax planning strategies can apply when using life settlements in a planned giving program. But here’s how this works in simplest terms: You donate your life insurance policy to a charitable organization, which immediately sells the policy for a lump sum of cash via a life settlement. These and other benefits are making life settlements an attractive option for seniors with unwanted/unneeded insurance policies. Consequently, the life settlement industry has seen significant growth in recent years. A study by Conning & Co. Research found that senior citizens owned approximately $500 billion worth of life insurance in 2003, of which $100 billion was owned by seniors eligible for life settlements. Since 2003, more and more of these eligible senior clients have sold their policies and helped the market increase. Separate research by the University of Pennsylvania's business school found that life settlement providers paid approximately $340 million to consumers for their underperforming life insurance policies, an opportunity that was not available to them just a few years before. "We estimate that life settlements, alone, generate surplus benefits in excess of $240 million annually for life insurance policyholders who have exercised their option to sell their policies at a competitive rate," according to the research. Selling Your Policy You could be a prime candidate if you are of retirement age, have paid off your mortgage and other debts, and no longer require the financial protection of life insurance. The amount you receive will depend on your age, health, death benefit, and the number of years your policy has been in force. Seniors with the greatest chance of selling their policies are those that are older than 65 years of age, have a calculated life expectancy of more than two years (but less than 10 years) and may have experienced a health change that has led to their insurance premiums increasing. Depending on the policy holder’s life expectancy, just about any type of policy can be sold, including universal life, whole life and convertible term contracts. However, policies generally must be valued at least $100,000. Determining whether to sell your life insurance policy is a purely personal decision. You might consider a life settlement under the following circumstances: • Your employment status has changed. • You need additional funds to pay medical/long-term care expenses. • Your insurance premiums are too expensive and you can no longer afford them. • You would like to implement a charitable or family gifting plan. • You are facing bankruptcy. Consulting with an Advisor Before you decide to sell your insurance policy, you should examine all the available options, advises the American Council of Life Insurers, a Washington D.C.- based trade group. And instead of going it alone, consult with a financial advisor who is familiar with life settlements. This could include account/CPA, lawyer (especially elder law attorney), financial/estate planner, certified senior advisor or charitable trust officers. Additionally, you might consider working with a broker—although your financial advisor can submit your case to the life settlement company directly. However, in an industry where market value for life insurance policies may be unfamiliar, brokers typically do the best job of getting fair market value for policies. They submit life settlement cases and bids to multiple companies, which can facilitate negotiations between high bidders. Keep in mind that life settlement companies are essentially investors that fund many transactions each year. They hold purchased policies as portfolio assets, rather than making them available to outside investors. They also have in-house compliance departments to carefully review transactions, and they are backed by institutional funds from a major bank. Steps to Life Settlement Transactions Wondering what happens during life settlement transactions? Here are the steps involved in the typical transaction: • Step 1: You consult with an advisor and decide to sell your policy. • Step 2: You and your advisor select a broker. • Step 3: The broker submits your case (and you provide a release for your medical information) to various companies. • Step 4: If your policy is eligible for a life settlement, providers send offers to the broker. • Step 5: You accept an offer and then complete the company’s closing package. • Step 6: The life settlement company places a cash payment in escrow and submits change of ownership forms to the insurance carrier. • Step 7: Once the paperwork is verified, the funds are transferred to you. Whole Life Insurance, Trends, and Staying Power

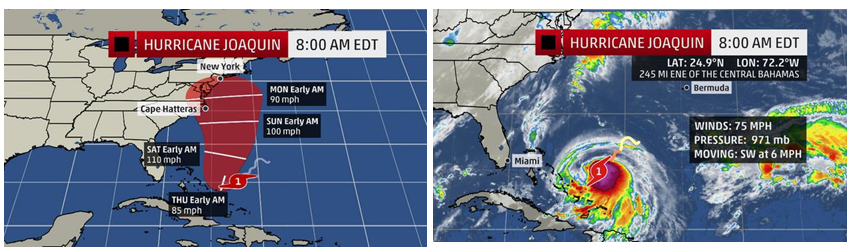

Whole life insurance provides customers with a life insurance policy that will help their loved ones in the future, and with an investment component that will help customers and their families right away. This mixture of delayed and instant gratification has been attractive to life insurance shoppers for decades, but today’s trend in life insurance is moving away from whole life insurance packages. Once, whole life insurance policies were the standard, but today they are the exception. As the economy changes and the American public become increasingly savvy about money management, the full service that a whole life insurance policy provides just isn’t as necessary as it used to be. People who want a more hands on approach to investing are likely to find a whole life insurance policy too limiting. And, the amount of money that one of these policies requires each month can make it difficult to pursue other investment options, especially for middle and lower class families who are living on a budget. A lot of financial experts today feel the investment portions of whole life insurance policies do not offer customers the best return rate on their money. This provides an incentive for people to purchase term life insurance policies which do not include any investment components, and then invest their money elsewhere. However, there are still some advantages to purchasing a whole life insurance policy. Although the investments that an insurance company will make on your behalf may not be the most lucrative, they will almost certainly be among the most stable. Many people prefer a lower rate of return with a lower chance of loss rather than a riskier gamble. There is plenty to be said in favor of this perspective, especially when it comes to planning for the future. In addition, people who do not have the discipline or inclination to save money on their own often find the structured saving a whole life insurance policy requires to be a boon. If the idea of budgeting your own savings plans and spending time researching hot stock tips appeals to you, a whole life insurance policy probably won’t be to your personal taste. Of course, even if you don’t opt for this tried and true kind of policy, you can be certain that someone else will. Although today’s trends seem to foretell the end of the whole life insurance policy, there are still enough customers interested in this kind of traditional and conservative policy that insurance companies will be likely to offer this kind of coverage for many years to come.  Tropical Storm Joaquin has now been upgraded to a Category 1 Hurricane. Most models show a direct northerly route, with potential rains and winds affecting North Carolina and north sometime early next week. So far it's projected path is very unpredictable. We are open for new business at this time. Please note there are no binding restrictions currently in place, but we expect them to begin receiving them very soon. The unpredictable nature of the storm will make carriers cautious. If you need to bind coverage on new policies, you should do so asap, by clicking HERE |

better Insurance

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2024 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed