|

ACTUAL CASH VALUE An amount equivalent to the fair market value of the stolen or damaged property immediately preceding the loss. For real property, this amount can be based on a determination of the fair market value of the property before and after the loss. For vehicles, this amount can be determined by local area private party sales and dealer quotations for comparable vehicles. AGENT A licensed person or organization authorized to sell insurance by or on behalf of an insurance company. AUTOMOBILE INSURANCE Coverage on the risks associated with driving or owning an automobile. It can include collision, liability, comprehensive, medical, and uninsured motorist coverages. BINDER A temporary or preliminary agreement, which provides coverage until a policy, can be written or delivered. BROKER A licensed person or organization paid by you to look for insurance on your behalf. CANCELLATION The termination of insurance coverage during the policy period. Flat cancellation is the cancellation of a policy as of its effective date, without any premium charge. CLAIM Notice to an insurer that under the terms of a policy, a loss may be covered. CLAIMANT The first or third party. That is any person who asserts right of recovery. CO-INSURANCE Provision in an insurance policy, usually optional, under which the policyholder, for a reduced rate, agrees to maintain insurance equal to a specified percentage of the value of the property covered. Policyholders who fail to maintain the minimum amount of coverage specified, assume a proportionate share of the loss. DECLINE The company refuses to accept the request for insurance coverage. DEDUCTIBLE The amount of the loss which the insured is responsible to pay before benefits from the insurance company are payable. You may choose a higher deductible to lower your premium. DEPRECIATION A decrease in value due to age, wear and tear, etc. ENDORSEMENT Amendment to the policy used to add or delete coverage. Also referred to as a "rider." EXCLUSION Certain causes and conditions, listed in the policy, which are not covered. EXPIRATION DATE The date on which the policy ends. FACE AMOUNT The dollar amount to be paid to the beneficiary when the insured dies. It does not include other amounts that may be paid from insurance purchased with dividends or any policy riders. FIRE INSURANCE Coverage for loss of or damage to a building and/or contents due to fire. GRACE PERIOD A period (usually 31 days) after the premium due date, during which an overdue premium may be paid without penalty. The policy remains in force throughout this period. GUARANTEED INSURABILITY An option that permits the policyholder to buy additional stated amounts of life insurance at stated times in the future without evidence of insurability. HEALTH INSURANCE A policy that will pay specified sums for medical expenses or treatments. Health policies can offer many options and vary in their approaches to coverage. HOMEOWNER INSURANCE An elective combination of coverages for the risks of owning a home. Can include losses due to fire, burglary, vandalism, earthquake, and other perils. INCONTESTABLE CLAUSE A policy provision in which the company agrees not to contest the validity of the contract after it has been in force for a certain period of time, usually two years. INSURED The policyholder - the person(s) protected in case of a loss or claim. INSURER The insurance company. LIFE INSURANCE A policy that will pay a specified sum to beneficiaries upon the death of the insured. LIMIT Maximum amount a policy will pay either overall or under a particular coverage. LOAN VALUE The amount that can be borrowed at a specified rate of interest from the issuing company by the policyholder, using the value of the policy as collateral. In the event the policyholder dies with the debt partially or fully unpaid, then the amount borrowed plus any interest is deducted from the amount payable. MATERIAL MISREPRESENTATION The policyholder / applicant makes a false statement of any material (important) fact on his/her application. For instance, the policyholder provides false information regarding the location where the vehicle is garaged. MISQUOTE An incorrect estimate of the insurance premium. PERIL The cause of a possible loss. For example, fire, theft, or hail. POLICY The written contract of insurance. POLICY LIMIT The maximum amount a policy will pay, either overall or under a particular coverage. PREMIUM The amount of money an insurance company charges for insurance coverage. PREMIUM FINANCING A policyholder contracts with a lender to pay the insurance premium on his/her behalf. The policyholder agrees to repay the lender for the cost of the premium, plus interest and fees. PRO-RATA CANCELLATION When the policy is terminated midterm by the insurance company, the earned premium is calculated only for the period coverage was provided. For example: an annual policy with premium of $1,000 is cancelled after 40 days of coverage at the company's election. The earned premium would be calculated as follows: 40/365 days X $1,000 = $110. QUOTE An estimate of the cost of insurance, based on information supplied to the insurance company by the applicant. REINSTATEMENT The restoring of a lapsed policy to full force and effect. The reinstatement may be effective after the cancellation date, creating a lapse of coverage. Some companies require evidence of insurability and payment of past due premiums plus interest. REPLACEMENT VALUE The cost to repair or replace an insured item. Some insurance only pays the actual cash or market value of the item at the time of the loss, not what it would cost to fix or replace it. If you have personal property replacement cost coverage, your insurance will pay the full cost to repair an item or buy a new one once the repairs or purchases have been made. RIDER Usually known as an endorsement, a rider is an amendment to the policy used to add or delete coverage. SHORT-RATE CANCELLATION When the policy is terminated prior to the expiration date at the policyholder's request. Earned premium charged would be more than the pro-rata earned premium. Generally, the return premium would be approximately 90 percent of the pro-rata return premium. However, the company may also establish its own short-rate schedule. SOLICITOR A licensed employee of a fire and casualty agent or broker who may act for the agent or broker in some circumstances. SURCHARGE An extra charge applied by the insurer. For automobile insurance, a surcharge is usually for accidents or moving violations. SURRENDER To terminate or cancel a life insurance policy before the maturity date. In the case of a cash value policy, the policyholder may exercise one of the nonforfeiture options at the time of surrender. UNDERWRITING The process of selecting applicants for insurance and classifying them according to their degrees of insurability so that the appropriate premium rates may be charged. The process includes rejection of unacceptable risks. WAITING PERIOD A period of time set forth in a policy that must pass before some or all coverages begin.

0 Comments

Leave a Reply. |

Real EstateStay up to date on Cape Cod Real Estate! Land for Sale, Water Front Properties & more! Register now for free email updates of new listings matching your home search.

Auto Insurance

Homeowners Insurance Condo Insurance Renters Insurance Rental Home Insurance Rental Condo Insurance Landlord Insurance Motorcycle Insurance Personal Umbrella Policy Earthquake Insurance Flood Insurance Off Road Vehicles Motor Home Insurance Mobile Home Insurance Travel Trailer Insurance Recreational Vehicles Boat & Yacht Insurance Jet Ski Insurance Personal Watercraft Snowmobile Insurance Archives

September 2023

Categories

All

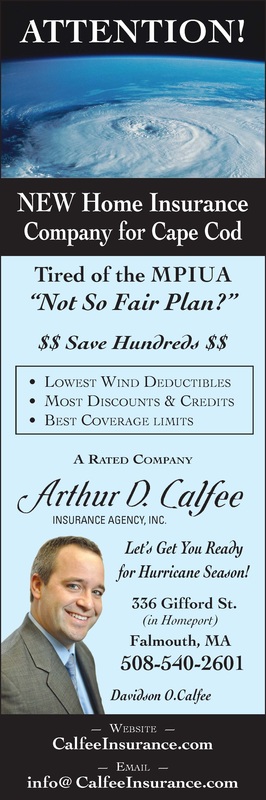

Arthur D. Calfee Insurance Agency, Inc. is proudly serving primary home, vacation home, auto, collector car, business, general liability, property, professional liability, contractor's liability, worker's comp, key man, whole life, term life, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, Eastham, Falmouth, Hatchville, Harwich, Hyannis, Hyannisport, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Truro, Wellfleet, Woods Hole, Yarmouth, and Yarmouthport.

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2024 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed