Cape Cod Home Insurance Q3 2016 Universal Insurance Holdings Inc Earnings Call Fort Lauderdale Nov 3, 2016 (Thomson StreetEvents) -- Edited Transcript of Universal Insurance Holdings Inc earnings conference call or presentation Wednesday, November 2, 2016 at 8:45:00pm GMT TEXT version of Transcript ================================================================================ Corporate Participants ================================================================================ * Matt Palmieri Universal Insurance Holdings, Inc. - SVP of Finance & Statutory Controller * Sean Downes Universal Insurance Holdings, Inc. - Chairman & CEO * Jon Springer Universal Insurance Holdings, Inc. - Director, President & Chief Risk Officer * Frank Wilcox Universal Insurance Holdings, Inc. - CFO ================================================================================ Conference Call Participants ================================================================================ * Arash Soleimani Keefe, Bruyette & Woods - Analyst * Peter McHugh Private Investor * Vimal Gupta Private Investor ================================================================================ Presentation -------------------------------------------------------------------------------- Operator [1] -------------------------------------------------------------------------------- Good day, ladies and gentlemen, and welcome to the Universal Insurance Holdings Third Quarter 2016 Earnings Call. At this time, all participants are in a listen-only mode. Later, there will conduct a question-and-answer session and instructions will follow at that time. (Operator Instructions) As a reminder, this conference is being recorded. I would now like to turn the conference over to Matt Palmieri, Senior Vice President. Sir, you may begin. -------------------------------------------------------------------------------- Matt Palmieri, Universal Insurance Holdings, Inc. - SVP of Finance & Statutory Controller [2] -------------------------------------------------------------------------------- Thank you, Sharon, and good afternoon, everyone. Welcome to the third quarter 2016 earnings conference call for Universal Insurance Holdings, Inc. With me today are Sean Downes, Chairman & Chief Executive Officer; Jon Springer, our Director, President & Chief Risk officer; and Frank Wilcox, Chief Financial Officer. Following Sean's opening remarks, Jon will provide an operational update and Frank will review financial results for the third quarter of 2016. The call will then be reopened for questions. Before we begin, please note that this presentation may contain forward-looking statements about our business and financial results. Forward-looking statements reflect our current view of future events and are typically associated with the words such as believe, expect, anticipate and similar expressions. We caution those listening including investors not to rely solely on forward-looking statements as they can imply risks and uncertainties, some of which cannot be predicted or quantified and future results can differ materially from our expectations We encourage you to carefully consider the risks described in our SEC filings with the SEC, which are available on the SEC's website or the SEC filing section of our website. We do not undertake any obligation to update or correct any forward-looking statements. With that, I'd like to turn the presentation over to Sean Downes. Sean? -------------------------------------------------------------------------------- Sean Downes, Universal Insurance Holdings, Inc. - Chairman & CEO [3] -------------------------------------------------------------------------------- Thank you, Matt, and thank you all for joining us this afternoon. Before I begin, Universal lost a Member of its extended family last month, Ken Leonard. Ken was an actuary with Willis Towers Watson and one of our key consulting actuaries for over a decade. Ken was an integral part of our actuarial team, and he will be greatly missed. Our heartfelt condolences are with Ken's family and business colleagues. I'd like to begin today by providing some highlights from the quarter, and then take a moment to review our strategy and growth initiatives. Jon will then discuss our operational highlights and Frank will conclude by discussing our financial results. As I'm sure some of you saw in today's press release, we are pleased to have delivered another profitable quarter, even with Hurricane Hermine making landfall in Florida. During the third quarter, we reported record total revenue of $172.4 million, a 9.8% increase over the same period in 2015, and net earned premiums of $159.5 million, a 9.2% increase over the same period in 2015. Net income for the quarter was $26.9 million and diluted EPS was $0.75. We achieved these strong results despite the previously mentioned weather-related impact highlighting the underlying strength of our business model and continued improvements in our underwriting and claims divisions, as well as our increased conservatism as it relates to our reinsurance spend. We believe that these vast improvements demonstrate our ability to deliver healthy profits even when faced with challenging weather conditions. Our continued geographic expansion has led to an increase in policy count of approximately 47,000 policies through the first nine months of the year. As our geographic portfolio becomes more diversified, we are simultaneously creating a more robust organic growth engine and stronger, more resilient business model. Contributing to our organic growth is Universal Direct. We are excited to see the continued expansion of our direct-to-consumer online platform for homeowners insurance into new markets, and the positive feedback we have been receiving from our customers. Today, Universal Direct is available in 11 states. And since our second quarter 2016 launch, we have written more than 1,000 policies for approximately $1 million in premium. As we continue to enter and test new markets, we are focused on growing our scale to reach more customers and offer more products to our current and future policyholders. It is clear from the feedback we have received that our current Universal Direct customers are interested in purchasing multiple insurance products through our online platform. In the coming months, we'll be announcing strategic partnerships that will allow Universal Direct to provide our customers, in each state, with a variety of insurance products beyond our traditional homeowners insurance. In August, we announced that our wholly-owned subsidiary, American Platinum Property and Casualty Insurance Company, received authorization from the Florida Office of Insurance Regulation to amended certificate of authority to add fire, commercial, multi-peril, and other lines of business in Florida. Expanding into the commercial residential business is a significant step for us, as it provides us with the ability to tap into large complementary markets and pursue organic growth opportunities by expanding the depth of our operations. We are pleased to announce that our rates have been officially approved. We plan to begin offering our commercial insurance products sometime in the fourth quarter. Before turning the call over to Jon, I'd like to take a moment to discuss our preliminary assessment of Hurricane Matthew losses. First, our thoughts and prayers go out to all the families who experienced this catastrophe, and we hope everybody's lives are back to normal very soon. Universal received 5,657 claims to date, and currently we have closed over 80% of our claims, compared to the industry closure rate of approximately 45%. We believe this is a testament to the strength of our internal claims infrastructure, including our Fast Track team, which was instrumental in our ability to close claims quickly. As we sit here today, from a conservative perspective, we believe that the after-tax impact to our fourth quarter results will be a reduction in profits of approximately $14 million to $18 million, still enabling us to have a profitable fourth quarter. With that, I will now turn it over to Jon. -------------------------------------------------------------------------------- Jon Springer, Universal Insurance Holdings, Inc. - Director, President & Chief Risk Officer [4] -------------------------------------------------------------------------------- Thank you, Sean. I will comment further on two items you briefly mentioned, the recent growth trends in UPCIC and also how the year-to-date catastrophe loss activity impacted our third quarter results and our current reinsurance program. First, regarding recent growth, we continue to be pleased with our organic growth rate, both inside Florida as well as within our 12 other active states. For the third quarter of 2016, from a pure policy count growth standpoint, our total portfolio experienced a second consecutive quarter of net growth of approximately 17,000 policies, 50% of which came in Florida. Outside of Florida, North Carolina, Georgia, Pennsylvania, and Indiana led the way with both Massachusetts and Minnesota continuing to build momentum. It is important to remember that we continue with our strategy of adding business organically one policy at a time. As of 09/30/2016, 14.6% of UPCIC's policies in force and 20% of its insured values now reside outside the state of Florida. These diversification ratios have improved since year-end 2015 from just 12% of policies and 16% of insured values, and from year-end 2014 of only 9% of policies and 12% of insured values. As Sean referred to a moment ago, we booked additional loss in the third quarter totaling $11 million due to Hurricane Hermine and the strengthening of reserves for catastrophe events that occurred earlier in 2016. We believe this positions us well for the first nine months of catastrophe activity. As respect Hurricane Matthew, as a reminder, the UPCIC reinsurance program contains a pretax net retention of $35 million for our core all states catastrophe tower and also includes a supplemental catastrophe tower covering all states outside of Florida, with a pretax retention of $5 million. As previously described, these retentions are not additive, rather the other states program serves as a supplement that would potentially reduce the core program's retention. Given current loss estimates for Hurricane Matthew in Georgia and the Carolinas, at this time, we are indeed expecting a reinsurance recovery from the first layer of the supplemental other states reinsurance tower. Reinsurers have been notified and several have already offered to advance funds. It may be interesting to put some perspective on the overall strength of our catastrophe reinsurance program. PCS recently estimated that Hurricane Matthew personal lines loss for all impacted states for the entire industry would be $2.2 billion. With the top end of our catastrophe reinsurance tower stretching to above $2.4 billion, the UPCIC reinsurance program would have enough limit to cover the personal lines loss from Hurricane Matthew for the entire industry. And in that scenario, our pretax retention would have been just $5 million. With that, I'll now turn the discussion over to Frank for our financial highlights. -------------------------------------------------------------------------------- Frank Wilcox, Universal Insurance Holdings, Inc. - CFO [5] -------------------------------------------------------------------------------- Thank you, Jon. We generated profit during the third quarter of 2016 notwithstanding $11 million of incremental pretax loss and LAE recorded for Hurricane Hermine and other severe weather events occurring earlier in 2016. Net income for the third quarter of 2016 totaled $26.9 million, a decrease of $3.4 million, or 11.3% compared to $30.3 million in 2015. Diluted EPS for the second quarter was $0.75, down $0.09, or 10.7% from the same quarter in 2015. As a result of the decrease in net income, partially offset by a modest decrease in diluted shares outstanding. During this time, we experienced top line growth with increases in every category of revenue for the third quarter of 2016 compared to 2015. Net earned premiums in total revenues were higher than any other quarter in the Company's history. We generated a combined net ratio of 80.4% for the third quarter of 2016 compared to 74.7% for the same quarter in 2015, and 73.4% for the second quarter of 2016. The $11 million incremental charge to losses and LAE added 6.9 percentage points to our combined net ratio for the third quarter of 2016. Direct premiums earned $234.5 million, offset by ceded premiums earned of $75 million, generated $159.5 million of net earned premiums for the third quarter of 2016 compared to $146.1 million for the same period in 2015. The increase in net earned premiums of $13.4 million, or 9.2% was a result of organic growth, which generated an increase in both direct and ceded earned premiums of $19.7 million and $6.3 million, respectively. Ceded premiums earned as a percent of direct premiums earned was 32% during the third quarter of 2016 and 2015. Net investment income for the third quarter -- for the quarter of $2.3 million was $1 million, or 76.3% greater than the third quarter of 2016. This reflects both an increase in our invested assets and actions taken to maximize yields, as securities mature while maintaining high credit quality. Total invested assets reached $643.9 million as of September 30, 2016 compared to $545.2 million one year prior, an increase of 18.1%. Commission revenue of $4.6 million for the third -- for the quarter was up by $0.5 million, or 11.9% compared to the same quarter in [2016], reflecting the differences in our reinsurance programs in effect during those periods, including an increase in our exposures covered by reinsurance. Policy fees of $4.2 million for the quarter were up $406,000, or 10.6% year-over-year from an increase in the number of policies written during the third quarter of 2016 compared to the same period in 2015. Losses and LAE net were $73.5 million for the three months ended September 30, 2016 compared to $53.9 million during the same period in 2015. A large portion of the overall increase in net losses and LAE of $19.6 million was driven by the $11 million in incremental loss and LAE charges related to severe weather in 2016, which added 6.9 percentage points to our net loss ratio for the third quarter. General and administrative expenses were $54.7 million for the third quarter of 2016 compared to $55.3 million for the same quarter in 2015, a decrease of $564,000. An increase in acquisition costs of $2.2 million and other operating costs of $494,000, stemming from growth were more than offset by a decrease in stock-based compensation of $3.3 million. Our expense ratio, which is G&A as a percentage of net earned premiums for the third quarter of 2016 was 34.3% compared to 37.8% for the same period in 2015. The factors behind the decrease in the expense ratio include the reduction in stock-based compensation and economies of scale. The effective income tax rate increased to 39.1% in the third quarter of 2016 compared to 36.7% for the same period in 2015. Excluding discrete items for both periods, the underlying effective tax rates are 38.1% for the third quarter of 2016 and 39.2% for the third quarter of 2015. Our underlying effective tax rate has been trending down primarily from reductions in the amount of non-deductible executive compensation, increasing use of tax exempt securities and lower state income taxes, as we diversify outside of Florida. Our balance sheet remains strong and continues to grow with stockholders' equity and book value per common share reaching all-time highs of $373.3 million and $10.66 per share, respectively, as of September 30, 2016. Consolidated unrestricted cash and cash equivalents were $205.2 million and combined surplus for our insurance subsidiaries was $326.2 million as of September 30, 2016, respectively. At this point, I'd like to turn the call back to the operator. ================================================================================ Questions and Answers -------------------------------------------------------------------------------- Operator [1] -------------------------------------------------------------------------------- (Operator Instructions) Arash Soleimani, KBW. -------------------------------------------------------------------------------- Arash Soleimani, Keefe, Bruyette & Woods - Analyst [2] -------------------------------------------------------------------------------- Just wanted to ask a few questions. So a lot of your peers have been reporting adverse development. Just wanted to get your thoughts on how you feel about your reserves and what risks do you see in that regard? -------------------------------------------------------------------------------- Sean Downes, Universal Insurance Holdings, Inc. - Chairman & CEO [3] -------------------------------------------------------------------------------- We really can't expand upon our peers. Obviously, as you're fully aware, we have made large investments into our claims operation over the last three years. Personnel wise, Platforms wise, I believe we're starting to see the dividends of that. As it relates to our reserves, we feel very confident in our reserves. If we take a look at the last four, five years, we've received over 120,000 claims. We currently have approximately 1,500 claims [of in] pre-2016. With this Fast Track division and our internal division, we're just getting the claims quickly, we're settling claims quickly, we're alleviating the adverse development that you see in a lot of claims when IAs are involved or when claims linger, so I just think that it's an evolution of the Company from -- over the last few years and the hard work and dedication of our employees and specifically from a claims perspective. So, I think we feel very confident about where we stand with our reserves currently. -------------------------------------------------------------------------------- Arash Soleimani, Keefe, Bruyette & Woods - Analyst [4] -------------------------------------------------------------------------------- Okay, thanks for providing that detail. In terms of AOB, how is your experience with AOB and AOB-related litigation change this quarter versus last quarter and versus last year. Would you say it's improved, stayed the same, or gotten worse? -------------------------------------------------------------------------------- Sean Downes, Universal Insurance Holdings, Inc. - Chairman & CEO [5] -------------------------------------------------------------------------------- If you compare the first three quarters of 2015 to 2016, we're basically down 5 points, as it relates to AOB claims or cases in -- that are in-house. So we're seeing a modest reduction. This AOB issue was an issue for all companies. I think what maybe separates us from some others is just the way in which we handle the claim as we've previously expounded upon and the way in which we're getting to these claims quickly and we're paying these claims in a lot of [emphasis] same day. When you're indemnifying the insured, the potential for an AOB situation is negated. So we think by getting to these claims quickly, we are mitigating the potential for a lot of this AOB situation. So I just think it's a claims handling situation for us, we're all experiencing it, but year-over-year we're relatively flat, down 5 points, if you will, as it relates to litigation related to AOB. -------------------------------------------------------------------------------- Arash Soleimani, Keefe, Bruyette & Woods - Analyst [6] -------------------------------------------------------------------------------- So with that said, does that imply that your accident, your loss picks