|

When was the last time you took a look at your home’s foundation?

Maintaining a solid foundation is crucial to ensure the safety and stability of your property — and making prompt repairs will protect you from larger, more expensive problems down the road. Regardless of the age of your house, inspecting the foundation should be part of your annual to-do list. Here are five things you can do to avoid damage and maintain a solid foundation. Check for signs of foundation damage. Inspect the exterior of your house for large cracks in the foundation. Inside, look for crumbling, bowing or sagging walls. Diagonal cracks on interior walls and cracks in the floor or ceiling can also indicate foundation problems. If you spot issues, it’s best to call an experienced professional for repairs. Keep water from pooling around the foundation. Too much water can cause foundation upheaval. Make sure you have proper drainage in the form of gutters, downspouts, downspout extensions and soil sloping to carry excess water away from the foundation. Keep the soil moist. While you don’t want to drown your foundation in water, you also don’t want clay-rich soil to get too dry, potentially causing cracks in your foundation. If you live in a dry climate or have dry seasons, you want to keep the soil moist enough to prevent contraction. Control vegetation near the foundation. Attractive landscaping adds to your home’s curb appeal, but stick to smaller plants for gardens that border your home’s foundation. Tree roots can cause problems with your foundation, so it’s best to plant trees in other areas of your yard. Repair any damage promptly. When it comes to home maintenance, whether with your foundation or something else, catching and repairing problems as soon as possible can save you money and headaches in the future. Do you have questions about maintaining your home or your insurance coverage? Reach out today.

0 Comments

Are you missing out on savings? If you have insurance policies with more than one company, the answer is most likely yes.

The commercials are true: Bundling insurance policies is often cheaper and more convenient when done with a single insurer. But why? While bundling may not be right for everyone, here is the how – and the why – on insurance bundling. Then you can make your own decision. What does it mean to bundle my home and auto insurance? Bundling your home (or renter’s) and auto insurance means getting both policies from the same insurer. You can ask for a quote to see your potential savings before you make a switch. 1. Save money when you bundle policies. You probably have to have home and auto insurance anyway, so you want to get the best possible deal on your coverage. You may be eligible for a multipolicy discount when you get more than one insurance policy from the same company. This is in addition to any other discounts you receive, such as for a good driving record. 2. Simplify payments and organization. Bundling your insurance coverage can help you simplify with one monthly payment instead of several. It’s also easier to keep up with your policies when you can view all your insurance documents in one place. Check your coverage, ask a question, and file a claim — all from the same online portal or mobile app. If your insurance needs to change in the future, you just have one phone call to make. 3. Increase your convenience as a customer. If you file claims often, it's better to have a company that knows and values you as a customer. And even if you don’t file many claims, holding multiple policies with a single insurer gives more business to a company that has given you superior customer service in the past. If you have any questions, reach out for help.  We recommend coverage amounts for your personal situation and break down everything we offer with clear-cut explanations so you know exactly what you’re getting. When purchasing property, doing your due diligence is more than a turn of phrase. The period when a house is under contract is an essential part of the homebuying process and requires careful attention to detail. By answering some simple questions about your home, we’ll get you the protection that you deserve, all through our secure network. We recommend coverage amounts for your personal situation and break down everything we offer with clear-cut explanations so you know exactly what you’re getting. The Basics The due diligence process is the buyer's opportunity to review all facets of a potential home sale. From home inspection findings to homeowner insurance costs, it's when you'll take the time to understand exactly what you're potentially buying. Here are a few due diligence do's and don'ts to consider: Do find out how long it lasts. Two weeks is fairly standard for the average due diligence process. However, shorter periods may be negotiated to gain a competitive edge in a seller's market. Don't make assumptions about when it begins. In some cases, due diligence is conducted before a property goes under contract. In others, it begins after the contract is signed. Do consult an insurance agent. Floodplain and fire-prone areas may require additional coverage. Make sure you know the estimated costs and what a new homeowners insurance policy will cover. Don't skim the home inspection. Make sure you're familiar with every line of the report. You may want to get quotes from contractors or negotiate repair costs into your offer. Do your research. Review neighborhood characteristics and check the area's crime rates. Look at zoning laws to ensure they align with your long-term goals. Don't forget to review the HOA. If you're joining a homeowners association, it's not enough to simply read your HOA documents. Make sure the community is in good physical condition and the association is financially sound. Being thorough in the due diligence phase will help you uncover potential issues and make the right choices for you and your family. The best homeowner insurance is the insurance that best meets your needs. The insurance shopper that takes the time to understand the basic elements of home insurance will have much more confidence and sense of satisfaction when making an insurance purchase. The homeowner policy has been around for a long time and so most of us have a general concept on how the policy works. The more you know about the market value of your home and the approximate cost to rebuild it the better off you will be when shopping for the homeowner policy. This kind of knowledge is the foundation for determining what kind of policy to purchase. The age of your home has a direct bearing on the market value. The older homes built in the 1900’s have much lower market values today because most of them have depreciated. The market value for an older Victorian style home may be $50,000 but the actual cost to rebuild that home may be $200,000. The older homes that depreciate in market value are insured with actual cash value policies. They are often called market value policies. These policies will reimburse you for the market value of your home when there is a total loss. The market value policy is the best homeowner policy for the older home that has depreciated. The replacement cost policy is better designed for newer homes or homes under construction. The replacement cost of a home and the market value are almost the same. Replacement cost is applied to the dwelling and most often to the contents of the dwelling. Replacement cost will repair or replace any loss with like kind and quality of materials without depreciation. The best homeowner insurance for you will be determined by the age and market value of your home. The discounts for older and newer homes are the same. The protective device discount for deadbolt locks, smoke detectors, and fire extinguisher apply to both types of policies. Fire and burglar alarm systems are additional discounts that could be applied to both older and newer homes. Check our recommended insurers for more details.  Universal Insurance Holdings, Inc. ("UIH" or the "Company") was organized as Universal Heights, Inc. in 1990. The Company changed its name to Universal Insurance Holdings, Inc. on January 12, 2001. In April 1997, the Company organized a subsidiary, Universal Property & Casualty Insurance Company ("UPCIC"), as part of its strategy to take advantage of growth opportunities in the Florida homeowners’ insurance marketplace. UPCIC was formed to participate in the transfer of homeowners' insurance policies from the Florida Residential Property and Casualty Joint Underwriting Association ("JUA"). The Company has since evolved into a vertically integrated insurance holding company, which through its various subsidiaries, covers substantially all aspects of insurance underwriting, distribution, claims processing and exposure management. Universal Insurance Holdings, Inc. (UIH), with its wholly-owned subsidiaries, is a vertically integrated insurance holding company performing all aspects of insurance underwriting, distribution and claims. Universal Property & Casualty Insurance Company (UPCIC), a wholly owned subsidiary of the Company, is one of the three leading writers of homeowners insurance in Florida and is now fully licensed and has commenced its operations in Alabama, Delaware, Florida, Georgia, Hawaii, Indiana, Maryland, Massachusetts, Michigan, Minnesota, North Carolina, Pennsylvania, and South Carolina. American Platinum Property and Casualty Insurance Company (APPCIC), also a wholly owned subsidiary, currently writes homeowners multi-peril insurance on Florida homes valued in excess of $1 million, which are limits and coverages currently not targeted through its affiliate UPCIC. UIH’s insurance company subsidiaries have established strong relationships with a network of over 8,000 independent agents by emphasizing personal interaction, offering superior services and maintaining an exclusive focus on homeowners insurance. The Company’s insurance company underwriters work closely with independent agents to market and underwrite business. With competitively priced products, convenient installment billing plans and proactive claims management, both UPCIC and APPCIC provide their customers with superior service. At December 31, 2015, UIH's insurance company subsidiaries serviced approximately 624 thousand homeowners and dwelling fire insurance policies. Management Structure Sean P. Downes Chairman and Chief Executive OfficerSean P. Downes has been Chairman of the Board of Directors and Chief Executive Officer of the Company since 2013 and a director of the Company since 2005. Mr. Downes also served as President of the Company from 2013 until March 2016. Prior to serving in these roles, he served as Senior Vice President and Chief Operating Officer of the Company since 2005 and Chief Operating Officer and a director of UPCIC, a wholly-owned subsidiary of the Company, since 2003. Mr. Downes was Chief Operating Officer of Universal Adjusting Corporation from 1999 to 2003. During that time, Mr. Downes created the Company's claims operation. Before joining the Company in 1999, Mr. Downes was Vice President of Downes and Associates, a multi-line insurance claims adjustment corporation. Jon W. Springer President and Chief Risk OfficerJon W. Springer has been President and Chief Risk Officer of the Company since March 2016 and a director of the Company since 2013. Mr. Springer has held several senior leadership positions with increasing responsibility at the Company, and has been instrumental in the development of the Company’s reinsurance programs and operations. Prior to assuming the positions of President and Chief Risk Officer, Mr. Springer served as Executive Vice President and Chief Operating Officer of the Company since 2013. Previously, Mr. Springer was Executive Vice President of Blue Atlantic Reinsurance Corporation, a wholly-owned subsidiary of the Company, from 2008 to 2013, and Executive Vice President of Universal Risk Advisors, Inc., a wholly-owned subsidiary of the Company, from 2006 to 2008. Before joining Universal Risk Advisors, Inc., Mr. Springer was an Executive Vice President of Willis Re, Inc. and was responsible for managing property and casualty operations in its Minneapolis office. Stephen J. Donaghy Chief Operating OfficerStephen J. Donaghy has been Chief Operating Officer of the Company since March 2016. Mr. Donaghy has held key senior leadership roles in the areas of operations, marketing, sales and corporate strategy throughout his career. Prior to assuming the position of Chief Operating Officer, Mr. Donaghy served as the Company’s Chief Marketing Officer, a position he held starting in January 2015. Mr. Donaghy previously served as the Company’s Chief Administrative Officer from 2013 to June 2015, Chief Information Officer from 2009 to 2013 and Executive Vice President from 2006 to 2009. Before joining the Company, Mr. Donaghy held various executive positions at JM Family Enterprises, a top 100 Forbes private company in the United States; including Vice President of Strategic Initiatives, Vice President of Sales and Marketing and Senior Information Officer. Frank Wilcox Chief Financial Officer and Principal Accounting OfficerFrank C. Wilcox became Chief Financial Officer and Principal Accounting Officer of the Company and its wholly-owned insurance subsidiaries in 2013. Prior to this role, he served as the Company's Vice President - Finance since 2011. Before joining the Company, Mr. Wilcox was Director, Consolidation and SEC Reporting at Burger King Corporation from 2006 to 2011. From 2000 to 2006, he served as Senior Vice President, Controller at BankUnited. Earlier in his career he served in various capacities within the financial services industry, which included a role as an auditor at a large public accounting firm. Mr. Wilcox has been licensed as a certified public accountant in New York since 1996. Kimberly D. Cooper Chief Information OfficerKimberly D. Cooper became the Chief Administrative Officer of the Company in June 2015 and the Chief Information Officer of the Company in February 2015. Prior to assuming these roles, Ms. Cooper spent eight years in the Company’s IT department, serving as both IT Manager and then IT Audit Director. She managed new application deployment and performed ongoing security and risk awareness training to improve operational efficiencies and ensure ongoing compliance with regulatory requirements. Before joining the Company, Ms. Cooper supervised audit and assurance engagements for Fortune 500 clients in the financial services industry, both domestically and internationally, as part of the systems and process assurance practice at PricewaterhouseCoopers (PwC). She has been licensed as a Certified Information Security Auditor (CISA) and Certified in Risk and Information Security Controls (CRISC) since December of 2007. Ms. Cooper holds a Bachelor of Science degree from University of California, Berkeley. |

Real EstateStay up to date on Cape Cod Real Estate! Land for Sale, Water Front Properties & more! Register now for free email updates of new listings matching your home search.

Auto Insurance

Homeowners Insurance Condo Insurance Renters Insurance Rental Home Insurance Rental Condo Insurance Landlord Insurance Motorcycle Insurance Personal Umbrella Policy Earthquake Insurance Flood Insurance Off Road Vehicles Motor Home Insurance Mobile Home Insurance Travel Trailer Insurance Recreational Vehicles Boat & Yacht Insurance Jet Ski Insurance Personal Watercraft Snowmobile Insurance Archives

September 2023

Categories

All

Arthur D. Calfee Insurance Agency, Inc. is proudly serving primary home, vacation home, auto, collector car, business, general liability, property, professional liability, contractor's liability, worker's comp, key man, whole life, term life, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, Eastham, Falmouth, Hatchville, Harwich, Hyannis, Hyannisport, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Truro, Wellfleet, Woods Hole, Yarmouth, and Yarmouthport.

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

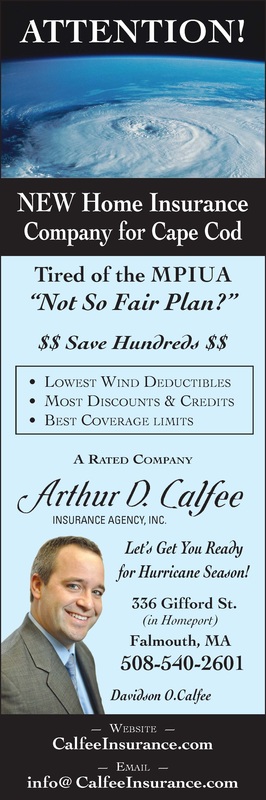

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

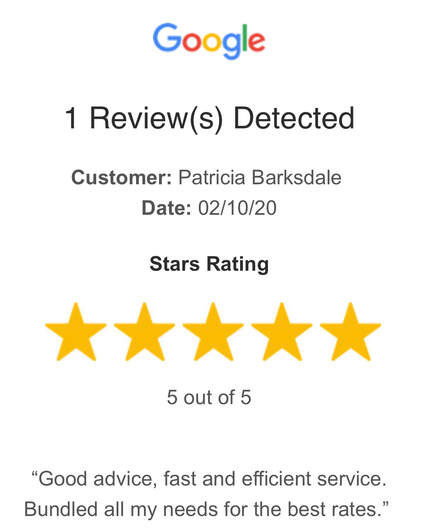

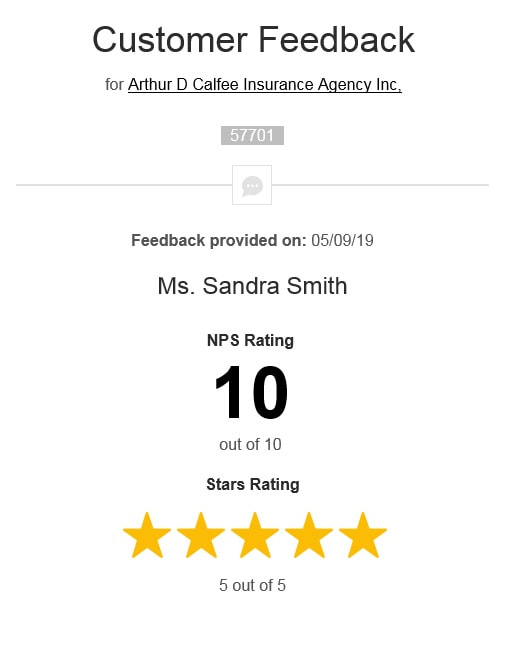

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2023 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed