|

Are you safe in a car during a tornado?

It's not safe to remain in your car or drive during a tornado. Cars, buses, and other vehicles can easily be knocked over and tossed around. That's why you should always get to the nearest sturdy building and get underground if possible. Can you take shelter below an overpass or a bridge? Despite popular belief, government officials like the Ohio Committee for Severe Weather Awareness advise that seeking shelter under structures like bridges and overpasses is a bad idea. These areas can expose you to higher wind speeds and more dangerous flying debris. What to do when driving during a tornado

0 Comments

When it comes to home repairs and renovations, it can be difficult to know what you can accomplish on your own — and which projects are best handled by a trained professional.

Costs, safety, time and the finished product are all things you should plan around. Consider the pros and cons of doing it yourself versus hiring a professional for a project. You may be able to do smaller things on your own, but some jobs are better left to an expert. What’s the time commitment? Thanks to online tutorials, you have access to near-infinite home repair knowledge. But how much time do you actually have to put that information into action? Before starting a DIY project, make sure you can complete the work within your target timeframe. For example, if you need to get a nursery ready before a new baby is born, can you expect to meet that deadline? Are you okay with spending so much of your spare time on it? How much will you save? Since you’re not paying someone else for their labor, you should be able to save a ton of money on your home project, right? The answer isn’t always that simple. For example, do you already have the tools and materials you need? You can always get a few quotes to compare the expense of hiring a professional. And keep in mind that you may have to hire a pro if there are issues, meaning extra spending on top of the money you’ve already invested into it. Is safety an issue? A good rule of thumb is that any project requiring a permit might be too big or too risky to DIY. This includes electricity, plumbing, digging and structural changes. It’s not worth the chance that a mistake could hurt you or make your home unsafe. Can you accept “good enough” instead of perfect? Let’s face it: Sometimes a finished DIY project doesn’t look as good as if a contractor did it. If you want a renovation to come out perfectly (or if you want to sell your home quickly), consider hiring a professional. Have questions about your home insurance and how your coverage can be affected by renovations? Reach out for assistance. Are you missing out on savings? If you have insurance policies with more than one company, the answer is most likely yes.

The commercials are true: Bundling insurance policies is often cheaper and more convenient when done with a single insurer. But why? While bundling may not be right for everyone, here is the how – and the why – on insurance bundling. Then you can make your own decision. What does it mean to bundle my home and auto insurance? Bundling your home (or renter’s) and auto insurance means getting both policies from the same insurer. You can ask for a quote to see your potential savings before you make a switch. 1. Save money when you bundle policies. You probably have to have home and auto insurance anyway, so you want to get the best possible deal on your coverage. You may be eligible for a multipolicy discount when you get more than one insurance policy from the same company. This is in addition to any other discounts you receive, such as for a good driving record. 2. Simplify payments and organization. Bundling your insurance coverage can help you simplify with one monthly payment instead of several. It’s also easier to keep up with your policies when you can view all your insurance documents in one place. Check your coverage, ask a question, and file a claim — all from the same online portal or mobile app. If your insurance needs to change in the future, you just have one phone call to make. 3. Increase your convenience as a customer. If you file claims often, it's better to have a company that knows and values you as a customer. And even if you don’t file many claims, holding multiple policies with a single insurer gives more business to a company that has given you superior customer service in the past. If you have any questions, reach out for help. Do you have uninvited guests in your home? Depending on where you live, pests could be a year-round or seasonal issue, but they are never welcome. Nothing shatters your sense of peace and comfort in your home like discovering mice, termites, ants or other pests looking for food and shelter.

Luckily, there are tried-and-true methods for dealing with bugs and rodents in both the short and long terms. Keep reading to discover the best pest control solutions for your home. Short-Term Pest Control Solutions Once you’ve spotted signs of an infestation in your home, here’s what you can do to control the problem immediately:

Once you get things under control for now, you’ll want to address the root cause to keep pests away for the long run.

While no one enjoys dealing with pest issues, regular maintenance and prevention can help keep your home a haven — but only for you and your human guests. Have questions about homeownership or insurance? Reach out so we can discuss your coverage.  We know that many of our customers are continuing to do their part to help stop the spread of COVID-19 by staying at home. Even as more states begin to relax their shelter-in-place orders, many people continue to drive fewer miles, resulting in a decrease in auto claims.

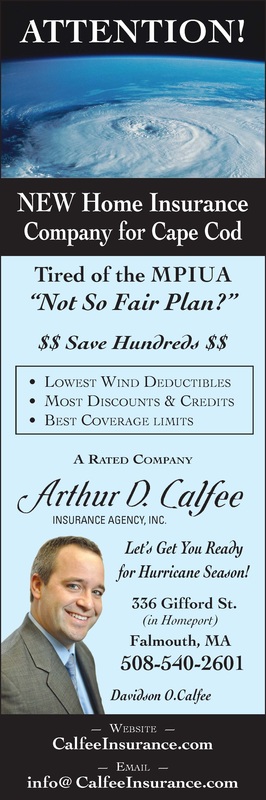

With that in mind, we are extending our Stay-at-Home Auto Premium Credit Program, which will automatically give our Travelers Insurance customers a 15% credit on their June auto premiums. Customers will receive the automatic credit either on future bills or via their last payment method. Answers to questions that you may have about this program can be found here. The extension of our Stay-at-Home Auto Program is another example of our efforts to provide relief during this challenging time. For our Travelers Insurance customers, other initiatives include suspending cancellation and nonrenewal of coverage due to nonpayment through June 15 – there will be no interest, late fees or penalties charged during this time. We have pledged $5 million to COVID-19 relief efforts to assist families and communities across North America, the United Kingdom and the Republic of Ireland. Need Home Insurance?We run our business with a value system of love (concern for others), trust, respect, a commitment to excellence and fun. And thanks, in part, to the customer service focus way we run our business, Calfee Insurance, has consistently been rated 5-Stars (superior) on Google & other platforms by current clients for more than 40 Years.

We offer a wide range of coverage, including auto, home, renters and life insurance. It doesn't stop there - we also provide motorcycle and small business insurance. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Auto & Home Bundle Quote 508-540-2601Get a quote online and work with an insurance agent to find the right Home Insurance coverage for your property and unique needs.

Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.  We recommend coverage amounts for your personal situation and break down everything we offer with clear-cut explanations so you know exactly what you’re getting. When purchasing property, doing your due diligence is more than a turn of phrase. The period when a house is under contract is an essential part of the homebuying process and requires careful attention to detail. By answering some simple questions about your home, we’ll get you the protection that you deserve, all through our secure network. We recommend coverage amounts for your personal situation and break down everything we offer with clear-cut explanations so you know exactly what you’re getting. The Basics The due diligence process is the buyer's opportunity to review all facets of a potential home sale. From home inspection findings to homeowner insurance costs, it's when you'll take the time to understand exactly what you're potentially buying. Here are a few due diligence do's and don'ts to consider: Do find out how long it lasts. Two weeks is fairly standard for the average due diligence process. However, shorter periods may be negotiated to gain a competitive edge in a seller's market. Don't make assumptions about when it begins. In some cases, due diligence is conducted before a property goes under contract. In others, it begins after the contract is signed. Do consult an insurance agent. Floodplain and fire-prone areas may require additional coverage. Make sure you know the estimated costs and what a new homeowners insurance policy will cover. Don't skim the home inspection. Make sure you're familiar with every line of the report. You may want to get quotes from contractors or negotiate repair costs into your offer. Do your research. Review neighborhood characteristics and check the area's crime rates. Look at zoning laws to ensure they align with your long-term goals. Don't forget to review the HOA. If you're joining a homeowners association, it's not enough to simply read your HOA documents. Make sure the community is in good physical condition and the association is financially sound. Being thorough in the due diligence phase will help you uncover potential issues and make the right choices for you and your family. |

Real EstateStay up to date on Cape Cod Real Estate! Land for Sale, Water Front Properties & more! Register now for free email updates of new listings matching your home search.

Auto Insurance

Homeowners Insurance Condo Insurance Renters Insurance Rental Home Insurance Rental Condo Insurance Landlord Insurance Motorcycle Insurance Personal Umbrella Policy Earthquake Insurance Flood Insurance Off Road Vehicles Motor Home Insurance Mobile Home Insurance Travel Trailer Insurance Recreational Vehicles Boat & Yacht Insurance Jet Ski Insurance Personal Watercraft Snowmobile Insurance Archives

September 2023

Categories

All

Arthur D. Calfee Insurance Agency, Inc. is proudly serving primary home, vacation home, auto, collector car, business, general liability, property, professional liability, contractor's liability, worker's comp, key man, whole life, term life, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, Eastham, Falmouth, Hatchville, Harwich, Hyannis, Hyannisport, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Truro, Wellfleet, Woods Hole, Yarmouth, and Yarmouthport.

|

-

HOME

- Send me a Home Insurance Quote >

- FLOOD Insurance, Massachusetts >

- Cape Cod Home Insurance

- Pay Your Home Insurance Bill Online

- Ordinance or Law Coverage

- How to Prevent a Claim on your Home Insurance Policy

- Videos - Cape Cod Real Estate Tips >

- Cape Cod Massachusetts Arbella Insurance Discounts

- Cape Cod Massachusetts Lloyds of London Home Insurance

- Safety Insurance Discounts for Cape Cod, Massachusetts

- MPIUA - MA Property Insurance Underwriting Association "Fair Plan"

- Cape Cod Massachusetts Home Protection Insurance

- Hurricane Preparedness >

-

AUTO

- Send me an Auto Insurance Quote for Cape Cod, Massachusetts

- BOAT Insurance >

- Cape Cod, MA Dept. of Motor Vehicles

- Cape Cod Massachusetts - Report an Auto Insurance Claim

- Auto Insurance Quote - CAR BUYING TIPS : Auto Insurance for Cape Cod, MA

- InControl Driver Training

- Car Insurance for Cape Cod Massachusetts - Arbella Insurance - Send me an Auto Quote >

- Plymouth Rock - Send me an Auto Quote >

- Encompass Insurance Discounts

- Safety Insurance - Send me an Auto Quote >

- Travelers Insurance Discounts

- Progressive Insurance - Send me an Auto Quote

- LIFE

- OFFICES

- ABOUT US

- Stay Home

- Home Insurance Explained

- Agent Login

- Privacy Policy

- Videos - Cape Cod Real Estate Investing, Taxes & Insurance

- Videos - Cape Cod Coastal Real Estate

- Português

Arthur D. Calfee Insurance Agency, Inc. is a friendly local insurance agency proudly offering Massachusetts, Cape Cod and the Islands. A-Excellent AM Best rating, A+ Excellent by the BBB

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Using innovative thinking, cutting-edge tools and expert resources at national and local levels, we deliver the best possible outcome on every policy we manage. Need Home Insurance? Easy, Fast, & Secure Home Insurance. Get Free Quotes 100% Online Now! Available 24/7. Affordable Rates. Cover Your Biggest Investments. Get a homeowners insurance quote, find coverage options. We'll help you understand and customize the right home insurance coverage for you.

Home is where your heart is—along with a healthy chunk of your net worth. Get started today with a free homeowner's quote.

Compare home insurance quotes today and save on protection for your biggest investment. Build a Custom Policy & Make the Switch! Our local underwriting professionals focus exclusively on finding the best home insurance, homeowner's insurance, hazard insurance, investment property insurance, flood insurance, flood zone information, vacation home insurance, second home insurance, auto insurance, collector car insurance, business insurance, general liability insurance, property insurance, professional liability insurance, contractor's liability insurance, worker's comp insurance, key man insurance, whole life insurance, term life insurance, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Pocasset, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, East Dennis, Eastham, Falmouth, East Falmouth, Hatchville, West Falmouth, North Falmouth, Woods Hole, Harwich, Hyannis, Hyannisport, Martha's Vineyard, Nantucket, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Sagamore, Sagamore Beach, Truro, Wellfleet, Yarmouth, and Yarmouthport. Real-Time Pricing. Insurance coverage: Wind Damage, Fire Loss, Water Damage. Protect your home and belongings. Low Rates For Your Best Options to Save Money On Great Coverage! Get a quote today. Home insurance helps protect your house and your family.

Testimonials & Endorsements for the Best Insurance Agent on Cape Cod, MA

PHONE: (800) 479-2601 CUSTOMER SUPPORT & SERVICE

Please note: The above is meant as general information to help you understand the different aspects of insurance. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features on this page are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

© 2024 Copyright, Arthur D. Calfee Insurance Agency, Inc.

Calfee Cares.® Privacy Policy

Calfee Cares.® Privacy Policy

RSS Feed

RSS Feed