kind of going forward versus last year. We shouldn't expect them to increase as a result of AOB, we should actually expect that they're getting better because of that 5% decrease you mentioned. -------------------------------------------------------------------------------- Sean Downes, Universal Insurance Holdings, Inc. - Chairman & CEO [7] -------------------------------------------------------------------------------- What I would tell you is that I do not expect any increase at all in our loss pick for 2016. We currently, right now, have submitted our third quarter data to our outside actuary and we'll be getting some input from them in the next few weeks; and then again, they will analyze it at the end of the year. But we feel very confident about where we stand with our claims department, specifically and the way in which we are handling these issues. So I don't foresee any increase at all, as it relates to our loss pick directly attributed to AOB or anything else. -------------------------------------------------------------------------------- Arash Soleimani, Keefe, Bruyette & Woods - Analyst [8] -------------------------------------------------------------------------------- Okay, thanks. So, you had mentioned Hurricane Matthew. Even though Matthew was not as bad as a lot of people originally thought, do you -- are you seeing any AOBs stemming from Matthew? Are you seeing the public adjusters and attorneys take advantage of that situation? -------------------------------------------------------------------------------- Sean Downes, Universal Insurance Holdings, Inc. - Chairman & CEO [9] -------------------------------------------------------------------------------- We really haven't seen it that much. Again, as I stated, we were able to mobilize our Fast Track adjusters immediately after the loss and I believe that's mitigated many of the challenges presented by AOB. I have not seen any AOB issue so far. We have seen a few public adjusters involved in some cases. But like I said, we pretty much have touched 97% of all of our claims and closed 80% of them. And the ones that we have not closed, we have a proper reserve on them, that's in line with the cases that we have closed. I'm sure we'll see something, but we have not seeing anything as of yet, and I believe our ability to pay the claim quickly and to close claim out obviously is fixing that situation as far as AOB is concerned. -------------------------------------------------------------------------------- Arash Soleimani, Keefe, Bruyette & Woods - Analyst [10] -------------------------------------------------------------------------------- Thanks. And that $14 million to $18 million range that I think Jon had provided. So even if I take the upper end of that, the $18 million, pretax that would imply about $28 million, so that's below new retention. Can you just comment quickly on how you were able to get the, I guess, total loss to be below your retention, pretax? -------------------------------------------------------------------------------- Jon Springer, Universal Insurance Holdings, Inc. - Director, President & Chief Risk Officer [11] -------------------------------------------------------------------------------- Well, there is a couple things going on there. Both our current view of what the gross loss might be as well as, as I've tried to explain a couple times, our other states reinsurance program serves as a supplement that as we recover from that, it will reduce our retention. So with the losses that we've seen so far in Georgia and the Carolinas, as I -- I believe I mentioned in the opening remarks, we are indeed expecting a recovery from the first layer of that program. -------------------------------------------------------------------------------- Arash Soleimani, Keefe, Bruyette & Woods - Analyst [12] -------------------------------------------------------------------------------- I know that basically anything above $5 million reduces your overall retention. -------------------------------------------------------------------------------- Jon Springer, Universal Insurance Holdings, Inc. - Director, President & Chief Risk Officer [13] -------------------------------------------------------------------------------- Yes. If the event in total including Florida exceeds $35 million. -------------------------------------------------------------------------------- Arash Soleimani, Keefe, Bruyette & Woods - Analyst [14] -------------------------------------------------------------------------------- Okay, that makes sense. But it's fair to think of the pretax amount as being a maximum of $28 million? -------------------------------------------------------------------------------- Jon Springer, Universal Insurance Holdings, Inc. - Director, President & Chief Risk Officer [15] -------------------------------------------------------------------------------- Yes, I think using 40% round number, tax rate $14 million to $18 million become $23 million to $30 million pretax. -------------------------------------------------------------------------------- Arash Soleimani, Keefe, Bruyette & Woods - Analyst [16] -------------------------------------------------------------------------------- Okay. And do you, I mean I know it's early compared to June 1, 2017 renewals. But do you think that Matthews occurrence will at all impair your negotiating ability or do you think it was too small to really have that effect? -------------------------------------------------------------------------------- Jon Springer, Universal Insurance Holdings, Inc. - Director, President & Chief Risk Officer [17] -------------------------------------------------------------------------------- Well, I think you're talking about an event. PCS came out with some numbers the other day, and they have the personal lines loss at about $2.2 billion and I believe just another $500 million or so for the commercial component. So, you're talking about $3 billion event, given the capital position in today's reinsurance market, I don't think that moves the dial at all. In fact I'm not sure it's even a noticeable event for the vast majority of our reinsurance partners. Also I'd like to take this opportunity to remind you that one of the things that we do intentionally to insulate ourselves from this potential is we have purchased a fairly significant amount of our catastrophe reinsurance on a multi-year basis. So when you factor in just ballpark numbers, when you factor in the amount of coverage that we buy from the Florida Hurricane Cat Fund, and the amount of coverage that we have purchased multi-year where the terms are fixed or they could potentially go down depending upon certain circumstances, but they cannot go up. When you factor those two things in, we have two-thirds -- over two-thirds of our catastrophe reinsurance spend at a fixed price, so it can go up. So even if Matthew or any other event were to occur that was able to move the reinsurance marketplace pricing, we would only have -- heading into 2017, we'd only have one-third of our catastrophe spend at risk of that pricing adjustment. -------------------------------------------------------------------------------- Arash Soleimani, Keefe, Bruyette & Woods - Analyst [18] -------------------------------------------------------------------------------- And is this specifically for that -- you saw the coverage below the cap fund? -------------------------------------------------------------------------------- Jon Springer, Universal Insurance Holdings, Inc. - Director, President & Chief Risk Officer [19] -------------------------------------------------------------------------------- The two-thirds is in total of everything. -------------------------------------------------------------------------------- Arash Soleimani, Keefe, Bruyette & Woods - Analyst [20] -------------------------------------------------------------------------------- In terms of the -- your growth inside and outside Florida, I mean I guess what we saw this quarter and last quarter, is that kind of a fair run rate to assume kind of over the next year or so, sustainable growth rate? -------------------------------------------------------------------------------- Jon Springer, Universal Insurance Holdings, Inc. - Director, President & Chief Risk Officer [21] -------------------------------------------------------------------------------- Yes, I think generally, I'll make a few comments and you can do with it what you will for your pro forma. But over the course of the last 12 months, we've grown by approximately 8.5%, $75-ish million. We tend to look at Florida, and our other states portfolio separately. So Florida grew during that period of time about 6%, whereas the other states, of course, with a more modest starting point grew by closer to 45%. That's the past 12 months. As we look forward, I think it's safe to assume that Florida will continue to grow in that sort of 5% to 6% range annually. And then if you're talking about the other states portfolio, obviously, each year that goes by, we develop more critical mass. So I think the dollars that we grew in that other states program which, over the course of the last 12 months, was about $27 million. I think we'll continue to grow sort of in that $30 million to maybe $40 million a year. Obviously, as that portfolio gets bigger, it will become much more difficult to grow by the 45%. I think that percent will slowly come down, but we'll grow $30 million to $40 million a year in the other states portfolio for the coming two to three years. -------------------------------------------------------------------------------- Sean Downes, Universal Insurance Holdings, Inc. - Chairman & CEO [22] -------------------------------------------------------------------------------- And Arash, obviously one of the unknowns really is the Universal Direct strategy. Obviously, we mentioned that we've written approximately $1 million to date in premium, but we haven't really thrown a lot of marketing dollars added per se. So that's one of the unknowns we're really, we're trying to forecast what our growth going to be going forward. We think that's going to be a positive effect. We just can't really go ahead and put a number on it yet. -------------------------------------------------------------------------------- Arash Soleimani, Keefe, Bruyette & Woods - Analyst [23] -------------------------------------------------------------------------------- Thanks. And since you mentioned Universal Direct, can you, I guess, talk a little bit more about that? And I guess your vision for that new product line and some of the partnerships you are mentioning? Are we talking partnerships with auto carriers? -------------------------------------------------------------------------------- Sean Downes, Universal Insurance Holdings, Inc. - Chairman & CEO [24] -------------------------------------------------------------------------------- Yes. Obviously, we're pleasantly surprised by the success of Universal Direct. A lot of people thought that people wouldn't take the time and effort to purchase a homeowner's policy online. The IT department here at Universal did an excellent job in creating this platform for us and made it pretty easy for us and people to use. We're excited about it. We do have a lot of opportunities, nothing that we have declared yet, but we have a lot of opportunities to work with some auto carriers, some other homeowners companies that write business a little differently than we do. So I think in the next quarter -- this quarter or the next quarter, you'll see us put some things to paper and announce some good joint ventures that will be very positive Universal Direct. -------------------------------------------------------------------------------- Arash Soleimani, Keefe, Bruyette & Woods - Analyst [25] -------------------------------------------------------------------------------- Are you using Denver in all the states? -------------------------------------------------------------------------------- Sean Downes, Universal Insurance Holdings, Inc. - Chairman & CEO [26] -------------------------------------------------------------------------------- In states where they like them. -------------------------------------------------------------------------------- Arash Soleimani, Keefe, Bruyette & Woods - Analyst [27] -------------------------------------------------------------------------------- And would you say, I guess, the other new product you kind of mentioned was commercial residential. I guess what are you -- how should we think about that going forward? Is that going to be Florida only, is that going to be multi-state? And can just talk a little bit more about why you're interested in that line? -------------------------------------------------------------------------------- Frank Wilcox, Universal Insurance Holdings, Inc. - CFO [28] -------------------------------------------------------------------------------- Sure, absolutely. Initially it will be Florida only and we'll be writing it in American Platinum Universal Property and Casualty, sister company, which prior to this had been focused on high-value homeowner business. We think there is a tremendous opportunity in the commercial residential marketplace, specifically in Florida, especially for an admitted carrier and we've spoken to a lot of our existing agent partners and there definitely is a need for another carrier in this space. So our target will be the one to four story garden-style condos. We're not going to be writing the 20-storey condo buildings on the water. We're after a different niche of business. We've been working on this for quite some time, including building up our underwriting team over the course of last six months, preparing our systems to handle commercial business as opposed to previously only personal lines. I think you've heard us say before and Jon has alluded to, the rates were filed in July, approved near the end of October, and we're on the homestretch, feeling confident that we'll be able to write our first commercial policy yet here in the fourth quarter of 2016. -------------------------------------------------------------------------------- Sean Downes, Universal Insurance Holdings, Inc. - Chairman & CEO [29] -------------------------------------------------------------------------------- And with that, Arash, we obviously feel that we have the expertise in-house as far as claims are concerned and the underwriting, as Jon said earlier. But of one note, all of the platforms that we are using and going to be using for the commercial side are all things that we have created internally and not off the shelf or paying fees for us. So, we own all of our own systems and we think that there is going to be a good positive line of organic growth for us as it relates to this commercial product. -------------------------------------------------------------------------------- Arash Soleimani, Keefe, Bruyette & Woods - Analyst [30] -------------------------------------------------------------------------------- And it's the same agency work with on the personal lines side (inaudible)? -------------------------------------------------------------------------------- Sean Downes, Universal Insurance Holdings, Inc. - Chairman & CEO [31] -------------------------------------------------------------------------------- Correct. -------------------------------------------------------------------------------- Arash Soleimani, Keefe, Bruyette & Woods - Analyst [32] -------------------------------------------------------------------------------- Okay, thanks. And just very last quick numbers question maybe for Frank. I know you said the $11 million was for Hermine and included some of the development from storms. Aside from that, was there any development in the quarter, favorable or unfavorable? -------------------------------------------------------------------------------- Frank Wilcox, Universal Insurance Holdings, Inc. - CFO [33] -------------------------------------------------------------------------------- No. -------------------------------------------------------------------------------- Sean Downes, Universal Insurance Holdings, Inc. - Chairman & CEO [34] -------------------------------------------------------------------------------- No, there was not. -------------------------------------------------------------------------------- Operator [35] -------------------------------------------------------------------------------- Peter McHugh, Private Investor. -------------------------------------------------------------------------------- Peter McHugh, Private Investor [36] -------------------------------------------------------------------------------- Hi, congratulations on a solid execution for the quarter. Frank, I was just wondering if you could touch, elaborate on your opening remarks on the differences in the effective tax rate on a year-over-year basis for the third quarter? -------------------------------------------------------------------------------- Frank Wilcox, Universal Insurance Holdings, Inc. - CFO [37] -------------------------------------------------------------------------------- Sure, Peter. I'd be happy to. So, in order to appreciate the effective rates in the third quarter of any given year, you should understand that that is the quarter when we complete our income tax returns for the prior year. So, in any given year, we estimate what our ultimate tax liability will be with the taxing jurisdictions, and we put up -- a number up through the end of the year. And when we complete those tax returns, we make any adjustments. So, when I was talking about those discrete items that I backed out in order to normalize the effective tax rate, the vast majority of that is from the true up to the tax returns. So, last year, we actually overestimated -- I'm sorry, in 2014, we overestimated the income tax provision and wound up with a refund and a credit to income tax expense, which reduced our effective tax rate by 269 basis points. This year, we actually had a small adjustment going the other way. And when you normalize your effective tax rates by taking out those discrete items, that's where you land with 38.1% for this quarter in 2016 versus 39.1% for the same quarter last year. Now, the 38.1% compares to about -- I think it was 39.4% for the full year of 2015. So, looking at a quarter in isolation is not always the best thing to do. The best thing to do would be to look at your trends over time. We expect that our full year effective rate for 2016 should be somewhere between 38.8% to 39.1%. -------------------------------------------------------------------------------- Operator [38] -------------------------------------------------------------------------------- Vimal Gupta, Private Investor. -------------------------------------------------------------------------------- Vimal Gupta, Private Investor [39] -------------------------------------------------------------------------------- Thank you for the good quarter. Could you elaborate on the market conduct exam which was recently done for UVE? -------------------------------------------------------------------------------- Sean Downes, Universal Insurance Holdings, Inc. - Chairman & CEO [40] -------------------------------------------------------------------------------- You said the market conduct exam? -------------------------------------------------------------------------------- Vimal Gupta, Private Investor [41] -------------------------------------------------------------------------------- Yes. -------------------------------------------------------------------------------- Jon Springer, Universal Insurance Holdings, Inc. - Director, President & Chief Risk Officer [42] -------------------------------------------------------------------------------- Thanks, Vimal. As a Florida domiciled company, Universal Property and Casualty and American Platinum, are subject to a financial exam from the Florida [ORI] once in every five years, as well as any other type of exams that they want to do which they typically refer to as market conduct exams. There's no set intervals for those. So I think what you're referring to is, most recently we just completed a market conduct exam which was really done for the OIR to assess our response as a company to the well-publicized exam and resulting consent order from 2013. I'm very pleased with the result of this most recent examination. Clearly, the OIR recognized the benefits of the changes that we made in both personnel and procedures, beginning in late 2013 and carrying on into 2014 and really ever since. Obviously, our goal is always to be 100% error free in all aspects of our business. But just being honest that's probably impossible given the nature of the insurance business and all of the unique customer interactions that we're required to have every year. I think it's important for you to know, Vimal and other investors to know that during the course of this most recent exam, we had lots of constructive dialog with the OIR. In fact, in their report they specifically noted the positive impacts of the personnel and procedural changes that we had made. So my understanding is that the Florida OIR will be publishing the final report here soon if they haven't already. And then maybe just lastly to touch on the first type of exam that I mentioned, the financial exam, Universal just finished or rather finished its most recent financial exam in March of 2015 and the results of that exam were no financial adjustments and no recommendations. At that time, they also did a financial examination on American Platinum; and likewise, no adjustments or recommendations from that exam. -------------------------------------------------------------------------------- Vimal Gupta, Private Investor [43] -------------------------------------------------------------------------------- Okay. I need couple of stats. You mentioned about new policies 47,000 in the nine months. Could you give what were the total policies outstanding on September 30? This year, September 30? -------------------------------------------------------------------------------- Sean Downes, Universal Insurance Holdings, Inc. - Chairman & CEO [44] -------------------------------------------------------------------------------- I'm sorry, could you repeat that Vimal? -------------------------------------------------------------------------------- Vimal Gupta, Private Investor [45] -------------------------------------------------------------------------------- The total number of policies insured by UVE on quarter end September 30, 2016? -------------------------------------------------------------------------------- Sean Downes, Universal Insurance Holdings, Inc. - Chairman & CEO [46] -------------------------------------------------------------------------------- 671,366. -------------------------------------------------------------------------------- Vimal Gupta, Private Investor [47] -------------------------------------------------------------------------------- And the total number of employees you had September 30? Total number of employees, personnel (multiple speakers)? -------------------------------------------------------------------------------- Sean Downes, Universal Insurance Holdings, Inc. - Chairman & CEO [48] -------------------------------------------------------------------------------- Frank can (inaudible) but it's approximately 450. -------------------------------------------------------------------------------- Frank Wilcox, Universal Insurance Holdings, Inc. - CFO [49] -------------------------------------------------------------------------------- 440, right in that range, Vimal. -------------------------------------------------------------------------------- Sean Downes, Universal Insurance Holdings, Inc. - Chairman & CEO [50] -------------------------------------------------------------------------------- Vimal, just for little color too. Of those 671,000 give or take, roughly 100,000 of those policies are now in other states outside of Florida. -------------------------------------------------------------------------------- Vimal Gupta, Private Investor [51] -------------------------------------------------------------------------------- My last question is, since this quarter was such a wonderful quarter, should the shareholder be looking for the bonus dividend that you declare in December, or could you comment something on that for the fourth quarter? -------------------------------------------------------------------------------- Sean Downes, Universal Insurance Holdings, Inc. - Chairman & CEO [52] -------------------------------------------------------------------------------- I will tell you that we're having our Board of Directors meeting tomorrow. We will be discussing that and we will be releasing something very soon. -------------------------------------------------------------------------------- Operator [53] -------------------------------------------------------------------------------- Thank you. I'm showing no further questions, I'd like to turn the call back over to management. -------------------------------------------------------------------------------- Sean Downes, Universal Insurance Holdings, Inc. - Chairman & CEO [54] -------------------------------------------------------------------------------- In closing, we believe that our continued geographic expansion efforts, growing distribution channels, broader portfolio of offerings, and the strategic changes we made over the past year has and will continue to drive operational and financial improvements. Looking ahead into 2017, we are confident that we will end the year on a positive note and we'll continue to focus on writing, organically growing rate adequate business in all of our markets. Finally, I would like to personally thank our employees for their hard work and dedication. Our success so far this year will not be possible without their tireless commitment. I would also like to thank all of our agents, shareholders, our Board of Directors, and of course our management team. Thank you. -------------------------------------------------------------------------------- Operator [55] -------------------------------------------------------------------------------- Ladies and gentlemen, this concludes today's conference. Thank you for your participation. Have a wonderful day. You may now disconnect.

1 Comment

pat

9/13/2019 03:41:48 am

to whom it may concern, i have been waiting for universal property & casualty ins. co. to settle my claim, hurricane michael damage my home, instead of setteling, they wait for nexts year hurricane season to begin and still nothing, the cost to repair is 50,000 i quess if i dont recieve nothing you will have to pay 131,503 for dwelling, and you report a net profit of how many millions, but cant settel a 50,000 claim. my claim no. fl18-0103668-h718, can you big bosses put a foot in there ass i pay 1500 a year and this is the kind of care i get

Reply

Leave a Reply. |

Real EstateStay up to date on Cape Cod Real Estate! Land for Sale, Water Front Properties & more! Register now for free email updates of new listings matching your home search.

Auto Insurance

Homeowners Insurance Condo Insurance Renters Insurance Rental Home Insurance Rental Condo Insurance Landlord Insurance Motorcycle Insurance Personal Umbrella Policy Earthquake Insurance Flood Insurance Off Road Vehicles Motor Home Insurance Mobile Home Insurance Travel Trailer Insurance Recreational Vehicles Boat & Yacht Insurance Jet Ski Insurance Personal Watercraft Snowmobile Insurance Archives

September 2023

Categories

All

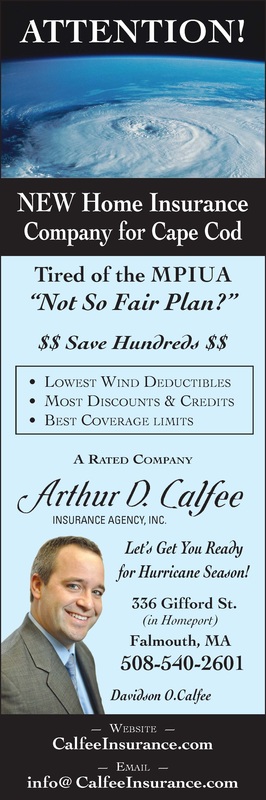

Arthur D. Calfee Insurance Agency, Inc. is proudly serving primary home, vacation home, auto, collector car, business, general liability, property, professional liability, contractor's liability, worker's comp, key man, whole life, term life, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, Eastham, Falmouth, Hatchville, Harwich, Hyannis, Hyannisport, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Truro, Wellfleet, Woods Hole, Yarmouth, and Yarmouthport.

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2024 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed