|

When was the last time you took a look at your home’s foundation?

Maintaining a solid foundation is crucial to ensure the safety and stability of your property — and making prompt repairs will protect you from larger, more expensive problems down the road. Regardless of the age of your house, inspecting the foundation should be part of your annual to-do list. Here are five things you can do to avoid damage and maintain a solid foundation. Check for signs of foundation damage. Inspect the exterior of your house for large cracks in the foundation. Inside, look for crumbling, bowing or sagging walls. Diagonal cracks on interior walls and cracks in the floor or ceiling can also indicate foundation problems. If you spot issues, it’s best to call an experienced professional for repairs. Keep water from pooling around the foundation. Too much water can cause foundation upheaval. Make sure you have proper drainage in the form of gutters, downspouts, downspout extensions and soil sloping to carry excess water away from the foundation. Keep the soil moist. While you don’t want to drown your foundation in water, you also don’t want clay-rich soil to get too dry, potentially causing cracks in your foundation. If you live in a dry climate or have dry seasons, you want to keep the soil moist enough to prevent contraction. Control vegetation near the foundation. Attractive landscaping adds to your home’s curb appeal, but stick to smaller plants for gardens that border your home’s foundation. Tree roots can cause problems with your foundation, so it’s best to plant trees in other areas of your yard. Repair any damage promptly. When it comes to home maintenance, whether with your foundation or something else, catching and repairing problems as soon as possible can save you money and headaches in the future. Do you have questions about maintaining your home or your insurance coverage? Reach out today.

0 Comments

When was the last time you gave your home and auto insurance policies an annual checkup?

A lot can happen in a year, and reviewing your current coverage is worthwhile to see if anything needs to be updated or changed. Keep reading to learn why you should check in on your policies. Major Home Renovation If you added on to your home, upgraded the kitchen and bathrooms, or made any other big changes to the property, make sure you have enough dwelling coverage to rebuild your newly remodeled home. Even if you’ve only done minor renovations, rising construction labor and materials prices could mean that your coverage wouldn’t be enough to rebuild your home in its current condition. In that case, you’ll want to increase your coverage to avoid having to foot some of the bills yourself. Addition of Valuable Objects Have you purchased or inherited valuable artwork, antiques or jewelry in the past year? It’s time to update your home inventory and see if you have the proper policies to replace the value of the items inside your home. And if you added a home security system to protect your valuables, you may be eligible for a discount. Change in Marital Status Did you get married recently? You could be eligible for a discount if you bundle home and auto insurance policies with your new spouse. If you got divorced or your spouse has passed, you can no longer be on a joint car or home insurance policy with that person. Reach out to get a quote for your own policy. Payments on an Auto Loan Review your auto insurance coverage to see if it still meets your needs. For example, if you’ve paid enough of your auto loan down, you may no longer need gap insurance. If you’ve changed jobs and are doing less driving, you may be able to get a discount. Do you have questions about your coverage? Reach out so we can discuss your Are you missing out on savings? If you have insurance policies with more than one company, the answer is most likely yes.

The commercials are true: Bundling insurance policies is often cheaper and more convenient when done with a single insurer. But why? While bundling may not be right for everyone, here is the how – and the why – on insurance bundling. Then you can make your own decision. What does it mean to bundle my home and auto insurance? Bundling your home (or renter’s) and auto insurance means getting both policies from the same insurer. You can ask for a quote to see your potential savings before you make a switch. 1. Save money when you bundle policies. You probably have to have home and auto insurance anyway, so you want to get the best possible deal on your coverage. You may be eligible for a multipolicy discount when you get more than one insurance policy from the same company. This is in addition to any other discounts you receive, such as for a good driving record. 2. Simplify payments and organization. Bundling your insurance coverage can help you simplify with one monthly payment instead of several. It’s also easier to keep up with your policies when you can view all your insurance documents in one place. Check your coverage, ask a question, and file a claim — all from the same online portal or mobile app. If your insurance needs to change in the future, you just have one phone call to make. 3. Increase your convenience as a customer. If you file claims often, it's better to have a company that knows and values you as a customer. And even if you don’t file many claims, holding multiple policies with a single insurer gives more business to a company that has given you superior customer service in the past. If you have any questions, reach out for help. Do you have uninvited guests in your home? Depending on where you live, pests could be a year-round or seasonal issue, but they are never welcome. Nothing shatters your sense of peace and comfort in your home like discovering mice, termites, ants or other pests looking for food and shelter.

Luckily, there are tried-and-true methods for dealing with bugs and rodents in both the short and long terms. Keep reading to discover the best pest control solutions for your home. Short-Term Pest Control Solutions Once you’ve spotted signs of an infestation in your home, here’s what you can do to control the problem immediately:

Once you get things under control for now, you’ll want to address the root cause to keep pests away for the long run.

While no one enjoys dealing with pest issues, regular maintenance and prevention can help keep your home a haven — but only for you and your human guests. Have questions about homeownership or insurance? Reach out so we can discuss your coverage. Are you planning a backyard project? With spring here and summer on the horizon, many homeowners are ready to spruce up their backyards or take on a big project. If you’re ready to plant new trees, build a deck or patio, add a pond, or do anything else that requires digging, make sure you know where underground utilities are before you break ground.Send me a Home Insurance Quote Keep reading to learn who to call before you dig, how to identify different utility markings and how to keep yourself safe during an excavation project. Call 811. This is the national call-before-you-dig number. You or your contractor should call 811 to request the marking of buried utilities so you don’t accidentally damage an underground utility line. You can also contact 811 online through your state’s website. Understand the different colors. Once the buried utilities in your yard are marked, you may see different color markings. Here’s what they mean:

If you’re doing your own backyard digging project, make sure to stretch and warm up before you get started. Otherwise, you risk injuring yourself. Use the right equipment. Are the hand tools in your shed or garage enough, or do you need to rent equipment for your project? Do your research before you begin so you have the proper tools. Contractors should be insured and bonded. If you’re hiring a contractor for your digging or excavation project, check that they have insurance and are bonded. This protects you if they don’t finish the project or cause damage to your property. If you accidentally hit a utility line while digging, call 911. And if you have questions about your home insurance, reach out for answers. The best homeowner insurance is the insurance that best meets your needs. The insurance shopper that takes the time to understand the basic elements of home insurance will have much more confidence and sense of satisfaction when making an insurance purchase. The homeowner policy has been around for a long time and so most of us have a general concept on how the policy works. The more you know about the market value of your home and the approximate cost to rebuild it the better off you will be when shopping for the homeowner policy. This kind of knowledge is the foundation for determining what kind of policy to purchase. The age of your home has a direct bearing on the market value. The older homes built in the 1900’s have much lower market values today because most of them have depreciated. The market value for an older Victorian style home may be $50,000 but the actual cost to rebuild that home may be $200,000. The older homes that depreciate in market value are insured with actual cash value policies. They are often called market value policies. These policies will reimburse you for the market value of your home when there is a total loss. The market value policy is the best homeowner policy for the older home that has depreciated. The replacement cost policy is better designed for newer homes or homes under construction. The replacement cost of a home and the market value are almost the same. Replacement cost is applied to the dwelling and most often to the contents of the dwelling. Replacement cost will repair or replace any loss with like kind and quality of materials without depreciation. The best homeowner insurance for you will be determined by the age and market value of your home. The discounts for older and newer homes are the same. The protective device discount for deadbolt locks, smoke detectors, and fire extinguisher apply to both types of policies. Fire and burglar alarm systems are additional discounts that could be applied to both older and newer homes. Check our recommended insurers for more details. Last year the UK's average premium for Buildings Insurance increased by 1% to just over £205 and the average for Contents Insurance rose to £151, up 2%. But within the market we've seen some much bigger rises – if you're with Norwich Union you'll have seen your premium rise by around 6%. So what's going on? Every year we see premiums rising. Surely with so much competition in the home insurance market, you wouldn't expect to see such inexorable rises in premiums? Let's consider the situation more carefully. The cost of repairing and rebuilding houses is a reflection of the rising price of labour and building materials. This means that cost to the insurers of claims under the buildings cover similarly rises. So as their costs rise, so do your premiums. And there's also the indisputable fact that cost inflation also affects the insurance companies own operating costs. Wherever possible, they're bound to add a little extra on for that! Then there's that lovely British weather. Michael Fish could be forgiven for believing we don't live in a hurricane zone, but nevertheless it's a fact that storms, and especially floods, are becoming ever more frequent. Flood damage can be particularly destructive with, according to the Association of British Insurers, the average insurance claim ranging between £15,000 and £30,000. And during the last 18 months we have seen particularly destructive floods create headline news at Helmsley in North Yorkshire, Carlisle, and Boscastle in Cornwall. Those events must have cost the insurance companies multi-millions. The other area where costs have been rising is burglary. The average burglary claim has now risen to around £1,400. There seem to be two reasons – firstly burglars are finding pickings easier to come by and move on. Modern family homes are packed with valuable electronic gismos – from laptops to I pods, digital cameras and flat screen TV's. The other reason is that burglars are targeting well-off neighbourhoods more and more. Against this background the insurance companies are able to price home and contents insurance down to individual postcodes. If their records show a problem with flooding, or subsidence, or an increasing incidence of burglary in you immediate area, their computers will load your premium to reflect the additional risk. Your no-claims discount will only serve to offset these upward pressures to a certain extent. And don't forget that once you have a five years no-claims record, your discount doesn't increase, it's capped. Thereafter, all the premium increases will land fully in your lap. So what can you do to save money? The most important step by far, is to shop around every year for the best available deal. Maybe it's a chore, but thirty or forty minutes on the Internet (including ten minutes on this web site!) will yield you results. Within that space of time you'll have found the cheapest insurer and, as an online customer, you'll probably have qualified for an additional 10% discount. Then you can always agree to pay by direct debit – that'll also trim off a bit more. Of course there are other things you can do, especially in the arena of home security. Join the local neighbourhood watch scheme, install security locks on your windows, fit external security lighting, up-grade the locks on your doors and get a burglar alarm. Added security will earn you discounts on your insurance but will cost you money to install! Perhaps the added peace of mind alone will be worth the cost. Only the local neighbourhood watch scheme arrives free! The best general rule is don't stick with the same insurance company too long. Keep them on their toes. They have a tendency to take loyal customers for granted. Yes, it really does pay to shop around – try it and prove it to yourself! |

Real EstateStay up to date on Cape Cod Real Estate! Land for Sale, Water Front Properties & more! Register now for free email updates of new listings matching your home search.

Auto Insurance

Homeowners Insurance Condo Insurance Renters Insurance Rental Home Insurance Rental Condo Insurance Landlord Insurance Motorcycle Insurance Personal Umbrella Policy Earthquake Insurance Flood Insurance Off Road Vehicles Motor Home Insurance Mobile Home Insurance Travel Trailer Insurance Recreational Vehicles Boat & Yacht Insurance Jet Ski Insurance Personal Watercraft Snowmobile Insurance Archives

September 2023

Categories

All

Arthur D. Calfee Insurance Agency, Inc. is proudly serving primary home, vacation home, auto, collector car, business, general liability, property, professional liability, contractor's liability, worker's comp, key man, whole life, term life, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, Eastham, Falmouth, Hatchville, Harwich, Hyannis, Hyannisport, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Truro, Wellfleet, Woods Hole, Yarmouth, and Yarmouthport.

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

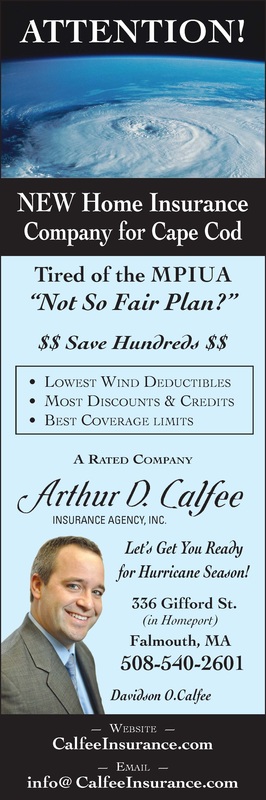

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

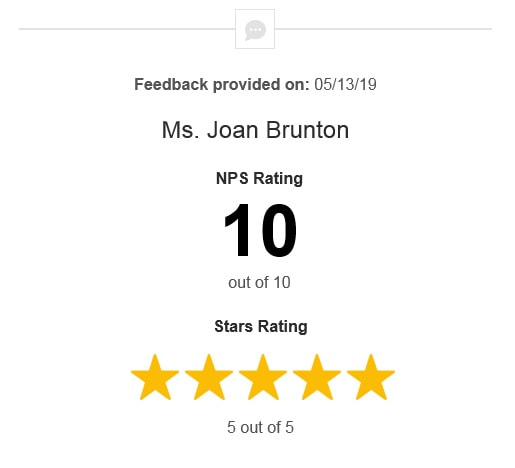

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2024 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed